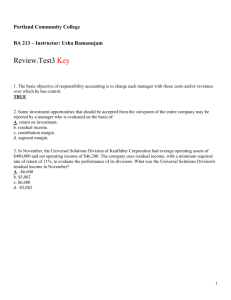

Chapter 24 – Kimmel Accounting 5e Challenge Exercises CE 24

advertisement

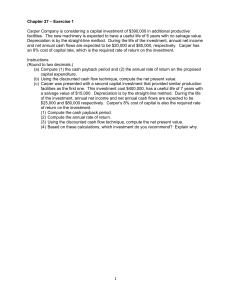

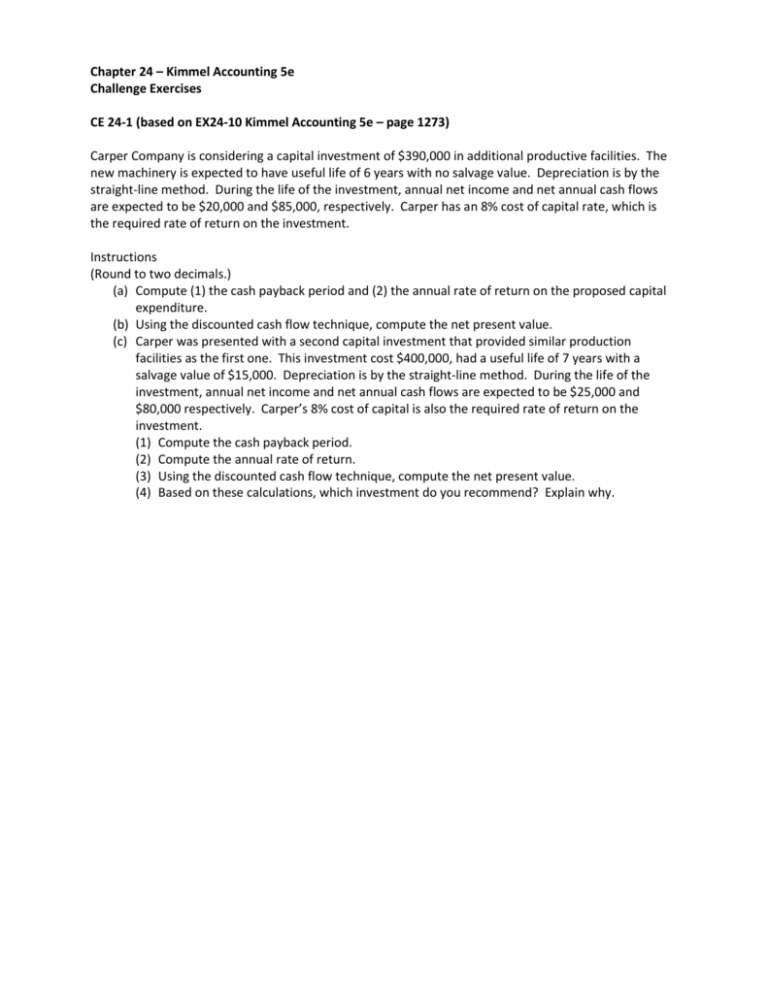

Chapter 24 – Kimmel Accounting 5e Challenge Exercises CE 24-1 (based on EX24-10 Kimmel Accounting 5e – page 1273) Carper Company is considering a capital investment of $390,000 in additional productive facilities. The new machinery is expected to have useful life of 6 years with no salvage value. Depreciation is by the straight-line method. During the life of the investment, annual net income and net annual cash flows are expected to be $20,000 and $85,000, respectively. Carper has an 8% cost of capital rate, which is the required rate of return on the investment. Instructions (Round to two decimals.) (a) Compute (1) the cash payback period and (2) the annual rate of return on the proposed capital expenditure. (b) Using the discounted cash flow technique, compute the net present value. (c) Carper was presented with a second capital investment that provided similar production facilities as the first one. This investment cost $400,000, had a useful life of 7 years with a salvage value of $15,000. Depreciation is by the straight-line method. During the life of the investment, annual net income and net annual cash flows are expected to be $25,000 and $80,000 respectively. Carper’s 8% cost of capital is also the required rate of return on the investment. (1) Compute the cash payback period. (2) Compute the annual rate of return. (3) Using the discounted cash flow technique, compute the net present value. (4) Based on these calculations, which investment do you recommend? Explain why. CE 24-2 (based on EX24-4 Kimmel Accounting 5e – page 1272) Angler Corp. is considering purchasing one of two new processing machines. Either machine would make it possible for the company to produce its products more efficiently than it is currently equipped to do. Estimates regarding each machine are provided below: Original cost Estimated life Salvage value Estimated annual cash inflows Estimated annual cash outflows Machine A $113,250 10 years -0$30,000 $ 7,500 Machine B $270,000 10 years -0$60,000 $15,000 Instructions (a) Calculate the net present value and profitability index of each machine. Assume an 8% discount rate. Which machine should be purchased? (b) Angler Corp. did some further research and found one other possible machine that would produce the same type of production efficiencies. The information regarding Machine C is below: Machine C Original cost $250,000 Estimated life 10 years Salvage value $ 30,000 Estimated annual cash inflows $ 45,000 Estimated annual cash outflows $ 10,000 (1) Calculate the net present value and profitability index for Machine C. Use an 8% discount rate. (2) Rank the investments based on net present value. Which machine would be chosen based on this calculation? (3) Rank the investments based on profitability index. Which machine would be chosen based on this calculation? (4) Which machine should be purchased based on all the information provided? Discuss your reasons why.