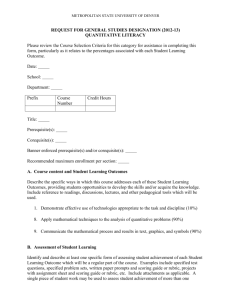

Course Objectives - Department of LD

advertisement

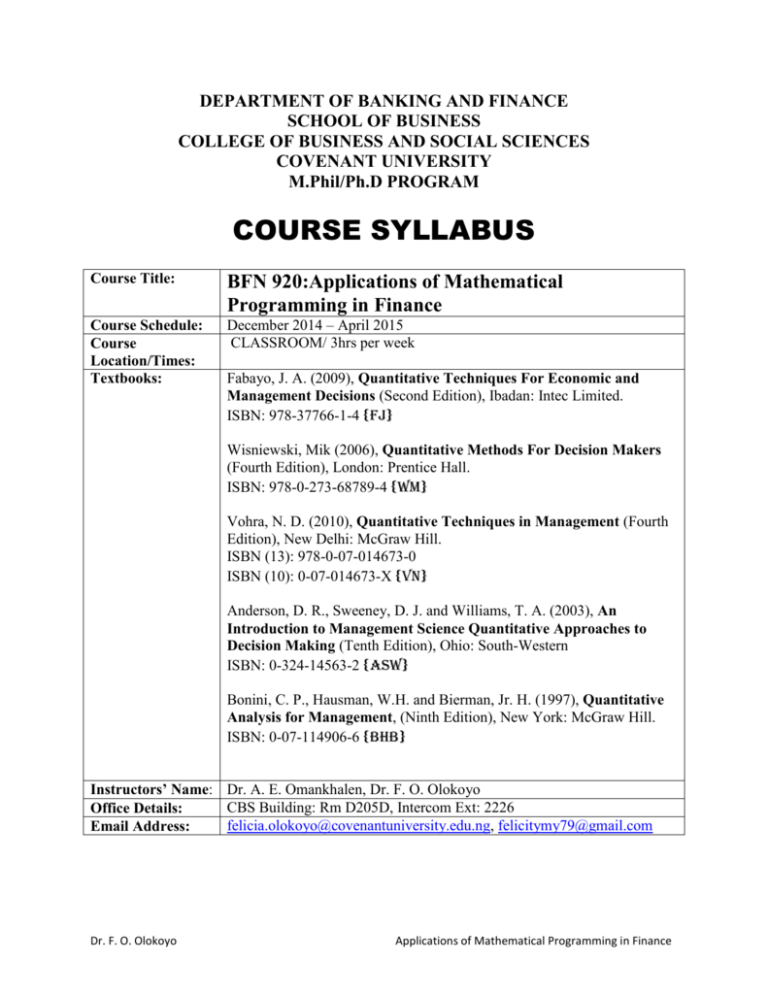

DEPARTMENT OF BANKING AND FINANCE

SCHOOL OF BUSINESS

COLLEGE OF BUSINESS AND SOCIAL SCIENCES

COVENANT UNIVERSITY

M.Phil/Ph.D PROGRAM

COURSE SYLLABUS

Course Title:

BFN 920:Applications of Mathematical

Programming in Finance

Course Schedule:

Course

Location/Times:

Textbooks:

December 2014 – April 2015

CLASSROOM/ 3hrs per week

Fabayo, J. A. (2009), Quantitative Techniques For Economic and

Management Decisions (Second Edition), Ibadan: Intec Limited.

ISBN: 978-37766-1-4 {FJ}

Wisniewski, Mik (2006), Quantitative Methods For Decision Makers

(Fourth Edition), London: Prentice Hall.

ISBN: 978-0-273-68789-4 {WM}

Vohra, N. D. (2010), Quantitative Techniques in Management (Fourth

Edition), New Delhi: McGraw Hill.

ISBN (13): 978-0-07-014673-0

ISBN (10): 0-07-014673-X {VN}

Anderson, D. R., Sweeney, D. J. and Williams, T. A. (2003), An

Introduction to Management Science Quantitative Approaches to

Decision Making (Tenth Edition), Ohio: South-Western

ISBN: 0-324-14563-2 {ASW}

Bonini, C. P., Hausman, W.H. and Bierman, Jr. H. (1997), Quantitative

Analysis for Management, (Ninth Edition), New York: McGraw Hill.

ISBN: 0-07-114906-6 {BHB}

Instructors’ Name: Dr. A. E. Omankhalen, Dr. F. O. Olokoyo

CBS Building: Rm D205D, Intercom Ext: 2226

Office Details:

felicia.olokoyo@covenantuniversity.edu.ng, felicitymy79@gmail.com

Email Address:

Dr. F. O. Olokoyo

Applications of Mathematical Programming in Finance

COURSE DESCRIPTION ______________________________________________________

This course treats at the theoretical and quantitative level the concept of mathematical

programming models and techniques as applicable in finance for effective decision making. As

decision making especially at organizational levels can be complex and has becoming

increasingly so in contemporary times, decisions have to be based largely on quantitative

information(facts or data) which have to be collected, collated, summarized, presented and

analysed in ways that, inter-alia, show relationships, indicate trends and show rates of

changes in various relevant variables. Quantitative analysis involves the application of

scientific techniques to different complex problems emanating from the control and

management of large interactive system of men, machines, materials and money in

virtually all fields of human endeavours.

Course Objectives

Introduction to Quantitative Analysis

Establish the meaning and nature of quantitative analysis

Identify the problems requiring quantitative analysis

Evaluate the phases of quantitative analysis

Examine the application areas of quantitative analysis

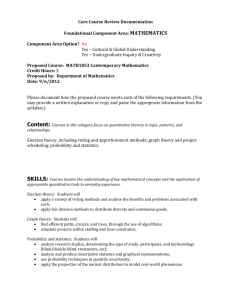

Mathematical Modeling in Finance

To understand the basic concepts in mathematical programming with special emphasis on

the optimization models.

Discuss the concept of model building

Identify the classification of models and the different types of models

Assess the relevance of quantitative models

Examine the process of financial model building

Mathematical Programming Models (MPMs)

To have an in-depth knowledge of the categories of the mathematical programming

models of portfolio selection viz-a-vis:

Linear Programming Model –Investment Decisions under Condition of Certainty

Non-linear Programming Model – Portfolio Selection

Goal Programming Model – Financial Budgeting

Integer Programming Model – Resource Allocation Problem

Mathematical Theory of Decision Making and Capital Budgeting

To appreciate various mathematical theories of decision making with more emphasis on:

Decision analysis and payoff matrix

Sequencing theory for project construction

Queuing theory and design and games theory

To have an understanding of how to adapt portfolio selection to capital budgeting with

inventory and cash management models

Dr. F. O. Olokoyo

Applications of Mathematical Programming in Finance

Point Values for the Course

ASSIGNMENTS

Seminar paper

Journal Articles Review

Final Exam

Total

POINTS

15%

15%

70%

100%

How Points and Percentage Equate to Grades

70 and Above

A

60 – 69

B

50 – 59

C

45 – 49

D

44 and Below

F

COURSE STRUCTURE

(A) Seminar Paper

Each student is expected to identify a research topic and submit to the instructor for approval.

Once the topic is approved by the instructor, the student is expected to carry out a good and

acceptable research work prior to the conclusion of the course lectures. The research work will

be carried out with the guidance of the course instructor and should be published.

(B) Journal Articles Review

Students are expected to rely on textbooks on quantitative analysis/techniques to get in-depth

background knowledge of the subject matter for each module. The students then proceed to

review the articles selected for each module by the instructor. The main requirement for this

assignment is the students’ ability to read the selected journal papers and do a good job of

reviewing/critiquing them. Each student is expected to read and write a 3 pages review of each

journal article. All articles in each module should be reviewed and the reports spiral-binded

together to be submitted to the instructor.

(C) Final Exam

The students must prepare adequately for the exam which is a very important part of the course.

The examination materials will be drawn from the classroom lectures, term paper as well as

journal articles. It is therefore of paramount importance that students pay attention to all details.

Dr. F. O. Olokoyo

Applications of Mathematical Programming in Finance

Module 1

Introduction to Quantitative Analysis

Establish the meaning and nature of quantitative analysis

Identify the problems requiring quantitative analysis

Evaluate the phases of quantitative analysis

Examine the application areas of quantitative analysis

Textbook Coverage:

{FJ}: Chapter One – Pages 1 - 15

{VN}: Chapter One – Pages 1 – 17

{WM}: Chapter One – Pages 1 – 15

{ASW}: Chapter One – Pages 1 – 12

ASSIGNMENTS______________________________________________________________

Journal Papers Review:

1. Decision Making with Quantitative Tools

http://www.cliffsnotes.com/WileyCDA/CliffsReviewTopic/Decision-Maki ng-withQuantitativeTools.topicArticleId-8944,articleId-8866.html

2. Steps for Solving Quantitative Problems and evolving techniques

go.hrw.com/resources/go_sc/ssp/HUGPS037.PDF

Dr. F. O. Olokoyo

Applications of Mathematical Programming in Finance

Module 2

Mathematical Modeling in Finance

To understand the basic concepts in mathematical programming with special emphasis on

the optimization models.

Discuss the concept of model building

Identify the classification of models and the different types of models

Assess the relevance of quantitative models

Examine the process of financial model building

Textbook Coverage:

{VN}: Chapter Nineteen – Pages 982 – 1005

{ASW}: Chapter One – Pages 7 – 22

{BHB}: Chapter One – Pages 2 – 38

ASSIGNMENTS______________________________________________________________

Journal Papers Review:

1. Mathematical

Models for Financial Management

by

M.

H.

Miller,

www.chicagobooth.edu/.../1302AC86C73446F0B7920294904E19F2.P...

2. Influence of Mathematical Models in Finance on Practice: Past, Present and Future [and

Discussion], Robert C. Merton, R. V. Simons and A. D. Wilkie, pp.451- 463,

www.jstor.org/stable/54356

Dr. F. O. Olokoyo

Applications of Mathematical Programming in Finance

Module 3

Mathematical Programming Models (MPMs)

To have an in-depth knowledge of the categories of the mathematical programming

models of portfolio selection viz-a-vis:

Linear Programming Model –Investment Decisions under Condition of Certainty

Non-linear Programming Model – Portfolio Selection

Goal Programming Model – Financial Budgeting

Integer Programming Model – Resource Allocation Problem

Textbook Coverage:

{FJ}: Chapter Thirteen – Pages 452 – 497

{VN}: Chapters Two – Seven – Pages 18 – 404

Chapter Sixteen – Pages 842 -870

{WM}: Chapter Eleven – Pages 399 – 429

{ASW}: Chapters Two-Five and Eight - Pages 31 – 224, 368 - 410

{BHB}: Chapter Two - Four – Pages 40 – 184

ASSIGNMENTS______________________________________________________________

Journal Papers Review:

1. A Mathematical Programming Model to Global Supply Chain Management: Conceptual

Approach and Managerial Insights by Panos Kouvelis and Meir J. Rosenblatt

apps.olin.wustl.edu/workingpapers/pdf/2003-03-002.pdf

2. Mathematical Programming: An Overview web.mit.edu/15.053/www/AMP-Chapter-01.pdf

Dr. F. O. Olokoyo

Applications of Mathematical Programming in Finance

Module 4

Mathematical Theory of Decision Making and Capital Budgeting

To appreciate various mathematical theories of decision making with more emphasis on:

Decision analysis and payoff matrix

Sequencing theory for project construction

Queuing theory and design and games theory

To have an understanding of how to adapt portfolio selection to capital budgeting with

inventory and cash management models

Textbook Coverage:

{FJ}: Chapter Fourteen – Pages 506 – 526

Chapter Sixteen – Pages 575 – 619

Chapter Seventeen – Pages 625 - 679

{VN}: Chapter Eight – Pages 414 – 442

Chapter Nine – Pages 442 -870

Chapter Ten – Pages 522 – 561

Chapter Thirteen – Pages 696 – 743

Chapter Fifteen – Pages 796 – 831

{WM}: Chapter Six – Pages 180 – 200

{ASW}: Chapters Eleven – Pages 479 – 523

Chapter Twelve – Pages 525 – 553

Chapter Fourteen – Pages 624 - 684

{BHB}: Chapter Eight – Pages 332 - 377

Chapter Nine – Pages 380 – 407

ASSIGNMENTS______________________________________________________________

Journal Papers Review:

1. Groups Discussing Inventory Quantitative Model of Decision Making – Yahoo Groups

http://groups.yahoo.com/phrase/inventory-quantitative-model-of-decision-making

2. Solving Of Waiting Lines Models in the Bank Using Queuing Theory Model the Practice

Case: Islami Bank Bangladesh Limited, Chawkbazar Branch, Chittagong by Mohammad

Shyfur Rahman chowdhury, Mohammad Toufiqur Rahman and Mohammad Rokibul Kabir.

www.iosrjournals.org/ccount/click.php?id=5088

Dr. F. O. Olokoyo

Applications of Mathematical Programming in Finance