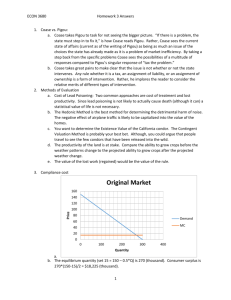

Coase Theorem

advertisement

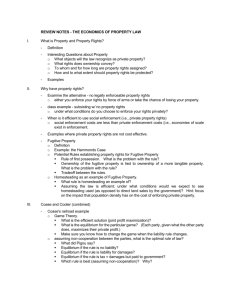

Coase Theorem From Wikipedia, the free encyclopedia In law and economics, the Coase theorem describes the economic efficiency of an economic allocation or outcome in the presence of externalities. The theorem states that if trade in an externality is possible and there are sufficiently low transaction costs, bargaining will lead to an efficient outcome regardless of the initial allocation of property. In practice, obstacles to bargaining or poorly defined property rights can prevent Coasian bargaining. This "theorem" is commonly attributed to The University of Chicago's Nobel Prize laureate Ronald Coase. This 1960 paper, along with his 1937 paper on the nature of the firm (which also emphasizes the role of transaction costs), earned Ronald Coase the 1991 Nobel Memorial Prize in Economic Sciences. The theorem Coase developed his theorem when considering the regulation of radio frequencies. Competing radio stations could use the same frequencies and would therefore interfere with each other's broadcasts. The problem faced by regulators was how to eliminate interference and allocate frequencies to radio stations efficiently. What Coase proposed in 1959 was that as long as property rights in these frequencies were well defined, it ultimately did not matter if adjacent radio stations interfered with each other by broadcasting in the same frequency band. Furthermore, it did not matter to whom the property rights were granted. His reasoning was that the station able to reap the higher economic gain from broadcasting would have an incentive to pay the other station not to interfere. In the absence of transaction costs, both stations would strike a mutually advantageous deal. It would not matter which station had the initial right to broadcast; eventually, the right to broadcast would end up with the party that was able to put it to the most highly valued use. Of course, the parties themselves would care who was granted the rights initially because this allocation would impact their wealth, but the end result of who broadcasts would not change because the parties would trade to the outcome that was overall most efficient. This counterintuitive insight — that the initial imposition of legal entitlement is irrelevant because the parties will eventually reach the same result — is Coase’s invariance thesis. Coase's main point, clarified in his article 'The Problem of Social Cost,' published in 1960 and cited when he was awarded the Nobel Prize in 1991, was that transaction costs, however, could not be neglected, and therefore, the initial allocation of property rights often mattered. As a result, one normative conclusion sometimes drawn from the Coase theorem is that property rights should initially be assigned to the actors for whom avoiding the costs associated with the externality problem are the lowest. The problem in real life is that nobody knowsex ante the most valued use of a resource, and also that there exist costs involving the reallocation of resources by government. Another, more refined, normative conclusion also often discussed in law and economics is that government should create institutions that minimize transaction costs, so as to allow misallocations of resources to be corrected as cheaply as possible. Version 1: A clear delineation of private property rights is an essential prelude to market transactions. Version 2: As long as private property rights are well defined under zero transaction cost, exchange will eliminate divergence and lead to efficient use of resources or highest valued use of resources. Version 3: The allocation of resources is invariant to the assignment of private property rights under zero transaction cost and zero income effect. Efficiency and invariance Because Ronald Coase himself did not originally intend to set forth any one particular theorem, it has largely been the effort of others who have developed the loose formulation of the Coase theorem. What Coase initially provided was fuel in the form of “counterintuitive insight” [3] that externalities necessarily involved more than a single party engaged in conflicting activities and must be treated as a reciprocal problem. His work explored the relationship between the parties and their conflicting activities and the role of assigned rights/liabilities. While the exact definition of the Coase theorem remains unsettled, there are two issues or claims within the theorem: the results will be efficient and the results in terms of resource allocation will be the same regardless of initial assignments of rights/liabilities. Efficiency version: aside from transaction costs, the prevailing outcome will be efficiet The zero transaction cost condition is taken to mean that there are no impediments to bargaining. Since any inefficient allocation leaves unexploited contractual opportunities, the allocation cannot be a contractual equilibrium. Invariance version: aside from transaction costs, the same efficient outcome will prevail This version fits the legal cases cited by Coase. If it is more efficient to prevent cattle trampling a farmer's fields by fencing in the farm, rather than fencing in the cattle, the outcome of bargaining will be the fence around the farmer's fields, regardless of whether victim rights or unrestricted grazing-rights prevail. Subsequent authors have shown that this version of the theorem is not generally true, however. Changing liability placement changes wealth distribution, which in turn affects demand and prices.[4] These wealth effects may be small, however.

![New Institutional Economics [NIE]](http://s2.studylib.net/store/data/005438886_1-ae096202c0642c437b8d589e7fef75a9-300x300.png)