Chapter 15: Monetary Policy

advertisement

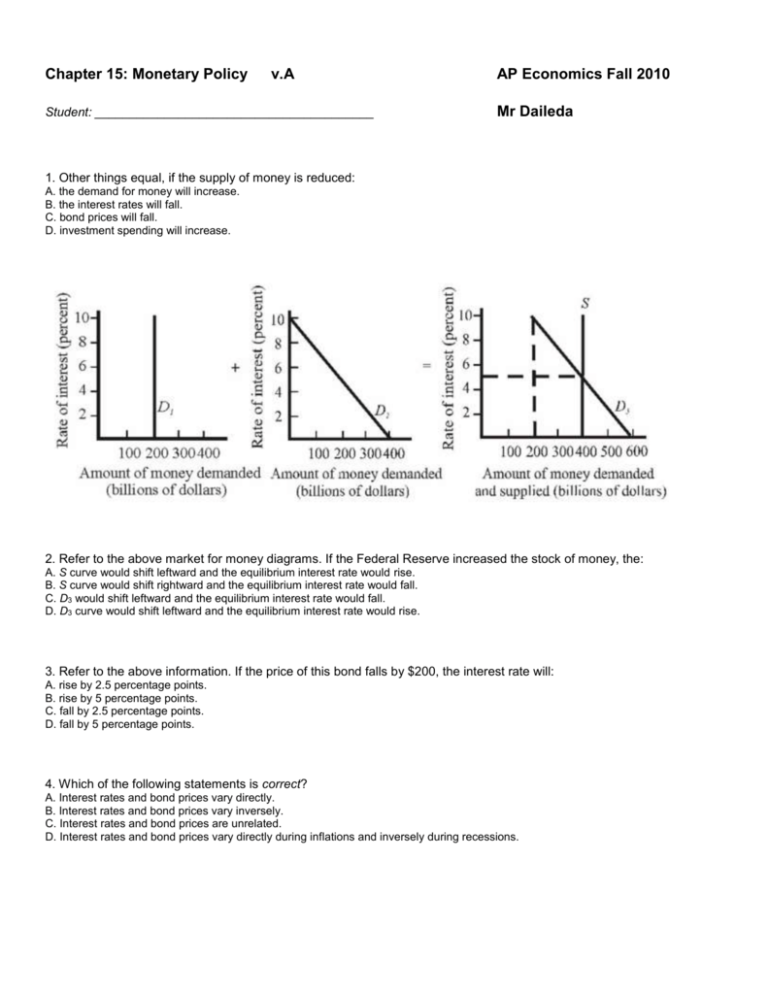

Chapter 15: Monetary Policy v.A Student: ________________________________________ AP Economics Fall 2010 Mr Daileda 1. Other things equal, if the supply of money is reduced: A. the demand for money will increase. B. the interest rates will fall. C. bond prices will fall. D. investment spending will increase. 2. Refer to the above market for money diagrams. If the Federal Reserve increased the stock of money, the: A. S curve would shift leftward and the equilibrium interest rate would rise. B. S curve would shift rightward and the equilibrium interest rate would fall. C. D3 would shift leftward and the equilibrium interest rate would fall. D. D3 curve would shift leftward and the equilibrium interest rate would rise. 3. Refer to the above information. If the price of this bond falls by $200, the interest rate will: A. rise by 2.5 percentage points. B. rise by 5 percentage points. C. fall by 2.5 percentage points. D. fall by 5 percentage points. 4. Which of the following statements is correct? A. Interest rates and bond prices vary directly. B. Interest rates and bond prices vary inversely. C. Interest rates and bond prices are unrelated. D. Interest rates and bond prices vary directly during inflations and inversely during recessions. 5. Refer to the above diagram of the market for money. The equilibrium interest rate is: A. i1. B. i2. C. i3. D. not determinable without additional information. Answer the next question(s) on the basis of the following information for a bond having no expiration date: bond price = $1000; bond fixed annual interest payment = $100; bond annual interest rate = 10 percent. 6. The equilibrium rate of interest in the market for money is determined by the intersection of the: A. supply of money curve and the asset demand for money curve. B. supply of money curve and the transactions demand for money curve. C. supply of money curve and the total demand for money curve. D. investment demand curve and total demand for money curve. 7. Refer to the above diagram of the market for money. The vertical money supply curve Sm reflects the fact that: A. bond prices and interest rates are inversely related. B. the stock of money is determined by the Federal Reserve System and does not change when the interest rate changes. C. the velocity of money is zero. D. lower interest rates result in lower opportunity costs of supplying money. 8. If the quantity of money demanded exceeds the quantity supplied: A. the supply-of-money curve will shift to the left. B. the demand-for-money curve will shift to the right. C. the interest rate will rise. D. the interest rate will fall. 9. An increase in nominal GDP increases the demand for money because: A. interest rates will rise. B. more money is needed to finance a larger volume of transactions. C. bond prices will fall. D. the opportunity cost of holding money will decline. 10. The asset demand for money: A. is unrelated to both the interest rate and the level of GDP. B. varies inversely with the rate of interest. C. varies inversely with the level of real GDP. D. varies directly with the level of nominal GDP. 11. It is costly to hold money because: A. deflation may reduce its purchasing power. B. in doing so one sacrifices interest income. C. bond prices are highly variable. D. the velocity of money may decline. 12. Which of the following is an asset on the consolidated balance sheet of the Federal Reserve Banks? A. loans to commercial banks B. Federal Reserve Notes in circulation C. Treasury deposits D. reserves of commercial banks 13. Federal Reserve Notes in circulation are: A. an asset as viewed by the Federal Reserve Banks. B. a liability as viewed by the Federal Reserve Banks. C. neither an asset nor a liability as viewed by the Federal Reserve Banks. D. part of M1, but not of M2 or MZM. 14. Which of the following will increase commercial bank reserves? A. the purchase of government bonds in the open market by the Federal Reserve Banks B. a decrease in the reserve ratio C. an increase in the discount rate D. the sale of government bonds in the open market by the Federal Reserve Banks 15. When a commercial bank borrows from a Federal Reserve Bank: A. the supply of money automatically increases. B. it indicates that the commercial bank is unsound financially. C. the commercial bank's lending ability is increased. D. the commercial bank's reserves are reduced. 16. The Federal Reserve Banks sell government securities to the public. As a result, the checkable deposits: A. of commercial banks are unchanged, but their reserves increase. B. and reserves of commercial banks both decrease. C. of commercial banks are unchanged, but their reserves decrease. D. of commercial banks are both unchanged. 17. The Federal Reserve Banks buy government securities from commercial banks. As a result, the checkable deposits: A. of commercial banks are unchanged, but their reserves increase. B. and reserves of commercial banks both decrease. C. of commercial banks are unchanged, but their reserves decrease. D. and reserves of commercial banks are both unchanged. 18. Commercial banks and thrifts usually hold only small amounts of excess reserves because: A. the presence of such reserves tends to boost interest rates and reduce investment. B. the Fed constantly uses open market operations to eliminate excess reserves. C. the Fed does not pay interest on reserves. D. the Fed does not want commercial banks and thrifts to be too liquid. 19. In the United States monetary policy is the responsibility of the: A. U.S. Treasury. B. Department of Commerce. C. Board of Governors of the Federal Reserve System. D. U.S. Congress. 20. The three main tools of monetary policy are: A. tax rate changes, the discount rate, and open-market operations. B. tax rate changes, changes in government expenditures, and open-market operations. C. the discount rate, the reserve ratio, and open-market operations. D. changes in government expenditures, the reserve ratio, and the discount rate. 21. Assume the reserve ratio is 25 percent and Federal Reserve Banks buy $4 million of U.S. securities from the public, which deposits this amount into checking accounts. As a result of these transactions, the supply of money is: A. not directly affected, but the money-creating potential of the commercial banking system is increased by $12 million. B. directly increased by $4 million and the money-creating potential of the commercial banking system is increased by an additional $16 million. C. directly reduced by $4 million and the money-creating potential of the commercial banking system is decreased by an additional $12 million. D. directly increased by $4 million and the money-creating potential of the commercial banking system is increased by an additional $12 million. 22. Assume the legal reserve ratio is 25 percent and the Fourth National Bank borrows $10,000 from the Federal Reserve Bank in its district. As a result: A. commercial bank reserves are increased by $10,000. B. the supply of money automatically declines by $7,500. C. commercial bank reserves are increased by $7,500. D. the supply of money is automatically increased by $10,000. 23. Assume that a single commercial bank has no excess reserves and that the reserve ratio is 20 percent. If this bank sells a bond for $1,000 to a Federal Reserve Bank, it can expand its loans by a maximum of: A. $1,000. B. $2,000. C. $800. D. $5,000. 24. Refer to the above balance sheets. If the reserve ratio is 25%, commercial banks have excess reserves of: A. $12. B. $22. C. $16. D. $24. 25. Refer to the above balance sheets. If the reserve ratio is 25%, the maximum money-creating potential of the commercial banking system is: A. $36. B. $17. C. $48. D. $24. 26. Refer to the above balance sheets and assume the reserve ratio is 25%. Suppose the Federal Reserve Banks buy $2 in securities from the public, which deposits this amount into checking accounts. As a result of these transactions, the supply of money will: A. be unaffected but the money-creating potential of the commercial banking system will increase by $6. B. directly decrease by $2 and the money-creating potential of the commercial banking system will be unaffected. C. directly increase by $8 and the money-creating potential of the commercial banking system will increase by an additional $32. D. directly increase by $2 and the money-creating potential of the commercial banking system will increase by an additional $6. 27. Refer to the above balance sheets and assume the reserve ratio is 25%. Suppose the Federal Reserve Banks sell $2 in securities directly to the commercial banks. As a result of this transaction the supply of money: A. will decrease by $2, but the money-creating potential of the commercial banking system will not be affected. B. is not directly affected, but the money-creating potential of the commercial banking system will decrease by $8. C. will directly increase by $2 and the money-creating potential of the commercial banking system will decrease by an additional $8. D. will directly increase by $2 and the money-creating potential of the commercial banking system will increase by an additional $8. 28. The Federal Reserve System regulates the money supply primarily by: A. controlling the production of coins at the United States mint. B. altering the reserve requirements of commercial banks and thereby the ability of banks to make loans. C. altering the reserves of commercial banks, largely through sales and purchases of government bonds. D. restricting the issuance of Federal Reserve Notes because paper money is the largest portion of the money supply. 29. Open-market operations change: A. the size of the monetary multiplier, but not commercial bank reserves. B. commercial bank reserves, but not the size of the monetary multiplier. C. neither commercial bank reserves nor the size of the monetary multiplier. D. both commercial bank reserves and the size of the monetary multiplier. 30. If the Fed were to increase the legal reserve ratio, we would expect: A. lower interest rates, an expanded GDP, and depreciation of the dollar. B. lower interest rates, an expanded GDP, and appreciation of the dollar. C. higher interest rates, a contracted GDP, and appreciation of the dollar. D. higher interest rates, a contracted GDP, and depreciation of the dollar. 31. Assume that the commercial banking system has checkable deposits of $10 billion and excess reserves of $1 billion at a time when the reserve requirement is 20 percent. If the reserve requirement is now raised to 30 percent, the banking system then has: A. excess reserves of $2 billion. B. neither an excess nor a deficiency of reserves. C. a deficiency of reserves of $.5 billion. D. excess reserves of only $.5 billion. Answer the next question(s) on the basis of the following consolidated balance sheet of the commercial banking system. Assume that the reserve requirement is 20 percent. All figures are in billions and each question should be answered independently of changes specified in all preceding ones. 32. Refer to the above data. The commercial banking system has excess reserves of: A. zero. B. $2 billion. C. $5 billion. D. $10 billion. 33. Refer to the above data. The monetary multiplier for the commercial banking system is: A. 5. B. 10. C. 15. D. 20. 34. Refer to the above data. If the Fed increased the reserve requirement from 20 percent to 25 percent, a deficiency of reserves in the commercial banking system of _____ would occur and the monetary multiplier would fall to ____. A. $50 billion; 5 B. $10 billion; 4 C. $50 billion; 4 D. $10 billion; 8 35. Refer to the above data. If the Fed reduced the reserve requirement from 20 percent to 16 percent, excess reserves in the commercial banking system would increase by _____ and the monetary multiplier would rise to ____. A. $10 billion; 5 B. $40 billion; 6.25 C. $10 billion; 10 D. $40 billion; 12.5 36. Refer to the above data. Suppose the Fed wants to increase the money supply by $1000 billion to drive down interest rates and stimulate the economy. To accomplish this it could lower the reserve requirement from 20 percent to: A. 10 percent. B. 12 percent. C. 14 percent. D. 12 percent. 37. Refer to the above data. Suppose the Fed wants to reduce the money supply by $200 billion to drive up interest rates and dampen inflation. To accomplish this it could increase the reserve requirement from 20 percent to: A. 22 percent. B. 25 percent. C. 30 percent. D. 33 percent. 38. The discount rate is the rate of interest at which: A. Federal Reserve Banks lend to commercial banks. B. savings and loan associations lend to some builders. C. Federal Reserve Banks lend to large corporations. D. commercial banks lend to large corporations. 39. The Fed sets the discount rate at 1 percentage point above: A. the prime lending rate. B. the Fed target for the Federal funds rate. C. the rate of inflation. D. the rate paid on series EE saving bonds. 40. Which of the following tools of monetary policy has not been used since 1992? A. the discount rate B. the reserve ratio C. open market operations D. the Federal funds rate 41. The Federal funds rate is the interest rate that _______ charge(s) _______. A. banks; other banks. B. the Fed; commercial banks. C. banks; their best corporate customers. D. banks; on federal student loans. 42. To reduce the Federal funds rate, the Fed can: A. buy government bonds from the public. B. increase the discount rate. C. increase the prime interest rate. D. sell government bonds to commercial banks. 43. The Federal funds rate is: A. higher than both the prime interest rate and the discount rate. B. lower than both the prime interest rate and the discount rate. C. higher than the prime interest rate but lower than the discount rate. D. lower than the prime interest rate but higher than the discount rate. 44. The benchmark interest rate that banks use as a reference point for a variety of consumer and business loans is the: A. Federal funds rate. B. prime interest rate. C. discount rate. D. Treasury bill rate. 45. Which of the following best describes the cause-effect chain of an expansionary monetary policy? A. A decrease in the money supply will lower the interest rate, increase investment spending, and increase aggregate demand and GDP. B. A decrease in the money supply will raise the interest rate, decrease investment spending, and decrease aggregate demand and GDP. C. An increase in the money supply will raise the interest rate, decrease investment spending, and decrease aggregate demand and GDP. D. An increase in the money supply will lower the interest rate, increase investment spending, and increase aggregate demand and GDP. 46. If the Federal Reserve authorities were attempting to reduce demand-pull inflation, the proper policies would be to: A. sell government securities, raise reserve requirements, and raise the discount rate. B. buy government securities, raise reserve requirements, and raise the discount rate. C. sell government securities, lower reserve requirements, and lower the discount rate. D. sell government securities, raise reserve requirements, and lower the discount rate. 47. Monetary policy is expected to have its greatest impact on: A. Xg. B. Ig. C. C. D. G. 48. Refer to the above diagrams. The numbers in parentheses after the AD1, AD2, and AD3 labels indicate the levels of investment spending associated with each curve. All figures are in billions. If the money supply is MS1 and the goal of the monetary authorities is full-employment output Qf, they should: A. increase the money supply from $80 to $100. B. increase the money supply from $80 to $120. C. maintain the money supply at $80. D. decrease the money supply from $80 to $60. 49. All else equal, when the Federal Reserve Banks engage in a restrictive monetary policy, the prices of government bonds usually: A. fall. B. rise. C. remain constant. D. move in the same direction as the bonds' interest rate yield. 50. A restrictive monetary policy is designed to shift the: A. aggregate demand curve rightward. B. aggregate demand curve leftward. C. aggregate supply curve rightward. D. aggregate supply curve leftward. 51. One of the strengths of monetary policy relative to fiscal policy is that monetary policy: A. can be implemented more quickly. B. is subject to closer political scrutiny. C. does not produce a net export effect. D. entails a larger spending income multiplier effect on real GDP. 52. The problem of cyclical asymmetry refers to the idea that: A. a restrictive monetary policy can force a contraction of the money supply, but an expansionary monetary policy may not achieve an increase in the money supply. B. the monetary authorities have been less willing to use an expansionary monetary policy than they have a restrictive monetary policy. C. cyclical downswings are typically of longer duration than cyclical upswings. D. an expansionary monetary policy can force an expansion of the money supply, but a restrictive monetary policy may not achieve a contraction of the money supply. Chapter 15: Monetary Policy Key 1. C 2. B 3. A 4. B 5. B 6. C 7. B 8. C 9. B 10. B 11. B 12. A 13. B 14. A 15. C 16. B 17. A 18. C 19. C 20. C 21. D 22. A 23. A 24. A 25. C 26. D 27. B 28. C 29. B 30. C 31. B 32. A 33. A 34. C 35. B 36. A 37. B 38. A 39. B 40. B 41. A 42. A 43. B 44. B 45. D 46. A 47. B 48. A 49. A 50. B 51. A 52. A Chapter 15: Monetary Policy Summary Category # of Questions Economics Page: 259 2 Economics Page: 260 5 Economics Page: 261 4 Economics Page: 262 6 Economics Page: 263 7 Economics Page: 263-264 2 Economics Page: 265 2 Economics Page: 265-266 4 Economics Page: 266 5 Economics Page: 267 4 Economics Page: 268 3 Economics Page: 270-271 1 Economics Page: 270-272 1 Economics Page: 272 1 Economics Page: 273 3 Economics Page: 274 1 Economics Page: 275 1 Learning Objective: 14-1 11 Learning Objective: 14-2 18 Learning Objective: 14-3 4 Learning Objective: 14-4 7 Learning Objective: 14-5 2 Macroeconomics Page: 259 2 Macroeconomics Page: 260 5 Macroeconomics Page: 261 4 Macroeconomics Page: 262 6 Macroeconomics Page: 263 7 Macroeconomics Page: 263-264 2 Macroeconomics Page: 265 2 Macroeconomics Page: 265-266 4 Macroeconomics Page: 266 5 Macroeconomics Page: 267 4 Macroeconomics Page: 268 3 Macroeconomics Page: 270-271 1 Macroeconomics Page: 270-272 1 Macroeconomics Page: 272 1 Macroeconomics Page: 273 3 Macroeconomics Page: 274 1 Macroeconomics Page: 275 1 McConnell - Chapter 014 58 Status: New 20 Topic: 1 3 Topic: 10 2 Topic: 2 8 Topic: 3 7 Topic: 4 2 Topic: 5 9 Topic: 6 8 Topic: 7 3 Topic: 8 4 Topic: 9 6 Type: Application of Concept 28 Type: Complex Analysis 1 Type: Definition 4 Type: Fact 5 Type: Graphical 4 Type: Table 10