Alan Liddel - New Zealand Credit & Finance Institute Inc

advertisement

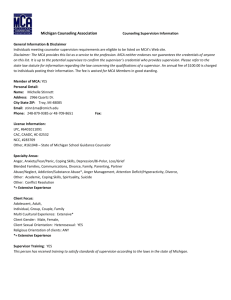

NZ Credit and Finance Institute conference July 2012 - Speech 13-7-12. Ladies and Gentlemen when I came in this morning, I heard someone asking another “who is this guy Alan Liddell?” and I thought it was a reasonable question. The other day I googled myself and the first entry related to the website of a credit consultant I do contract work for, the second referred to my Linked In profile (which is sparse) and the third one was - this invoice in July invoices 1. • Liddell Alan • Tauranga • Lawyer, Lawyers www.tuugo.co.nz/Companies/liddell-alan/0210003151712Cached Paedophile Liddell detained indefinitely - National - NZ Herald News Detective Sergeant Alan Symonds said that though Liddell was not the worst offender, ... That is not me or, more grammatically, I am not he. Some of what I say today overlaps with what I discussed with a lunchtime meeting of the Auckland branch back in March this year as the subject of that talk was also recent developments in the PPSA. The first case we look at is SOMME LTD v CENTRAL HOUSE MOVERS LTD - High Court, Wanganui, a decision of Kos J delivered on the 9 th of September last year. Citation so far is CIV-2011-483-2 A delivers four relocatable houses to B's property as part of a sale to B. However, B only pays one-third of the sum due to A. So A comes and takes three of the houses away again. The problem is that by then B has already sold the land (and the houses) to C. C sues A in conversion and trespass, and seeks summary judgment for what appears to be a highly inflated figure. Does A have an arguable defence? (From the judgement) A is Central House Movers (CHML), the supplier and remover of the houses, and defendant in this proceeding. CHML is in the business of shifting and selling houses. It operates from premises at Bulls. One of its directors, a Mr Michael O'Byrne, provided affidavit evidence.. B is a company called Vakamon Ltd -- the purchaser of the houses. Prior to August 2009 it owned the property at No 141B, No 3 Line. Vakamon was incorporated in August 2006 by a Mr Farid Herschend. Mr Herschend is the sole shareholder of Vakamon. He and his sister, a Ms Torkan May, are its directors. So CHML sells 4 houses to Vakamon and delivers them to Vakamon’s land. Vakamon fixes them to the land and does not pay for them. C is Somme Ltd, the plaintiff. It now owns the property at No 141B, No 3 Line. Somme was incorporated in July 2008. The sole shareholder and director of Somme is now a Mr Robert Stadniczenko. Mr Stadniczenko became the sole shareholder on 24 July 2009 -- a few days before Somme acquired the property at No 141B, No 3 Line. Mr Stadniczenko provided affidavit evidence. After the houses were delivered they had been placed on and attached to piles. Skirting boards had been placed round them. Some had exterior deckings and gardens were planted round them. The plaintiff company claimed also that services - power, water etc - had been connected but the court did not believe it. CHML sues and obtains judgment against Vakamon which by then is not worth powder and shot. It is a shell. And now from the judgment: Unsurprisingly frustrated with what had occurred, CHML's Mr O'Byrne, went to the property on 30 January 2010. He took with him 25 workmen. Over the course of the day they removed three of the houses. The fourth was disconnected and prepared for removal. Some of its fixtures and fittings were removed. There is some dispute on the evidence as to what occurred during the removal process. Mr O'Byrne was present. So were the 25 workmen. On the other side, Mr Stadniczenko did not attend. He seems to have been out on a boat in Cook Strait. But his solicitor, a Mr Moore, had no fishing to do that day and so he attended instead. Then two police constables attended. They came at Mr Moore's request. Mr Moore left the site and prepared 30 trespass notices. On his return he handed out the notices to Mr O'Byrne and his workmen. The notices were not received with complete equanimity by those served. The words used are not stated in evidence, but with the due regard for precedent displayed in those parts, were probably "emphatic versions of You be off'". Work to remove the houses continued notwithstanding the notices. The police did not intervene further. They saw it all as a civil dispute. Far away on his boat, but informed of events by cellphone, Mr Stadniczenko saw it rather differently. He thought that his houses were being stolen. But perhaps house stealing had not yet been recognised as a crime in the Wanganui police district. Certainly it was fairly novel activity for any district. In any case Mr Stadniczenko's theories on the state of the criminal law did not avail him. The police continued to stand by. Each side continued to order the other off. Probably in similar terms and tones as accompanied the trespass notices. But no one went anywhere. Mr Moore then arranged for 15 security guards -- they are less charitably described by Mr O'Byrne -- to attend. They parked their vehicles in front of the defendant's house removal transporters. Soon after, they engaged the workmen in conversation. Despite the security guards' presence, and their parking arrangements, three houses were still removed. The fourth was left behind. It had been much damaged in the course of preparing to remove it. There is a dispute as to whether an agreement was reached permitting removal of the three houses. I will get to that issue in due course. The judge then quoted from another case which suggested that since the houses were fixed to the land it was for CHML to prove that they were not intended to be part of it. Since CHML could not prove that the houses had been intended to remain as chattels, the houses were therefore part of the land and belonged to whoever owned the land. In this case it is Somme. So any remedy for CHML is going to be in damages, not against the houses. But we already know that Vakamon which was the contractual purchaser is a shell. However, even before that, what was missing from CHML’s defence? Two things. Did Vakamon own the houses on the land before it sold the land to Somme? Section 20 rule 1 of the Sale of Goods Act 1908 says it did. Secondly, did CHMl take any security interest? No, it didn’t. But even if it had done so and had registered that interest, it would have been fruitless as the houses were no longer chattels. They were fixtures on the land and no longer subject to the PPSA. What CHML should have done was retain a security interest in the houses but also obtained an agreement to mortgage over the land in case the houses were fixed to it and then lodged a caveat pursuant to the agreement to mortgage. Similarly it should have obtained the consent of any mortgagee to the effect that either the houses did not become part of the land or that CHML had the right in any event to remove them if not paid. Now as it happens before CHML went and got the houses, there was a proposal from the solicitors for Vakamon whereby Vakamon acknowledged the outstanding debt (by then apparently $187,000) that CHML would get some security over the land once a subdivisional consent was granted and that then Vakamon would enter into an agreement to mortgage. A deed of acknowledgment of debt was signed by Vakamon. However, it was conditional as to the consent being obtained and the court held that it did not create an immediate right to a mortgage. Then of course Vakamon sold to Somme, anyway. Now the court held that Vakamon’s wrongful action in selling to Somme may have essentially “triggered” CHML’s right to call for an immediate agreement to mortgage and the Judge left it to the final hearing to deal with that issue. Remember this was an argument over summary judgment. Further, even if CHML succeeded in proving a right to an immediate agreement to mortgage, supporting a caveat, it then faced Somme which claimed to be a bona fide purchaser for value. The judge said that it was too early to make a finding of dishonesty against Somme and its principal but if dishonesty was found the fraud exception to indefeasibility might apply. Secondly, Somme might face an in personam (against the company not in relation to the land) action in Equity based on unconscionable conduct. Why would it find dishonesty against Somme? If I tell you that the initial director and shareholder of Somme was Mrs May, the sister of Mr Herschend and that Mr Stadniczenko became shareholder and director a few days before Somme purchased the land and that Mr Stadniczenko was the trustee of Mrs May’s trust and that Mr Stadniczenko had guaranteed Vakamon’s debt to its mortgage lender and there were other business connections with Mrs May - would you then suspect some dishonesty. Clearly the judge had his suspicions and said so. The court found that the relationship between Vakamon and Somme was much closer than the bald information given here which in itself raises suspicions as to whether Vakamon had ever intended to pay CHML. Anyway, the judge said that though CHML might have defences to the claim for damages, it did not have a defence to the claim of conversion as Somme undoubtedly owned the houses and had not agreed to their removal. Despite that, he decided it was one of the rare cases where he should exercise his discretion and refuse summary judgment. He refused it not only on quantum but also liability even though CHML had no defence. He had a discretion to do that, one rarely exercised, and he exercised it. He also awarded costs to CHML. Now the facts can be used to support a conclusion that Herschend, Mrs May and Mr Stadniczenko were in cahoots to obtain the houses cheaply. Similarly, there may have been an entirely innocent explanation of why Vakamon could not pay for the houses and had to sell the property when it did and the fact that Herschend, Mrs May and Mr Stadniczenko were related in business or to each other was a pure coincidence. However, it is a very good example of why business owners should know something about the law relating to their businesses because what was necessary to protect CHML’s position was simple and cheap compared with the total price of the 4 houses of $287,000 The next case I wanted to deal with was that of RABOBANK V MCNULTY a decision of the Court of Appeal [2011] NZCA 212 issued on the 10 th of March last year. It relates to leases for a term of one year and bailment. What’s bailment? Bailment has a number of definitions but as a minimum for it to exist, one person must be in possession of goods to which another person has a superior or reversionary right. You all know that a lease for a term of more than one year is also a security agreement requiring registration to protect the lessor’s title against as many counterclaimants as possible. Thus an operating lease is caught by the PPSA as well as a finance lease. So what is a lease for a term of one year? The PPSA defines it thus: Lease for a term of more than 1 year -(a) Means a lease or bailment of goods for a term of more than 1 year; and (b) Includes -(i) A lease for an indefinite term, including a lease for an indefinite term that is determinable by 1 or both of the parties not later than 1 year after the date of its execution; and (ii) A lease for a term of 1 year or less that is automatically renewable or that is renewable at the option of 1 of the parties for 1 or more terms, where the total of the terms, including the original term, may exceed 1 year; and (iii) A lease for a term of 1 year or less where the lessee, with the consent of the lessor, retains uninterrupted or substantially uninterrupted possession of the leased goods for a period of more than 1 year after the day on which the lessee first acquired possession of them, but the lease does not become a lease for a term of more than 1 year until the lessee's possession extends for more than 1 year; but (c) Does not include (i) A lease by a lessor who is not regularly engaged in the business of leasing. Notice that (b) makes no reference to bailment. So theoretically a lease for a term of more than one year includes a bailment if the bailment is for a term of more than one year but not if the bailment is for a term of less than one year even though a lease for less than one year can also become one for more than one year if the term is indeterminate or if the lessee holds over with the lessor’s consent so that the lease extends to more than one year. The issue has arisen several times in my experience but Rabobank v McNulty is the first Court of Appeal decision and I agree with it The McNulty case involved a stallion owned by a group of investors. Mr McAnulty and others, collectively the February Syndicate, entered into a standing agreement with Stoney Bridge Ltd (SBL) whereby SBL was appointed as studmaster/manager of a stallion owned by the Syndicate. For those of you who are interested its name was St Rheims. SBL became a bailee of the stallion. Under the standing agreement, the Syndicate did not receive any rent from SBL. A portion of the service fees earned by the stallion were paid to SBL. Rabobank New Zealand Ltd provided finance to SBL and SBL granted a security interest over its property to Rabobank. Rabobank registered a financing statement under the Personal Property Securities Act 1999 (the PPSA). The Syndicate did not register a financing statement. SBL defaulted on its obligations to Rabobank. Rabobank claimed it had a secured interest in the stallion, which had been perfected by registration and therefore took priority over the Syndicate's interest in the stallion. The Syndicate claimed its interest in the stallion was not a security interest and therefore the priority rules of the Act did not apply. The issue before the Court was whether the standing agreement constituted a "lease for a term of more than one year" per ss 16(1) and 17(1) of the Act and was therefore a security agreement creating a security interest. If the bailment was such a lease and if the syndicate were “regularly engaged in the business of leasing “then the syndicate’s interest should have been registered and as it wasn’t, Rabobank had a priority claim to St Rheims. If the bailment was not a lease or if the owners were not in the business of bailing a horse or horses then they did not have a lease and not need to register and their ownership claim beat that of Rabobank. The Court of Appeal essentially said that it thought that the word “lease” in subparagraph b and c of the definition of lease for a term of one year was shorthand for “lease or bailment of goods”. A highly sensible interpretation and first strike to Rabobank. Consequently if the owners of St Rheims were in the business of leasing or bailing goods then they should have registered their security interest in St Reims and therefore Rabobank’s position was superior. That makes sense and means that parties are more likely to know where they are. Was the syndicate regularly the business of leasing goods? The Court of Appeal, decided that a one-off bailment was not being “regularly engaged in the business of leasing goods”. It could be if it was the first of a series of bailment or leases. However, this was the only one the syndicate had. The court said that the syndicate was in the business of maintaining and making a profit from its stallion and the cost of standing the horse with the studmaster was an incidental expense, not the business itself. The Court went on to say that “In our view, the words "in the business of leasing goods" should be read as importing a requirement that the owner actually be intending to profit from the bailment or lease. This would exclude gratuitous bailments where the bailor was not receiving any payment for the use of the goods and bailments where the bailee is in the business of bailments, not the bailor. The interpretation we favour has the practical effect of excluding from the definition of "lease for a term of more than 1 year" all bailments in respect of which the bailor is not receiving (or intending to receive) consideration with a view to making a profit. Although it is not an aid to interpretation of the PPSA, it is interesting that the recently enacted Australian Personal Property Securities Act 2009 (Cth) has express statutory language that yields that outcome.” [Of course, the fact that the Aussies said so specifically IS an aid to interpretation. Our CA is merely acknowledging that the Australians got it right first time and our Ministry of Economic Development has never got round to fixing up our PPSA. It’s actually quite odd as some of the more bizarre and confusing aspects have been fixed up but others have been left for the courts to sort out with attendant commercial loss and provision of work to lawyers.] And the words “in respect of which the bailor is not receiving (or intending to receive) consideration with a view to making a profit” as a way of deciding whether the bailor is in the business of leasing also makes sense. Being in business surely means you intend to make a profit and if you do not intend to make a profit you are a hobby or a charity or a government department. Now, despite that fact that the owner of the goods might regularly bail them, it looks as if failure to receive any rental from the bailee (the person in possession) would mean that it was not a lease of goods for more than one year. So a drinks wholesaling company like Coca Cola Amatil could lend a retailer a frig for storage of Coca Cola products without the frig becoming subject to the retailer’s bank’s GSA. A petrol retailer could supply its customer with tanks without their goods suddenly being caught up in the security interest granted by the retailer to its bank. I think it is practical and sensible. Our third case deals with a lien. Anyone know what a lien is? A lien is the right of someone to retain possession of something belonging to someone else or to have a charge over it until the someone else satisfies an obligation - usually pay money. There are lots of types of lien and they can arise under contract or at common law or by statute. But if you have a contractual lien entitling you to retain possession of something - goods - or have a charge over it till an obligation is satisfied, what is that? A security interest. So, if you need to assert that contractual that lien against another secured party of the same debtor with respect to the same goods, you need to have the lien in writing and you’d be wise to register. However, liens also exist at common law - what’s an example? The mechanics lien the lien your garage has against your car when it works on it. In law the garage need not release your car to you until you have paid for the work. That lien has in fact been extended by statute but it originated at common law. Such common law liens also take priority over a security interest in some circumstances under section 93 of the PPSA. 93 Lien has priority over security interest relating to same goods A lien arising out of materials or services provided in respect of goods that are subject to a security interest in the same goods has priority over that security interest if— (a) the materials or services relating to the lien were provided in the ordinary course of business; and (b) the lien has not arisen under an Act that provides that the lien does not have the priority; and (c) the person who provided the materials or services did not, at the time the person provided those materials or services, know that the security agreement relating to the security interest contained a provision prohibiting the creation of a lien by the debtor. Example Person A has a perfected security interest in person B's car. Person B takes the car to a garage for repairs. The garage repairs the car but keeps possession of it until the garage receives payment for those repairs. The garage's lien has priority over person A's security interest. Well, a mechanic has a lien over your car for the work he does but what about somebody who stores, packs and distributes goods for sale on behalf of another - is there a packer’s lien in New Zealand? The Court of Appeal last year in TOLL LOGISTICS V MCKAY [2011] NZCA CA 188 held that there was none. A company called Scene 1 Entertainment Ltd imported DVD’s for sale. It stored them with Toll in Toll’s warehouse and when it received orders for a DVD it told Toll and Toll packed up the DVD and sent it off to the customer. Scene 1 banked with the ASB and granted it a security interest over all its present and after-acquired property. It then defaulted with the ASB and the ASB appointed receivers. The ASB had registered its financing statement on the PPSR on 4th of March 2008. When Scene 1 went into receivership it owed Toll $287,368.50 and Toll was then holding in its warehouse 500,000 DVD’s worth approximately $2.6 million. The ASB was owed $7 million and said it had the right to all the DVD’s in priority to Toll’s claims. Toll asserted a general packer's lien over the DVDs. Toll said it was entitled to the lien because part of services it provided to Scene 1 involved the packing of the DVDs to the order of Scene 1's customers. Toll claimed that a lien arose either at common law or pursuant to contractual arrangements agreed with Scene 1 and recorded in a letter dated 5 June 2009. Now Toll had a contractual lien under the letter but had not registered. Why might it deliberately not have registered - apart from ignorance or slackness or bad decisionmaking? It had possession of the DVD’s and possession is a form of perfecting your security interest just like registration. However, what would override Tolls possession? A security interest registered before Toll got possession. So the ASB general security agreement had priority over Toll’s security interest in the form of its lien Toll then asserted a lien at common law and, as we noted above, that has priority over a security interest provided that the lien claimant does not know of the security interest of the secured party. Your mechanic does not have priority over your hire purchase company for the value of the work he does if he knows the car is on hire purchase and the hire purchase agreement prohibits the creation of liens. The Court of Appeal went back to cases hundreds of years old to find that that there was no packer’s lien in New Zealand and to the extent such had existed in the past it had been associated with a time when packers were also factors and certainly in this case, Toll was not factoring Scene 1’s debts. Accordingly Toll failed. The Ministry of Consumer Affairs and Legislation since its Consumer Credit Review in 1999-2000. I’m now going to talk to you a little about the proposed changes to the Credit Contracts and Consumer Finance Act 2003 (“CC&CFA”) but out of interest, more from the point of view of the approach to lending of the Ministry of Consumer Affairs. Now, the CC&CFA was supposed to be the latest thing in consumer protection and prevention of lender abuse. It was drafted as a result of some un-researched reports from the Ministry of Consumer Affairs (“MCA”) which came out from June 1999 to October 200. The official name is the Consumer Credit Law Review - the CCLR. A lot of what is said is common sense but much of it is waffle, some of it is wrong. These are the reports. I read them and I noted that none of them referred to consultations with people from the lending industry at all let alone the small financier and high risk lending industry. In 2000, I went to a seminar where the Ministry had speakers talking about its intentions for the new legislation and I asked the main speaker how many finance companies they had consulted and he told me none. Can you imagine what drafting 5 reports on an industry - and some of them exhibit serious ignorance - without even consulting the members of that industry. Imagine what would happen if the government tried to do that with education or Maori affairs or welfare. That policy of keeping the industry out of proposals for reform of lending has continued. Anyway, the MCA cocked it up so badly that, they had to come back again, less that 6 years after the CC&CFA came into force, to have another go and part of that was the so called Financial Summit in (I think) August 2011. In fact the Ministry has they have been trying to get credit law to fit with how its policy wonks think it should ever since they got the Labour Government to pass the act originally. Let’s see how they have managed: Puzzle One The first think to look at is 5 of the CCLR, at pages 15 - 17. There the MCA lists criticisms of the Disputes Tribunal as a source of settlement of disputes between borrowers and lender. The jurisdiction for the DT at the time was $7,500 or $12,000 with the consent of both parties. Here is the extract from page 17. It is criticising the Disputes Tribunal. “Limited rights of appeal The feature of the Disputes Tribunal system of perhaps most concern to legal observers is that legally untrained referees can make binding decisions that are wrong in law and cannot be appealed. Referees are required to determine disputes according to the substantial merits and justice of the case, but this does not guarantee that the law will be followed. This is more likely to be a problem if the referee is not familiar with the law relevant to the dispute or the law is difficult to understand and apply, as is the case with the Credit Contracts Act. Not only is this unfair to those parties who do not obtain their legal rights as a result of a Tribunal decision. it also contributes to inconsistency between decisions as there is no further opportunity to "get the law right”.” Now you would think that with that attitude, the Ministry would be assiduous in making sure that a new dispute resolution system created to provide for consumer borrowers would deal with those problems (Or rather deal with what the MCA regards as problems - in fact the DT operates very well on a system of substantial justice.) So what do we get? In 2008, the Labour Government enacted the Financial Service Providers (Registration and Dispute Resolution) Act (“FSPA”). It provides that all financial service providers, which includes all lenders, must register. Additionally, they all, not just those lending under consumer credit contracts, must join a dispute resolution scheme. There are 4 such schemes, each run by a Disputes Resolution Provider. Most finance companies have registered with the only non-governmental DRP - that is Financial Service Complaints Ltd or FSCL. The FSPA was drafted by and came out of the Ministry of Economic Development which is the umbrella ministry of the MCA. The MCA is a branch of the MED. So what did the MED come up with in reconciling the problems its sub-ministry said were caused by the Disputes Tribunals? Schedule 1 Disputes Tribunals Who prepares complaining borrower’s case Parties able to ask Disputes Providers Resolution Borrower (sometimes with help from court staff but never from anyone who contributes to the decision) The DRP staff (may be a person who also contributes to the decision) Yes Not normal practice No but referee may require No Yes No If both parties attend personally. Normal if in Unlikely but possible if face to face mediation same town. takes place Now an informal requirement Not required but may be $7,500 (now $15,000) $200,000 (now same) questions of the opposition through referees Evidence on oath Hearing held Lender gets complainant to face Legally qualified referee Jurisdiction in 2008 Right of appeal Yes if hearing unfairly held Borrowers Yes All Lenders No DRP’s have initial decision subject to higher internal review if either party does not accept. Who pays referee complainant upheld? if State Lender Who pays referee complaint rejected? if State Lender - even if borrower’s claim is opportunistic and blackmailing. Consistency between decisions due to further opportunity to "get the law right”? No. Only if the borrower appeals I have already had experience of an initial recommendation from a DRP which ignored the fact that a naïve and foolish borrower had borrowed money for a commercial purpose, taking the money from my client lender and paying it to a friend to invest in the friend’s business. The friend misappropriated the money. The DRP treated her as if she had borrowed for a domestic, household or personal purpose that is as if she had borrowed under a consumer credit contract. That decision essentially guts the distinction in the CC&CFA between consumer credit contracts on the one hand and business or investment credit contracts on the other. Such decisions could be corrected with an appeal process but, from the Ministry’s position, it appears that lack of appeal rights are only wrong if consumers lack them. In the case concerned, as it was an initial recommendation, we had a chance to comment and, in any event, the borrower accepted the recommendation. So did my client because although the reasoning had this massive flaw, the actual result was not too bad for my client and it was a good lesson for it to review its procedures anyway. I have no doubt that the DRP was considerably relieved that both sides accepted the initial recommendation because, if it had had to revisit its decision on review, it would have had to acknowledge its own egregious mistake and possibly to reduce the award to the borrower (who was represented by a solicitor). What would have happened however, if the lender had not instructed me and the penalty had been much heavier? The lender might have objected and gone to review but there is no guarantee that the DRP would have noticed its own mistake without input from me or from someone else aware of the law. And there would have been no appeal for the lender and not chance to get the law right? So much for the MCA’s concerns in its report of 12 years ago Puzzle two In the Part 2 of the Consumer Credit Law Review (“CCLR”) at page 17, paragraph 3.3.4 the MCA says: “Opportunistic use of the Act by defaulting borrowers Defaulting borrowers can use the provisions of the Act to avoid contractual obligations, at great expense to the lender and other third parties. Many reported judgements on the Credit Contracts Act involve non-consumer transactions. Borrowers often are experienced traders who received professional advice before entering into the transaction. Not uncommonly, they later invoke the reopening or the disclosure provisions of the Credit Contracts Act to avoid performance of obligations which were apparent to them at the time of agreement.” Firstly, intelligent, experienced, articulate defaulting borrowers are not restricted to business borrowers. I have had the misfortune to deal on behalf of a number of finance companies with articulate and intelligent consumer borrowers, who have had a very good idea of their rights and have been unhesitating in their attempts to gain advantage from presumed deficiencies in my clients’ documentation, procedures and practices in order to avoid the consequences of their defaults. Secondly, the abuses able to be carried out by borrowers are still available to them as a result of FSPA. That legislation is an open invitation to the deranged, the dishonest, the deluded and the merely dopey to claim a non-existent dispute as a manner of blackmailing lenders into foregoing penalties on default or of obtaining another advantage such as a waiver of full prepayment losses or of other fees. Indeed, one Dispute Resolution Provider, Financial Services Complaints Limited, deliberately does not publicise the fees it charges lenders for each dispute so as to discourage dishonest borrowers from using the threat of loss of such fees to blackmail lenders into concessions. I have already acted for a firm faced with such a blackmail attempt. I’m sure you will not have missed the fact that business and investment borrowers also have rights to apply to the DRP’s in the event of a dispute. So even if the MCA’s concern at business borrowers abusing the system was genuine in 2000, by 2008, it had not only set up more procedures for consumer borrowers to do so, but it had made it easier for business borrowers to do so as well. Ordinary Courts in year Disputes Resolution 2000 Providers from 2008 Business borrowers able to game the system Yes Yes Consumer borrowers able to game the system Yes Yes Change from 2000 to 2008 No Consumer and business borrowers able to game the system and successful lenders must pay the DRP for the privilege of defending themselves Puzzle three The CCLR in part 5 on page 19 section 2.4.1 complains at the power imbalance between borrowers and lenders - the lenders being regarded as having more knowledge and “clout”. This is what it says” “Unequal position of borrower versus lender The lender will usually know more than the borrower about the contract, the Credit Contracts Act, and the legal system generally. Lenders are often large institutions, with far greater resources and "clout` than an individual borrower. Consumer credit policy has traditionally recognised that there is a major imbalance of knowledge and power between lender and borrower. Some of the criticisms in this chapter suggest that the redress and enforcement provisions of the Credit Contracts Act do not always rectify this imbalance between borrower and lender.” It is interesting to note this in the light of the aberrant interpretation of section 51 of the CC&CFA which caused the Commerce Commission, supported by the MCA, to bully finance companies on issue where both were wrong. It threatened prosecution unless the companies repaid break fees (losses on full prepayment) or stopped charging them in a way that recovered their losses. The fact is that the MCA and Commerce Commission were wrong and but use of the power imbalance for a wrongful purpose did not seem to bother the Ministry then. It was not until the Commerce Commission unsuccessfully prosecuted Avanti Finance (and then lost again after a foolish appeal) that the industry began as a rule to charge proper break fees. Nobody likes to see power abused but the Ministry’s insincerity on the subject is unedifying, especially in the light of the Commission’s refusal to debate or even discuss its interpretation of the law with the industry beforehand. Further, since the Avanti decision there has been absolutely no attempt from the MCA or the Commerce Commission to engage with the industry on fees for loss on full prepayment but instead the CC&CFA retains an attempt to compel lenders to adopt the restrictive and commercially bizarre voluntary calculation used in the regulations. (The voluntary regulation does not allow for possible variation in the lender’s cost of funds between the time a loan is made and the time it is repaid and re-lent and also penalises lenders who have reserves and are able to lend to new customers without using prepaid funds). It is easy to be cynical about the MCA and I also have constant problems with people quoting its websites. Time prevents me giving you samples of the legal advice it publishes on its site but suffice to tell you that a lot what it says is the law is subject to dispute and some of it is plain wrong. So can we go to the Minister and get the MCA reined in somehow? There have been 4 ministers in the last year - John Boscowen, who resigned in May 2011, Simon Powell, Chris Tremain and Simon Bridges. Craig Foss may have held it for a milisecond or so too - it’s hard to tell from searches on the net. I had hopes of the current Minister - Simon Bridges - appointed a couple of months ago. Bright young guy, ex criminal prosecutor in my home town and my local MP. I emailed him on one issue to do with the MCA’s incompetent management of its website a month or so ago and he fixed the website within two days. He listens, I thought and he’s efficient too. So when his Ministry in staff speeches and he himself in speeches and publications, started saying that the new changes proposed to the CC&CFA would affect only loan sharks and that responsible lenders won’t be affected, I emailed him and said “hey, this legislation affects all my clients - how do you define a loan shark and please tell me how my clients are loan sharks. Here is the email: Dear Minister, I note that in Tauranga National Party Electorate May newsletter you refer to laws toughening up on loan sharks. Attached is a copy of the newsletter. I assume that the consultation meetings you refer in the newsletter to having held were those held in Christchurch, Wellington and Auckland on the proposed changes to the Credit Contracts and Consumer Finance Act (“CC&CFA”). You are aware that I attended the Auckland meeting. One of the Ministry of Consumer Affairs (“MCA”) speakers at the Auckland consultation meeting also used the expression “loan sharks” and said that the proposed legislation was aimed only at such businesses. I was a little surprised as I had read the legislation and it appeared to me to be directed at all lenders who lent money for consumer purposes, not merely at “loan sharks”. However, I thought that perhaps the Ministry regarded all lenders who made loans to consumer as loan sharks. I hoped I was wrong. Accordingly last Wednesday , as I was finishing my submissions on the proposed bill, I phoned the Ministry and asked one of the staff dealing with the CC&CFA (Amelia Bell) what a loan shark was. She told me that the Ministry did not use the expression as it was “political” and she referred me to “the Minister”. Now I know that the Ministry does use the expression as I heard the speaker at Auckland do so. Further when I go on to the Ministry Website one of the URL’s is for “beehive.govt.nz – Consumer Affairs” and that leads me to another site with a list of press releases of which one is headed “Loan shark law meetings start next week”. For your interest, here is the URL for that. At the bottom of that press release there are further URL’s for you and back to the Consumer Affairs section of the beehive URL. One assumes that the Ministry would not have a link to something that it did not agree with, especially what it is the beehive government website. http://www.beehive.govt.nz/release/loan-shark-law-meetings-start-next-week As the Ministry was evasive, I was unable to address the question in my submission. Since then I have been given a copy of the newsletter and seen the press release on the beehive site. They concern me as the expression “loan shark” is extremely offensive and instead of being restricted to some casual oral comments, they are now in writing for all to see. Since the Ministry does use the expression and denies it but you use it and would not deny it, would you mind please advising the answers to the following questions. 1 What precisely is a loan shark? My clients and I would prefer that you gave us this definition in clear concise and intelligible language. That is the requirement for lenders when giving disclosure to borrowers under the CC&CFA we would expect you to apply the same standard to your own advice to my tax paying clients. The reference to people who operate out of car boots or garages (your expressions in Auckland) is hardly going to inform us. 2 Do you regard all my clients as loan sharks? I recently filed a submission with the MCA on behalf of a 24 finance companies who make loans for consumer purposes. They are concerned because the proposed changes will impose widely and vaguely worded standards which depend hugely on value judgements and those standards affect all of those 24 finance companies. They are listed at the end of the submission I supplied but I am happy to provide a list to you directly. 3 If my clients are regarded as loan sharks, why are they? 4 If you do not regard all my clients as loan sharks, do you regard some of them as such? 5 If you accept that some or all of my clients are not loan sharks, why is your Ministry introducing legislation that affects all business that lend to consumers rather than merely lenders who fall within the definition of loan sharks (which I assume you are going to give us)? 6 Or, if you cannot define a loan shark, why are you using the expression? And why is it in writing published in government websites and your electorate newsletter? Anyway, the minister didn’t reply. I couldn’t work out why and then realised how naïve I’d been when he replied quickly the first time. In the first email I had pointed out to him that when we Googled the words Minister of Consumer Affairs, the second entry was an announcement on the MCA website that John Boscowen had been appointed the new Minister and he was 4 ministers back. I guess when it comes to the minister being personally affected he moves quickly but not when his Ministry is demonising a bunch of small businesses which are operating within the law in a highly regulated environment. So with this sort of background, when the MCA introduces changes to credit law and claims that the changes are intended only to affect loan sharks, when in fact they apply to the whole consumer lending industry, you can imagine that faith in the Ministry’s integrity of process is pretty low. And when you read the changes and learn of the appalling lack of proper research behind them, you can see why it drops to minus levels. There was consultation after the ministry drafted a bill for consideration but that consultation was less effective as the MCA had already set the stage using its own prejudices and assumptions. Besides, the industry was “consulted” merely as part of the general public. Time prevents my covering all the flaws in the MCA’s proposals and the worst, the wording of the so called “responsible lending” rules are not covered at all here but here is a small sample. Example 1 - Default interest may only be charged on unpaid instalments, not on the full unpaid balance of the loan. Now this shows such a ignorance of lending and of risk that one wonders what the qualifications of the staff at the MCA might be. The Ministry in fact has claimed on its website for some years that this is already the law but it knows it’s wrong and now the policy wonks want set it out specifically. OK - the theory behind it is that since the lender is only losing the use of the instalment on default, penalty interest should only be charged on that instalment. What’s missing? What has not been considered? Lending and interest rates are all about risk. When a lender sets an interest rate for its borrowers, it is based on its assessment of risk for that borrower or that class of borrowers. However, bearing in mind that every time a borrower fails to repay all or part of a loan, the failure begins with one or more payment defaults, the fact that a borrower may so default once or more is something that affects what interest rate a lender will charge him. If a lender is in the high risk lending business, its basic interest rate is likely to be from 16% per annum to 30% per annum based on that risk. If a lender knew in advance that any loan applicant was going to default in paying an instalment at least once, the interest rate on the initial loan amount would be anywhere from 5 to 10% per annum higher, depending on what a lender knew about the applicant and that borrower class. Since a lender does not know in advance, it treats the applicant as if she will make all her payments on time and charges her the normal rate for her or her borrower class risk level and when she defaults (and only if she defaults), the lender charges her for the additional risk caused by that default. That additional charge should be applied against the unpaid balance because it is the unpaid balance that is at greater risk as a result of the default. Had the lender known at the beginning the debtor would default it would have charged the higher interest rate on the whole loan from the beginning. The proposal to alter the incidence of risk in the manner set out in the proposed amendments is bizarre and will merely load greater burdens on to non defaulting borrowers. Example 2 A lender must disclose agreed changes and changes following an exercise of a power even if the terms have become more lenient to the debtor. In some circumstances this may not matter. It will be inconvenient and lenders would rather avoid it but they charge for sending out disclosure letters and emails and can compensate themselves. However one aspect of it is plain stupid and it would have been avoided if the MCA had consulted one (just one and any one) small finance company before putting it in the bill. That is to repeal sections 22(3) and 23(5) of the CC&CFA which essentially say that if the parties agree or the lender exercises a power to allow the debtor extra time to make a payment (or in some others ways to reduce the debtor’s obligation, then variation disclosure is not necessary. I have a friend who runs a small lending company with a book of about $500,000. He has a lot of small loans. He gets called several times a week to be advised in advance that one or another debtor will miss the next due periodical payment. He notes the person’s file, charges them the penalty interest and, because they call in advance, he waives the default fee which he otherwise would charge. That fee, which involves trying to contact the debtor when there is a default and seeing what the problem is, will be $15.00 for a first default like that. If he has to send out a variation disclosure notice every time he gets a phone call from a debtor and gives him a bit longer to pay, he is going to be sending out several notices a week telling a borrower what the person already knows and people who are struggling to the point where they are going to miss making an instalment are then going to be loaded with another fee. It costs money to create send out notices and the amounts lenders can charge are regulated and lenders would rather avoid it. Section 45(5) of the Act is proposed to be repealed. That is the subsection that presently allows a lender to charge a reasonable commission when passing on the cost of credit related insurance premiums The complete prohibition of commissions in the absence of explanation, suggests an intention not to provide for a fair commission but to deny a lender income altogether. No research has been published showing any excess of commissions charged or comparing commissions paid to lenders with commissions paid to insurance brokers, lawyers, accountants and other businesses operating insurance agencies. What is the evil this prohibition is aimed at? Why are lenders being refused the right to charge commission when other agents are allowed to do so. The MCA is silent on the topic. Thank you for listening to me.