Stark, False Claims Act, Anti-Kickback

advertisement

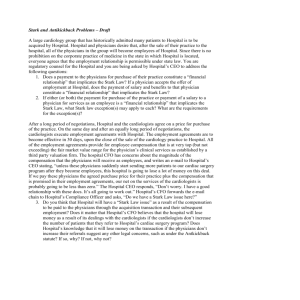

Stark and Antikickback Problems – Draft 3 (Problems 1 and 2 Only) 1. A large cardiology group that has historically admitted many patients to Hospital is in negotiations to be acquired by Hospital. Hospital is in a health professional shortage area for cardiologists, and Hospital and physicians therefore believe that it is important that, after the sale of their practice to the hospital, all of the physicians in the group remain in the community and become employees of Hospital. Since there is no prohibition on the corporate practice of medicine in the state in which Hospital is located, counsel for Hospital and Group agree that a direct employment relationship is permissible under state law. You are regulatory counsel for the Hospital and you are being asked by Hospital’s CEO to address the following questions: Questions: Does a payment to the physicians for purchase of their practice constitute a “financial relationship” that implicates the Stark Law? If a physician accepts the offer of employment at Hospital, does the payment of salary and benefits to that physician constitute a “financial relationship” that implicates the Stark Law? If yes, what Stark Law exceptions may apply? What are the requirements for the exception(s)? A. Issue Spotting: Students should understand the definitions of “financial relationship,” “referral” and “Designated Health Services” as they appear in the Stark law, in order to be able to determine that the proposed transactions will all implicate the Stark Law unless an exception applies. They should also be able to determine whether and which exceptions may apply to each transaction, and to enumerate the requirements for each applicable Stark Law exception. Discussion may touch on local state law regarding corporate practice of medicine, which could be an issue of concern in the planned arrangement were in not for the stipulation that the state in which Hospital is located does not have a prohibition on the corporate practice of medicine. B. Where to look: Students should review the text of the Physician Self Referral Law (the “Stark Law”), and the associated regulations promulgated by CMS (Phase 1 to Phase III), with focus on the defined terms and descriptions of exceptions. C. Possible Solutions: Given that the proposed arrangements both involve a “financial relationship” and may involve “referrals” of “designated health services,” and given that the Stark Law is a strict liability statute, all of the arrangements should structured to meet a Stark Law exception. The practice purchase transaction may be structured to meet the “isolated transactions” exception, and the post-acquisition physician employment arrangements may be structured to meet the exception for bona fide employment arrangements. Students should propose next steps, bearing in mind that structuring the arrangements to meet the identified exceptions will require ensuring that every requirement of the applicable exception is met. 2. After many months of negotiations, Hospital and cardiologists agree on a price for Hospital’s purchase of the cardiologists’ practice. That price is determined to be fair market value for the practice by a reputable, independent valuation firm. After an equally long period of negotiations, the cardiologists each execute employment agreements with Hospital, which are to become effective in 30 days, upon the close of the sale of the cardiology practice to Hospital. According to a report from a different but equally reputable independent valuation firm as the one that issued the opinion regarding the fair market value of the practice purchase price, all of the employment agreements provide for employee compensation that is at the high end (but not exceeding) the fair market value range for the services that the respective cardiologist will provide as an employee of Hospital. However, regardless of assurances that the compensation amounts in the purchase and employment agreements are fair market value, Hospital’s CFO has concerns about their magnitude, and writes an e-mail to Hospital’s CEO stating, “unless these cardiologists suddenly start sending more patients to our cardiac surgery program after they become employees, this hospital is going to lose a lot of money on these deals. If we pay these physicians the agreed purchase price for their practice plus the compensation that is guaranteed in their employment agreements, our net on the services of the cardiologists is probably going to be less than zero, for a very long time.” The Hospital CEO responds, “Don’t worry. I have a good relationship with these docs. It’s all going to work out.” Hospital’s CFO forwards the e-mail chain to Hospital’s Compliance Officer and asks, “Do we have a Stark Law issue here? How about an Antikickback Law issue?” Questions: Do you think that Hospital will have a “Stark Law issue” as a result of the magnitude of the compensation that will be paid to the cardiologists through their employment agreements? Is your opinion affected by the fact that Hospital’s CFO believes, and has warned Hospital’s CEO, that Hospital will lose money as a result of its arrangements with the cardiologists, unless the cardiologists increase their referrals to Hospital’s cardiac surgery program? Do you believe that there is an “Antikickback Law issue”? If so, why? If not, why not? A. Issue Spotting: Students should understand that both the isolated transactions exception to the Stark Law, and the bona fide employment relationships exception to the Stark Law, require that compensation to referring physicians be consistent with fair market value for what the physicians are providing, that compensation not be determined in a manner that takes into account (directly or indirectly) the volume or value of any referrals from the physicians, and that the compensation be “commercially reasonable” even if no referrals were made to the employer. Students should be aware of government guidance regarding what makes a payment arrangement “commercially reasonable,” including guidance that a payment arrangement must make business sense even in the absence of referrals or other business between the parties. Students should understand that an arrangement may be found to violate the Federal Antikickback Statute, and, perhaps a state antikickback statute, if it can be established that even one purpose of the arrangement is offer or provide compensation for referrals. Students should recognize that: (i) the purchase transaction will not meet the requirements of an Antikickback safe harbor; (ii) the employment arrangements could meet the requirements for statutory exception/safe harbor under the Antikickback statute (which does not have specific requirements for fair market value or commercially reasonable compensation); and (iii) whether the arrangements together (purchase transaction and post-purchase employment) implicate the Antikickback Statute does not hinge on whether purchase and employment arrangements each meet the requirements for safe harbor, but instead, on whether together they are undertaken for the purpose of knowingly and willfully soliciting or receiving referrals. Student should recognize that the statements made by Hospital’s CEO suggest, but do not clearly indicate, that Hospital’s CEO expects an increase in referrals by the cardiologists to Hospital’s cardiac surgery program after the contemplated arrangements come to fruition. Students should recognize that the statements by themselves do not establish the requisite intent to violate the Antikickback Statute. D. Where to look: Students should review the text of the Stark Law and the associated regulations promulgated by CMS (Phase 1 to Phase III), focusing on the isolated transactions exception and the exception for bona fide employment relationships. More advanced students may review recent case law such as United States ex rel. Singh v. Bradford Regional Medical Center, and United States ex rel. Drakeford v. Tuomey Healthcare System, Inc., and DOJ releases regarding the settlement of claims with Covenant Medical Center, focusing on discussion of the importance of ensuring that arrangements are reasonable even in the absence of (or absent a change in) referrals. Students should review the text of the Federal Antikickback Statute and associated safe harbor regulations for sale of a practice and bona fide employment relationships, and should be aware of the one purpose test adopted in United States v. Greber. More advanced students may review the OIG Compliance Guidance for Hospitals (1997), as well as other recent OIG publications and advisory opinions regarding hospital relationships with physicians. E. Possible Solutions: Stark Law Issues: Students need to decide whether the arrangements with the cardiologists should be amended to provide for different compensation terms, or may reasonably proceed as planned. When making this decision, students may consider the following: Since all of the compensation that is to be paid to the cardiologists is within the range of fair market value as established by a reputable, independent expert, the Stark Law risk with these arrangements is largely dependent on whether the compensation is commercially reasonable even if no referrals are made to Hospital. Arguably, the CFO’s expression of concern is based on the aggregate value of the compensation to be paid through the practice purchase transaction and employment agreements. This suggests that each of the transactions, when considered in isolation, could be commercially reasonable even if no referrals were made. If this were the case, then each transaction (purchase and employment) could meet the requirements of a Stark exception, making them both safe for Hospital under the Stark strict liability standard. Students may be advised of and discuss differing opinions on whether a purchase transaction and post-purchase employment arrangement should be considered independently or together for purposes of Stark compliance (with recognition that this is an area of some controversy). Students may consider the existence of other factors (aside from a positive cash flow from the services of the cardiologists) that would suggest that the contemplated transactions are commercially reasonable even if no referrals are made to Hospital. For example, Hospital is in an geographic area that has a shortage of cardiologists. If the area also has changing patient demographics that threaten the continuing ability of the existing local cardiologists to generate enough revenue to cover the costs of remaining in private practice in the community, and Hospital needs the services of a cadre of local cardiologists to be “on call” and immediately available to address the needs of patients who come to its emergency room (as is necessary to comply with federal and state requirements for emergency care), then purchase of the cardiologists’ existing practice and subsequent direct employment of the cardiologists with fair market value compensation may make commercial sense for Hospital, even if the cardiologists services will not generate positive cash flow for Hospital. Antikickback Law Issues: Students need to evaluate the risk of an action under the Antikickback statute, with understanding that the analysis of activities under the Antikickback statute must focus on intent of the parties.