TRID Checklist - Sterling Compliance LLC

advertisement

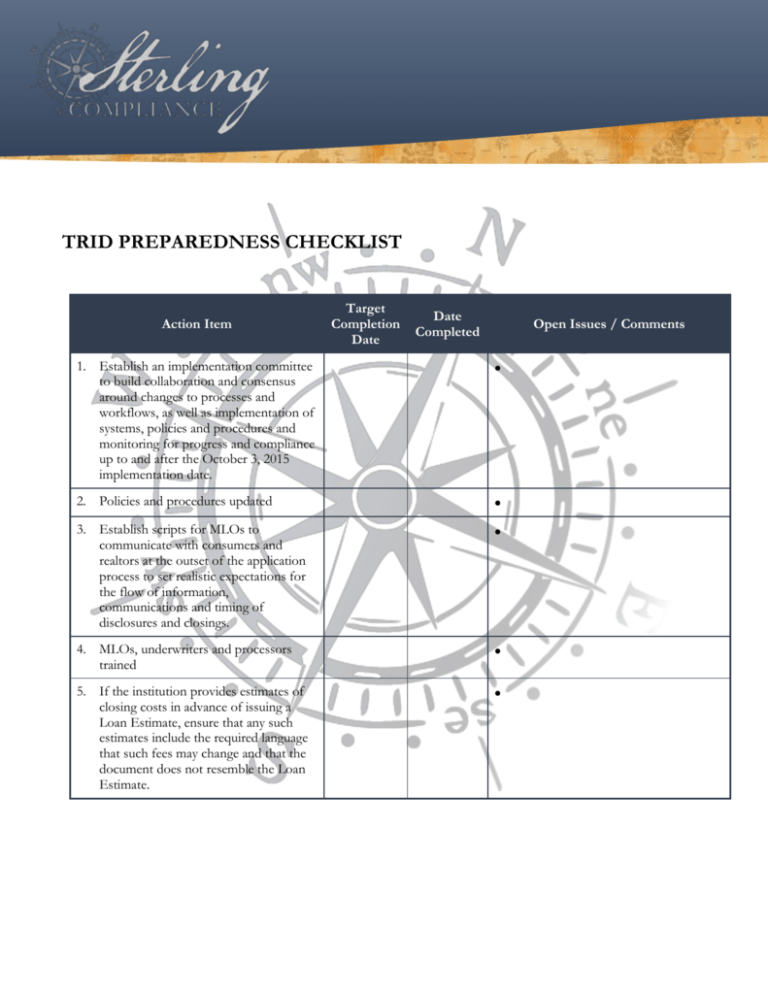

TRID PREPAREDNESS CHECKLIST Action Item Target Completion Date Date Completed Open Issues / Comments 1. Establish an implementation committee to build collaboration and consensus around changes to processes and workflows, as well as implementation of systems, policies and procedures and monitoring for progress and compliance up to and after the October 3, 2015 implementation date. 2. Policies and procedures updated 3. Establish scripts for MLOs to communicate with consumers and realtors at the outset of the application process to set realistic expectations for the flow of information, communications and timing of disclosures and closings. 4. MLOs, underwriters and processors trained 5. If the institution provides estimates of closing costs in advance of issuing a Loan Estimate, ensure that any such estimates include the required language that such fees may change and that the document does not resemble the Loan Estimate. ument title] Action Item Target Completion Date Date Completed Open Issues / Comments 6. Review any checklists or letters provided to consumers at the outset of the application process to ensure that there is no indication of verification of application information being required prior to delivery of the Loan Estimate. 7. Ensure that no fees other than credit report fees are being collected prior to issuing the Loan Estimate and receiving Intent to Proceed from the consumer. Clearly communicate to staff that they cannot collect post-dated checks or credit card numbers for any fees prior to the delivery of the Loan Estimate and confirmation of consumer’s intent to proceed, as such activity constitutes “imposing a fee”, even if the check is not cashed or the card charged until after the Loan Estimate and Intent to Proceed. 8. Checklists developed for pre-close and post-close compliance reviews 9. System and software updates in place and implemented 10. Products and policies developed within LOS (If the institution is no using an automated LOS, define each product description to ensure it is consistently correctly described on disclosures.) 11. Standard fees defined and categorized to ensure sufficient, consistent descriptions are being used and the fees are correctly listed in the appropriate sections of the disclosures. 12. Lists of service providers developed and affiliate providers identified to correctly determine tolerance categories. Define services for which consumers will be permitted to shop. www.sterlingcompliancellc.com alucas@sterlingcompliancellc.com | 412.855.7740 lzigo@sterlingcompliancellc.com | 724.813.2354 ument title] Action Item Target Completion Date Date Completed Open Issues / Comments 13. Determine how the institution will identify 0% and 10% tolerance items and ultimately reconcile for determination of any required cure. Most loan operating systems will have this capability, but it should be tested. If you’re not using an LOS platform for disclosures, you will need to have a way to reconcile the tolerances and retain the documentation with the loan file. 14. Discussions held with settlement agents used by the institution to establish logistics around ongoing communications throughout the process as well as the closing process, including providing and reviewing disclosures and any revisions. 15. Transactions tested within LOS to validate accuracy of disclosures. This should include a purchase and refinance transaction for each product type (i.e., fixed rate, ARM, construction, home equity loan, etc.). Also test for fee increases beyond tolerance to ensure required cures are identified and the credits are reflected on the Closing Disclosure. 16. Determine where changes to process workflows between MLO, processors, underwriters, closing agents need to be adjusted to ensure disclosures are being issued within required timeframes throughout the process, including any revisions resulting from changed circumstances. Consider centralizing certain aspects that may not currently be centralized to maintain reasonable control of the process. 17. Evaluate Rate Lock Agreements to determine whether the lock period is appropriate given the likelihood of longer turnaround times for closings under TRID. www.sterlingcompliancellc.com alucas@sterlingcompliancellc.com | 412.855.7740 lzigo@sterlingcompliancellc.com | 724.813.2354 ument title] Action Item Target Completion Date Date Completed Open Issues / Comments 18. Determine how you will document delivery and receipt of the Loan Estimate and Closing Disclosure to evidence compliance with timing requirements. If using multiple delivery channels for disclosures (US Mail, in person, electronic), ensure staff understand the timing rules, including the “mailbox” rule and how to document the file for the method of delivery, dates sent and acknowledged receipt by the consumer. 19. If moving to electronic delivery of disclosures, verify that the process complies with the E-Sign Act for documenting consumer consent, ability to opt out, acknowledgement of receipt, and tracking same within the system. Provide training, as necessary, to ensure staff understands E-Sign requirements. 20. Define transactions not covered by TRID for which a GFE and/or HUD may still be required. 21. Determine applicable state laws for determining: a. Date of Consummation b. Liability after foreclosure 22. If loan numbers are not assigned at the outset, determine what Loan ID will be used on the Loan Estimate and carried through to the Closing Disclosure, and how that will be assigned. 23. If your institution is not currently using a LOS platform, consider options versus potential risk of non-compliance with manual processes and documentation. 24. Establish independent review or audit procedures for TRID compliance, both during testing phase and postimplementation. www.sterlingcompliancellc.com alucas@sterlingcompliancellc.com | 412.855.7740 lzigo@sterlingcompliancellc.com | 724.813.2354 ument title] Action Item Target Completion Date Date Completed Open Issues / Comments 25. Document and track all non-compliance and process difficulties for appropriate resolution. 26. Establish periodic reporting to Management and Board of status of implementation, issues arising from independent reviews or audits and corrective actions taken. www.sterlingcompliancellc.com alucas@sterlingcompliancellc.com | 412.855.7740 lzigo@sterlingcompliancellc.com | 724.813.2354