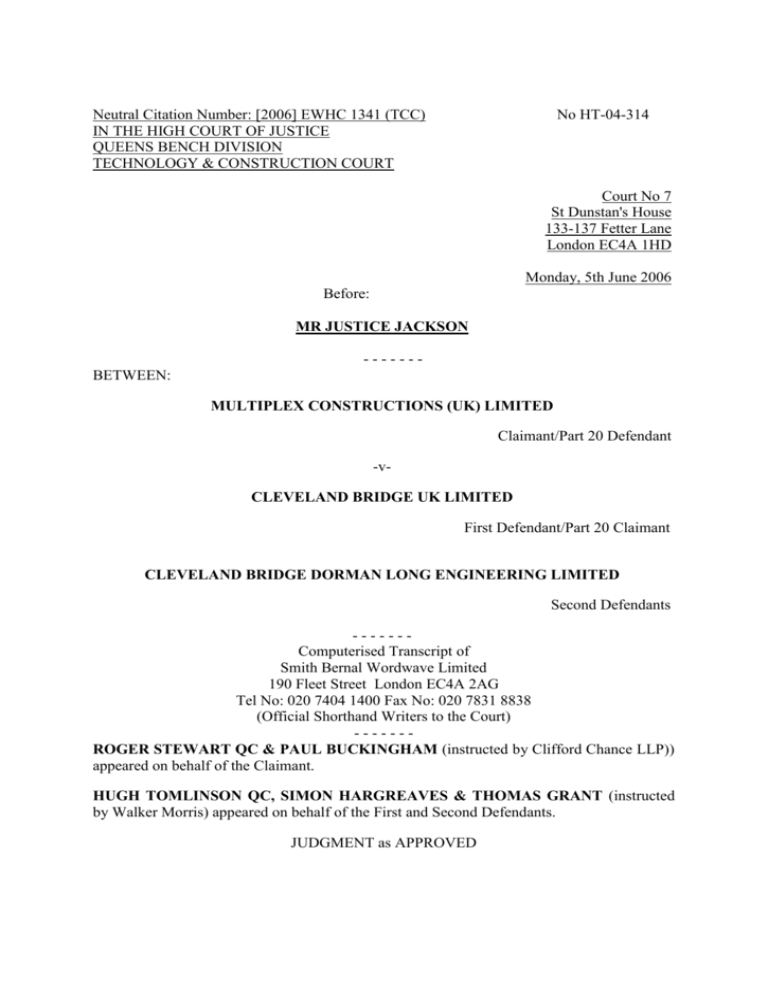

the Wembley court ruling in full (Word )

advertisement