C20PW_C4 - Heriot

advertisement

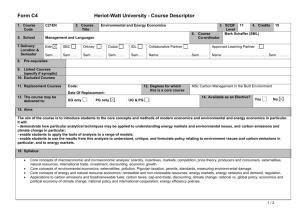

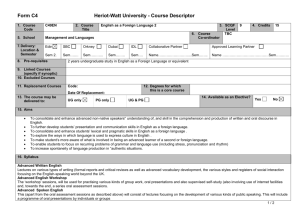

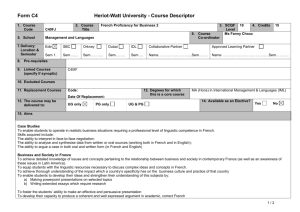

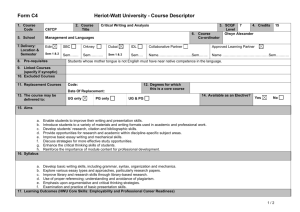

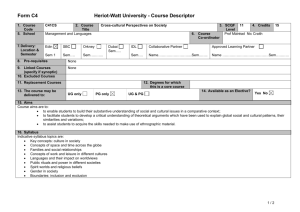

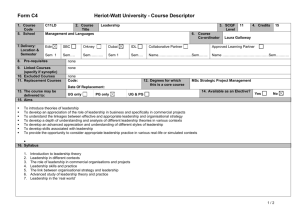

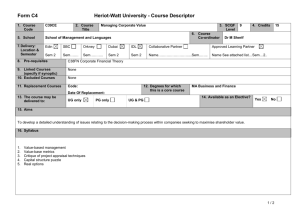

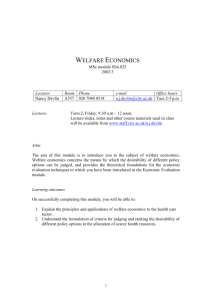

Form C4 1. Course Code 5. School 7. Delivery: Location & Semester Heriot-Watt University - Course Descriptor C20PW 2. Course Title Management and Languages Edin X Sem 1 8. Pre-requisites 9. Linked Courses (specify if synoptic) 10. Excluded Courses 11. Replacement Courses Introduction to Public Sector and Welfare Economics 3. SCQF Level 6. Course Co-ordinator 10 4. Credits 15 Prof. Karen Turner SBC Orkney Dubai IDL Collaborative Partner Approved Learning Partner Sem…. Sem……….. Sem….. Sem…. Name…………………….....Sem..…... Name …………………………………Sem……….. C28IE N/A Code: 12. Degrees for which this is a core course Date Of Replacement: 13. The course may be 14. Available as an Elective? Yes X No UG only X PG only UG & PG delivered to: 15. Aims * The broad aim of this course is to provide students with a basic level of understanding of the role economics can pay in public policy and spending evaluation, ranking and decision making. * This will involve introducing students to the subject area of normative or welfare economics, which concerns the evaluation of consequences of particular types of policy changes, determining a basis according to which various policy proposals may be ranked and thereby coming to a judgment concerning the desirability of different options for society. * This involves extending on basic neoclassical microeconomic frameworks that students have encountered in previous courses, such as public goods, externalities and other sources of market failure. Here we place them in the context of providing a rationale for the existence of government. * However, in this class students will be introduced to new concepts and frameworks, including considering utility versus welfare, individual versus social welfare, efficiency versus equity, value judgments and the Pareto principle, compensation criteria and social/public choice. * Students will also be introduced to one of the main analytical techniques used in policy evaluation at all levels of government. This is social cost benefit analysis, which differs from conventional CBA through the types of costs and benefits included (in the presence of market failure), their valuation (based on social rather than opportunity costs and determining shadow prices where market prices do not exist or are incorrect) and type of discount rate used (the social discount rate, reported in the UK Green Book). This class will serve employability aims through reference to practical 'real world' applications of SCBA to supplement and complement the textbook theoretical framework. 1/2 Form C4 Heriot-Watt University - Course Descriptor 16. Syllabus The course consists of a mixture of lectures and seminars. Lectures will cover topics including the economic rationale for government; Pareto optimality; efficiency, equity, the compensation principle, and the social welfare function; market failures, public goods and externalities; public choice; and social cost benefit analysis. 17. Learning Outcomes (HWU Core Skills: Employability and Professional Career Readiness) Subject Mastery Understanding, knowledge and cognitive skills Competence in applying the basic theoretical constructs and frameworks of welfare and public economics that will allow graduates to play an active role in the process of public policy evaluation and ranking. Practical knowledge of the application of social cost benefit analysis as a tool employed at all levels of government in assessing whether to undertake a particular project/spending programme. Scholarship, enquiry and research (research-informed learning) Understanding of how welfare economics has evolved over the years, and of how academic economists' expertise differs from but interacts with that of government economic advisers. Personal Abilities Industrial, commercial and professional practice Recognising and appreciating the role economists can play in making value judgements regarding the benefit of society as a whole where market failures exist. Autonomy, accountability and working with others Preparation for potential future employment as a public sector economist (e.g. the UK Government Economic Service) or in the private sector where public sector decision making and/or policies have a direct impact (e.g. public sector supply chain activity or delivery of public projects). Communication, numeracy and ICT Ability to present information in a form understandable by peers and by non-academics. 18. Assessment Methods 19. Re-assessment Methods Method Duration of Exam Weighting (%) Synoptic courses? Method (if applicable) Coursework & Continuous assessment Examination 20. Date and Version Date of Proposal 11/03/13 Diet(s) (if applicable) 30% 2 hours Duration of Exam None Exam 2 hours Decemb er 70% Date of Approval by School Committee Date of Implementation Version Number 2/2 1