Course: Corporate Finance

advertisement

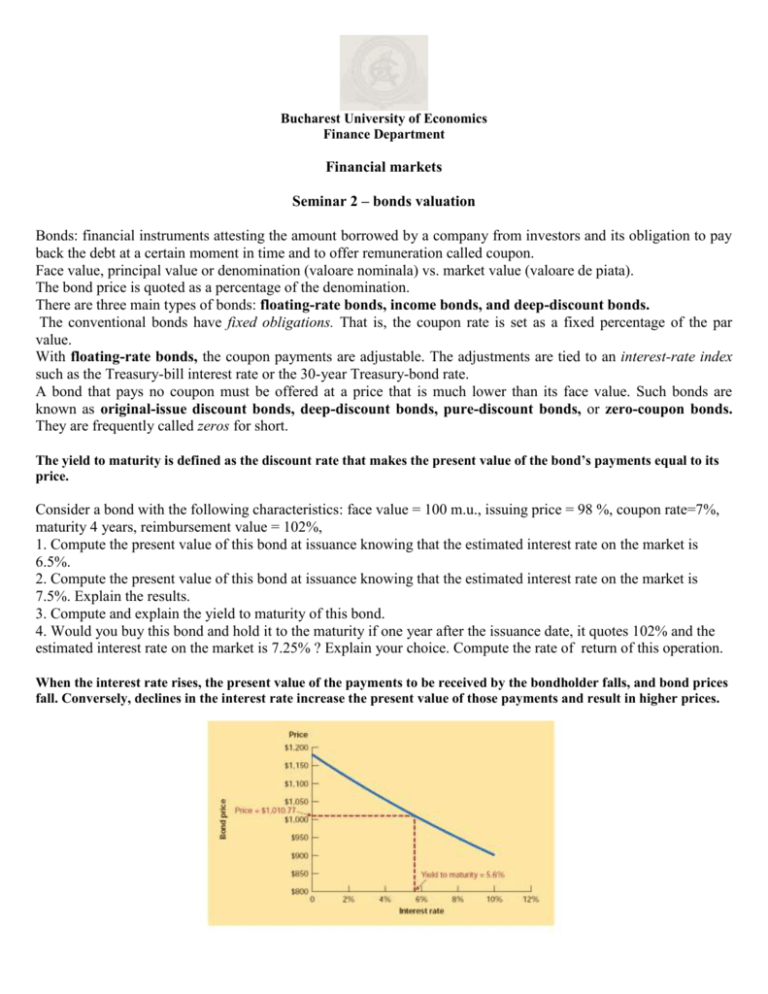

Bucharest University of Economics Finance Department Financial markets Seminar 2 – bonds valuation Bonds: financial instruments attesting the amount borrowed by a company from investors and its obligation to pay back the debt at a certain moment in time and to offer remuneration called coupon. Face value, principal value or denomination (valoare nominala) vs. market value (valoare de piata). The bond price is quoted as a percentage of the denomination. There are three main types of bonds: floating-rate bonds, income bonds, and deep-discount bonds. The conventional bonds have fixed obligations. That is, the coupon rate is set as a fixed percentage of the par value. With floating-rate bonds, the coupon payments are adjustable. The adjustments are tied to an interest-rate index such as the Treasury-bill interest rate or the 30-year Treasury-bond rate. A bond that pays no coupon must be offered at a price that is much lower than its face value. Such bonds are known as original-issue discount bonds, deep-discount bonds, pure-discount bonds, or zero-coupon bonds. They are frequently called zeros for short. The yield to maturity is defined as the discount rate that makes the present value of the bond’s payments equal to its price. Consider a bond with the following characteristics: face value = 100 m.u., issuing price = 98 %, coupon rate=7%, maturity 4 years, reimbursement value = 102%, 1. Compute the present value of this bond at issuance knowing that the estimated interest rate on the market is 6.5%. 2. Compute the present value of this bond at issuance knowing that the estimated interest rate on the market is 7.5%. Explain the results. 3. Compute and explain the yield to maturity of this bond. 4. Would you buy this bond and hold it to the maturity if one year after the issuance date, it quotes 102% and the estimated interest rate on the market is 7.25% ? Explain your choice. Compute the rate of return of this operation. When the interest rate rises, the present value of the payments to be received by the bondholder falls, and bond prices fall. Conversely, declines in the interest rate increase the present value of those payments and result in higher prices. Duration is a weighted measure of the length of time the bond will pay out. Basically, it is a weighted average of the maturity of all the income streams from a bond or portfolio of bonds. D =[Σ t•income / (1+r)t] / PV Sensitivity is the change in the value of a fixed income security that will result from a 1% change in the interest rate. S= -D Δ PV = -D• Δr = S• Δr 5. Compute the duration of the bond and estimate its price if the interest rate on the market is 7,3%. Exercises: 1. Compute the yield to maturity and the duration of a pure-discount bond issued on January 1st 2008 having an issuance price of 600 m.u., a maturity period of 4 years and a reimbursement value of 900. Compute its present value on January 1st 2010 if the interest rate on the market is 5% and the rate of return on the operation of buying this bond on January 1st 2010 at the price of 760 m.u.. 2. An investor wants to create a bonds portfolio immune on 5 years having two types of bonds: A) bonds having a face value of 100 and a coupon rate of 6%, the interest rate on the market being estimated at 5,75% and the maturity of 5 years, B) zero coupon bonds with a maturity of 7 years. Please provide the structure of this portfolio.