Module 25 - Banking and Money Creation

advertisement

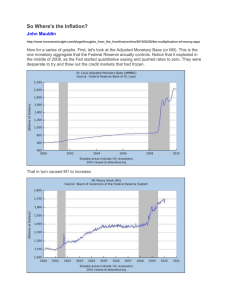

AP Economics Mr. Bernstein Module 25: Banking and Money Creation February 26, 2015 AP Economics Mr. Bernstein Banking and Money Creation • Objectives - Understand each of the following: • The role of banks in the economy • The reasons for and types of banking regulation • How banks create money 2 AP Economics Mr. Bernstein How Banks Create Money • Banks receive deposits • Banks make loans • Banks hold reserves against those loans • If reserves are 10%, loans can be 10x deposits • This effectively creates money • Demonstrated by T-Account: • Fed sets reserve requirements 3 AP Economics Mr. Bernstein How Banks Create Money: An Example • Similar to the Spending Multiplier 4 AP Economics Mr. Bernstein Problem of Bank Runs • If public fears a bank may fold and be unable to pay back depositors, they rush to the bank to make withdrawals before others can • Since deposits are several times reserves, a bank with solid loans but the subject of rumours may be unable to meet demand for withdrawals • Can become a self-fulfilling prophecy • Preventing bank runs is a primary reason for bank regulation 5 AP Economics Mr. Bernstein Bank Regulation • Deposit Insurance • Current FDIC insurance is $250,000 per account • Capital Requirements (= Assets – Liabilities) • Capital Requirements have been rising since 2008 crisis • Reserve Requirements • Currently 10% in the USA • Discount Window • Fed stands as short-term lender to banks in need of capital 6 AP Economics Mr. Bernstein Reserves, Bank Deposits and the Money Multiplier • Money Multiplier = 1 / reserve ratio…MM = 1/rr • Excess Reserves = Total Reserves - rr • MM tells us how much money can be created from each $ of Excess Reserves • In reality, MM is not 10 – its now < 1. • Why? 7