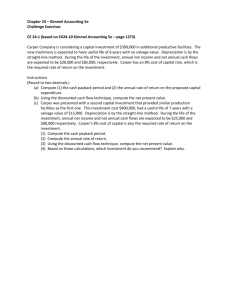

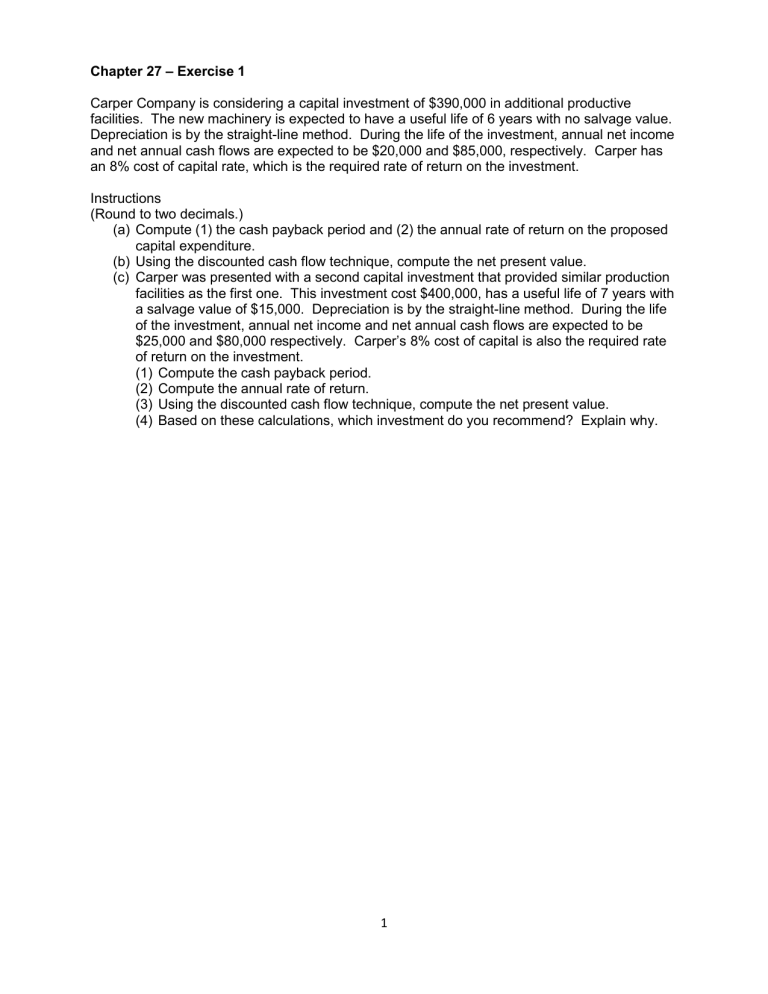

Chapter 27 – Exercise 1 Carper Company is considering a capital investment of $390,000 in additional productive facilities. The new machinery is expected to have a useful life of 6 years with no salvage value. Depreciation is by the straight-line method. During the life of the investment, annual net income and net annual cash flows are expected to be $20,000 and $85,000, respectively. Carper has an 8% cost of capital rate, which is the required rate of return on the investment. Instructions (Round to two decimals.) (a) Compute (1) the cash payback period and (2) the annual rate of return on the proposed capital expenditure. (b) Using the discounted cash flow technique, compute the net present value. (c) Carper was presented with a second capital investment that provided similar production facilities as the first one. This investment cost $400,000, has a useful life of 7 years with a salvage value of $15,000. Depreciation is by the straight-line method. During the life of the investment, annual net income and net annual cash flows are expected to be $25,000 and $80,000 respectively. Carper’s 8% cost of capital is also the required rate of return on the investment. (1) Compute the cash payback period. (2) Compute the annual rate of return. (3) Using the discounted cash flow technique, compute the net present value. (4) Based on these calculations, which investment do you recommend? Explain why. 1 2