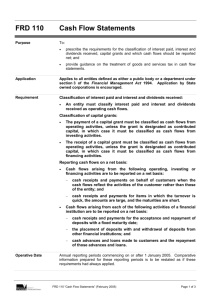

The Cash Flow Statement note

advertisement

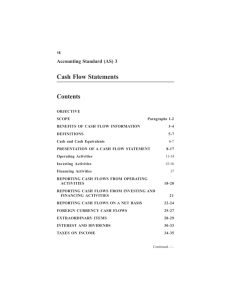

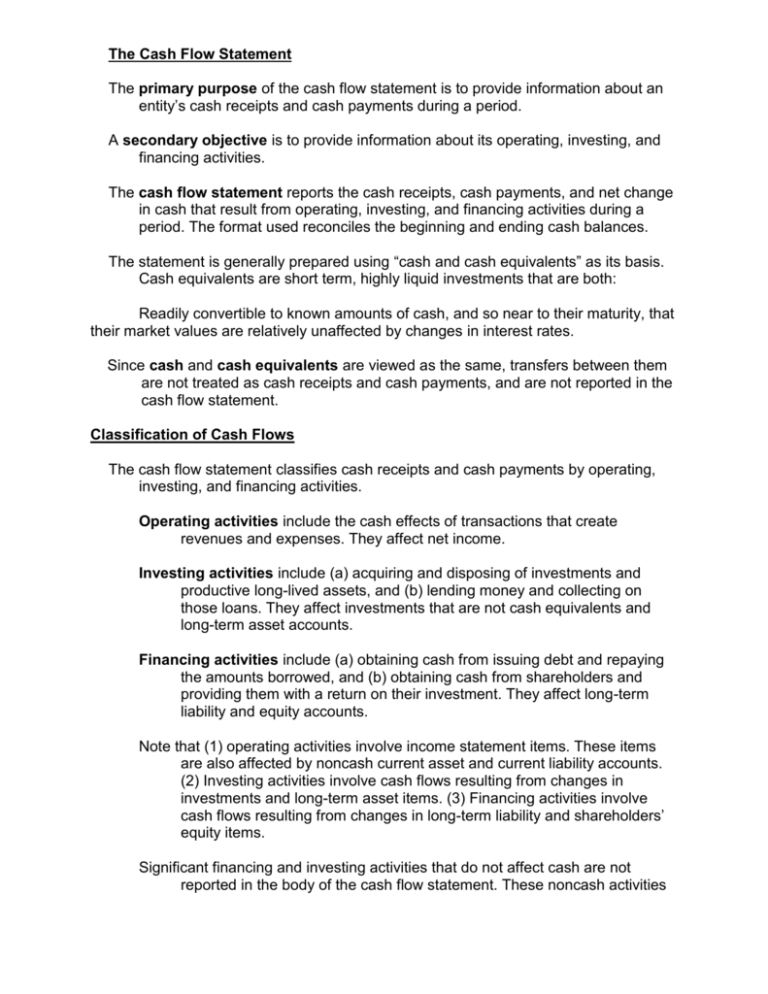

The Cash Flow Statement The primary purpose of the cash flow statement is to provide information about an entity’s cash receipts and cash payments during a period. A secondary objective is to provide information about its operating, investing, and financing activities. The cash flow statement reports the cash receipts, cash payments, and net change in cash that result from operating, investing, and financing activities during a period. The format used reconciles the beginning and ending cash balances. The statement is generally prepared using “cash and cash equivalents” as its basis. Cash equivalents are short term, highly liquid investments that are both: Readily convertible to known amounts of cash, and so near to their maturity, that their market values are relatively unaffected by changes in interest rates. Since cash and cash equivalents are viewed as the same, transfers between them are not treated as cash receipts and cash payments, and are not reported in the cash flow statement. Classification of Cash Flows The cash flow statement classifies cash receipts and cash payments by operating, investing, and financing activities. Operating activities include the cash effects of transactions that create revenues and expenses. They affect net income. Investing activities include (a) acquiring and disposing of investments and productive long-lived assets, and (b) lending money and collecting on those loans. They affect investments that are not cash equivalents and long-term asset accounts. Financing activities include (a) obtaining cash from issuing debt and repaying the amounts borrowed, and (b) obtaining cash from shareholders and providing them with a return on their investment. They affect long-term liability and equity accounts. Note that (1) operating activities involve income statement items. These items are also affected by noncash current asset and current liability accounts. (2) Investing activities involve cash flows resulting from changes in investments and long-term asset items. (3) Financing activities involve cash flows resulting from changes in long-term liability and shareholders’ equity items. Significant financing and investing activities that do not affect cash are not reported in the body of the cash flow statement. These noncash activities are reported in a separate note to the financial statements, which satisfies the full disclosure principle. Format of the Cash Flow Statement The cash flows from the operating activities section always appears first, followed by the investing activities and the financing activities section. Individual inflows and outflows from investing and financing activities are reported separately. The reported operating, investing, and financing activities result in net cash being either provided or used by each activity. The amounts of net cash provided or used by each activity are totalled to show the net increase or decrease in cash for the period. This amount is then added to or subtracted from the beginning-of-period cash balance to obtain the end-ofperiod cash balance. Finally, any significant noncash investing and financing activities are reported in a note to the statement. Usefulness of the Cash Flow Statement The information in a cash flow statement should help investors, creditors, and others assess: 1) The entity’s ability to generate future cash flows. 2) The entity’s ability to pay dividends and meet obligations. 3) The reasons for the difference between net income and net cash provided (used) by operating activities. 4) The cash investing and financing transactions during the period. Preparing the Cash Flow Statement Unlike the three other basic financial statements, the cash flow statement is not prepared from the adjusted trial balance. The information to prepare the cash flow statement usually comes from three sources: 1) Comparative balance sheet. 2) Current income statement. 3) Additional information. Preparing the cash flow statement from these data sources involves three steps: Step 1: Determine the net increase (decrease) in cash. The net increase (decrease) in cash is the ending cash less the beginning cash. Step 2: Determine the net cash provided (used) by operating activities. Analyse the current year’s income statement as well as the comparative balance sheets and selected additional data. Step 3: Determine net cash provided (used) by investing and financing activities. Comparative balance sheet data and selected additional information are analysed for their effects on cash. The conversion of net income from an accrual basis to a cash basis to determine net cash provided (used) by operating activities may be done using (1) the indirect method or (2) the direct method. Using the Information in the Financial Statements In the cash flow statement, cash provided by operating, investing, and financing activities is intended to indicate the cash generating capability of the company. A ratio analysis of the cash flow statement can evaluate liquidity, profitability, and solvency. Cash current debt coverage: measures liquidity. It indicates the amount of cash generated by operating activities for every dollar of current liabilities. The formula is: Net Cash Provided by Operating Activities Average Current Liabilities = Cash Current Debt Coverage Cash return on sales: measures profitability. It is the cash basis counterpart to the profit margin ratio, calculated under the accrual basis of accounting. The formula is: Net Cash Provided by Operating Activities Net Sales = Cash Return on Sales Cash flow per share: measures profitability. It is the cash basis counterpart to the earnings per share ratio, calculated under the accrual basis of accounting. It is an optional measure that may be included on the face of the cash flow statement or in a cross-referenced note to this statement. Earnings per share must be disclosed on the income statement or cross-referenced by note to the income statement. The formula for cash flow per share is: Cash Flow from Operating, Investing, and Financing Activities Number of Common Shares = Cash Flow Per Share Cash total debt coverage: measures long-term solvency. It is the cash basis counterpart to the debt to total assets, calculated under the accrual basis of accounting. The cash total debt coverage ratio demonstrates a company’s ability to repay its liabilities from the net cash provided by operating activities without having to liquidate the assets used in its operations. The formula is: Net Cash Provided by Operating Activities Average Total Liabilities = Cash Total Debt Coverage