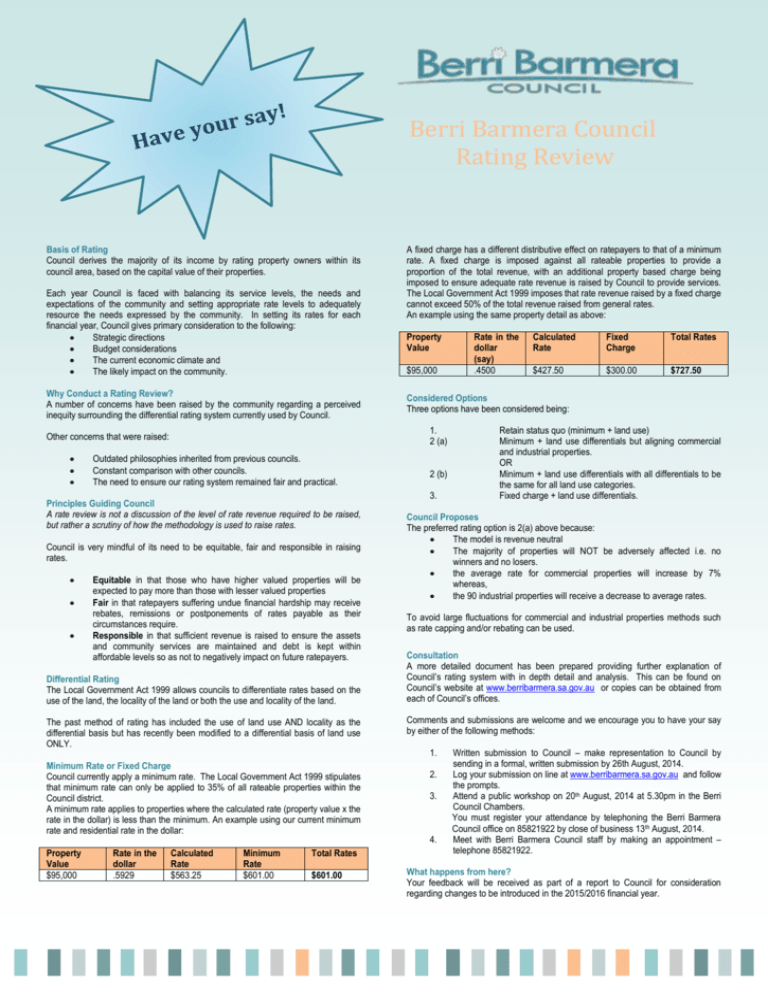

Rating Review Summary - Berri Barmera Council

advertisement

Berri Barmera Council Rating Review Basis of Rating Council derives the majority of its income by rating property owners within its council area, based on the capital value of their properties. Each year Council is faced with balancing its service levels, the needs and expectations of the community and setting appropriate rate levels to adequately resource the needs expressed by the community. In setting its rates for each financial year, Council gives primary consideration to the following: Strategic directions Budget considerations The current economic climate and The likely impact on the community. Why Conduct a Rating Review? A number of concerns have been raised by the community regarding a perceived inequity surrounding the differential rating system currently used by Council. Outdated philosophies inherited from previous councils. Constant comparison with other councils. The need to ensure our rating system remained fair and practical. Principles Guiding Council A rate review is not a discussion of the level of rate revenue required to be raised, but rather a scrutiny of how the methodology is used to raise rates. Council is very mindful of its need to be equitable, fair and responsible in raising rates. Equitable in that those who have higher valued properties will be expected to pay more than those with lesser valued properties Fair in that ratepayers suffering undue financial hardship may receive rebates, remissions or postponements of rates payable as their circumstances require. Responsible in that sufficient revenue is raised to ensure the assets and community services are maintained and debt is kept within affordable levels so as not to negatively impact on future ratepayers. Differential Rating The Local Government Act 1999 allows councils to differentiate rates based on the use of the land, the locality of the land or both the use and locality of the land. The past method of rating has included the use of land use AND locality as the differential basis but has recently been modified to a differential basis of land use ONLY. Minimum Rate or Fixed Charge Council currently apply a minimum rate. The Local Government Act 1999 stipulates that minimum rate can only be applied to 35% of all rateable properties within the Council district. A minimum rate applies to properties where the calculated rate (property value x the rate in the dollar) is less than the minimum. An example using our current minimum rate and residential rate in the dollar: Property Value $95,000 Rate in the dollar .5929 Property Value $95,000 Calculated Rate $563.25 Minimum Rate $601.00 Total Rates $601.00 Rate in the dollar (say) .4500 Calculated Rate Fixed Charge Total Rates $427.50 $300.00 $727.50 Considered Options Three options have been considered being: 1. 2 (a) Other concerns that were raised: A fixed charge has a different distributive effect on ratepayers to that of a minimum rate. A fixed charge is imposed against all rateable properties to provide a proportion of the total revenue, with an additional property based charge being imposed to ensure adequate rate revenue is raised by Council to provide services. The Local Government Act 1999 imposes that rate revenue raised by a fixed charge cannot exceed 50% of the total revenue raised from general rates. An example using the same property detail as above: 2 (b) 3. Retain status quo (minimum + land use) Minimum + land use differentials but aligning commercial and industrial properties. OR Minimum + land use differentials with all differentials to be the same for all land use categories. Fixed charge + land use differentials. Council Proposes The preferred rating option is 2(a) above because: The model is revenue neutral The majority of properties will NOT be adversely affected i.e. no winners and no losers. the average rate for commercial properties will increase by 7% whereas, the 90 industrial properties will receive a decrease to average rates. To avoid large fluctuations for commercial and industrial properties methods such as rate capping and/or rebating can be used. Consultation A more detailed document has been prepared providing further explanation of Council’s rating system with in depth detail and analysis. This can be found on Council’s website at www.berribarmera.sa.gov.au or copies can be obtained from each of Council’s offices. Comments and submissions are welcome and we encourage you to have your say by either of the following methods: 1. 2. 3. 4. Written submission to Council – make representation to Council by sending in a formal, written submission by 26th August, 2014. Log your submission on line at www.berribarmera.sa.gov.au and follow the prompts. Attend a public workshop on 20th August, 2014 at 5.30pm in the Berri Council Chambers. You must register your attendance by telephoning the Berri Barmera Council office on 85821922 by close of business 13th August, 2014. Meet with Berri Barmera Council staff by making an appointment – telephone 85821922. What happens from here? Your feedback will be received as part of a report to Council for consideration regarding changes to be introduced in the 2015/2016 financial year.