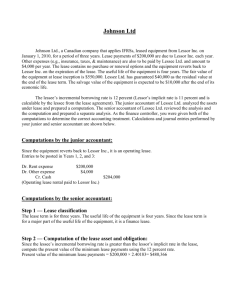

Lease Example 2

advertisement

Acct 414 SOLUTION Prof. Teresa Gordon LEASE EXAMPLE #2 Lessee: No title transfer, no BPO, LT < 75%. Interest rate = 10% (annuity due) but PVMLP < 90% of FMV (see computations below) so it is a capital lease for the lessee. Lessor: Direct Financing lease because (1) PVMLP > 90% of FMV, (2) no cost or collection uncertainties for lessor (satisfied the 2 extra rules) and (3) FMV = cost of asset (lessor does not have a gain or loss) PVMLP computations: Since we know the implicit interest rate, we use the lower of the two rates: i=10%, n=3, pmt=36,556, PVIF-OA =2.4869 * 1.10 = PVIF-AD Therefore, PVMLP = 2.4869 * 1.10 * 36,556 = 100,002 (Approximately fair value with a bit of a rounding difference) What if the lessee did NOT know the implicit interest rate? What would the PVMLP be? Example 2 - using incremental borrowing rate: i=12%, n=3, pmt=36,556, PVIF-OA =2.4018 * 1.12 = PVIF-AD 2.4018 * 1.12 * 36,556 = 98,336 = PVMLP Note that this would be a capital lease even if PVMLP were not > 90,000 since it met the 75% of economic life test! However, we would need to construct a different amortization table for the lessee. Amortization Table 0 1 2 Date 1/01/02 1/01/02 1/01/03 1/01/04 Lease Payment 36,556 36,556 36,556 Interest 0 6,344 3,323 Principal 36,556 30,212 33,233 Balance 100,000 63,444 33,232 0 1 Acct. 414 – Spring 2006 n Lease 2 FMV = MLP Lessee 0 1 2 3 4 5 6 B 90,000 90% FMV 3 Lease Term 3 Economic Life 100.00% LT as % Eco. Life Comments 36,556 36,556 36,556 Lessor Cash Flows Comments 0 1 2 3 4 5 6 C MLP Lessor 0 1 2 3 4 5 6 E 100,000 Lessee's discount 10.00% rate Lessee's PVMLP: 100,000 Annuity Due Lease 2 Type of Lease: FOR LESSEE: Why? Capital LT >75% Eco Life A D HOMEWORK ASSIGNMENT (63,444) 36,556 36,556 10.00% Guess 10.000% Implicit Rate Comments 36,556 36,556 36,556 DIRECT FINANCING LESSOR 1/2/12 Net Investment in Lease. Cash Equipment 63,444 36,556 $100,000 12/31/12 Net Investment in Lease Interest Revenue $ 6,344 1/2/13 Cash Net Investment in Lease $36,556 LESSEE 1/2/12 Leased Asset Leased Liability. Lease Liability. Cash 12/31/12 Depreciation Expense Acc'd Depreciation Interest Expense Lease Liability. 1/2/13 Lease Liability. Cash $ 6,344 $36,556 $100,000 $100,000 $ 36,556 $ 36,556 $ 33,333 $ 33,333 $ 6,344 $ 6,344 $ 36,556 $36,556 Lessor's PVMLP = 100,000 Annuity Due Lease 2 Type of Lease: FOR LESSOR: Why? Dir Fin LT >75% Eco Life No profit, no cost or collection uncertainties 2