Booklet for Saudi Nationals visiting India

advertisement

Booklet for Saudi Nationals visiting India

Chapter No. I

Deals with the Registration of foreign nationals on arrival in India on different categories of

visa like: Tourist Visa, Assignment Visa, Business Visa, Medical Visa, Student visa, etc. and the

documents required for the purpose.

REGISTRATION OF FOREIGN NATIONALS VISITING INDIA

A.

All foreigners (including foreigners of Indian origin) visiting India on long term (more

than 180 days) Student Visa, Medical Visa, Research Visa and Employment Visa are

required to get themselves registered with the Foreigners Registration Officer (FRRO)/

Foreigners Registration Officer (FRO) concerned jurisdiction over the place where the

foreigner intends to stay, within 14 days of arrival.

B.

Foreigners other than those mentioned above will not be required to get themselves

registered, even if they have entered India on a long term visa provided their

continuous stay in India does not exceed 180 days. If the intention of the foreigner is

to stay in India for more than 180 days, he/she should get himself/herself registered

well before the expiry of 180 days from the date of arrival with the FRRO/FRO

concerned.

C.

Foreigners (including minors above 16 years of age) have to report in person or

through an authorized representative to the appropriate Registration Officer for

registration. Medical patients may be exempted from appearing in person for

registration.

1

D.

Registration is also required in the case of visa less than 180 days and if there is

special endorsement "for registration required". However foreigners entering on

Entry(X) and Business visas valid for more than 180 days are required to register with

the FRRO, FRO if they continuously intend to stay for more than 6 months i.e. more

than 180 days on each visit. (But exempting visa bearing endorsement as "Stay not to

exceed 180days hence no registration required).

E.

Apart from the above, foreigners entering on Tourist, Journalist and any other category

of visa which is valid for more than 180 days and do not have a special endorsement of

"Each stay 180 days hence no registration required" are required to register with the

concerned F.R.R.O.'s, F.R.O.s within 180 days of their arrival. Foreigners (including

minors) have to report in person for Registration.

F.

Ordinarily, the registration process is completed on the same day, but it may vary in

those cases where field enquiry/other checks are required to be done by the

registration officer. The above guidelines are valid for all cases except those where visa

has special endorsement regarding registration.

LATE REGISTRATION:

No fee is charged for registration, but a foreigner who has delayed registration and if delay is

condoned, a penalty in Indian currency equivalent to US$ 30/- for late registration may be

charged.

Over stay:

In the event of overstay, foreigner is liable for prosecution under the Foreigners Act 1946 and

imprisonment up to 5 years with fine & Deportation from India.

REPORT OF ABSENCE FROM REGISTERED ADDRESS:

If at any time a foreigner proposes to be absent from his / her registered address for a

continuous period of eight weeks or more or change his / her registered address, then the

foreigner is required to inform in person or through an authorized representative or by

registered post to his / her Registration Officer of his / her intention to change his registered

address or to leave either temporarily or permanently the jurisdiction of the Registration

Officer. In case of return, the foreigner should inform the Registration Officer of the date of

return and, in case the foreigner is moving away to another place, inform the change of

address. Any changes made subsequently should also be intimated to the Registration Officer.

Every foreigner, who stays for a period of more than eight weeks at any place in any district

other than the district in which his / her registered address is situated, shall inform the

Registration Officer of that district of his / her presence. This can be made in writing and the

requirements deemed to have been fulfilled if, prior to arrival the foreigner furnishes to the

Registration Officer of the said district intimating the dates of his proposed arrival and

departure from the district.

REQUIRED DOCUMENTS FOR REGISTRATION

STUDENT VISA REGISTRATION

2

1.

2.

3.

4.

Application form (Annexure I)

Recent Passport Size Photograph

Request letter addressed to FRRO (Only in case of Delay / Overstay)

Original passport and copy of passport (photo page, page indicating passport validity,

visa page and page indicating arrival stamp of Indian immigration)

5. Address proof – copy of valid & notarized lease agreement or copy of recent electricity

bill or telephone bill along with a letter from house owner & ID proof of the owner or

letter from hostel/hotel or copy of ‘C’ form

6. Original bonafide certificate from the educational institutions – bonafide certificate in

given format only acceptable

7. Study in seminaries and other theological institution, undertaking from applicant and

his/her sponsor that foreigner will not be engaged in Missionary activity or any other

occupation paid or unpaid.

8. Financial sustenance – bank letter or copy of passbook, for minors, bank letter or copy

of passbook of applicant’s father/mother

9. For change of college/course prior permission from the FRRO & letter for cancellation of

admission/NOC from previous institution

10. Fees payable, if any (to be submitted as Demand Draft after approval of application)

11. Any other supporting document

BUSINESS VISA REGISTRATION

1.

2.

3.

4.

Application form (Annexure I)

Recent Passport size Photograph

Request letter addressed to FRRO (Only in case of Delay / Overstay)

Original passport and copy of passport (photo-page, page indicating passport validity,

visa page and page indicating arrival stamp of Indian immigration)

5. Address proof – copy of valid & notarized lease agreement or copy of recent electricity

bill or telephone bill along with a letter from house owner & ID proof of the owner or

letter from hostel/hotel or copy of ‘C’ form

6. Letter addressed to FRRO by Business firm about the nature and duration of the

Business

7. Letter from AIESEC in case of internship/project based work shop

8. Letter from the AIESEC to show that the company would pay the subsistence allowance

or arrange for boarding and lodging

9. Fees payable, if any (to be submitted as DD after approval of application)

10. Relevant documents from the concerned authority according to the business activity

such as Technical meeting/board meeting/manpower recruitments/pre & post sales

activity etc.

11. Any other supporting document

MEDICAL VISA REGISTRATION

1. Application form (Annexure I)

2. Recent Passport size Photograph

3. Request letter addressed to FRRO (Only in case of Delay / Overstay)

3

4. Original passport and copy of passport (photo page, page indicating passport validity,

visa page and page indicating arrival stamp of Indian immigration)

5. Address proof – copy of valid & notarized lease agreement or copy of recent electricity

bill or telephone bill along with a letter from house owner & ID proof of the owner or

letter from hostel/hotel or copy of ‘C’ form

6. Medical report from recognized/specialized hospital/ treatment centre specifying the

period of treatment with patient details. Treating doctor’s name and signature with

hospital seal and nature of illness

7. Fees payable, if any (to be submitted as DD after approval of the applicant)

8. Any other supporting document

MEDICAL ATTENDANT (MED-X) VISA REGISTRATION

1.

2.

3.

4.

Application form (Annexure I)

Recent Passport size Photograph

Request letter addressed to FRRO (Only in case of Delay / Overstay)

Original passport and copy of passport (photo-page, page indicating passport validity,

visa page and page indicating arrival stamp of Indian immigration)

5. Address proof – copy of valid & notarized lease agreement or copy of recent electricity

bill or telephone bill along with a letter from house owner & ID proof of the owner or

letter from hostel/hotel or copy of ‘C’ form Medical report from recognized/specialized

hospital/ treatment centre specifying the period of treatment of patient, nature of

illness and medical attendant details, treating doctor’s name and signature with

hospital seal (if registering separately – not accompanying the patient)

6. Fees payable, if any (to be submitted as DD after approval of application)

7. Any other supporting document

X/ENTRY/DEPENDANT VISA REGISTRATION

1.

2.

3.

4.

5.

6.

7.

8.

9.

Application form (Annexure I)

Recent Passport size Photograph

Request letter addressed to FRRO (Only in case of Delay / Overstay)

Original passport and copy of passport (photo page, page indicating passport validity,

visa page and page indicating arrival stamp of Indian immigration)

Address proof – copy of valid & notarized lease agreement or copy of recent electricity

bill or telephone bill along with a letter from house owner & ID proof of the owner or

letter from hostel/hotel or copy of ‘C’ form

Copy of Marriage Certificate duly solemnized /registered in India (if married in India). If

married abroad, marriage certificate to be authenticated/certified by concerned Indian

Mission abroad/Apostils

If parents, spouse on employment/ business, letter from the company/firm

Indian Origin proof wherever applicable

Copy of parents passport/visa and residential permit if parents are registered with this

office If own property in India:

(a) Copy of RBI clearance for purchase wherever applicable,

(b) Copy of registration certificate of property

4

10. For training in military establishment:

(a) Letter from the local defense training establishment,

(b) Letter from the Ministry of Defence.

11. For social community work in NGO sponsored by AIESEC under exchange program:

(a) Letter from AIESEC to show that NGO would pay the substance allowance or

arrange for boarding and lodging,

(b) Proof of registration of NGO,

(c) Letter from NGO

12. Fees payable, if any (to be submitted as DD after approval of the application)

13. Any other supporting document

TOURIST VISA REGISTRATION

1.

2.

3.

4.

5.

6.

7.

8.

9.

Application form (Annexure I)

Recent Passport size Photograph

Request letter addressed to FRRO (Only in case of Delay / Overstay)

Original passport and copy of passport (photo page, page indicating passport validity,

visa page and page indicating arrival stamp of Indian immigration)

Address proof – copy of valid & notarized lease agreement or copy of recent electricity

bill or telephone bill along with a letter from house owner & ID proof of the owner or

letter from hostel/hotel or copy of ‘C’ form

Letter from airport/Letter from the foreigner regarding travel itinerary, if certificate

from airport is not available (tourism cases)

Copy of permission from concerned foreign mission (re-entry) wherever applicable.

Fees if applicable, if any (to be submitted as DD after approval of application)

Any other supporting document

5

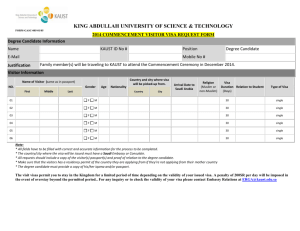

Annexure

Online Application Form (www.immigrationindia.nic.in)

(Registration to FRRO)

6

7

8

9

Booklet for Saudi Nationals visiting India

Chapter No. II.

Deals with the requirement and procedure to obtain Identity Card and Residence Visa.

IDENTITY CARD

Identity Card issued by Ministry of External Affairs, Government of India is necessary to

endorse/ renewal residence visa for Diplomats/ Officials and their dependents.

Identity Cards are required to be carried by their respective holders at all times by the

rules and regulation of Government of India.

Eligible Diplomats/ Officials located in Delhi are issued Identity Card by Protocol II

Division, Ministry of External Affairs, Government of India, and Eligible Diplomats/ Officials

located outside Delhi are issued Identity Cards by the Protocol Department of the State

Governments concerned.

Issuing Authority in New Delhi:

Protocol II Division,

Ministry of External Affairs,

Government of India,

Jawaharlal Nehru Bhawan

10

New Delhi

Issuing Authority in Mumbai:

Protocol Department,

Government of Maharashtra,

Mumbai

Eligibility

1. Diplomats/ Officials and their spouses are eligible to obtain I. Cards.

2. Children between 12 and 21 years of age and holding diplomatic / official passport,

fully dependent upon parents and not engaged in remunerative employment are issued

Identity Cards

3. Dependents, other than spouses and children, are issued Identity Cards only when they

are holding Diplomatic or Official Passports.

PROCEDURE

1. Eligible Diplomat/ Official appointed against new posts will be issued Identity Card after

obtaining concurrence of the Ministry / Department of the Government of India to the

creation of such posts through Protocol III Division, Ministry of External Affairs,

Government of India.

2. Personnel on training in India on short term assignments of less than one year are not

issued Identity Cards.

3. Requests for issue/ renewal of Identity Cards will be submitted to Protocol II Division

(within 7 (Seven) days of arrival in India if Applying first time), in quintuplicate, along

with the five identical copies of latest passport size colour photographs and photocopy

of pages of passport, showing personal particulars, Indian visa and date of entry into

India in Form No 4 (Annexure II) for Diplomat/ Official and Form No. 5 (Annexure III)

for spouses and dependents.

4. In case of loss of Identity Cards; Loss of Identity cards should be reported to the

nearest police station and the issuing authority without delay. Requests for a duplicate

Identity Card will be submitted to Protocol II Division on the form prescribed for issue

of fresh identity cards, along with a copy of the report lodged with the police authority.

Duplicate Identity Cards are validated only for the remaining period of validity of the

Identity Card reported lost.

5. Identity Cards held by Diplomat/ Official and their dependent should be returned to the

respective issuing authority within a week of completion of their assignment in India

with date of their final departure.

REQUIREMENT FOR ISSUE/ RENEWAL/ DUPLICATE IDENTITY CARD

FOR DIPLOMATS/ OFFICIALS

1.

2.

3.

4.

5.

Covering Letter from the Mission.

Form No IV (Annexure II), duly filled up with signature.

5 color Photographs with white background.

Self Attested Photocopy of the passport showing Personal details.

and last Indian visa, along with first immigration clearance stamp.

11

6. Ministry’s permission, if new arrival (or new replacement in Military Attaché Office).

7. Copy of FIR, if identity card lost and applying for duplicate.

8. Original I. Card to be returned, if applying for renewal.

FOR SPOUSE AND DEPENDENT

1. Covering Letter from Attaché Office

2. Form No. V (Annexure III), duly filled up with signatures

3. 5 color photographs with white back ground

4. Photocopies of: (Attested by Head of Family)

a.

Photocopy of passport showing personal details and last Indian visa

b.

Photocopy of the passport of head of family, showing personal details

and last Indian visa, along with photocopy of Identity Card

5. Copy of FIR, if identity card lost and applying for duplicate

6. Original I. Card to be returned, if applying for renewal

RESIDENCE VISA

DIPLOMATS/ OFFICIALS:

1. Identity Card issued by Ministry of External Affairs, Government of India is necessary to

endorse/ renewal residence visa for Diplomat/ Officials and their spouses and

depended. Residence visa will not be endorse/ renew more than Passport and Identity

Cards expiration date.

2. In Case of issuance of New Passport, Valid visa from the old passport will be

transferred to New Passport.

PROCEDURE

1. Residence visa for Diplomatic/ Official Passports holders will be endorsed/ renewed

from PV II Division, Ministry of External Affairs, Patiala House, New Delhi.

2. Residence visa will not be endorsed/ renewed more than the validity of Passport and

Identity Cards date.

3. Residence visa will not be endorsed/ renewed more than the validity of residence visa

of Head of family.

12

Issuing Authority in New Delhi:

PV II Division,

Ministry of External Affairs,

Patiala House,

New Delhi

REQUIREMENTS

1. Passport with covering letter

2. Copy of I. Card + copy of I. Card of Head of Family

(Attested by Head of Family)

3. Copy of online filled up form with signature

Website to fill online form: - https://indianvisaonline.gov.in/visa/

(Annexure IV)

4. 2 color photographs size 2”X2” without any border

5. Photocopies of:- (Attested by Head of family)

a.

Photocopy of I. Card

b.

Photocopies of Passport of Head of family, showing personal details and last

Indian visa along with photocopy of I. Card

6. Old passport ( in case of transferring visa on new passport)

RESIDENCE VISA FOR DEPENDENT OF ORDINARY PASSPORT HOLDER

1. Passport with covering Letter

2. 2 Photographs

3. 5 Photocopies of Passport of Head of family, showing personal details and last Indian

visa along with photocopy of I. Card (Attested by Head of Family)

4. Procedure:

1st Step: Request to get NOC from Protocol II Division, MEA,Govt. of India

2nd Step: Request to get NOC from PV II Division, MEA, Patiala House, N. Delhi

3rd Step: Request to get Permission for endorsement/ renewal residence visa form Ministry

of Home Affairs, Govt. of India, New Delhi.

4th Step: Endorsement/ Renewal residence visa from FRRO, MHA.

VISAS FOR ORDINARY PASSPORT HOLDERS (Annexure V)

VISA CONVERSION

Generally specific power of Visa conversions and extension to ordinary passport holder

residing in India, rests with the Ministry of Home Affairs, New Delhi. For this purpose the

ordinary passport holder can approach Ministry of Home Affairs between 10 am to 12 noon on

13

all working days (Monday to Friday). The change of visa status is normally not allowed. It can

be considered by the Ministry of Home Affairs only in extraordinary circumstances.

Ordinary Passport holders, not residing in Delhi may approach the FRROs/ FROs cum

superintendent of Police concerned, who would forward their case to Ministry of Home Affairs

for approval. Applications for extension/ conversion should be made well in advance.

VISA EXTENSION

A. 15 days visa extension: Extension of stay up to 15 days on any type of visas in

emergent cases such as illness, death, non-availability of flights etc., subject to

production of confirmed onward journey ticket.

B. Three Months Visa Extension: FRROs can grant one short term extension, if need be,

for a period of 3 months while referring case to Ministry of Home Affairs, Foreign

Division, New Delhi and awaiting orders.

C. Medical Visa: Visa for ordinary passport holder on medical visa can be extended for a

further period of one year on production of medical certificate/ advice from

reputed/recognized/ specialized hospital in India. Any further extension on medical visa

will be granted by the Ministry of Home Affairs, New Delhi.

D. Student Visa: FRROs/ District Superintendents of Police (FROs) can grant extension of

stay to those on Student Visa for one year at a time on production of bonafide

certificate from the recognized college/ university up to the duration of the course or

5years whichever is less.

E. Business/ Employment Visa: Ordinary Passport holders, who are on business/

employment visa and their first one year extension has already been approved by

Ministry of Home Affairs can seek further extension of one year at a time for next four

years from their concerned FRROs/ FROs cum superintendents of police on production

of relevant documents for the purpose. Dependent spouse and children of such

ordinary passport holders can also be granted extension on co-terminus basis.

F. Visa Transfer on new travel document: In case of lost passport, FRROs/ FROs-cumSuperintendent of Police may regularize stay and grant exit permission on the new

travel documents given by the foreign mission provided the stay has not exceeded the

visa period. Further, the whole visa can be endorsed on the new passport after

confirmation of the kind of visa issued from Embassy.

G. Police Clearance Certificates: After complying with the requisite procedural formalities

(Crosschecking, confirmation etc.), FRROs/ FROs cum superintendent of police can

grant Police Clearance Certificate (PCC) to their respective registered foreign national

as pertaining to their period of residence in India.

H. Landing Permit: FRROs/ FROs cum superintendents of police can grant landing permit

to the ordinary passport holders, arriving in India without valid Visa, In emergent

situation like death/ illness in the family up to a period of 15 days provided immigration

officer is satisfied regarding the bonafide of the foreigner’s visit. For further extension

14

of stay in such cases, the ordinary passport holder should report to Ministry of Home

Affairs, Foreign Division, New Delhi except in case of minors which can be extended till

the minor attains the age of majority.

REQUIREMENTS FOR EXIT OF ALL VISAS

1.

2.

3.

4.

5.

6.

7.

8.

9.

Application form (Annexure V)

Recent Passport Size Photograph

Request letter addressed to FRRO (Only in case of Delay / Overstay)

Original passport and copy of passport (photo page, page indicating passport validity,

visa page and page indicating arrival stamp of Indian immigration)

Address proof – copy of valid & notarized lease agreement or copy of recent electricity

bill or telephone bill along with a letter from house owner & ID proof of the owner or

letter from hostel/hotel or copy of ‘C’ form

If employed, letter from the employer and up to date tax paid details with copy of PAN

card

If on Business, letter from the Business firm and up-to-date tax paid details with copy

of PAN card

If on Student visa, no dues certificate from the educational institution

For loss of passport

a. new passport or emergency travel document issued by the concerned foreign

missions and one photocopy,

b. letter from the concerned foreign missions,

c. police report about the loss/stolen passport (in Loss certificate or FIR)

10. For child born in India,

a. copy of passport or emergency travel document,

b. letter from the concerned foreign mission,

c. copy of birth certificate,

d. copy of passport/visa and RP (Res. Permit) of parents (if parents are registered)

11. Fees payable (Demand draft)

12. Police report (In case of Overstay etc) wherever required, except minor

13. Any other supporting document

15

Annexure

Form 4 (Application for Identity Card for Diplomat/ Official)

16

17

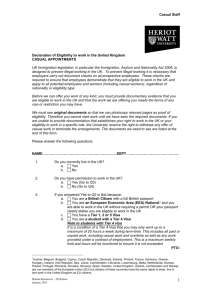

Annexure

Form 5 (Application for Identity Card of Spouse and Dependent of

Diplomats/ Officials)

18

19

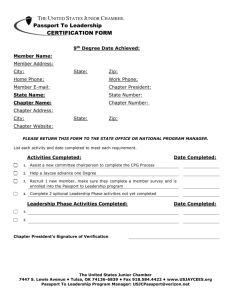

Annexure

Online Indian Visa (Resident visa for diplomat/ Official)

(https://indianvisaonline.gov.in/visa/)

20

21

22

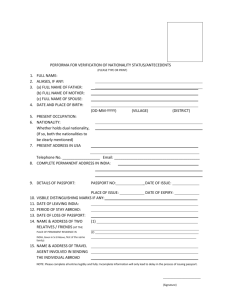

Annexure

Online Application Form (All visas for ordinary Passports)

(www.immigrationindia.nic.in)

23

Booklet for Saudi Nationals visiting India

Chapter No. III.

Speaks about the Privileges and Immunities available for the Diplomats/Officials

coming to India on assignment visas.

PRIVILEGES AND IMMUNITIES- DIPLOMATIC MISSIONS

A. IMMUNITY AND INVIOLABILITY

Diplomatic Missions

1. The Premises of the Embassy shall be inviolable; the agents of the host Government

may not enter these except with consent of the Head of the Mission.

2. The host government will take all appropriate steps to protect the premises of the

mission against any intrusion or damage and to prevent any threat to peace of the

Embassy or harm to its dignity.

3. The premises of Embassy, its property, means of transport duly registered shall be

immune from search, requisition, attachment or execution.

4. The archives and documents of the Embassy shall be inviolable at any time and any

where they may be.

5. All Official correspondence of the Mission shall be inviolable.

24

6. The Govt. of India will permit and protect free communication for all official purposes.

For communicating with the government and other missions and consulates of the

Kingdom, wherever situated, the Embassy may use all suitable means, including

diplomatic couriers and messages in code or cipher and symbols. The Mission may

install and use a wireless transmitter only with the approval of the Govt. of India.

7. The private residences of diplomats shall enjoy the same immunity and protection as

that of the Mission. All his property, papers, correspondence shall also enjoy

inviolability.

8. A diplomat shall not be liable to any form of arrest or detention. The Indian Government

shall treat him with due respect and shall take all steps to prevent any attack on his

person, freedom or dignity.

9. A Diplomat is not obliged to give evidence as a witness.

10. A diplomat shall enjoy immunity from criminal, civil and administrative jurisdiction

except in the case of:

a) A real action relating to private immovable property situated in India, unless he

holds it on behalf his government for the purposes of the Mission;

b) An action relating to succession in which the diplomat is involved as an executor,

administrator, heir or successor as a private person and not on behalf of his

government; and

c) An action relating to any professional or commercial activity exercised by the

Diplomat/official in India outside his official function.

11. The members of the family of a diplomat/official forming part of his household, if they

are not nationals of India, enjoy the immunities as specified above.

Administrative & Technical Personnel

Members of Administrative and Technical personnel of the Embassy shall enjoy

immunity from arrest or detention. They shall enjoy immunity in respect of acts performed

in the course of their official duties. Such members shall not enjoy immunity from civil and

administrative jurisdiction in respect of acts performed outside the course of their duties.

B) PRIVILIGES

EXEMPTION FROM CUSTOMS DUTY

(a) Diplomatic Missions

1. Diplomatic Missions are allowed to import articles free of duty for their official use

including reasonable quantity of Office equipment, construction material, motor

vehicles and other goods with the prior approval of Protocol Special Section. Import

installation and operation, however, of wireless telegraphy apparatus, satellite dishes,

satellite earth station equipment, GPS systems, etc. without obtaining import permit

and proper license from the Govt. of India, is prohibited. Similarly, articles meant for

25

donations, participation/display in trade exhibitions or other such events are not

allowed to be imported duty-free (Form No.7 (Annexure VI) & Form No.8 Annexure VII)

2. Prior approval is mandatory for items being imported/purchased locally by a mission for

official use.

3. Goods imported duty-free shall not be sold/disposed of before expiry of 3 years from

the date of import. Separate provisions govern sale of motor vehicles.

(b) Diplomats/Officials

1. Diplomats/officials are granted exemption from payment of Customs duty on all goods

including motor vehicles imported or purchased from bond for their personal use and

their family members forming part of their household.

2. Electrical and Electronic Gadgets: Circular No. D-VI/451/(1)98 dated: September 1,

2003, Protocol book at page no.116 (Annexure XV) lists items and their quantities for

which exemption from payment of Customs duty can be granted. Diplomatic agents are

also permitted one piece each of personnel computer, fax machine, and Piano without

furnishing a re-export undertaking.

3. Diplomatic agents can import, availing of exemption from payment of customs duty, or

purchase locally, availing of exemption from payment of Excise Duty (if applicable on

principle of reciprocity), one motor vehicle for their personal use within two years from

the date of their arrival in India. Diplomats of the rank of First Secretary and above, if

accompanied by family members, may be permitted to import duty free/purchase

locally with exemption from payment of customs/Excise Duty a second motor vehicle

for personal use within a period of two years from the date of arrival in India.

Motor vehicles should conform to norms of emission and other conditions prescribed from

time to time by the Govt. of India. Left Hand Drive vehicles are not allowed to be imported or

sold to non-privileged person in the open market. These vehicles are either to be re-exported

or sold to another privileged person or sold to a scrap dealer with prior approval of the

Protocol section of the MEA on conditions prescribed by the Ministry.

(c) Administrative and Technical Personnel

These personnel can avail exemption from payment of Customs duty on import of

personal and household effects (excluding motor vehicles) and electrical and electronic

specified items for personal use and of Diplomats/ Officials and their family members for daily

use forming part of their household on the conditions of the goods reach India within four

months of their first arrival in India to take up their assignments.

26

Annexure

Form 7 (Custom Duty Exemption Certificate for official use)

27

Annexure

Form 8 (Custom Duty Exemption Certificate for personal use)

28

Annexure

Ministry’s Note No. D-VI/451(1)/1/98

List of Importable Items for personal use

29

30

Booklet for Saudi Nationals visiting India

Chapter No. IV.

This chapter deals with Exception/ Restrictions on Import under the Vienna

Convention on Diplomatic Relations.

EXEMPTION FROM OTHER TAXES AND FEES

Diplomatic Agents are exempted from payment of the following taxes/fees:

Income Tax/Wealth Tax, Property Tax, Road Tax, Registration fee, Driving License Fees,

Foreign Travel Tax, Inland Travel Tax, Entry Tax on Diplomatic Vehicles.

Exemption from/Refund of following taxes and fees is granted based on the principle of

reciprocity:

a) Excise Duty on purchase of vehicles, electrical and Office equipments, building material

for the building of mission, Excise Duty on purchase of petrol for official motor vehicles.

(b) Value Added Tax (VAT) on goods and petrol, diesel and other fuel

purchased for

official use.

b) Luxury Tax on hotel bills

c) Service Tax on availing of Select services.

e) Administrative & Technical Staff are exempt from income tax on their salary received

from their respective governments.

31

RESTRICTIONS ON IMPORT

a) Import or possession of arms & ammunition is prohibited.

b) Import of Beef in any form is prohibited

c) Restrictions are also imposed on import of certain agricultural and animal products

32

Booklet for Saudi Nationals visiting India

Chapter No. V.

Deals with Custom clearance of Consignments

PROCEDURE FOR CUSTOMS CLEARANCE OF GOODS ADMISSIBLE FOR DUTY FREE

IMPORT

The routine import of household goods/personal effects of the Diplomat/Official on first

arrival are allowed to be cleared {on forms No.7 (Annexure VI) & Form 8 (Annexure VII)}.

Indeed, Prior Approval is needed in case a Diplomatic mission/Diplomatic agent is intending to

import electrical, electronic, computers, and motor vehicles for official use /personal use after

the first arrival.

A. EXEMPTION CERTIFICATE

1. An Exemption Certificate (EC) duly attested by the Protocol Special Section of the

Ministry of External Affairs, Jawaharlal Nehru Bhawan, New Delhi, enables the

Diplomats/Officials located in Delhi and their privileged Members to clear Personal

Effects/Household goods/Official Goods/motor vehicles etc. by availing of Exemption

from payment of Customs Duty. The members of the Foreign Representations and

their members functioning in different states of India can avail their Exemption

Certificates from the Protocol Department of the State Govt. concerned.

33

2. The EC will be submitted in prescribed Forms {No.7 (Annexure VI), Form 8 (annexure

VII), Form 9(Annexure VIII)} in quadruplicate with a Note Verbale, with all the relevant

documents duly signed by the Diplomat/Official and authenticated by the Head of the

Mission concerned. The quadruplicate copies – each will be market, ‘original,

‘duplicate, triplicate, and quadruplicate.’

The Protocol Special Division of MEA will

return the original and duplicate copies of the EC duly attested to the Embassy/Mission

to be submitted to the respective Customs Authority for release of goods, without

payment of Customs Duty, of the items in the EC.

B. Documents to be attached with ECs:

ECs will in all cases, be accompanied by the following documents duly stamped

by the Embassy in respective order:

a) Prior Approval for the Protocol Special Section for the import, wherever required

(as mentioned above)

b) Invoice and the Packing List in original

c) Airway Bill, Bill of Lading or Postal Notice depending on the mode of import.

d) Certificate of origin of goods from supplier

e) Cargo Arrival Notice/Delivery order issued by the Airport/Port/Postal Authority

concerned

f) For import of publicity material, publications, books, magazines, recorded videos,

audio cassettes, DVDs, VCDs. Etc. and the details like volume, subject matter, no.

of copies and packages, language, value and any relevant detail should be

enclosed. ECs. Merely stating “Printed material/recorded video cassettes” will not

be accepted.

g) For import of electronic/electrical equipment, the invoice will contain the following

additional specific details:

i.

Make & Model of the Item

ii.

Capacity of the Air conditioner, Size of Television Screen, Computer

Hardware Specifications and

iii.

Serial No. of the equipment.

h) For import of wireless communication equipment, satellite phones, GPS systems,

satellite earth stations, prior approval of the Government of India, to be obtained

through Protocol III Section, shall invariably be furnished.

i)

For import of motor vehicles; details of make, model, year of

manufacture,

transmission, displacement, Right Hand /Left Hand (Left

hand vehicles are not

allowed in India), and a certificate of compliance with emission norms (Now Euro –

IV and above) shall be communicated. The norms of emission will conform to EuroIV or Bharat Stage –IV or higher as notified from time to time.

j)

For import of auto spare parts; a list of parts, their serial numbers and registration

number, make and model of vehicle for which the spare parts are being imported

will also be provided.

k) Depending on the kind of import and its intended/subsequent use, an undertaking

will be enclosed with each copy of the EC as per the following formats:

a)

Imports for Official use:

34

“This is to certify that the articles specified in the enclosed Exemption Certificate

are intended for the Official use of (name of the Embassy/mission) and that they are

the property (Name of the Sending State) and will continue to be so.”

Official Seal of Embassy/Mission

Signature of Head of Mission

(or officer authorized to sign on his behalf)

Place:

Date:

b)

Import of Personal and Household Effects.

“ Certified that I arrived in India on …………(date) and that the goods being

imported under the Exemption Certificate No……dated…..were my properties at the time

of my first arrival in India.” Signature of the Diplomat/Official.

Place:

Date:

Countersigned by the Head of Mission with Seal of the Mission.

c)

Import of Samples and other items for display/demonstration in the

Embassy/Consulate/Attaché Offices.

“ This is to certify that the samples mentioned in exemption Certificate

No……………..dated……are the product of…………(name of the country/Organization) and

are solely for display and/or demonstration inside the premises of the office of

…………..of this Mission/Attaché Office. If these samples are used for display and

demonstration purposes at a place, other than the premises mentioned above, the

customs duty leviable there shall be paid by this Mission.”

Official Seal of Mission

Signature of Head of Mission

(or Officer authorized to sign on his

behalf)

Place:

Date:

l)

For importing items in replacement of those re-exported earlier, ECs will be

accompanied by an ‘Export Certificate’ issued by Customs Authorities of the

Port/Airport of re-export.

C) Unutilized ECs.

35

The ‘Original’ and Duplicate copies of all attested ECs remaining un-utilized for

three months from the date of attestation will invariably be returned to the attesting

authority for cancellation.

D)

Guidance to filing ECs for attestation by the Ministry of External Affairs:

To avoid delays in processing ECs for attestation, the missions should ensure the

following:

a)

ECs filed for attestation in each calendar year should bear separate

running numbers for items for ‘official use’ of the Mission and for

‘personal’ use of individual Privileged Persons for all categories of

imports;

b)

Items listed in the ECs should be limited to the expressly required for

official use of the Mission or for personal use of the privileged persons or

members of their family;

c)

Each item should be clearly listed separately.

d)

The individual and the collective value of the items should invariably be

recorded in equivalent Indian Rupees in the relevant Column of EC.

e)

Alterations, striking through a word or sentence and overwriting should

be avoided.

E)

Countersigning of ECs

1.

Ecs. For items for ‘Official use’ should be signed by the Head of Mission. ECs. For

items of ‘personal use’ of a privileged person or member of his family will be

signed by the privileged person concerned and countersigned by Head of

mission.

2.

Head of missions with ten or more privileged persons can delegate the

responsibility of countersigning to another senior Diplomat of the Mission

F)

Specimen signatures of Countersigning Authority:

Three copies of the specimen signature of the countersigning authority on

separate sheets with official seal of the Mission will be submitted to the Protocol Special

Section.

G)

Demurrage

The Embassy/Mission should ensure early clearance of their consignments so as

to avoid demurrage charges. Requests for waiving of or refund of demurrage charges

could be considered only if the delay is directly attributable to the administrative

processing time in Protocol Division.

H)

Restrictions on import of publicity material

36

a) Dip. Missions may import calendars, diaries, publicity posters and booklets for free

distribution on exemption from duty provided such material has been produced or

manufactured by the country importing it.

b) For import of publicity material, books, magazines, printed material etc. as

OFFICIAL PURPOSE, the mission will make clear distinction between material for

official use and for free distribution for publicity purpose for free donation and the

fact will be clearly declared in the exemption.

c) Import of Religious books, tourism & educational material.

E. C. will not be issued for Religious books when it is for free distribution/donation.

Tourism publicity material also does not qualify for exemption from payment of

customs

duty.

d) Import of beef and poultry in any form is prohibited as per Exam policy.

e) Import of wireless telecommunication system/dish antenna/GPS system/earth

station or other advanced communication system are governed by regulations

contained in circular Note Verbale No. DIII/451/1/2001-Pt dated: April 10, 2003

(Annexure XVI.)

f)

Facility for Import of Tapestry/fabric material has been withdrawn.

g) Export of Antique items, including Coin, sculpture, manuscript, work of art or

craftsmanship, any article detached from a historical building or cave, article of

science, art, crafts, literature, religion, custom, moral or politics in bygone ages or

objects declared by the central government to an antiquity in existence for not less

than one hundred years, outside India is prohibited -- under Export Control Act 1947.

h) The Trading in Shahtoosh Shawls has been declared illegal in India, in Schedule I of

the Wild Life (Protection) Act, 1972.

i)

I)

At the port of exit in India, the Customs authorities are empowered to seek a

declaration from passengers that their baggage does not contain any antiquities

except those for which valid and proper export license has been obtained.

CUSTOMS REGULATIONS FOR CLEARANCE AND INFORMATION FOR

IMPORTS HOUSEHOLD GOODS AND PERSONAL ON FIRST ARRIVAL:

(WHEN THE CONSIGNEE AND CONSIGNOR ARE THE SAME)

The consignment under this category is cleared on BD FORM (Baggage Declaration

Form) available at the airport. It is deemed that the diplomat/official arriving in

India on Diplomatic assignment Visa will bring with him his used household goods

and personal effects on transfer of his residence.

a) DOCUMENTS REQUIRED

1. PERSONAL BAGGAGE ON FIRST ARRIVAL OF DIPLOMAT/OFFICIAL:

37

2. Exemption Certificate from the Protocol Special, Govt. of India, Jawaharlal

Nehru Bhawan, New Delhi, on Form No.8 Original & Duplicate.

3. Original Passport

4. Original Bill of Lading/Airway bill

5. Packing list/Invoice

6. Baggage Declaration Form duly sealed and signed by the Diplomat/Official

7. Original DO

8. GATT declaration

9. Authority letter in the name of the Customs Officer authorizing the

CHA/agents to clear the consignment on behalf of the Diplomat and forward

the same to the residence of Diplomat/Official.

b) ABOUT PERSONAL CONSIGNMENTS TO BE CLEARED AFTER THE FIRST

ARRIVAL OF DIPLOMAT/OFFICIAL:

(The subsequent imports can only be undertaken with the Prior Approval of the

Protocol Special of the Government of India, New Delhi).

a) Exemption Certificate from the Protocol Special, Govt. of India, Jawaharlal

Nehru Bhawan, New Delhi, on Form No.8 (Original & Duplicate)(for personal

effects)

b) Original Bill of Lading/Airway bill

c) Packing list/Invoice

d) Bill of Entry/BD Form duly sealed and signed by the Diplomat/Official

e) Original DO

f)

GATT Declaration

g) Authority letter in the name of the Customs Officer authorizing the

CHA/agents to clear the consignment on behalf of the Diplomat/Official and

forward the same to his address.

c) OFFICIAL CONSIGNMENTS OF THE MISSION:

All Official consignments of the Embassy would be covered by the following

procedure:

Prior Approval is mandatory and is to be obtained from the Protocol Special,

Govt. of India, New Delhi, for any official consignment from the Kingdom of

Saudi Arabia i.e. Electronic, Electrical, Computer and its accessories, Air

conditioners etc i.e. Capacity of the Air conditioners, Size of Television Screen,

Computer Hardware Specifications and Serial No. of the equipment. After Prior

Concurrence, the EC is to be sent with the PA along with AWB, Invoice, Packing

list, Serial Numbers of the items being imported, brochures and their price:

1. Exemption Certificate from the Protocol Special, Govt. of India, Jawaharlal

Nehru Bhawan, New Delhi, on Form No.7 (for official consignments) Original

& Duplicate.

2. Original Bill of Lading/Air waybill

38

3. Packing list/Invoice

4. Bill of Entry Form duly sealed and signed by the Head of the Mission with

Diplomatic seal.

5. Original DO

6. GATT Declaration

7. Authority letter from the Head of the Mission in the name of the Customs

Officer authorizing the CHA/agents to clear the consignment on behalf of the

Diplomatic Mission and forward the same to the Mission’s address.

d) SPECIFIC INFORMATION

a) New goods imported, after taking PRIOR APPROVAL of MEA, are intended

only for personal use of the Diplomat/Official and their family members and

not to be sold before the expiry of three years from the date of import.

b) Diplomats/Official may re-export household goods and personal effects on

completion of their assignments in India.

c) Diplomats are not required to be present at the Customs Clearance

d) The Royal Embassy in New Delhi/Consulate in Mumbai will obtain the EC

after the physical arrival of the Shipment in India.

e) Catalogue, Technical write up, Literature in case of machineries, spares or

chemicals as may be applicable

f) Certificate of Origin to be included in MEA documents

g) The household goods/personal effects can be imported within two years of

their arrival into India in case of Diplomats and within four (4) months in

case of Special/Official passport holders.

h) The clearance of the goods at the customs can only be affected

the documents on line through some approved CHA.

by

filing

e) Some of the approved Customs House Agents approved by the Delhi

Chambers of Commerce can be seen in the link below:

http://www.delhichamber.co.in/Custom-Freight-ShippingCargo.asp?ALP=All

39

Annexure

Form 7 (Custom Duty Exemption Certificate for official use)

40

Annexure

Form 8 (Custom Duty Exemption Certificate for personal use)

41

Annexure

Form 9 (Custom Duty Exemption Certificate for Motor Vehicle)

42

43

Annexure

Ministry’s Note No. D-VI/451(1)/1/98

List of Importable Items for personal use

44

45

Booklet for Saudi Nationals visiting India

Chapter No. VI.

Deals with Procedures of availing, importing, purchasing, registration and disposal

of Motor Vehicles.

REGULATION FOR MOTOR VEHICLES

FOR EVERY PURCHASE/IMPORT OF MOTOR VEHICLES OR ITEMS OTHER THAN MOTOR

VEHICLES A PRIOR APPROVAL HAS TO BE OBTAINED FROM THE PROTOCOL SPECIAL,

MINISTRY OF EXTERNAL AFFAIRS, GOVT. OF INDIA, JAWAHARLAL NEHRU BHAWAN, NEW

DELHI, WELL IN ADVANCE OF IMPORT OR PURCHASE.

1. Diplomats will be allowed to import availing of exemption from payment of customs

duty, or purchase locally, availing of exemption from payment of excise duty one motor

vehicle for their personal use within two years from the date of their arrival in India.

The condition relating to purchase of vehicle within two years of arrival is, however, not

applicable in the case of Heads of Missions in India.

2. Diplomats of the rank of First Secretary and above, if accompanied by members of

their family, will be permitted to import duty free/purchase locally with exemption from

payment of customs/excise duty a second car for personal use within a period of two

years from the date of arrival in India.

46

3. Imported non-Commercial Motor vehicles:

Imported non-Commercial Motor vehicles to be registered in the National Capital

Region including National Capital Territory of Delhi shall conform to Bharat Stage IV

emission norms. Vehicles to be registered in other State/Locality of India will similarly

conform to the norms applicable in the respective state, as notified from time to time.

(This condition will however not apply to CNG vehicles). The Certificate on emission

norms will be obtained either from the manufacturer of the imported motor vehicle or

its authorized representative.

4. All Diplomatic missions/Posts will be allowed to purchase staff cars “within reasonable

limits” on the principle of reciprocity. All cases of purchase will continue to be with the

prior approval of the Protocol Special Section of the Ministry of External Affairs, Govt.

of India. Requests will be cleared within one week.

5. Export of Motor Vehicles:

Imported motor vehicles of the Embassy and Diplomats/Officials may be allowed to be

exported without export trade control formalities, on the principle of reciprocity, on

production of a certificate from the Head of the Mission concerned or an officer duly

authorized by him stating that:

i)

ii)

iii)

iv)

The Motor vehicle was imported by the mission/privileged person without

exchange control formalities.

No foreign currency transaction is envisaged in the proposed export; and

Exemption from Export trade control formalities is allowed to the Indian

Diplomatic Mission, Consulate and the privileged members in the country of the

Diplomat concerned.

Left Hands Drive Motor Vehicles cannot be sold/disposed of to a non-privileged

person in India.

6. REGULATIONS FOR SALE/DISPOSAL OF MOTOR VEHICLES:

A. Vehicles imported free of customs duty:

The Foreign Privileged Persons” Rules 1957, as amended from time to time, govern the

disposal of motor vehicles imported against exemption from payment of Customs Duty.

The Rules offer following options:

i)

Export the vehicle with prior permission of the Protocol Special on Application

form no.17 (Annexure VIII)

ii)

Can sell to another privileged person the vehicle after one year of Registration

with the permission of the MEA (on Form No.17).

iii)

Can sell after three years from registration date to any non-privileged person,

with the permission of the Ministry of External Affairs Protocol Spl. Division, on

payment of applicable customs duty as assessed at the time of sale/disposal.

(on Form No.17)

iv)

A privileged person if transferred before three years from Registration Date, can

sell the vehicle to a non-Privileged person on payment of applicable Customs

duty, only if such car had been imported within one year of his arrival.

v)

If a car is accidental /damaged can be sold to the Insurance Company that has

insured the vehicle without prejudice to the latter’s rights to sell. If the

47

Insurance Company declines the offer, the vehicle may sold to a suitable agency

for scrapping only.

NOTE: Left-hand drive vehicle cannot be sold/disposed of to a non-privileged

person in India.

7. Sale of Duty-Free vehicles to non-privileged persons with exemption from payment of

Customs Duty is allowed in the following cases:

a)

Dip. Missions, on the principles of reciprocity, will be allowed to sell their vehicles

in the open market to non-privileged persons without payment of Customs Duty on

expiry of four (4) years from Registration Date. Request for such permission may

be submitted to Protocol Special in advance of final departure of the beneficiary

from India.

8. Customs Duty on sale/disposal of imported Duty-Free motor vehicles to non-Privileged

persons is determined by and is also payable to the Commissioner of Customs nearest

to the headquarters of the privileged person concerned. The Customs Duty is calculated

in the following manner:

a) For sale to a non-privileged person the Duty shall be determined after allowing for

depreciation at the sales specified by the CBEC (Central Bureau of Excise and

Customs) for imported second-hand cars. The rate of Customs Duty and the

exchange rate of foreign currency shall as prevailing on the date of approval of

sale/disposal.

b) Duty on totally damaged vehicles shall be determined by Customs authorities taking

into account the sale price as inclusive of duty. The rate of Duty shall be taken as

applicable to vehicles not so damaged at the time of sale/disposal.

c) If a vehicle is stolen, customs duty shall still be payable. The customs duty shall be

determined taking into account the amount of insurance claim as inclusive of duty

and the rate of duty shall be same as prior to its being stolen. (The missions are

advised to insure the vehicles for a value equal to cost plus customs duty

applicable).

B. Locally Manufactured vehicles:

9. Locally manufactured cars purchased with exemption from payment of Central Excise

Duty or with refund of such duty may be exported or sold or transferred to other

privileged persons/organizations only the permission of the Protocol Special, MEA.

Application for such sale/disposal shall be submitted in Form No 18 (Annexure IX).

10. The vehicle on completion of 3 years from Registration date may be allowed to be sold

to non-privileged person with exemption from payment of Excise Duty, but this will be

decided on the principle of reciprocity.

11. All Diplomatic missions are expected to respect local traffic laws. Diplomatic cars can

also be fined for traffic offences of red light jumping, dangerous driving, unauthorized

parking etc. In case of drunken driving, the diplomatic vehicles could be stopped and

the driver prevented from driving further to avoid causing any accident under the

influence of alcohol.

48

12. All cases of accidents involving vehicles of Diplomatic Missions/Posts should be reported

to the nearest Police Station and to the Protocol Officer-III of the Ministry of External

Affairs, Govt. of India giving full details of the incident and also indicating name/rank

of owner as well as name/rank of user of the vehicle at the time accident. It may be

noted that under Vienna Convention -1961, of diplomatic relations, the immunity of

members of the Administrative and Technical staff of the Diplomatic Missions from civil

and administrative jurisdiction does not extend to acts performed outside the course of

their duties.

PROCEDURE FOR REGISTRATION

Applications for registration of imported or locally purchased vehicles need to be

submitted within 30 days of import/purchase. Vehicles without proper registration mark

and with “AF” numbers plates is in violation of local laws.

a) No motor vehicle can ply on roads in India without a valid registration with the

authority concerned. Procedure for Registration is as follows:

Application on Form No.19 (Annexure X), in quadruplicate, to be submitted

within 30 days of purchase/import/acquisition to Protocol Special Section of MEA,

and to the Protocol Department of the State Govt., as applicable for those

Diplomats/Officials located outside Delhi.

b) After due authorization and assignment of a registration mark (CD/CC/UN) and

a number, the Form No.19, after attestation of MEA will be submitted to the

respective Vehicle Registration Authority. The vehicle will be produced before

registration authority as may be required.

c) The Registration Authority shall register the vehicle under the assigned mark

and number and issue a certificate, copy of which must be available in the

vehicle at all time.

PRE-REQUISITES FOR REGISTRATION

1. The vehicle to be registered should be RIGHT HAND DRIVE, have valid insurance and

should conform to emission norms (EURO-IV BHARAT STAGE IV OR ABOVE )

a) Insurance against third party risks: By law it is incumbent on every individual

possessing/driving/owning a motor vehicle to insure him against any liability that

may arise from death of or body injury to any person caused by the use of a vehicle

in a public place. The Embassy should ensure that their members having vehicles

are at all times in possession of valid insurance policies against third party risks and

to be renewed regularly and under no circumstances allowed to lapse.

b) Insurance for Customs duty: In the event of loss/accident/damage of vehicles

imported duty free, pro-rata (proportionate) customs duty has to be paid by the

49

privileged person/organization on the amount of insurance claim. The members in

their own interest should include in the value the customs duty as also the c.i.f.

value of the vehicle.

c) Emission Control Norms: Only those non-commercial vehicles which conform to

Euro-IV or higher norms of emission, confirmed from the manufacturer of vehicle,

can be registered in the National Capital Territory of Delhi. This restriction does not

apply to non-commercial vehicles on CNG.

2. USE OF DIPLOMATIC/UN NUMBER PLATES.

It shall be the duty of each mission and its entitled members to avoid and check

any unauthorized use of CD numbers allotted to their vehicles. Following guidelines are

to be noted:

a) Exhibition of Registration Mark:

Registration Marks/Numbers of Vehicles of the Embassy and diplomats are to be

displayed in white on plates with a deep blue back ground, in English.

b) ‘A/F’ Number Plates:

Vehicles without proper registration number and with ‘A/F’ number plates is in

violation of local laws. Vehicles with ‘A/F’ number plates do not enjoy privileges and

immunities and MEA does not intervene in matters relating to violations of traffic

rules with improper and un-registered number plates.

Loss of Number Plates:

In case of theft and loss of number plates the owner shall report to the nearest

police station.

c) Transfer & Sale of motor vehicle:

The imported vehicle can be sold to a privileged person, if it is sold before four

(4) years from the date of Registration, and can be sold (to a non-privilege person,

in the open market) if the vehicle has completed (4) years, after taking prior

concurrence for sale from the Protocol Special, MEA, Government of India, on final

transfer of the diplomat/official.

The vehicle can be sold in the open market to a non-privilege person before

expiry of four years on payment of customs/excise duty forgone at the time of

import/purchase. The time limit for sale in the open market in case of locally

purchased cars is three (3) years from the date of registration. Requests for

registration/transfer of imported vehicles will be entertained by the MEA only after

the Bill of Entry has been amended to include the name of the new owner. (Form

No. 29 Annexure XI and Form No 30 Annexure XII)

50

d) Duplicate Certificate of Registration:

If the Certificate of Registration (CR) is torn, defaced, lost or destroyed, the

owner shall apply in Form 22, enclosing the torn, defaced copy to the Registering

Authority for issue of a duplicate Certificate. For lost CR, the Police Report shall be

appended with the Application Form No.22 (Annexure XIII).

51

Annexure

Form 17(Application for permission to sell/ disposal of

Imported Motor Vehicle)

52

53

Annexure

From 18 (Application for permission to sell/ disposal

of locally manufactured Motor Vehicles)

54

55

Annexure

Form 19 (Application for registration of motor vehicles)

56

57

Annexure

Form 29 (Transfer ownership)

58

Annexure

Form 30 (Transfer ownership)

59

60

Annexure

Form 22 (Application for issue Duplicate RC)

61

Booklet for Saudi Nationals visiting India

Chapter No. VII.

This chapter explains about the procedure for obtaining Driving License

DRIVING LICENSE

REQUIREMENTS FOR DRIVING LICENSE

International driving licenses are issued from various zonal offices. The validity of this permit

is for one year. You are required to get your licence from the country your visiting within one

year period. Following documents are to be produced at the time of applying for an

International driving license:

a. Application Form 9 and Medical Form 1-A (Annexure XIV)

b. Attested Copy of Valid driving license issued.

c. Attested copy of valid address proof.

d. Attested copy of valid Passport.

e. Attested copy of valid Visa.

f.

Fee of Rs. 500/-.

g. Five passport size photograph.

h. Medical Form 1-A

i.

Valid proof of Indian Nationals.

62

j.

The International driving license is issued from 8.30 AM to1:00 PM from the Concerned

Zonal Office

Annexure

Form 9 (Application for Renewal of Driving License)

63

64

Booklet for Saudi Nationals visiting India

Chapter No. VIII.

Speaks about the Regulations of Foreign Exchange Remittances

FOREIGN EXCHANGE REGULATION

1. Diplomats/ Officials scrupulously observe the restrictions imposed by the Foreign

Exchange Management Act (FEMA) on opening and maintenance of foreign currency

account in India, repatriations of foreign exchange from India, and on foreign exchange

transaction in India. General provisions of FEMA are given below.

2. Non-Saudi National without the general or special permission of the Reserve Bank of

India, exchange buy or otherwise acquire, borrow, sell, exchange or transfer foreign

exchange in any form including bank drafts and cheques. Such transactions will be

effected through authorized foreign exchange dealers only.

3. Non-Saudi National make any deposit or make payment or for the credit of any person

resident outside India, other than through an authorized dealer, except with the

permission of the Reserve Bank of India.

65

FOREIGN EXCHANGE ACCOUNTS

Diplomats/ Officials, their dependents and their family members are permitted to

maintain Indian Currency and Foreign Currency with Commercial Bank (including Foreign

Bank) authorized to deal in foreign exchange subject to the following conditions.

(a) Rupees Accounts

Diplomats/ Officials and their family members in India may maintain rupee accounts

with an authorized dealer and such deposits will be governed by same conditions as

applicable to resident Indian nationals.

(b) Foreign Currency Accounts

Credit o the account shall be only way to proceeds of inward remittance received from

outside India through normal banking channels; Funds held in such accounts if

converted in Rupees shall not be converted back into foreign currency; The account

may be held in the form of current or term deposits accounts, and in the

case of

diplomatic personals, may also be held in the form in of savings accounts; the rate of

interest on saving on terms depostis shall be such as may be determined by the

authorized dealers maintaining the account; The fund in may be repatriated outside

India without the approval of Reserve Bank.

66

Booklet for Saudi Nationals visiting India

Chapter No. IX.

Speaks about protected and restricted area in various states of India, as well as the

guideline for having firearms and others security matters regarding Royal Embassy.

Security

Diplomats and Official Passport holders who wish to visit, stay or pass through the areas

mentioned below are required to obtain necessary Restricted/ Protected Area permits from the

Ministry of External Affairs. Application should be submitted to Northern Division, Ministry of

External Affairs, New Delhi, giving minimum of 4 weeks notice to process the relevant case.

PROTECTED AREAS

1. Manipur: Loktak Lake, Imphal, Mourang INA Memoria, Keibul Deer Sanctuary and

Waithe Lake, Kongjam War Memorial (To and from Imphal By Air Only)

2. Nagaland: Kohima Dimapur, Phek Distt., War Cemetry, Dzukou valley

3. Mizoram:Vairangte, Thingadawi and Aizwal

4. Arunachal Pradesh:Itnagar, Ziro, Along, Pasighat, Miao, Namadapha Tapi, Sejusa

(Puki) Bhalukpong.

67

5. Sikkim: Songri, Tsangu (Chhangu Lake), Mangan, Singhik, Tong, Chungthang,

Lachung and Yunthang

6. Uttar Pradesh: Nanda Devi Sanctuary, Niti Ghati, Kalindi Khal in Chamoli, Uttar

Kashi Distt. Adjoining areas of Milan Glacier and Phitoragarh.

7. Himachal Pradesh: Poo, Khab Sumdo, Dhankar, Tabo Gompa, Kaja Morang,

Dabling, Lahul and Spiti.

8. Jammu & Kashmir: Khaise Sub-Division, Khaltse Dumkhar, Skorduchan, Hanudo,

Biana Dha, Nubra Sub-Division –Lah, Khardung La – Khalsar, Trit upto panamik,

Leh, Khardung La Upto Hunder, Leh Sabo, Digar La-Digar, Labab-Khungru, GampaTangar (only for Trekking),Nyoma Sub-Division-Leh, Upshi, Chumathang, Mahe,

Puga, Tso-Morari Lake, Kozok, Debring, Karu Chang-La Durbuk, Tangtso, Lukung,

Spankmik (Pangong Lake upto Spankmik) Group of 4 or more persons are allowed

as tourists.

9. Rajsthan:- Western Side up-to Indo-Pak border of National Highway No.15 running

from Sriganganagar to Sanchere.

RESTRICTED AREAS

1. Sikkim: Gangtok, Rumtek, Phodang, Pemayangste Khecheperi and Tashiging.

2. Andaman & Nicobar Islands: Municipal Area, Port Blair, Havelock Island, Long, Neil

Island, Jolly Byoy, North and South Cingue, Red Skin, Mayabunder, Diglipur, Mt.

Harriet and Madhuban

FIREARMS

1. According to the Arms Rules, 1962, it is mandatory to have a valid arms licence issued

by DCP (licensing) for possession and carrying of firearms. Further, import of

Automatic/ Semi-Automatic weapons and Firearms (including Pistols and Revolvers) of

prohibited bores to India is not permitted.

2. Ministry discourages possession of any kind of firearms by Diplomats/ Officials of its

family members. Indian authorities are responsible for the protection of personnel

attached to the Diplomatic Mission and adequate security cover is provided to them. in

exceptional circumstances, a handgun for defense purposes where this is considered

ammunition must then be kept in a designated place either in the Embassy or in the

official residence of the Ambassador. Carrying of the firearm by members of the

Diplomatic/ Officials outside the Embassy or Official Residence for defense or any other

purpose is not permitted. A valid license is mandatory in such cases.

If possibility of likelihood of threat to Embassy and their staff’s peace, it will without delay,

convey such information to Protocol II Section of Ministry of External Affairs, Govt. of India,

Jawaharlal Nehru Bhawan, New Delhi, will also share with Protocol Davison all available

information on threat to their premises, personnel or property to enable the authorities

concerned assess the situation for implementing appropriate precautionary measures.

68

SECURITY AND SEARCH AT THE AIRPORT

For the safety and Security of passenger and aircraft operating in India, hand/ cabin

baggage and the person of all departing passengers are frisked and searched by the security

authorities at the airport of departure. Ambassador and spouse and visiting foreign dignitaries

of the rank of cabinet ministers and above, and Royal Family Members are exempt from such

frisking and search.

CURRENCY DECLARATION

A person coming into India from abroad can bring with him foreign exchange without any

limit. However, if the aggregate value of the foreign exchange in the form of currency notes,

bank notes or travelers cheques brought in exceeds US $ 10,000/- or its equivalent and the

value of foreign currency exceeds US $ 500/- or its equivalent, it should be declared to the

Customs Authority at the Airport in the Currency Declaration Forms (CDF) on arrival in India.

69

Booklet for Saudi Nationals visiting India

Chapter No. X.

Speaks about facilities and procedures for admission to various Indian Educational

Institutions

EDUCATION IN INDIA

Diplomats/ Officials

In modification of the existing guidelines of Ministry of External Affairs, Govt. of

India, it has been decided that Diplomats/ Officials wishing to undertake studies in

Indian Universities while on Diplomatic/ Official visa may refer their request in this

regards together with details of the proposed course of study, to Protocol II Division,

Ministry of External Affairs, Govt. of India for its consideration. The Ministry of External

Affairs will consider each case on merit and revert within a period of four weeks from

date of receipt of such request.

Dependent of Diplomats/ Officials

Ministry of External Affairs, Govt. of India has clarified vide Ministry circular that

changing visa/ special permission from Protocol II Division, Ministry of External Affairs,

Govt. of India, for further studies in Indian Universities does not apply to spouses and

dependents of Diplomats/ Officials.

70

Ordinary Saudi Passport Holders

Ordinary Saudi Passport holders are eligible to obtain admission in any Course

in Indian University. They can attend the classes with Student visa on their passport, if

they don’t have student visa, conversion of visa status is necessary to get admission in

the educational institution. Following documents are required to convert other visas to

Student visa in special cases only.

1.

2.

3.

4.

Application form

Recent Passport Size Photograph

Request letter addressed to FRRO (Only in case of Delay / Overstay)

Original passport and copy of passport (photo page, page indicating passport

validity, visa page and page indicating arrival stamp of Indian immigration)

5. Address proof – copy of valid & notarized lease agreement or copy of recent

Electricity Bill or telephone Bill along with a letter from house owner & ID proof of

the owner or letter from hostel/hotel or copy of ‘C’ form

6. Original bonafide certificate from the educational institutions – bonafide certificate

in given format only acceptable

7. Study in seminaries and other theological institution, undertaking from applicant

and his/her sponsor that foreigner will not be engaged in Missionary activity or any

other occupation paid or unpaid.

8. Financial Sustenance – Bank letter or copy of passbook, for minors, bank letter or

copy of passbook of applicant’s father/mother

9. For change of college/course prior permission from the FRRO & letter for

cancellation of admission/NOC from previous institution

10. Fees payable, if any (to be submitted as Demand Draft after approval of

application)

11. Any other supporting document

The following documents required to apply in an university for foreign students:

(i)

(ii)

(iii)

(iv)

(v)

Copy of passport of parent working abroad

Copy of work permit/license to work/business

Copy of residence permit/visa

Letter from the employer

Affidavit from the parent for financial support

71

Booklet for Saudi Nationals visiting India

Chapter No. XI.

This chapter details telephone number of hotels, hospitals, police and diplomatic

force, etc.

IMPORTANT CONTACT ADDRESS AND NUMBERS

Saudi Citizen Help Department Number:

Royal Embassy of Royal Embassy,

2, Paschimi Marg,

Vasant Vihar,

New Delhi-110057

Mobile +91-9899221188

Tel:

+91-11-43244430

Fax:- +91-11-43244467

website: www.saudiembassy.org.in

Email: ctz.inemb@mofa.gov.sa

Royal Consulate General in Mumbai

Maker Tower “F”, 4th Floor,

Cuffe Parade,

Mumbai-400005

Tel: +91-22-22156001-2-3

Fax:- +91-22-22156006

Email: incon@mofa.gov.sa

Saudi Airlines in New Delhi

202/203, Second Floor,

Ansal Bhawan,

Reservation Tel:

+91-11-23310464/65/66/67

Reservation Fax: +91-11-23326657

72

16, Kasturba Gandhi Marg,

New Delhi-110001

Cargo Tel: +91-11-23652355

Cargo Fax: +91-11-23652355

Airport Service: +91-11-49638906

COUNTRY CALL CODE

+91

EMERGENCY NUMBERS

Police

100

Fire

101

Ambulance

102

Police Headquarters

23319661

Diplomatic Task Force

23361919

Tele Customer Care Numbers

Prepaid

Postpaid

Airtel

9810198101

9810012345

Vodafone

9811098110

HOSPITALS

Apollo Hospital

26925858/01

Max Medicentre

(Panchsheel Park)

26499870/40554055/46097000

Max (Saket)

261515050

Max (Gurgaon)

01246623000

73

HOTELS IN DELHI

Leela Palace

THE ASHOK

CLARIGES

HYATT REGENCY

IMPERIAL

MAURYA SHERATON

SHERATON (Saket)

LE' MERIDIEN

OBEROI

TAJ MAHAL

TAJ PALACE

RADISSON

THE GRAND

MARIOTTE

PARK ROYAL (Intercontinental Eros Hotel)

THE PARK

JAYPEE VASANT CONTINENTAL

THE METROPOLITAN-NIKKO

CROWNE PLAZA SURYA

GRAND INTERCONTINENTAL

THE AMBASSADOR

JAYPEE SIDDHARTH

J'S INN (Vasant Vihar)

HOTEL ROCKLAND (Vasant Vihar)

THE LALIT

SHANGRI-LA

CENTAUR

ICON TOWER

ICON VILL

CLARION COLLECTION THE QUTUB

11- 3933-1234

11- 2611-0101

11- 2301-0211

11- 2679-1234

11- 2334-1234

11- 2611-2233

11- 4266-2112

11- 2371-0101

11- 2436-3030

11- 2302-6162

11- 2611-0202

11- 2677-9191

11- 2677-1234

11- 2652-1122

11- 2622-3344

11- 2374-3000

11- 2614-8800

11- 5250-0200

11- 2683-5070

11- 2341-1001

11- 2463-2600

11- 2576-2501

11- 2614-7722

11- 2649-9780

11- 4444-7777

11- 4119-1919

11- 2560-7533

11- 4601-6611

11- 4166-9766

11- 2696-8287

HOTELS IN GURGAON

CROWN PLAZA TODAY

LEMON TREE HOTEL

THE LEELA KEMPINSKI

HOTAL PARK PREMIER

VISTA PARK

BRISTO HOTEL

124-4534000

124-4160303

124-4771234

124-4604600

124-4262222

124-4351111

74