IENG 302 Lecture 10: Incremental Analysis & IRR

Internal Rate of Return

Internal Rate of Return (IRR):

The interest rate i* at which NPW = 0

Note: This is the same as finding the roots of a polynomial equation. If there is more than one sign change in the net annual cash flows over the life of the project, then there is more than one internal rate of return (root)!

We may find the IRR by either the manual method we used for the bond yield, or we may use the computer to find the roots by either plots or numerical methods

1

IRR Example

Project A costs $10,000 and will last for 10 years. Annual, end of year revenues will be $3000, and expenses will be $1000.

There is no salvage value.

Project B costs $20,000 and will also last for

10 years. Annual revenues will be $4000 with annual expenses of $1500. Salvage value is $14,500.

What is each project’s IRR ?

2

Table Example

i*

6%

8%

10%

12%

18%

(P/A, i*, 10)

7.3601

6.7101

6.1446

5.6502

4.4941

Numerical Method Example: IENG 302 IRR.xls

(P/F, i*, 10)

.5584

.4632

.3855

.3220

.1911

3

25000

20000

15000

10000

5000

0

-5000

0

-10000

Project A

Project B

5 10

Interest Rate (% )

15 20

4

Decisions with IRR

When applied to project selection among independent projects – i.e. there are enough funds such that any or all of the projects may be selected – then investing based on IRR is easy:

Select all projects with IRR > MARR!

Note: Make sure that there is only one IRR (root)!

5

Decisions with IRR

When applied to project selection among mutually exclusive projects – i.e. there is not enough money to do them all – IRR can produce the same result as NPW and EAW.

However, incremental analysis MUST be used!

REASON: IRR is a relative measure of project merit

6

Why Must Incremental

Analysis be Used for

Competing Projects?

Assume that an MARR of 16% per year is required, and $85 000 is available to invest:

• Project A requires $50 000 upfront to obtain an IRR of 35% per year.

• Project B requires an $85 000 first cost and returns an IRR of 29% per year.

• What could we do with the un-invested money from Project A? ($35 000)

7

Why Must Incremental

Analysis be Used for

Competing Projects?

It would be reasonable to invest the remaining

$35 000 at the MARR:

• Overall IRR

A

= 50 000(.35) + 35 000(.16)

85 000

= 27.2% per year

• Project B returns an IRR of 29% per year on

ALL the money available to invest.

8

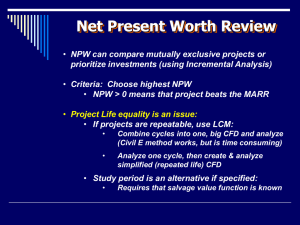

Incremental Analysis

A technique or approach that can be used with NPW, EAW, and later with IRR and Cost/Benefit to determine if an incremental expenditure should be made.

Note: If using NPW or IRR, lifetimes must be equal – so use Least Common Multiple or Study Period!

9

Incremental Analysis

Incremental Analysis can used by putting the options in the order of increasing initial investment.

Check the feasibility of the first investment.

• If it is feasible, then you consider the increment to the next level of investment.

• If it is not feasible, then you check the second investment alternative for feasibility, and so on until all options are considered.

10

Incremental Analysis

Incremental Analysis can also be used when you’re already incurring an expense

(e.g., DSL internet service) and you are trying to determine if it is a good decision to spend additional funds

(e.g., satellite or cable?).

11

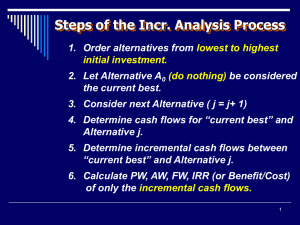

Steps of the Process

1. Order alternatives from lowest to highest initial investment.

2. Let Alternative A

0 the current best.

(do nothing) be considered

3. Consider next Alternative ( j = j+ 1)

4.

Determine cash flows for “current best” and

Alternative j.

5. Determine incremental cash flows between

“current best” and Alternative j.

6. Calculate PW, AW, FW, IRR (or Benefit/Cost) of only the incremental cash flows.

12

Steps of the Process

7. If incremental investment yields NPW,

EAW, or a NFW > 0 * , then the new

“current best” becomes Alternative j.

* (B/C ratio > 1, or IRR > MARR)

8. If there are remaining alternatives, go to

Step 3.

9. If all alternatives have been considered, select the “current best” alternative as the preferred alternative.

13

i = 18%

End of

Year, t

0

1

2

3

4

5

Net Cash Flows for Alternatives A

0

- A

3

A

0

$0

A

$0

1

A

2

A

3

-$50,000 -$75,000

0 4,500 20,000 20,000

0

0

4,500

4,500

20,000

20,000

25,000

30,000

0

0

4,500

4,500

20,000

20,000

35,000

40,000

14

IRR Incremental Analysis

Rank projects from lowest to highest initial cost

Eliminate any projects with IRR < MARR

Starting from the least expensive project to the next most expensive, justify each incremental investment

• IRR

HC-LC

< MARR Accept LC Project

& Reject HC Project

• IRR

HC-LC

= MARR Indifferent

• IRR

HC-LC

> MARR Reject LC Project

& Accept HC Project

15