Ethics of the Financial Professional

advertisement

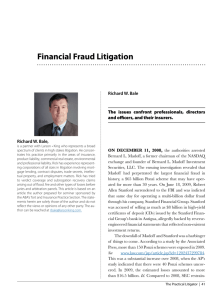

Name: _________________________________ Period ________ Date ____/____/____ Ethics of the Financial Professional Minds on the Markets Module 08 – Lesson 1 1. Ethics 1.1. Why is it important that financial professionals behave ethically? 1.1.1. A friend of yours describes another person as being ethical. What comes to mind when you hear this description is: ________________________________________________________________________ ________________________________________________________________________ ________________________________________________________________________ 2. What are Ethics? 2.1. The _____________________________________________________________________ ___________________________________________ . Ethics can be summarized by the “ ”: 2.1.1. “Do unto others, as you would have them do unto you.” 2.2. Business Ethics: The _______________________________________________________ . Ethics are the structured examination of how institutions and individuals should __________________________________________ . 2.2.1. Example: A portfolio manager must give the same consideration to the portfolio of family members as the portfolio of small, individual investors. 3. Why are Ethics Important? 3.1. They act as a _____________________________________________________________ . 3.2. Ethical business practices give customers confidence that their __________________ _________________________________________________________________________ . 3.3. Professionals, by virtue of being in a specialized industry, generally are experts in a particular field. This knowledge, if not used ethically, can be used in ____________ . _________________________________________________________________________ 3.4. The industry’s reputation is untarnished and clients can put trust in the industry when ethics are publicly known and displayed. Name: _________________________________ Period ________ Date ____/____/____ 4. Ethics vs. Law 4.1. There is a difference between . Something can be legal, but unethical. In the financial industry, it is important for professionals to adhere to the ____________________________________________________________________ . 4.2. Example: Business Week addressed a real life example of how the law and ethics can disagree. In the article, TV producers of a reality show allowed a woman who is an alcoholic to drive while intoxicated. Under the law, the TV producers are _________________________________________ for the woman and are treated as witnesses to the crime and not held liable for any accidents that occur. However, it is argued that the producers have an ethical responsibility to ___________________________________________________________ _________________________________________________________________________ . 5. Fiduciary Responsibility 5.1. Financial service professionals have the responsibility to _______________________ . This means that professionals must work for their clients when making investment decisions. They have to act _______________________________________________________________ . The word comes from the Latin word meaning “ .” It is paramount for financial professionals to maintain their clients’ trust and act in their best interest. 5.2. Example: Financial professionals need to base their recommendations on the customers’ _________________________________________________________________________ and other information to choose investments that are best suited for their situation. Financial professionals should NOT base their recommendations on _____________ _________________________________________________________________________ . 6. Types of Ethics 6.1. . 6.1.1. This type of ethics is derived from philosopher Immanuel Kant. 6.1.2. Under Kant’s view, ___________________________________________________ _____________________________________________________________________ . Name: _________________________________ Period ________ Date ____/____/____ 6.1.3. Every individual must be ______________________________________________ _____________________________________________________________________ . 6.2. . 6.2.1. Makes decisions that __________________________________ for the most people. 6.2.2. Another way to distinguish this type of ethics is asking if “ _________________ ____________________________________________________________________ .” 6.2.3. An action is “ ” if more people will benefit from it than will not benefit from it. 7. Corporate Responsibility 7.1. The set forth by an individual firm. Generally, a firm will put in place a __________________________________________ it will adhere to. These standards usually include making decisions with the best interest of their clients, shareholders, and the community in mind. Corporate Responsibility also creates _____________________ ___________________________________________ (fair hiring, non-harassment, etc.). 8. Why are Ethical Business Practices Hard to Maintain in the Financial Industry? 8.1. Generally, a financial representative’s livelihood relies on his/her ________________ _____________________________. __________________________ are given to employees based on . Thus, employees are more tempted to make decisions that will _________________________________________________________ . 9. Case Studies 9.1. Enron 9.1.1. An energy and commodities company that _______________________________ _____________________________________________________________________ . 9.1.2. Former CEO, Jeffrey Skilling, _____________________________, is currently serving 24 years in prison (although his sentence was later reduced to 14 years). He was also fined $24 million. Name: _________________________________ Period ________ Date ____/____/____ 9.1.3. , Andrew Fastow, served six years in prison for his involvement. 9.1.4. ENRON: The Smartest Guys in the Room is a 2005 documentary depicting the scandal. 9.2. Bernard Madoff 9.2.1. Created the largest Ponzi scheme in US history. Ponzi (aka Pyramid) Scheme: ___________________________________________ . In essence, money is shuffled around while the runner of the Ponzi scheme greatly exaggerates the _______________________________________________________ . 9.2.2. Madoff fabricated gains to his investors of approximately $65 billion when his investors had actually . He was sentenced to 150 years in prison and was forced to forfeit over $17 billion in March 2009. 9.3. Marc Dreier 9.3.1. A prominent lawyer who was sentenced to 20 years for running a in May 2009 and from 2004-2008. 9.3.2. Dreier swindled $400 million from _________________________________________ by selling $700 million of _________________________________________________ . 9.3.3. Dreier’s story is told in the 2011 documentary, Unraveled. 10. Web Challenge #1: If financial professionals are compensated when they take risks (in hopes of a big win and a big pay day), we shouldn’t be surprised when they do so. Therefore, a lot of attention has been paid to how we motivate and compensate financial professionals, especially CEOs and other executives at financial institutions. Research compensation reform that has been proposed (the EU has been a leader). Summarize three major reforms and the intended result of each. Finally, state whether or not you believe they will be effective, supporting your assertion. 11. Web Challenge #2: The Enron Corporation was once the 7th biggest publicly held corporation by market value, and it was largely a sham. Bernard Madoff ran a classic Ponzi scheme. Research the two cases and make a choice as to which incident was worse. Support your answer. Name: _________________________________ Period ________ Date ____/____/____ 12. Web Challenge #3: An epic Ponzi scheme that got little attention once Bernard Madoff came along was that of Allen Stanford. Research Stanford’s scheme as well as Madoff’s. Identify three strategies that both used to attract so much investor money.