Economic Comparisons of Mutually Exclusive Alternatives

advertisement

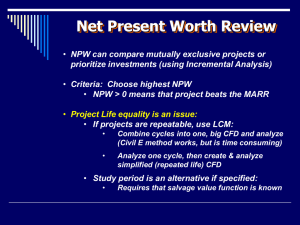

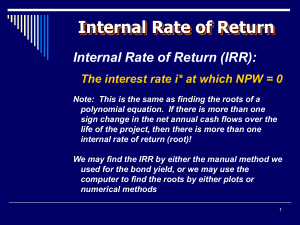

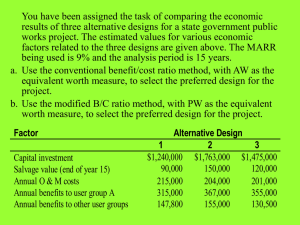

Economic Comparisons of Mutually Exclusive Alternatives Objective: To evaluate and compare mutually exclusive alternatives and select the most economical. The comparison is based on the lifecycle benefits and costs of each alternative over a specified study period. The Minimum Attractive Rate of Return (MARR) The lowest interest rate acceptable to the investor. Comparing Mutually Exclusive Alternatives The most common evaluation techniques include 1. Present worth analysis, 2. Annual (periodic) worth analysis, 3. Future worth analysis, 4. Internal rate-of-return, 5. Benefit-cost ratio, and 6. Payback period method. Below is a discussion of each of these techniques. Present Worth (PW) Analysis Objective: To evaluate and compare mutually exclusive alternatives based on the equivalent netpresent worth of the lifecycle cash flows for each alternative at a given minimum attractive rate of return (MARR). • The net present worth is computed as Net PW = PW(Revenues) – PW(Costs) • The cash flows include all life-cycle revenues and costs, i.e., all revenues and costs over the service life of the project or investment. • A zero or positive “Net PW” indicates a “profitable” or “economical” project or investment. • A positive “Net PW” indicates that the investment or project has an annual rate of return greater than the MARR. • A zero “Net PW” indicates that the investment or project has an annual rate of return exactly equal to MARR. • Similarly, a negative “Net PW” indicates that the investment/project has an annual rate of return less than MARR, hence, not preferable. • When comparing alternatives, the alternative with a higher “Net PW” is preferred over one with a lower “Net PW”. • Comparing alternatives using the “Net PW” criteria has to be done based on the same analysis period or lifetime for the alternatives. Example 1a: Selection between two mutually exclusive investments A B Initial investment (P) -S.R.10,000 -S.R.13,000 Annual revenues (A) S.R.3,500 S.R.5,300 Service life (N, in years) 4 4 MARR = 8%/year Net PW = PW(Rev) - PW(Costs) = A(P/A,i,N) – P S.R.1,592 S.R.4,554 Select the alternative with the higher net PW, i.e., select Alternative ___________. Example 1b. What if Alternative A has a 6-year service life? i.e. A -S.R.10,000 S.R.3,500 6 Initial investment Annual revenues Service life (years) MARR = 8%/year Net PW = PW(Rev) - PW(Costs) = A(P/A,i,N) – P S.R.6,180 Should the alternative with the higher net PW be selected? Why or why not? B -S.R.13,000 S.R.5,300 4 S.R.4,554 Note that, the present worth value should only be used for comparison if the alternatives are evaluated based on the same analysis or study period. Thus, when service lives of alternatives are different, a common study period has to be determined and used for all alternatives. In Example 1b above, there are three possible solution approaches: 1. Use an analysis period of 4 years, and determine the equivalent cash flows for terminating alternative A at the end of 4 years. 2. Use an analysis period of 6 years, and determine the equivalent cash flows for extending alternative B for two more years. 3. Use a common analysis period consisting of multiple service lives of the alternatives, typically using a common analysis period equal to the LCM of the individual alternative service lives. This assumes identical cash flow repeatability of the alternative investments over the analysis period. Approach 3 is the most common. In this example, the analysis period will be 12 years, which means: Alternative A will be repeated one more time, and Alternative B will be repeated two more times For each repetition, the cash flows are identical, as shown in the cash flow diagrams below: Future Worth (FW) Analysis Similar to PW analysis, except comparison is made based on the equivalent future worth values of the alternatives, based a common analysis period for all the alternatives being considered. Annual (Periodic) Worth (AW) Analysis Cash flow diagram: Net AW = AW(rev) - AW(costs) = (AR - AC) + S(P/F, i, N) - P(A/P, i, N) Advantages: 1. Easier to compute if the service lives are different, since there is no need to compute cash flows over LCM. 2. Easier concept for investor to understand. However, even with the AW method, when the service lives are different, the implicit assumption when the AW of the alternatives are compared is that they are compared based on a common analysis period. Hence, the assumption of repeatability of investment is also applicable, similar to the PW analysis. If dealing with costs only, with the following typical cash flow diagram The equivalent annual (periodic) costs are referred to as “equivalent uniform annual costs” (EUAC), s.t., EUAC = A + P(A/P, i, N) – S(A/F, i, N) Example 2a: Selection between two mutually exclusive investments A -S.R.10,000 S.R.3,500 4 B -S.R.13,000 S.R.5,300 4 A -S.R.10,000 S.R.3,500 6 B -S.R.13,000 S.R.5,300 4 S.R.1,337 S.R.1,375 Initial investment (P) Annual revenues (A) Service life (N, in years) MARR = 8%/year Net AW = AW(Rev) - AW(Costs) = A – P(A/P, i, N) S.R.481 S.R.1,375 Select the alternative with the higher net AW, i.e., select Alternative ___________. Example 2b: Initial investment (P) Annual revenues (A) Service life (N, in years) MARR = 8%/year Net AW = AW(Rev) - AW(Costs) = A – P(A/P, i, N) Should Alt. B be selected? The Internal Rate-of-Return (IRR) Method The IRR is the interest rate that results in a net-present of zero, i.e., it is the break-even interestrate. i.e. at i = IRR, NPW = PW(benefits) - PW(costs) = 0, or Similarly, NAW = AW(benefits)-AW(costs) = 0 and FAW = FW(benefits) - FW(costs) = 0 Example 1: Invest S.R.1000 now, get S.R.1200 at end of year. What is the IRR? IRR = _________ Example 2: Invest S.R.14,200 now, get S.R.2,000 net annual benefits for 10 years, salvage value S.R.3,500 CFD Solution: NPW = A(P/A, IRR, 10) + S(P/F, IRR,10) - P = 0 i.e., 2000(P/A, IRR, 10) + 3500(P/F, IRR,10) - 14,200 = 0 Solve by trial and error: at i = 9% NPW = 114 and i = 10% NPW = -561 interpolate:=> IRR = % what if i = 6% NPW = 2,475 and i = 12% NPW = -1,773 interpolate:=> IRR = ______% Which is the more correct value? => => Exact solution = _______% Notes: - Direction of guesses (sometimes not obvious, i.e., in multiple direction changes) - Positive vs. negative for interpolation - Non-linearity - over/under estimation - borrowed vs. invested money - Compare with MARR (for investment) Advantages: - easy to understand - no prior assumption of interest rate for computation More Examples: SUMMARY Internal Rate of Return (IRR) Method - The interest rate at which the benefits are equivalent to the costs over the analysis period. - Computationally, it is the interest rate that results in NPW = PW(Benefits) – PW(Costs) = 0, or NFW = FW(Benefits) – FW(Costs) = 0, or NAW = AW(Benefits) – AW(Costs) = 0, = EUAB – EUAC = 0; - The internal rate of return can be determined only for alternatives with both positive and negative cash flows. - Because of the complexity of analytical formulations, the IRR is typically calculated by trialand-error method. - The range between the “trial” interest rates has to be minimized in order to minimize the error in the computed value due to non-linearity. Use of the IRR in economic evaluation - For investment analysis, the IRR should be compared with the MARR - if IRR ≥ MARR → good investment - if IRR < MARR → not a good investment - No prior assumption of the desired rate of return required - Should the MARR value change, no need to repeat computation, only the decision need to be reviewed Advantages - It is generally an easier concept to understand - No prior assumption of the desired rate of return required Drawbacks - In general, it is a more computationally intensive approach. - Potential for multiple values of IRR: Rule-of-thumb: there are as many potential positive IRR values as the number of sign reversals in the cash flows over the analysis period Possible solution to the problem: - modifying cash flows to reduce the number of sign reversals to one - using ERR for re-investment of some cash flows Using the IRR to comparing alternatives: Example: Compare the following alternative investments based on a MARR of 5% Alternative A Initial investment -S.R.75,000 Annual revenue S.R.16,000 Annual cost -S.R.3,000 Salvage value S.R.10,000 Service life (years) 10 The IRR Net PW at MARR = 10% Alternative B -S.R.105,000 S.R.22,000 -S.R.5,000 S.R.15,000 10 Incremental Procedure 1. Identify all alternatives. 2. (Optional) Compute the rate of return (IRR) of each alternative. Any alternative with IRR < MARR should be rejected outright. For "cost alternatives", this step cannot be done, since no IRR can be computed for individual alternatives. 3. Arrange the remaining alternatives in order of increasing initial investment. 4. Establish the base or first "defender" alternative. If step 2 was done, then the base alternative is the alternative with the lowest initial cost. If step 2 was skipped, then the base alternative is the "do nothing" alternative. For "cost alternatives", the base alternative is the one with the lowest initial cost. 5. Perform an incremental IRR analysis between the defender and the alternative with the next higher initial cost. If the incremental IRR >= MARR, "reject" the defender and "accept" the higher cost alternative, which then becomes the new defender If the incremental IRR < MARR, "reject" the higher cost alternative and "retain" the current defender. 6. Select the next higher cost alternative, and repeat step 5 until all alternatives have been evaluated. The last remaining defender is the final preferred alternative. Notes: (1) The incremental procedure always results in the same findings as the PW, AW or FW methods. (2) Evaluation should always be done based on same study period for all alternatives