Organizational Design, Responsibility Accounting and Evaluation of

advertisement

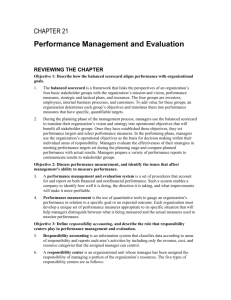

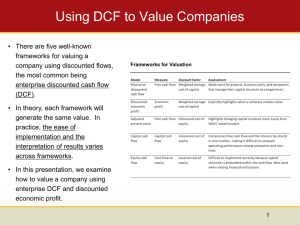

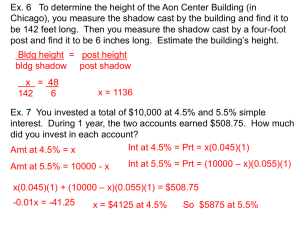

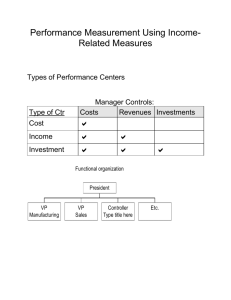

Organizational Design, Responsibility Accounting and Evaluation of Divisional Performance Chapter 18 To “de” or not to “de” Centralized Top-down approach Upper management makes decisions, lower management carries them out Keeps organization focused on common goals Can be very bureaucratic and slow moving To “de” or not to “de” Decentralized Responsibility for decisions pushed down to lower levels Takes advantage of local knowledge, specialization More timely response to issues Better motivation May lose sight of the “big picture” May result in duplication of effort Responsibility centers Cost center Responsible for costs incurred Well-defined relationship between inputs and outputs Manufacturing, etc. Discretionary cost center Relationship between inputs and outputs not well-defined Marketing, etc. Responsibility centers Revenue center Responsible for revenue generated by the center Profit center Responsible for both revenue and costs related to the center Investment center Responsible for capital investments and profit Responsibility reporting Performance reports Show budgeted and actual amounts and variances “Roll-up” to the next higher level Totals from lower levels become line items on performance report of next higher level Goals of responsibility reporting Should provide information on performance Should distinguish between controllable and uncontrollable costs and revenues Should motivate desired behavior Investment center performance Return on investment Ability to use assets to generate profits Residual income Excess of profit over required return on invested capital Economic value added Excess of after-tax operating profit over the weighted average cost of invested capital (less current liabilities) Return on investment Economic profit after all costs including opportunity cost of capital Function of asset turnover and profit margin How efficiently does the center use its assets to generate sales? Asset turnover What percentage of sales is profit? Profit margin Return on investment ROI = ROI Sales Invested capital = X Profit Invested capital Profit Sales Residual income Amount of profit remaining after subtracting the minimum required rate of return on the invested capital Residual income = Investment center profit Investment center's invested capital X Imputed interest rate Economic value added Seeks to measure the amount of economic value (as opposed to accounting value) added Adjusts accounting income for various “distortions” Capitalize R&D, advertising, training, etc. that benefit future years Use price level adjustments to restate to current year values Etc, as many as 160 adjustments Economic value added Basic formula Investment Economic center's value = after-tax added operating profit - Investment center's total assets Investment center's current liabilities Weighted average X cost of capital Economic value added Calculation of weighted average cost of capital Weighted average cost = of capital After-tax cost of debt X capital Market value of debt Market value of debt + + Cost of equity capital Market value of equity X Market value of equity Some considerations Invested capital Use average of beginning and end-of year balances Which assets to include? Total assets? Total productive assets? Total assets less current liabilities? Gross or net book value? Some considerations Different measures may motivate different behaviors Example: A project that will return more than the minimum cost of capital, but less than current ROI Will increase residual income Will decrease ROI