Press Release - Experis.com

ManpowerGroup

Mesogeion 2-4

Athens Tower

115 27

ΑTHENS

T: 210 32.24.301

F: 210 32.48.644 www.manpowergroup.gr

Media Contact:

Metaxia Kladis

210 322 43 01 – 6956 200 217 mkladis@manpowergroup.gr

Manpower Employment Outlook Survey

Employer Confidence in Greece Gaining Strength

Net Employment Outlook Improves for Third Consecutive Quarter

The Net Employment Outlook in Greece stands at -6% for Quarter 2 2013

This quarter’s survey reveals:

- 4 & 7 percentage point improvement in hiring intentions, compared to last quarter and Quarter 2, 2012 respectively.

- A quarter-over-quarter and year-over-year improvement in all but one industry sector

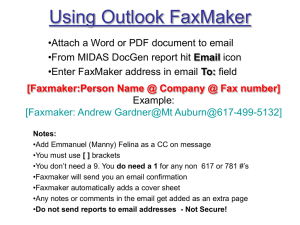

Athens, March 12 th , 2013 ManpowerGroup Greece released today its quarterly Manpower

Employment Outlook Survey, with Greek employers reporting the most optimistic forecast since the second quarter of 2010. The Net Employment Outlook has now been negative for 13 consecutive quarters, however hiring prospects have improved considerably, both in quarterover-quarter and year-on-year comparisons. Outlooks improve by varying degrees in all but one industry sector in both quarter-over-quarter and year-over-year comparisons.

The quarterly research reveals that 13 per cent of employers anticipate an increase in staffing levels, 16 per cent forecast a decrease and 69 per cent predict no change to their current workforces. Once seasonal variations are removed from the data the Net Employment Outlook stands at -6%. Quarter-over-quarter, the Outlook improves 4 percent. When compared with

Quarter 2 2012, hiring prospects improve by 7 percentage points.

The Manpower Employment Outlook Survey for the second quarter 2013 was conducted by interviewing a representative sample of 751 employers in Greece.

Manpower Employment Outlook Survey 2Q 2013 / Page 2

ManpowerGroup - Net Employment Outlook Evolution in Greece

“The stabilization trend first observed in Q1 2013 is expected to further strengthen during the quarter ahead. Although the Net Employment Outlook remains negative, the percentage of employers who will be cutting payrolls is declining, while the percentage of those who plan to add to their workforce is slowly rising. In fact, the Outlook has now improved by varying degrees for three consecutive quarters, and for the first time since mid-2010 we can report with limited optimism. This trend could partly reflect a few positive developments that we saw during the last quarter. The slow but steady implementation of long-discussed structural reforms has encouraged a few multinationals, already operating in Greece, to make their plans more concrete and shift part of their production to our country. Foreign investment interest is reportedly growing, contributing to the improvement of the confidence index. Nevertheless, employers will continue to be cautious and job creation in this new era of uncertainty will be limited despite any pick-up signs, ” comments Dr Venetia Koussia, ManpowerGroup’s

Managing Director. “In the light of the second-quarter data, we still need to focus on solutions fighting the dangerously high youth unemployment rates. With more than 6 out of 10 young

Greek people being out of the job market or belonging in NEETs (Not in Employment,

Education or Training), we urgently need to take specific actions to remedy the remaining structural inefficiencies of the Greek labor market and implement PARES initiatives with really

Active Labor Market Policies ”.

Sector Comparisons

Employers in seven of the nine industry sectors forecast negative payroll growth during the next three months. The weakest hiring prospects are reported in the Wholesale & Retail Trade sector, with a Net Employment Outlook of -16%. Disappointing hiring plans are also evident in the Electricity, Gas & Water Supply sector, with an Outlook of -9%, and in the Construction sector where the Outlook is -8%. Elsewhere, Public & Social sector employers report an

Outlook of -7% and the Outlook for the Manufacturing sector stands at -6%. However, employers in two sectors forecast slight job gains in 2Q 2013. The Outlook for the Restaurants

Manpower Employment Outlook Survey 2Q 2013 / Page 3

& Hotels sector stands at +3%, while Agriculture, Hunting, Forestry & Fishing sector employers report an Outlook of +1%.

Quarter-over-quarter, hiring prospects strengthen in eight of the nine industry sectors.

Restaurants & Hotels sector employers report a sharp improvement of 21 percentage points, while the Outlook for the Agriculture, Hunting, Forestry & Fishing sector is 12 percentage points stronger. Increases of 8 percentage points are reported in both the Manufacturing sector and the Transport, Storage & Communication sector, while employers report 5 percentage point improvements in the Construction sector and the Electricity, Gas & Water Supply sector.

Meanwhile, the Public & Social sector Outlook remains relatively stable.

Year-over-year, employers report improved hiring intentions in eight of the nine industry sectors. The Outlook for the Restaurants & Hotels sector improves by 16 percentage points, while increases of 13 and 12 percentage points are reported in the Construction sector and the

Agriculture, Hunting, Forestry & Fishing sector, respectively. Outlooks strengthen by 11 percentage points in both the Transport, Storage & Communication sector and the

Manufacturing sector, and an improvement of 9 percentage points is reported by Finance,

Insurance, Real Estate & Business Services sector employers. However, in the Electricity, Gas

& Water Supply sector, hiring prospects weaken by 4 percentage points.

“ With fears of a Grexit slowly fading and a 15%-20% increase of bookings in 2013, job seekers in the Tourism sector can expect to benefit from the first positive hiring intentions reported since 1Q 2010. Another interesting result is noted in the Construction sector, where the

Outlook –despite still being negative- is the strongest since 4Q 2009, a result possibly related to announcements of new and resuming public infrastructure projects, ” comments Dr Venetia

Koussia. “We are finally in a position to send a more optimistic message to those looking for a job. It is true, however, that it is not only economic life cycles that are getting shorter; skills life cycles are also getting shorter. Therefore, those job seekers who are continuously on the lookout to keep their skills up-to-date will have more opportunities to stay employed.

”

Regional Comparisons

Employers in both regions expect the sluggish hiring pace to continue in 2Q 2013, reporting

Net Employment Outlooks of -6%. However, hiring prospects in North Greece are 11 percentage points stronger when compared with the previous quarter, while the Greater Attica

Outlook improves by 3 percentage points. Employers in both regions also report improved hiring prospects when compared with 2Q 2012. An increase of 8 percentage points is reported in Greater Attica and the North Greece Outlook is 7 percentage points stronger.

Manpower Employment Outlook Survey 2Q 2013 / Page 4

International comparisons

ManpowerGroup interviewed over 66,000 hiring managers across 42 countries and territories to measure employer hiring expectations for Q2 2013. The latest research reveals uncertainty still weighs on employer confidence across the globe. Net Employment Outlooks are mixed and it appears many hiring managers continue to wait for clearer resolution to Europe’s sovereign debt crisis as well as signs that the global economy is returning to firmer footing before labor markets are likely to achieve sustainable traction. Employers in more than threequarters of the labor markets surveyed report positive second-quarter hiring plans. Hiring plans strengthen quarter-over-quarter in 21 countries and territories, but decline by varying degrees in 15. Additionally, employers in 25 countries and territories report weaker forecasts compared to this time last year.

Manpower Employment Outlook Survey 2Q 2013 / Page 5

Worldwide, hiring expectations are strongest in Brazil, Taiwan, Turkey and India, and weakest in Italy, Spain, Greece and the Netherlands with Outlooks from Italy and Spain matching the weakest employer forecasts ever reported there.

The next Manpower Employment Outlook Survey will be released on 12 June 2013 to report hiring expectations for the third quarter of 2013.

The Manpower Employment Outlook Survey is available free of charge to the public through ManpowerGroup Greece.

To receive an e-mail notification when the survey is available each quarter, interested individuals are invited to complete an online subscription form at http://www.manpowergroup.com/investors/alerts.cfm?

.

Results for all 42 countries can be viewed in the new interactive Manpower Employment

Outlook Survey Explorer tool at http://manpowergroupsolutions.com/DataExplorer/ .

Note to Editors

Commentary is based on seasonally adjusted data where available. Full survey results for each of the

42 countries and territories included in this quarter’s survey, plus regional and global comparisons, can be found in the ManpowerGroup Press Room at http://manpowergroup.com/press/meos_landing.cfm.

In addition, all tables and graphs from the full report are available to be downloaded for use in publication or broadcast from the ManpowerGroup Web site at http://manpowergroupsolutions.com/DataExplorer/.

About the Survey

The global leader in innovative workforce solutions, ManpowerGroup releases the Manpower

Employment Outlook Survey quarterly to measure employers’ intentions to increase or decrease the number of employees in their workforce during the next quarter. The Manpower Employment Outlook

Survey has been running for more than 50 years and is the most extensive, forward-looking employment survey in the world, polling over 66,000 public and private employers in 42 countries and territories. The survey serves as a bellwether of labor market trends and activities and is regularly used to inform the

Bank of England’s Inflation Reports, as well as a regular data source for the European Commission, informing its EU Employment Situation and Social Outlook report the Monthly Monitor.

ManpowerGroup’s independent survey data is also sourced by financial analysts and economists around the world to help determine where labor markets are headed.

About ManpowerGroup

ManpowerGroup™ (NYSE: MAN), the world leader in innovative workforce solutions, creates and delivers high-impact solutions that enable our clients to achieve their business goals and enhance their competitiveness. With over 60 years of experience, our $21 billion company creates unique time to value through a comprehensive suite of innovative solutions that help clients win in the Human Age. These solutions cover an entire range of talent-driven needs from recruitment and assessment, training and development, and career management, to outsourcing and workforce consulting. ManpowerGroup

Manpower Employment Outlook Survey 2Q 2013 / Page 6 maintains the world's largest and industry-leading network of 3,500 offices in 80 countries and territories, generating a dynamic mix of an unmatched global footprint with valuable insight and local expertise to meet the needs of its 400,000 clients per year, across all industry sectors, small and medium-sized enterprises, local, multinational and global companies. By connecting our deep understanding of human potential to the ambitions of clients, ManpowerGroup helps the organizations and individuals we serve achieve more than they imagined — because their success leads to our success. And by creating these powerful connections, we create power that drives organizations forward, accelerates personal success and builds more sustainable communities. We help power the world of work. The ManpowerGroup suite of solutions is offered through ManpowerGroup™ Solutions, Manpower®, Experis™ and Right

Management®. Learn more about how ManpowerGroup can help you win in the Human Age at www.manpowergroup.com.