NICU Financial Analysis

advertisement

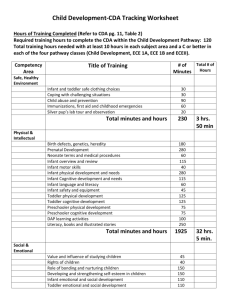

Running Head: NNP Group 2: Financial Analysis 1 NNP Group 2: Financial Analysis _________________________________________ Presented to Debra Armentrout, PhD, MSN, RN, NNP-BC THE UNIVERSITY OF TEXAS SCHOOL OF NURSING AT GALVESTON _________________________________________ In Partial Fulfillment Of the Requirements for the Course GNRS 5350: Nurse Practitioner – Professional Roles & Business Practices ___________________________________ By Tracey Causer, Katie Lawton, Gabriela Olivas, Ashley Robson July 20th, 2014 Running Head: NNP Group 2: Financial Analysis 2 NNP Group 2: Financial Analysis In this paper, we will be exploring the financial analysis of a healthy, uncomplicated, preterm, 28week gestation female infant over a ten week course-of-stay in the Neonatal Intensive Care Unit (NICU). The various costs associated with the care of this infant will be analyzed. We will also discuss what is charged versus what is actually reimbursed. The analysis will also explore whether it is feasible and profitable for a Neonatal Nurse Practitioner (NNP) to bill independently for the charges incurred rather than bill under the collaborating physician. Breakdown of Charges/Explanation of Charges ICD-9, CPT and Diagnoses Charges for the NICU are verified using ICD-9 diagnostic codes. ICD-9, or International Classification of Diseases, is a code system used to describe patient’s signs, symptoms, injuries, disease and conditions (UFHealth, 2014). These codes facilitate billing so it is imperative that the nurse practitioner have correct documentation on his/her patients to support charges billed in order to be properly reimbursed. The correlation between ICD-9 codes and CPT codes is in reference to medical billing and reimbursement. CPT, or Current Procedural Terminology, is used to identify the medical, surgical, radiology, laboratory, anesthesiology, and evaluation/management services provided by the health care professionals and the hospital (UFHealth, 2014). For a hospital to receive reimbursement from government and insurance agencies, every CPT code billed must correspond with an appropriate ICD-9 code to ensure it was medically necessary for the patient and their condition. If these codes don’t correlate together, the hospital is not reimbursed for the services or supplies provided. The diagnoses listed in Chart A will justify the expenditures for the purpose of this analysis. Running Head: NNP Group 2: Financial Analysis 3 Chart A: Diagnoses & ICD-9 codes for an uncomplicated 28 week neonate Preterm 28 weeks (765.24) Primary Apnea of Prematurity (770.81) Anemia of Prematurity (776.6) Observation & Evaluation of Newborn of Sepsis (V29.0) Pulmonary Insufficiency (518.82) Respiratory Distress Syndrome (769.0) Patent Ductus Arteriosus (747.0) Unspecified Fetal and Neonatal Jaundice (774.6) Feeding Problems of the Newborn (779.31) Salary Information Table 1 represent`s the staff involved in the care of the 28 week infant over the ten week course-ofstay in the NICU. It ranges from the Neonatologist to the Equipment tech. The respiratory therapist is only involved in the patient’s care until the neonate reached 32 weeks post conceptual age, when respiratory support is no longer needed. The occupational therapist is involved with the patient from admission by addressing development positioning to oral motor stimulation once the patient starts to feed. The equipment tech is involved in the care by continuous restocking the patient`s needed supplies. The staff salaries may not be directly billed but are included in the total cost to provide care. Admission Charges Charges for this patient begin at birth. This patient was born via C-Section. Initial charges begin with delivery attendance to stabilize the neonate and admission to the NICU. The patient was intubated on two occasions to receive surfactant. He did not need to remain intubated, so he is initially placed on nasal CPAP. A chest x-ray was obtained on admission to evaluate lung fields related to prematurity. The neonate will need long-term IV access for nutrition so an umbilical venous line was placed. The vein hydration charge is for the initial 30-60 minutes of fluids given to stabilize the neonate. The umbilical arterial catheter is placed for the purpose of monitoring the patient’s blood pressure (Gomella, Cunningham, & Eyal, 2013). Table 2 represents the cost of admission as well as reimbursement for the items billed. Running Head: NNP Group 2: Financial Analysis 4 Level II & Level III Bed Charges The neonate will be staying the in the NICU and the NICU consists of varying levels of care. Due to the fact this is an uncomplicated 28-week neonate, his stay in level III nursery will be three weeks and the other seven weeks will be in the less acute level II nursery. The information in Table 3 represents the bed charges for the stay per day in each of these levels. The charges for level III/ level II in the NICU incurred the following CPT codes, as shown in table 4. Modes of Respiratory Support Initially the neonate is intubated for surfactant administration. The remainder of the hospital stay, the neonate only requires nasal CPAP x 14 days, then NC at 2 L/min which was eventually weaned to I L/min, until he was on room air by DOL 28. Table 5 illustrates the costs associated with these modes of respiratory support. Medications, IV Fluids and Enteral Feedings From admission to discharge, a 28-week infant will need several medications, IV fluids and enteral feedings. Immediately after delivery, the infant will need a dose of surfactant due to surfactant deficiency administered through the endotracheal tube. Within the first 2 hours of life, the infant will need vitamin K to prevent neonatal hemorrhage and erythromycin for eye prophylaxis. After the initial septic work-up, the infant will need to be on broad spectrum antibiotics due to increased susceptibility for infection until lab results reveal otherwise. The infant would be given ampicillin every 12 hours IV for 72 hours and gentamicin IV daily for 72 hours. Since the infant was born at 28 weeks, the infant is at risk for apnea of prematurity and will need caffeine daily to prevent apnea episodes. While working on increasing enteral feedings the infant will need parenteral nutrition of TPN and IL. Starter TPN will begin after admission and TPN will continue until DOL 6 when the infant is on 80 mL/kg/day of feedings. The infant will be started on EBM on DOL 2 at 10 mL/kg/day, and increase daily until DOL 10, when the infant will be on 150 mL/kg/day. When the infant reaches 100 mL/kg/day, human milk fortifier will be added to the EBM, until the infant Running Head: NNP Group 2: Financial Analysis 5 reaches 34 weeks. At 80 mL/kg/day of enteral feedings, we would start multivitamins and iron. Once the infant weighs at least 2 kg the infant will need Hepatitis B vaccine, and because the infant will be 2 months old prior to discharge 2 month vaccines will be given. These include DTaP, Hib, IPV and PCV. Table 6 illustrates the cost of these medications. Lab Work Over the course of 10 weeks, the infant will require labs to analyze blood to evaluate blood components, serum chemistries, oxygenation status and infection. We would expect a 28-week infant, with an uncomplicated course, to have a complete blood count (CBC) with differential upon admission and every morning, for the first three days of life. While the infant is on parenteral nutrition, we would continue to monitor the serum chemistries, after the first 24 hours of life and every morning. By day of life 6, the infant would be on 80 mL/kg/day of enteral feeds and I would discontinue the IV fluids. After the first 24 hours of life, the infant will need a total serum bilirubin (TSB) to evaluated bilirubin and a newborn screen. Triglyceride levels are ordered to assess the infant’s tolerance to intralipids. With a sepsis evaluation, the patient would need a blood culture obtained, as well. Finally, Hgb/Hct with retic are ordered to assess for anemia. Table 7 illustrates the total cost for laboratory studies for this patient post admission. Chemstrips are ordered to assess for hypoglycemia or hyperglycemia in the neonate (Gomella et al., 2013). Supplies Over the course of the 10 weeks, various supplies will be used for the infant’s care from diapers, wipes, IV flushes, IV tubing, and feedings supplies. On a daily inquiry, the infant would approximately use 8 diapers/day and a box wipes/week. While increasing the infant’s feeds, the infant will remain on IV fluids. We expect the infant, over the 6 days of need for IV fluids to need 6-8 IV flushes/day and one set of IV tubing every 4 days. Prior to taking all PO feeds, the infant will need supplies for gavage feeding. Throughout the hospital stay, we expect the infant to need 3 NG feeding tubes, and 7 feeding connectiontubing sets per day. Table 8 illustrates the total cost for supplies for this patient post admission. Running Head: NNP Group 2: Financial Analysis 6 Radiological Studies Since the infant has been declared to have an uncomplicated course, I would expect the infant to only need 1 x-ray at admission. The infant will need a head ultrasound to assess for intracranial hemorrhage due to <30 weeks. Table 9 illustrates the cost for head ultrasound. Phototherapy Premature infants have an higher risk for hyperbilirubinemia because they have susceptibility to infection and have decreased amount of serum albumin, than in the term infant (Gomella et al., 2013). For a 28-week infant, with an uncomplicated case, we would expect the infant will need phototherapy by DOL 4 and be completed with therapy by DOL 6. Table 10 illustrates the total cost for phototherapy for this patient post admission. ROP Throughout the 10 weeks, a 28-week infant may need to undergo various procedures and interventions to assess for complications associated with prematurity. In the 28 week infant, exposure to increased oxygen support can lead to retinal detachment and blindness. Infants born prior to 30 weeks gestation and weight <1500 grams that have required cardiopulmonary support are at an increased risk for ROP (AAP, 2013). Based on the initial exam, the stage and occurrence of ROP identifies the schedule for follow-ups. For an ROP exam, the infant would be billed for ROP exam completed by optometrist, the eye kit and medications used in the exam. For the 28-week infant, we would expect the infant to receive to 2 ROP screens. Table 11 illustrates the total cost for ROP screens for this patient post admission. Reimbursement Medicaid is one resource for reimbursement for NNP services. Medicaid is funded by the federal government but governed by state programs. As nurse practitioners, we are considered the primary care provider, and need legislation in place for reimbursement. Although we have been considered the primary care provider under the fee for service system since 1990, legislation is needed to facilitate the proper Running Head: NNP Group 2: Financial Analysis 7 functions of practitioners. The Balanced Budget Act of 1997 has some misleading wording that inhibits the amount of healthcare for the vulnerable population. However, practitioners have been found to be extremely valuable, as a resource for state Medicaid fee for service (AANP, 2013). The changes that need to be made in the Federal Medicaid laws are: 1) Fee-for-fee service Medicaid to include direct payment, recognize all practitioners as primary case managers, and require NPs, CNSs, and CNMs to be included in Medicare managed care (ANA, 2013). Through the Collaboration of the Centers for Medicare and Medicaid Services (CMS), the goal is to have increased payments to primary care case managers. The Center for Medicare and Medicaid Services has an improving infant and maternal health campaign that can lead to long term decreased health care cost. Under Medicaid, there is a Provider Statistical and Reimbursement System (PS&R) that is helpful for institutional healthcare providers. This system puts together reimbursement data applicable to the finalized Medicare Part A claims, and providers may access their own Provider Summary reports by PS&R.(CMS, 2014).Medicaid coverage varies from state to state according to requirements. The payment is usually lower than through insurance. On average, reimbursement is 50-55% of billable charges. Private Insurance Private insurance is also a source for reimbursement. Insurance plan carriers include: Blue Cross Blue Shield, Aetna, Prudential, and Metropolitan, and others. The traditional fee-for-fee service provided by private insurance companies functions to reimburse providers for patient charges. Similar to Medicaid reimbursement, private insurance reimbursement varies from state to state. Advanced Practice Nurses should contact each insurance company for credentialing and reimbursement protocols. Summary: Ease or Difficulty of Success in Independent NNP Practice Although the NNP is established as a key primary care provider, issues surrounding variances in the view of the role/independence of the NP, as well as variances in payer/reimbursement policies, affect the ability to bill for NNP services independently at this time. Running Head: NNP Group 2: Financial Analysis 8 Variances Surrounding the NNP as an Independent Provider Differences in the opinions of governing authorities regarding independent practice by NNPs for billable services affect reimbursement policies. Texas Medicaid rules do not currently require supervision by a physician for service reimbursement but specify that NP perform only services within the scope of practice regulated by the State Board of Nurse Examiners and Texas state law (Texas Medical Association, 2014). However, the American Academy of Pediatrics (2009) holds the opinion that care provided by a NNP within the neonatal intensive care unit (NICU) should be supervised by a neonatologist. Scope of practice for advanced practice nurses varies widely from state to state and duties vary from institution to institution. The National Association of Neonatal Nurse Practitioners (NANNP) holds that because state licensure regulations are variable, the NNP practices independently in collaboration with or under a neonatologist’s supervision (2012). Because neonatal patients are cared for within inpatient hospital units and practitioners sometimes work within physician groups, relationships within these institutions may govern their practice and ability to bill for services independently. Although collaborative agreements and prescriptive authority agreements exist in some states, NNPs almost invariably work as employees within the acute care NICU hospital setting under the supervision of a neonatologist. Variances in opinion of the NNP and their role as independent practitioners make it difficult to regulate practice standards for advanced practice nurses and establish billing for service reimbursement policies with payers. Billing Issues Specific to the NNP In addition to the billing practices mentioned above, many variables affect billing and/or profitability for NNPs. For instance, in order to bill Medicaid for services, a NNP must first be enrolled, credentialed, and issued a provider number to bill under. When billing commercial insurance plans, some carriers have a credentialing process while others require billing under the physician’s name and provider number. Although Medicaid provides reimbursement to employed and self-employed NPs, commercial carriers may require the NNP to be employed under a physician for reimbursement. Medicaid stipulates that the service Running Head: NNP Group 2: Financial Analysis 9 provided and submitted for reimbursement cannot be just one part of a bundled service. For instance, services such as delivery, rounding, initiating transfers and writing transfer orders are part of bundled services and are not billable separately. Most payers will only pay 1 charge per day, per patient, per specialty, for evaluation/management, meaning that only one charge for Neonatology can be recovered, however, it is permissible to bill “shared” visits with physicians when the practitioner sees the hospital inpatient in the morning, and the physician follows with a face-to-face visit later that day. Medicaid typically reimburses 92% of the reimbursement made to physicians and commercial insurance reimbursement percentages vary from carrier to carrier, but average 85% (Buppert, 2009). Also, claims can be returned if any requirements for payment are unmet. Claims may have to be resubmitted; with additional cost. Outsourcing, defined as the strategic use of outside resources for billing services, may be beneficial for reducing unnecessary inefficiencies and increasing reimbursements, but also adds another degree of cost to the cost/reimbursement equation (Mackey, 2004). Feasibility of NNP Independent Practice and Billing When considering our financial analysis for this 28 -week infant, it appears that most payer reimbursement would be recovered by the hospital and physicians in the NICU, as bundled services payments. The NNP, if able to bill for some services independently, would not profit much, if at all, after adjusting for other costs. However, the ability by physicians and hospitals to bill for services provided by NNPs does bring added value to the role and may be necessary for survival of the role in the future. In today’s healthcare environment, NNPs must not only be competent providers of care but must also understand the concepts of the APRN role, Medicaid and other insurance policy regulation, credentialing processes, and the use of CPT/ICD-9 codes for reimbursement. Additionally, pursuing reimbursement for Advanced Practice Nursing services may well be necessary for the survival of the role in the future, and practitioners must make themselves knowledgeable regarding legislative requirements. Running Head: NNP Group 2: Financial Analysis 10 References American Association of Nurse Practitioners. (2013). Medicaid. Retrieved from http://www.aanp.org/legislation-regulation/federal-legislation/Medicaid American Academy of Pediatrics. (2009). Advanced practice in neonatal nursing. Pediatrics, 123(6), 16061607, Retrieved from http://pediatrics.aappublications.org/content/123/6/1606.full.pdf+html, doi:10.1542/peds.2009-0867 American Academy of Pediatrics. (2013). Screening examination of premature infants retinopathy of prematurity. Retrieved from http://pediatrics.aappublications.org/content/131/1/189.full. American Nurses Association, (2013). ANA factsheet on medicaid reimbursement. Retrieved from http://www.nursingworld.org/DocumentVault/GOVA/Federal/FederalIssues/MedicaidReimburseme nt%20.aspx Buppart, C. (2009). Billing issues for nurse practitioners who provide inpatient services. Medscape. Retrieved from http://www.medscape.com/viewarticle/705683.htm Centers for Medicare and Medicaid Services. (2014). Provider statistical & reimbursement report. Retrieved from https://www.cms.gov/Research-Statistics-Data-and-Systems/Statistics-Trends-andReports/PSRR/index.html?redirect=/PSRR/ Dayton Children’s Hospital. (2014). Pricing. Retrieved from http://www.childrensdayton.org /cms/site/pricing/index.html Fair Health Consumer Cost Lookup [FHCCL]. (2014). Fair health. Retrieved from http://fairhealthconsumer.org/medical_cost.php Gomella, T. L, Cunningham, M. D. & Eyal, F. G. (2013). Neonatology: Management, procedures, on-call problems, diseases and drugs (7th Ed.). New York: McGraw Hill Education Hanson, C. M., & Bennett, S. D. (2014). Business planning and reimbursement. In A. B. Hamric, J. A. Spross, & C. M. Hanson. (Eds.). Advanced nursing practice: an integrative approach (5th ed., pp. Running Head: NNP Group 2: Financial Analysis 505 - 537). St. Louis: Elsevier-Saunders. Mackey, T. A. (2004). Outsourcing issues for nurse practitioner practices. Nursing Economics, 22(1), Retrieved at http://medscape.com/viewarticle/470005 National Association of Neonatal Nurse Practitioners. (2013). Position Statement #3058: Neonatal Nurse Practitioner Workforce. Retrieved from http://www.nann.org/uploads/NNP_Workforce_Position_Statement_01.22.13_FINAL.pdf Texas Medical Association. (2014). At a glance billing guidelines. Retrieved from http://www.texmed.org/Template.aspx?id=2273 UFHealth (2014). What is a CPT code? Procedural and diagnosis coding must be linked by medical necessity. Retrieved from http://compliance.med.ufl.edu.compliance-tips/what-is-a-cpt-code/ 11 Running Head: NNP Group 2: Financial Analysis 12 Tables Table 1 Costs of staff related to 28 week infant stay in the NICU Employee Neonatologist Neonatal Nurse Practitioner Registered Nurse Respiratory Therapist Occupational Therapist Equipment Tech Hourly Wage $72.00 $45.00 Hours per Day 24 24 Days Used 70 70 Total Cost $120,960 $75,600 $35.00 24 70 $58,800 $32.00 24 28 $21,504 $35.00 1 46 $1575 $15 1 70 $1050 TOTAL $279,489.00 Table 2 Costs associated with admission into NICU (FHCCL, 2014) Admission related charge CPT Code Attending at delivery &1st stabilization of newborn 99464 Total Estimated Charge $76.95 Critical Care Evaluation & Management 99291 $250.09 Initial Inpatient Critical Care per day 28 days< 99468 $1137.20 Intubation, Endotracheal, Emergency Procedure 31500 Intrapulmonary Surfactant Administration 94610 Chest X-Ray frontal Umbilical Artery Catherization Umbilical Vein Catheterization Abdomen X-Ray Blood Gas Vein Hydration first 30-60 minutes Continuous Pulse Oximetry 71010 36606 36510 74000 82803 96630 94760 $121.84 𝑥 2 = $243.68 $74.60 𝑥 2 = $149.20 $30.42 $675.00 $625.00 $48.00 $32.00 $180.00 $66.00 x 70 days = $4620.00 Total Charges: $8067.54 Table 3 Charges for Total Stay in the NICU Level of Care in NICU Level III Level II Total Total days 21 49 Cost per day $4160.00 $3145.00 Total Cost $87,360.00 $154,105.00 $241,465.00 Running Head: NNP Group 2: Financial Analysis 13 Table 4 CPT codes related to a 28 week neonates NICU stay CPT related charge NICU Daily<28 days of age NICU Daily > 29 days of age Discharge Discharge Hearing Screen CPT Code Amount of Days Cost per day 99469 27 $2150.00 Total Estimated Charge $58,050.00 99465 42 $1540.00 $6468.00 1 $189.00 $24.99 $189.00 $24.99 99238 92551 1 Total Cost $64,731.99 Table 5 Cost of Modes of Respiratory Support for a 28 week Neonate (Dayton Children’s Hospital, 2014) Respiratory Method of Support NCPAP Nasal Cannula TOTAL: Cost per day Day on support $695.00 $101.00 14 14 Total Cost $9730.00 $1414.00 $11,144.00 Table 6 Cost of Total Medications for a 28 week Neonate Unit Cost Starter TPN TPN Intralipids Surfactant Vitamin K Erythromycin Ampicillin Gentamicin Caffeine MV/Fe Hepatitis B Hib, DTaP, IPV, PCV Prolacta $500.00 $750.00 $50.00 $75.00 $52.00 $47.00 $7.50 $3.16 $3.20 $13.00 $11.00 $164.00 $115.00 Quantity ordered during NICU stay 1 5 5 2 1 1 6 3 42 1 1 1 18 Total Cost $500.00 $3750.00 $250.00 $150.00 $ 52.00 $47.00 $45.00 $9.48 $134.40 $13.00 $11.00 $164.00 $2070.00 Table 7 Total Laboratory Cost for a 28 week neonate NICU stay (FHCCL, 2014) Laboratory Test CBC with differential Basic Metabolic Panel Newborn Screen CPT Code Cost 85025 $37.00 Quantity ordered during NICU stay 4 Total Cost 80048 $53.00 4 $212.00 83788 $40.00 2 $80.00 $148.00 Running Head: NNP Group 2: Financial Analysis Total Serum Bilirubin Triglycerides Arterial Blood Culture Chem Strips Hematocrit Retic Count Total Cost 14 82247 $27.00 5 $135.00 84478 87040 $39.50 $65.00 3 1 $118.50 $65.00 82948 85014 85049 $20.00 $35.00 $35.00 10 8 4 $200.00 $280.00 $140.00 $1481.50 Table 8 Total Supplies Cost during 28 week NICU Stay Table 9 Total Cost for Radiological Studies Test Each Cost Diapers Wipes IV start kits IV flushes IV tubing NG tubes Feeding Tubes Total Cost $1.50 $2.00 $6.00 $1.25 $15.00 $0.52 $1.50 Charge to Patient $44.00 $20.00 $18.00 $54.00 $30.00 $1.56 $84.00 $251.56 Radiological Procedure Head Ultrasound Total Cost Cost for patient $370.00 $370.00 Table 10 Total Cost for Phototherapy in 28 week neonate stay Test Cost per Day Charge to Patient Phototherapy Phototherapy Eye Shield Total Cost $112.00/day $336.00 $3.75 $339.75 Table 11 Total Cost for ROP in 28 week neonate stay Test Cost/Test Charge to Patient ROP exam ROP examination kit Cyclomydril Proparacaine Total Cost $66.00 $53.00 $270.00 $9.00 $132.00 $106.00 $27.00 $9.00 $274.00