We are Veteran Owned and we help veterans

advertisement

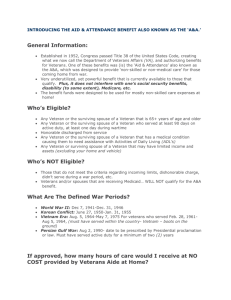

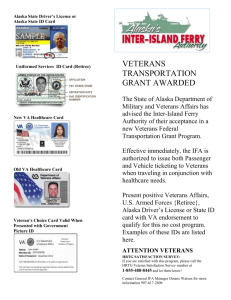

Veterans Benefit Pre-Qualification Form You may be eligible for a Veterans Benefit that many people don’t even know exists. Did you serve the United States military? Or are you the surviving spouse of a veteran? If so, you may be eligible for a little known Veterans Benefit that can help you pay for high-cost, nonreimbursed monthly medical expenses. It's the Non-Service Connected Disability Pension Benefit, also known as the Veterans Aid and Attendance Benefit, and it can provide additional monthly income up to $2,053 a month. The benefit can help pay for such out-of-pocket medical expenses as adult day services, home care, family caregivers, in-home safety equipment, assisted living, nursing home care, Medicare premiums, or medical co-pays. What does it take to qualify? This benefit is not based on service-related injuries and allows for veterans and single, surviving spouses with low incomes or high care expenses to receive additional support. For a veteran or surviving spouse to be eligible, the veteran: Must have served at least 90 days of active duty, with at least one day during a period of war Must have been honorably discharged Must meet medical and financial requirements set by the Veterans Administration for veterans or for single, surviving spouses Maximum monthly pension benefits for 2014 If applicants are qualified, the maximum monthly pension amounts are: o A veteran with no spouse or dependent children — $1,732 o A married veteran and spouse — $2,053 o Single, surviving spouse of a veteran — $1,113 The application process for the Veterans Aid and Attendance Benefit is complicated. Before you submit a claim for benefits, it is strongly recommended that you seek the guidance of a professional accredited by the Department of Veterans Affairs. ©2013 SH Franchising, LLC Updated 05/17/13 Page 1 of 4 Veterans Benefit Pre-Qualification Form VA Benefit for Aid and Attendance Eligibility Self-Pre-Qualification Form Please answer the questions below to help Senior Helpers determine if the veteran or single, surviving spouse may be deemed eligible by the Veterans Administration for Aid and Attendance, Housebound Benefits, or Basic Pension. Veteran Name: Age: Marital Status: Living or Deceased: Spouse’s Name: Living or Deceased: Phone: Email: Current Address: City: ST: ☐Own Current Residence Type: Monthly Payment: Zip: ☐Rent Property Value: Are you selling your home? ☐Y ☐N Have you recently moved assets? ☐Y ☐N Do you drive? ☐Y ☐N Does the veteran/spouse need assistance with the activities of daily living? ☐Y ☐N Did the veteran receive an honorable or general discharge? ☐Y ☐N Did the Veteran (living or deceased) serve at least one day during the following periods with 90 days of continuous military services? World War II – December 7, 1941 through December 31, 1946 Korean War – June 27, 1950 through January 31, 1955 Vietnam War – august 5, 1964 (February 28, 1961, for veterans who served “in country” before August 5, 1964) through May 7, 1975 Gulf War – August 2, 1980 through a date to be set by law or presidential proclamation ☐Y ☐ N ©2013 SH Franchising, LLC Updated 05/17/13 Page 2 of 4 Veterans Benefit Pre-Qualification Form List Medical Diagnosis: ☐Alzheimer’s ☐Dementia ☐Other: Select the activities of daily living for the person requiring assistance: ☐Dressing ☐Bathing ☐Toileting ☐Continence ☐Meals ☐Medication Management Determining Income Eligibility Monthly Income/Expenses Questionnaire A. Income Veteran Spouse Social Security $ $ Pensions (Include VA retirement/Disability Income) $ $ Interest Income/IRA Distribution $ $ Other (civil service/rental income/annuity payment, etc.) $ $ TOTAL MONTHLY GROSS INCOME $ $ B. Out-of-Pocket Expenses Veteran Spouse Medicare Part B and/or Part D $ $ Private Med. Insurance (Med Supplement/LTC/Cancer/etc.) $ $ Rx Insurance Plan or Rx Co-Pay $ $ Doctor Visit Co-pay $ $ Private, Home Care or Facility Health Care Cost $ $ TOTAL MONTHLY OUT OF POCKET EXPENSES $ $ C. Assets/Savings Veteran Spouse Checking, Savings, CDs $ $ Stocks, Bonds, Mutual Funds $ $ IRAs $ $ Trusts $ $ Other (Life Insurance, Annuities, Non primary home) $ $ TOTAL ASSETS/SAVINGS $ $ ©2013 SH Franchising, LLC Updated 05/17/13 Page 3 of 4 Veterans Benefit Pre-Qualification Form Please list all unreimbursed, reoccurring health care expenses below to determine your countable income. A zero “countable income” may result in full Aid and Attendance. D. Reoccurring Medical Expenses Veteran Spouse Assisted living cost (per month) $ $ Nursing home costs (per month) $ $ Home care service (per month) $ $ Health insurance premium (per month) $ $ Medicare premium (per month) $ $ Regular monthly or annual (unreimbursed) prescriptions (per month and verifiable through a pharmacy printout) $ $ Doctor Visit Co-pay (per month) $ $ TOTAL MONTHLY REOCCURING MEDICAL EXPENSES $ $ Countable Income Calculation Total Monthly Reoccurring Medical Expenses (D) $ Multiply by 12 to get total Annual Expenses $ Total Annual Income (A) $ Total Countable Income (subtract your total annual expenses from your total annual income) (A — D) $ Disclaimer: The purpose of this letter is to educate you about Veterans Administration (“VA”) home health care benefits that may qualify for. Our office can educate you about the benefits available and assist you in completing and submitting the benefits application to the VA. Please fill out the enclosed form so that we can make an initial determination regarding your potential qualification for the VA benefits. Our desire is to help you receive the VA benefits that you deserve and have earned for your service to our country. We are NOT the VA, nor are we in any way affiliated with the VA. If you wish to contact the VA you can do so by calling 800-827-1000 or visiting them at www.va.gov. NONE OF OUR SERVICES ARE INTENDED AS LEGAL OR FINANCIAL ADVICE. IF YOU ARE SEEKING LEGAL OR FINANCIAL ADVICE PLEASE CONSULT YOUR LEGAL/FINANCIAL ADVISOR. Senior Helpers – North Houston 14405 Walters Road Suite 390 Houston, TX 77014 Main 281 919 1876 Fax 832 218 2043 ©2013 SH Franchising, LLC Updated 05/17/13 Page 4 of 4