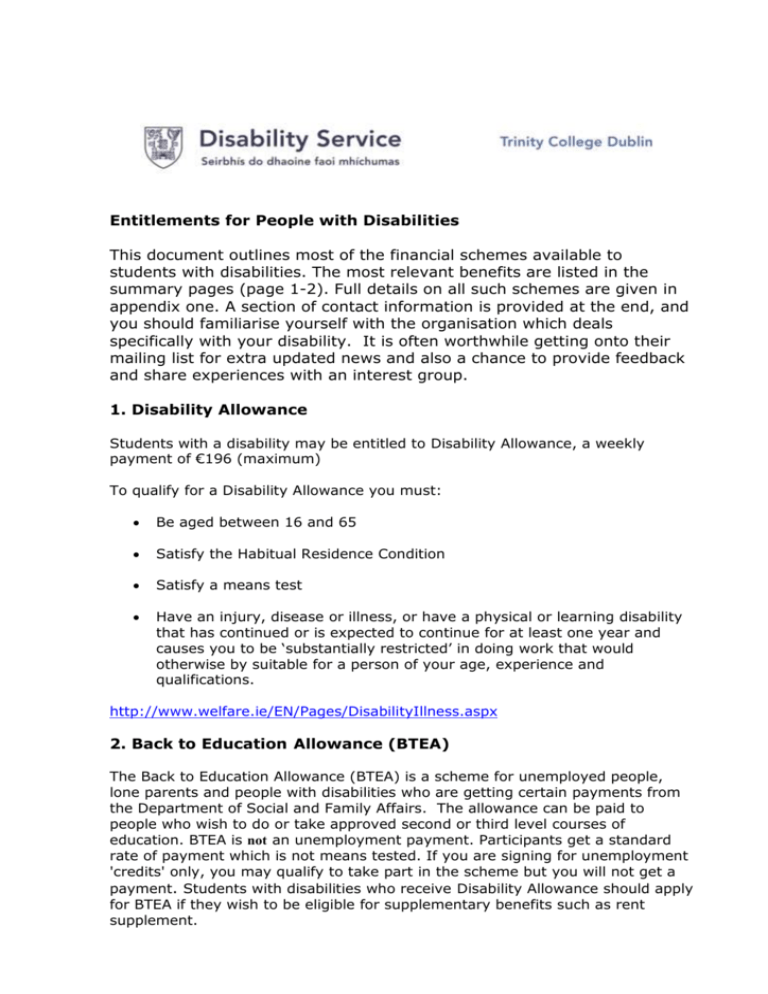

Entitlements for people with Disabilities

advertisement

Entitlements for People with Disabilities This document outlines most of the financial schemes available to students with disabilities. The most relevant benefits are listed in the summary pages (page 1-2). Full details on all such schemes are given in appendix one. A section of contact information is provided at the end, and you should familiarise yourself with the organisation which deals specifically with your disability. It is often worthwhile getting onto their mailing list for extra updated news and also a chance to provide feedback and share experiences with an interest group. 1. Disability Allowance Students with a disability may be entitled to Disability Allowance, a weekly payment of €196 (maximum) To qualify for a Disability Allowance you must: Be aged between 16 and 65 Satisfy the Habitual Residence Condition Satisfy a means test Have an injury, disease or illness, or have a physical or learning disability that has continued or is expected to continue for at least one year and causes you to be ‘substantially restricted’ in doing work that would otherwise by suitable for a person of your age, experience and qualifications. http://www.welfare.ie/EN/Pages/DisabilityIllness.aspx 2. Back to Education Allowance (BTEA) The Back to Education Allowance (BTEA) is a scheme for unemployed people, lone parents and people with disabilities who are getting certain payments from the Department of Social and Family Affairs. The allowance can be paid to people who wish to do or take approved second or third level courses of education. BTEA is not an unemployment payment. Participants get a standard rate of payment which is not means tested. If you are signing for unemployment 'credits' only, you may qualify to take part in the scheme but you will not get a payment. Students with disabilities who receive Disability Allowance should apply for BTEA if they wish to be eligible for supplementary benefits such as rent supplement. http://www.welfare.ie/EN/Schemes/BackToEducation/Pages/btea.aspx 3. Supplementary Benefits If your income, whether from basic Supplementary Welfare Allowance or otherwise, is too low to meet certain special needs, you may be granted a weekly supplement. Special needs may include: rent or mortgage interest payments exceptional heating expenses due to ill-health - you will be required to get a letter from your doctor before a supplement for special heating needs will be granted a prescribed special diet as a result of a specified medical condition. In most cases, it must be prescribed by a hospital consultant or a hospital registrar. However, some diets may be prescribed by a G.P.. The amount of any supplement will be decided by the Health Service Executive based on your circumstances. Students who receive Disability Allowance should apply for BTEA if they wish to be eligible for supplementary benefits. For further details on these and other benefits such as health care or transport, see www.welfare.ie or contact your local Community Welfare Officer: http://www.citizensinformation.ie/categories/health/how-health-isorganised/health_boards_and_community_welfare_officers For On-campus or Dublin 2 region contact: Community Welfare Officer Pearse Street Primary Care Centre Mark’s Lane (Off Lombard Street) Dublin 2 Tel 01 6777781 http://www.pearsestreetmedicalcentre.com/index.html For Trinity Hall or surrounds contact: Community Welfare Officer (Trinity Hall and surrounds) Health Centre, 36 Upper Rathmines Road, Dublin 6. Tel 01 497 3547 Tel 01 497 5863 Page 2 Appendix 1: Students with disabilities and the welfare system Sections 1. 2. 3. 4. 5. 6. 7. Education Payments available to disabled people Health Care Transport Tax Legal matters Further information 1. Education In addition to the student grant system, students with disabilities might avail of the Back to Education Allowance. This allowance replaces whatever disability payment you are already entitled to (see section 2) and has the additional benefit of allowing you to work without your salary affecting the payment. However, it could affect any secondary benefits you are receiving. It also includes a €400 books allowance annually. To qualify you must: a) be 18 or over and receiving a disability payment for at least 12 months (e.g. Blind Person’s Pension / Disability Allowance / Invalidity Pension / Unemployability Supplement), or b) be receiving Disability Benefit for 3 years (See section 2 for more on these benefits). Application is made via your college’s Disability Officer. Note that parttime students are not eligiable for any of these educational grants at present. Personal Assistants You may qualify for a PA to help with everyday tasks or specifically studyrelated ones. This may apply even if you are a part-time student. To find out more, the best organisation is the Irish Wheelchair Association, and also the Centre for Independent Living can help. They will process applications from people with a range of disabilities, not exclusive of mobility problems. (See section 7 for contact details) Private Grants for Graduates You might be interested in the following which are specifically targeted at students with disabilities: 1) Fulbright Scholarships a. The Jean Kennedy Scholarship – allows students with disabilities to research in any subject in the United States b. The Fulbright American/Ireland Fund Scholarship – allows a graduate to research at Gallaudet University for the deaf. Page 3 Contact: Hainault House, St. Stephen’s Green, Dublin 2 2) Dr. Ciaran Barry Scholarship This allows for research at the Central Remedial Clinic. Call 01 – 8057400. http://www.crc.ie/research_drc.shtml 2. Payments available to people with disabilities Most students with disabilities will qualify for either Disability Allowance or Blind Pension. There are other payments, which will be briefly dealt with, since most of them would not apply to the ‘typical’ student population (i.e. single, under 30 years of age and never in full-time employment). Means Test Both Disability Allowance and Blind Pension are means-tested. “Means’ includes all income you may have, whatever its source and the value of any property you may own. Failure to disclose could result in prosecution, so it is better, when applying to list everything you think might be relevant. There are a few exceptions to what counts as means, such as the value of the home you actually occupy and any money received from a recognised charity, but the best advice to any claimant is – declare these anyway. Habitual Residency Test Both Disability Allowance and Blind Pension require that you must be resident in Ireland or Great Britain for at least two years before applying. Main Schemes 1) Disability Allowance To qualify you must have a disability which would prevent you from doing the kind of work which an able-bodied person of your own age, experience and qualifications could undertake. In assessing your means, those of your parents are not taken into account, even if you live at home. You may have a job while on this allowance, provided it does not pay more than a certain sum (currently €120 per week). Before getting any kind of work, you must inform the Department of Social and Family Affairs and get their approval. To apply for Disability Allowance, contact your local social welfare office. 2) Blind Pension In order to qualify you must have your eyes tested by a qualified opthalmologist (an ordinary optician is not sufficient). Besides total blindness, other visual impairments are also considered (e.g. low general vision, tunnel vision). As with Disability Allowance, you may earn up to €120 per week provided your work has been reported to and approved by the Department of Social and Family Affairs. To apply for Blind Pension contact your local social welfare office. Page 4 In addition to Blind Pension you may also qualify for Blind Welfare Allowance, a discretionary payment provided by your Local Health Office. Free Travel Everyone on Disability Allowance or Blind Pension receives a free Travel Pass. Blind Pension automatically entitles you to a companion travel pass, but if you receive Disability Allowance you would have to provide evidence that you cannot safely travel alone in order to qualify for a companion pass. Living Alone Allowance In addition to Disability Allowance and Blind Pension you may qualify for this extra weekly payment. It is payable even if you do not live entirely alone. You must however satisfy one of the following conditions: a) if you live in someone else’s house, you must be able to demonstrate that you occupy either a self-contained flat or that you have separate cooking/dining and sleeping accommodation, b) you live alone during the day but either go to stay with friends or relations at night or have someone staying with you at night. This person must not contribute to household expenses in any way, or c) you live alone during the week but a friend or relative stays with you at weekends only. Apply to the Department of Social and Family Affairs (i.e. the one where you already get your main benefit from). Supplementary Welfare Allowance This is a weekly payment designed to supplement a low income and could help out a person with a disability who does not qualify for disability allowance or blind pension, but who cannot, due to their problems, earn a living wage. It can also be payable to those who are waiting for their applications to be processed. You must apply to the Community Welfare Officer at the local Health Centre. Diet Supplement People with medical conditions requiring an expensive specialised diet can apply for this benefit, but you require a hospital consultant (a normal GP is not sufficient). Apply to the Community Welfare Officer at your local Health Centre. Heating Supplement If you live alone and have medical proof that you require extra heating, then you can apply for this through the Community Welfare Officer at your local Health Centre. Exceptional Needs Payments Page 5 If you are in receipt of Disability Allowance, Blind Pension or Supplementary Welfare Allowance, or on a low income, you may be able to obtain a single one-off payment if unforeseen expense occurs. Apply to the Community Welfare Officer at your local Health Centre. Urgent Needs Payment Even if you are not currently receiving Disability Allowance, Blind Pension or Supplementary Welfare Allowance, you may still qualify for a one-off emergency payment. Apply to the Community Welfare Officer at your local Health Centre. If you are unsuccessful, you have the right of an appeal. Household Benefits Package If you receive Disability Allowance or Blind Pension you can apply for the following package provided: a) you live alone b) you live with another person with a disability or someone elderly, or c) you live with a full-time carer Note even if you do not fit into one of these categories you may still qualify. You can get the relevant forms at the Post Office or from: Free Schemes Section, Pension Services Office, College Road, Sligo. Telephone: (071) 916 9800 or Lo-Call: 1890 500 000 The package comprises the following: 1) Electricity allowance – this pays your standing charge and gives a fixed number of free units 2) Natural or bottled gas allowance – if you prefer, you can have the gas equivalent of the electricity allowance 3) Telephone allowance – this allows a certain sum off your telephone bill but can only be claimed by Eircom customers. 4) TV licence – if you qualify for the above, you automatically receive a free TV licence. In addition to the benefits which are means tested, the following are available regardless of income: For Blind / visually impaired people: Free directory enquiries: available to Eircom customers. If you have difficulty using the phone book you can call the operator and be connected to a free ‘special enquiries service’ which is the equivalent of directory enquiries. You will receive a PIN which you quote, followed by your name. This is recognised on a database of blind / partially sighted users who are not charged for the call. To apply, phone 1800 574 574. Braille / audio library: the National Council for the Blind of Ireland operates a Braille/audio tape library (and will provide the necessary equipment for the latter, at no cost). Contact them at: National Council Page 6 for the Blind of Ireland, Whitworth Road, Drumcondra Road, Drumcondra, Dublin 9. Phone: 01 8307033, LoCall: 1850 334 353. Website: www.ncbi.ie For Deaf / hard of hearing: Sign language interpreters: Irish Sign Link provides interpreters for Deaf and hearing-impaired people to assist in situations such as interviews, meetings, etc. Contact them at: Irish Sign Link, 25 Clyde Road, Ballsbridge, Dublin 4. Fax: 6685029, phone/minicom: 608 0437 or email: signlink@indigo.ie National relay service: a free text service for minicom users. 1800 207 900 (using minicom to a hearing person) 1800 207 800 (minicom to another minicom user) 1800 207 999 (emergency services) STEP (Scheme for Text Telephone Equality of Payment): this allows a rebate of calls on your phone bill (currently 70%). Contact the National Association for Deaf People, 35 North Fredrick Street, Dublin 1, Phone: 872 3800, Fax: 872 3816, email: nad@iol.ie Invalidity Pension The following payment might be applicable to mature students or other non-traditional groups. This benefit is for people who were formerly able to work and who have already amassed a certain number of PRSI credits. You will also be entitled to a free travel pass. Claim forms available from your local Social Welfare Office or the Invalidity Pension Claims Section of the Department of Social and Family Affairs. 3. Health Medical Card Although most college provide free health care for staff and students, the following information is included for guidance. Normally Medical Cards are issued to those whose income falls below a certain level. However, exceptions are sometimes made in the case of those who have special, i.e. more expensive treatment needs. If you are receiving a pension from another EU country, but are living here and are not in paid employment, then you may also qualify for a medical card. If you do receive one, you are entitled to free GP/hospital/medicines/optical/aural and dental services. Note: anyone who suffers from Hepatitis C as a result of contaminated blood products used in Ireland will receive a “Health Amednment Act Services Card” entitling them to most of the medical card benefits but without the need for a means test. Page 7 GP Visit Card These are issued to people on low incomes – but not low enough to qualify for a medical card. It entitles you to GP services but nothing else. For all of the above, apply to your Local Health Office. There is also an appeal procedure if you are unsuccessful via the designated appeals officer in the HSE. Hospitals There is a charge for each day you spend in hospital on a public ward, unless you have a medical card. If you cannot afford this you can write to the particular hospital involved, and request a waiver. Out Patients If a GP refers you there is no charge, but if you have no medical card and have to go to the A&E, you have to pay. However, if you return for subsequent visits due to the same problem, there is no further charge. Long Term Illness Scheme Regardless of income, drugs for the following conditions are free: Cerebral Palsy Cystic Fibrosis Diabetes Insipidus Diabetes Mellitus Epilepsy Haemophilia Hydrocephalus Leukaemia (acute) Mental Handicap Multiple Sclerosis Muscular Dystrophy Parkinson’s Disease Phenylketonuria Spina Bifida Apply to your Local Health Office. Drugs Payment Scheme This entitles an individual – or a family – to pay a certain sum per month towards the total cost of required medication, appliances etc. The rest is free. Your local pharmacy or health office will have the registration forms. Note: once registered you must continue using the same pharmacy and you will be given a plastic swipe card which must be presented each time you have a prescription filled. Page 8 Aural / Dental / Optical Services All of these are free to medical card holders and anyone who qualifies for the Treatment Benefit Scheme. This scheme is available to those formerly in full-time employment who have amassed sufficient PRSI credits and who is now in receipt of an Invalidity Pension or Disability Benefit. Apply to: Treatment Benefit Section, Department of Social and Family Affairs, Letterkenny, Co. Donegal. Phone: 704 3000, Lo-Call 1890 400 400 Appliances etc Help in buying these is given to medical card holders and those registered as having chronic conditions. In either case, VAT refunds are generally available. Contact VAT Repayments Section, Government Buildings, Kilrush Road, Ennis, Co. Clare. Lo-Call 1890 202 033 or visit www.revenue.ie Citizens Advice also has a website and contact number: www.assistireland.ie and 1890 277 478. In addition, the voluntary organisation dealing with your specific condition will have more information (see end of document for a list). 4. Transport Free Travel This is available to all those receiving Disability Allowance, Blind Pension, Invalidity Pension and anyone receiving these or similar benefits frm another EU state and who is permanently residen there. This applies to Dublin Bus / Bus Éireann / Iarnród Éireann / DART / Luas and a number of private travel operators. A companion pass is given to all Blind Pensioners and those who can demonstrate unfitness to travel alone. Apply to your local Social Welfare office or the Free Schemes section of the Department of Social and Family Affairs. Disabled Person’s Parking Card This allows a driver with a disability or passenger to park the vehicle in which they are travelling at any designated disabled parking space. This card is valid throughout the EU and also USA and Canada. There is a charge for this card and you must apply to either the Irish Wheelchair Association, National Mobility Centre, Ballinagappa Road, Clane, Co. Kildare (Phone 045 893 094) or the Parking Card Section, Disabled Drivers Association of Ireland, Ballindine, Co. Mayo (Phone 094 9364054, website www.iol.ie/~ability . You will need to get the form completed by both your doctor and a Garda. AA Services Page 9 If you belong to the Disabled Drivers Association, AA staff will provide free breakdown services. Note that this only applies to the kind of service AA personnel can provide – anything involving contractors must be paid for. Toll Charges Disabled drivers or passengers are exempt from toll charges, apply to Concessionary Travel Section, National Toll Roads PLC, York Road, Ringsend, Dublin 4: phone 01 668 2888. Trains Iarnród Éireann has a free “Guide for Mobility Impaired Passengers” available on request at the station or phone their Liaison Officer at 01 703 2634. Fáilte Ireland The Validated Accessible Scheme (VAS) provides information on disabledfriendly accommodation. Phone LoCall 1890 525 525 or 1850 230 330, websites www.failteireland.ie and www.ireland.ie Motorised Transport Grant If you are a person with a disability and a car is essential for your job or if you live in a remote area, you can apply for this grant. Normally, it is paid to disabled drivers, but it is possible to get it on behalf of a designated driver. Apply to your local Health Office. 5. Tax If your only income is a long-term disability payment, then it is unlikely to be taxed. However, the following information is of particular relevance to people with disabilities. In most cases there is a specific leaflet which your regional Revenue office will supply, or call 1890 306 706. They are also available on the website: www.revenue.ie Fees If you pay fees in college, then you or the fee payer can claim a tax credit. Blind Person’s Tax Credit Tax credits are claimable by single or married blind people (if both are blind). See leaflet IT35. In addition, you can claim an allowance for your guide dog if you are a registered owner with the Irish Guide Dog Association. Disabled Drivers and Passengers Tax Relief This allows for exemption from Vehicle Registration Tax (VRT) and VAT paid for an adapted vehicle or adaptations made to a standard vehicle. There is also an allowance in respect of excise duty paid on a certain number of gallons of petrol per year. Annual motor tax is also waived. Apply to: Disabled Drivers Section, Central Repayments Office, Office of Page 10 the Revenue Commissioners, Colshannagh, Co. Monaghan. Phone (047) 38010, Lo-Call 1890 606 061. Medical Expenses You can claim a refund for these on behalf of yourself or a disabled relative (excluding things like regular optical or dental exams) – leaflet IT6. Deed of Covenant This legal agreement allows someone to pay a yearly allowance to a disabled relative. It lasts for six years and enables the donor to claim tax relief but will be treated as taxable income in the case of the recipient. This could result in their losing a means-tested health board payment or a medical card. See leaflet IT7. Incomes which are not taxed Deposit Interest Retention Tax (DIRT): People with disabilities can claim DIRT refunds if their gross income is below or slightly over the exemption limit. See leaflet IT8. Personal Injury Compensation Payments and the income arising from their investment are exempt in cases where the injury was severe enough to leave the person permanently disabled. See leaflet IT13. This also applies to lump sums paid by an employer (leaflet IT21). 6. Legal Matters Legal Aid / Advice This is a means tested service whereby those on low incomes can avail themselves of legal aid or advice without incurring legal fees (although you may be required to make a contribution). There is also a voluntary group: Free Legal Advice Centres (FLAC) Apply to the Legal Aid Board, Cahirciveen, Co. Kerry. Phone – (066) 947 1000, website www.legalaidboard.ie Free Legal Advice Centres, 13 Lower Dorset Street, Dublin 1. Phone – 874 5690, website www.flac.ie 7. Information Name of Organisation Citizen’s Information Centres Address Phone Email Website 13a Upper O'Connell Street Dublin 1 lo-call 1890 777 121 See website: www.citizensinfor mation.ie Page 11 Ahead (Association for Higher Education Access and Disability) Centre for Independent Living Disability Federation of Ireland Disabled Drivers Association of Ireland Enable Ireland Irish Deaf Society Irish Wheelchair Association Mental Health Ireland National Association for Deaf People National Council for the Blind of Ireland People with Disabilities in Ireland National Disability Authority PO Box 30 East Hall UCD Carysfort Avenue Blackrock Co. Dublin Carmichael House North Brunswick St Dublin 7 Fumbally Court Fumbally Lane Dublin 8 Ballindine Co. Mayo 716 4396 ahead@iol.ie www.ahead.ie 873 0455 info@dublincil.or g www.dublincil.org 454 7978 info@disabilityfederation.ie www.disabilityfederation.ie (094) 936 4054 or 4266 ability@iol.ie www.iol.ie/~ability National Services Sandymount Avenue Dublin 4 30 Blessington St Dublin 7 Áras Chúchulainn Blackheath Drive Clontarf Dublin 3 Mensana House 6 Adelaide Street Dun Laoghaire Co. Dublin 35 North Frederick Street Dublin 1 2695355 info@enableirela nd.ie www.enableireland .ie 860 1878 ids@indigo.ie 818 6400 info@iwa.ie www.irishdeafsocie ty.org www.iwa.ie 284 1166 info@ mentalhealthirela nd.ie www.mentalhealth ireland.ie 872 3800 nad@iol.ie www.nadp.ie Whitworth Road Drumcondra Dublin 9 830 7033 LoCall 1850 334 353 info@ncbi.ie www.ncbi.ie Richmond Square Morning Star Avenue Dublin 7 25 Clyde Road Dublin 4 872 1744 info@pwdi.ie www.pwdi.ie 608 0400 nda@nda.ie www.nda.ie Page 12 Page 13