Coase (1960)

advertisement

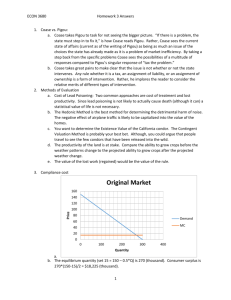

Road to the 1991 Nobel Prize in Economics COASE (1960) Presented by Eric Banister and Matt Panhans What is the Coase Theorem? It is necessary to know whether the damaging business is liable or not for damage caused since without the establishment of this initial delimitation of rights there can be no market transactions to transfer and recombine them. But the ultimate result (which maximises the value of production) is independent of the legal position if the pricing system is assumed to work without cost (Coase 1960, p. 8). The Coase theorem . . . asserts that under perfect competition private and social costs will be equal. (Stigler, Theory of Price, 1966, p. 113) if one assumes rationality, no transaction costs, and no legal impediments to bargaining, all misallocations of resources would be fully cured in the market by bargains (Calabresi 1968, p. 68 If transaction costs are zero the structure of the law does not matter because efficiency will result in any case (Polinsky 1974, p. 1665). In sum, the Coase theorem states the following: if the property rights to any resource are assigned rather than unassigned, and if exchange costs are sufficiently low, the ultimate use of the resource is independent of the initial assignment of the rights to the resource (although the initial assignment of rights does affect the wealth of the transactors involved) (Baird 1975, p. 222, emphasis added if there were (a) no wealth effects on demand, (b) no transaction costs and (c) rights to pollute or control pollution, the allocative solution would be invariant and optimal, regardless of the initial assignment of rights (Frech 1979, p. 254). In a world of zero transaction costs, the allocation of resources will be efficient, and invariant with respect to legal rules of liability, income effects aside (Zerbe 1980, p. 84). in the presence of transaction costs the location of a pollution tax or of other liability for damages does matter for efficiency (McCloskey, Applied Theory of Price, 1982, p. 354) [A] change in a liability rule will leave the agents’ production and consumption decisions both unchanged and economically efficient within the following (implicit) framework: (a) two agents to each externality bargain, (b) perfect knowledge of one another’s (convex) production and profit or utility functions, (c) competitive markets, (d) zero transactions costs, (e) costless court system, (f) profitmaximizing producers and expected utility maximizing consumers, (g) no wealth effects, (h) agents will strike mutually advantageous bargains in the absence of transactions costs (Hoffman and Spitzer 1982, p. 73). when parties can bargain together and settle their disagreements by cooperation, their behavior will be efficient regardless of the underlying rule of law (Cooter and Ulen 1988, p. 105) a change in [law] affects neither the efficiency of contracts nor the distribution of wealth between the parties (Schwab 1988, p. 242) Social context Reaction against “blackboard economists” Economics is increasingly mathematical, case studies becoming unfashionable Coase read many court cases of recording studios near noisy factories the theorem stood on its head a half century of received thinking about externalities and market failure. (Medema, p10) Externalities before 1960 (and still today) Goods whose value is more than their cost are produced. In the presence of externalities, this may not be the case. We need Pigovian taxes equal to negative externality to achieve economic efficiency. Coase added three things: (1) externalities are not necessarily inefficient, (2) Pigovian taxes are not necessarily desirable, and (3) problem is not externalities; the problem is transaction costs Against Pigou’s Railway Perfect competition Firm’s perspective, not liable for damage: 1 train/day yields revenue of $150 & costs $50 to operate 2 trains/day yield revenue of $250 & cost $100 But, 1 train causes $60 in crop damage; 2 cause $120 Total social production value from one train: $150 - $50 - $60 = $40 Total social production value from two trains: $250 - $100 - $ 120 = $30 Against Pigou’s Railway The Pigovian tradition argues one train should run and to ensure this, the railway operator should be made liable for damage Coase agrees that only one train should run, but critically disagrees that liability is always the optimal solution. The Problem with Pigou Let bargaining be prohibitively expensive. Whether liability is assigned now leads to different situations. When railway is liable for damages, additional cultivation means 1 train now causes $120 in crop damage and 2 trains now cause $240 in crop damage So, with liability assigned to the railway: 1 train: $150 - $50 - $120 = -$20 (train will not run) 2 trains: $250 - $100 - $240 = -$90 (trains not run) Now it is not profitable to run either train. Approach with the Coase Th. Two trains, bargaining prohibited: Back to $120 in crop damage. But some land ($120 worth of crops) has been abandoned from cultivation vis-à-vis the situation with liability for the railroad. Allow that not all of the crops on that now-abandoned land would have been destroyed, so the total value could be $160. Once abandoned, the land and resources could be used alternatively, say for uses worth $150. So, two trains, total social production value: $250 - $100 - $120 - $160 + $150 = $20 profit In Summary Pigovian approach: assign liability by disparity between private & social costs and particular deficiencies of system. But, “the proper procedure is to compare the total social product yielded by these different arrangements.” (34) Note the railway is not a generalized model, but is a specific example. With different numbers, a different result might obtain. And this is exactly Coase’s point: The correct approach to policy is an opportunity cost approach that requires knowledge of the specifics of a given situation and weighs the benefits and costs of “alternative social arrangements” rather than assigning liability or levying taxes for damage automatically Modern Day examples Wind turbine projects: Offshore of Cape Cod, MA: Electricity for 420,000 homes; powerful critics of imposing on the natural beauty and wildlife of Cape Cod; 81% popular support building turbines Appalachia: Residents have filed a nuisance suit to block construction Sydney pays residents to move outside city (ht:Traviss) Crowding, rising house prices, strain on infrastructure—all have led government offer residents AU$7,000 to move Complexity of such projects testifies to Coase’s point that high transaction and information costs can prevent parties from reaching an efficient bargain Law, Economics, & Ethics Encouraging a shift in law and policy: Proper regulation “has to come from a detailed investigation of the actual results of handling the problem in different ways.” (18-19) Coase strongly encouraged the courts to understand and be informed by the economic consequences of their rulings and the ideas of reciprocity in liability. In concluding the common ground here, Coase cited Frank H. Knight as saying, “problems of welfare economics must ultimately dissolve into a study of aesthetics and morals.” (43) Reality check: How would you react? Problems Critical Assumption: no transaction costs. even Coase (1960) acknowledged this limitation. Transaction costs are everywhere. Anything can be rationalized by transaction costs Fails in presence of asymmetric information Formalization of theory. And hopefully, predictive successes Development Since 1960 Coase Theorem Williamson and transaction costs Transaction become the basic unit James Buchanan: the lens of choice vs. the lens of contract approaches to economic organization “The Vertical Integration of Production” (1971) Pre-formal, semi-formal, and formal stages “an interesting and challenging future” Nanoeconomics References Coase (1960) David Friedman, “The Swedes Get It Right,” (1991). Link Medema (2010), Coase Theorem. link D. McCloskey note Williamson, Oliver. “Transaction Cost Economics: The Natural Progression.” AER. 100 (June 2010): 673–690. also, this link References http://www.boston.com/lifestyle/green/green blog/2010/04/cape_wind_decision_expected_ to.html http://www.npr.org/templates/story/story.ph p?storyId=5300507 http://www.guardian.co.uk/world/2011/jun/29 /sydney-pays-people-to-leave

![New Institutional Economics [NIE]](http://s2.studylib.net/store/data/005438886_1-ae096202c0642c437b8d589e7fef75a9-300x300.png)