P.s. #3 Solutions

advertisement

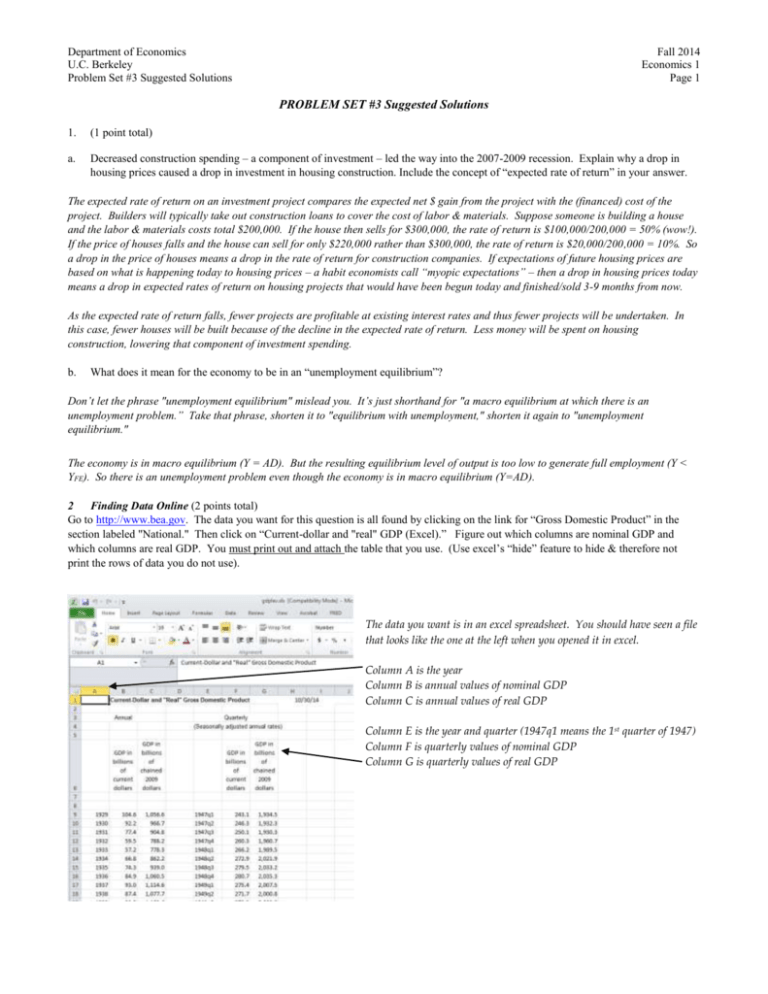

Department of Economics U.C. Berkeley Problem Set #3 Suggested Solutions Fall 2014 Economics 1 Page 1 PROBLEM SET #3 Suggested Solutions 1. (1 point total) a. Decreased construction spending – a component of investment – led the way into the 2007-2009 recession. Explain why a drop in housing prices caused a drop in investment in housing construction. Include the concept of “expected rate of return” in your answer. The expected rate of return on an investment project compares the expected net $ gain from the project with the (financed) cost of the project. Builders will typically take out construction loans to cover the cost of labor & materials. Suppose someone is building a house and the labor & materials costs total $200,000. If the house then sells for $300,000, the rate of return is $100,000/200,000 = 50% (wow!). If the price of houses falls and the house can sell for only $220,000 rather than $300,000, the rate of return is $20,000/200,000 = 10%. So a drop in the price of houses means a drop in the rate of return for construction companies. If expectations of future housing prices are based on what is happening today to housing prices – a habit economists call “myopic expectations” – then a drop in housing prices today means a drop in expected rates of return on housing projects that would have been begun today and finished/sold 3-9 months from now. As the expected rate of return falls, fewer projects are profitable at existing interest rates and thus fewer projects will be undertaken. In this case, fewer houses will be built because of the decline in the expected rate of return. Less money will be spent on housing construction, lowering that component of investment spending. b. What does it mean for the economy to be in an “unemployment equilibrium”? Don’t let the phrase "unemployment equilibrium" mislead you. It’s just shorthand for "a macro equilibrium at which there is an unemployment problem.” Take that phrase, shorten it to "equilibrium with unemployment," shorten it again to "unemployment equilibrium." The economy is in macro equilibrium (Y = AD). But the resulting equilibrium level of output is too low to generate full employment (Y < YFE). So there is an unemployment problem even though the economy is in macro equilibrium (Y=AD). 2 Finding Data Online (2 points total) Go to http://www.bea.gov. The data you want for this question is all found by clicking on the link for “Gross Domestic Product” in the section labeled "National." Then click on “Current-dollar and "real" GDP (Excel).” Figure out which columns are nominal GDP and which columns are real GDP. You must print out and attach the table that you use. (Use excel’s “hide” feature to hide & therefore not print the rows of data you do not use). The data you want is in an excel spreadsheet. You should have seen a file that looks like the one at the left when you opened it in excel. Column A is the year Column B is annual values of nominal GDP Column C is annual values of real GDP Column E is the year and quarter (1947q1 means the 1st quarter of 1947) Column F is quarterly values of nominal GDP Column G is quarterly values of real GDP Department of Economics U.C. Berkeley Problem Set #3 Suggested Solutions a. Fall 2014 Economics 1 Page 2 What year were you born? What was the annual value of U.S. nominal GDP that year? What was the annual value of U.S. real GDP? The answers will vary depending upon when you were born. Born in 1993? Nominal GDP that year was $6,878.7 billion = $6.9 trillion. Real GDP in 1993 was $9,521.0 billion = $9.5 trillion. Born in 1996? Nominal GDP that year was $8,100.2 billion = $8.1 trillion. Real GDP in 1996 was $10,561 billion = $10.6 trillion. Why is nominal GDP less than real GDP in these years? Because the base year is 2009 and prices increased between the early 1990s and 2009. So the prices used to calculate nominal GDP – the prices from the year you were born – are lower than the prices in 2009, the base year. b. Now look at the quarterly real GDP data. As the economy entered the 2007-09 recession, in what quarter did U.S. real GDP peak? What was the peak value? In what quarter did we pass that previous peak? What was the value of real GDP in the 3rd quarter of 2014? What was the growth rate of real GDP over the past year? For this question, you needed the quarterly real GDP data in column G. The economy peaked in 2007:IV (the 4th quarter of 2007, the months of October, November, and December 2007). The peak value was $14,992 billion = $15.0 trillion. (Not asked) The economy reached its trough in 2009:II (the 2nd quarter of 2009, the months of April, May, June). The trough value was $14,356 billion = $14.4 trillion. Notice that both nominal and real GDP declined, though the peak in nominal GDP was later than the peak in real GDP because prices were rising. We passed the previous peak in 2011:III (the 3rd quarter of 2011, the months of July, August, September 2011) . . . almost four years after the economy’s downturn began. Department of Economics U.C. Berkeley Problem Set #3 Suggested Solutions Fall 2014 Economics 1 Page 3 In 2014:III, real GDP was $16,150.6 billion = $16.2 trillion. The growth rate over the previous year compares the 2014:III and 2013:III values. (16150.6 – 15779.9) / 15,779.9 = 0.0235 = 2.3% growth rate. 3. (3 points total) Suppose the following equations describe a simple economy. All amounts are billions of $ per quarter. Consumption: Investment: Government: Exports: Imports: a. C = 100 + 0.80YD I = 300 G = 400 EX = 500 IM = 300 Transfer Payments to the Public: Tax Payments to the Government: TR = 1,000 TA = 1,500 What is this economy’s value of equilibrium income & output? In your answer, include the units. points. Attach your work or no Recall the following notation: AD = aggregate demand Y = income GDP = output We know that the following statements are always true at equilibrium: (1) output = income, (2) output = aggregate demand. Therefore, it follows that income equals aggregate demand when we are at equilibrium: Y = AD = C + I + G + EX - IM Be sure you understand why we subtract imports in the equation above. Aggregate demand measures spending for domestically-produced output, that is, output produced within the country. But some of the goods and services consumed (C) were imported. Some of the machines purchased & construction materials purchased (I) were imported. And some of the goods & services purchased by government agencies (G) were imported. Those imports are output of other countries, not output of our country. So we sum all these imported goods into imports (IM) and subtract IM from the other components of aggregate demand. Before we solve the equation, we need to take transfer payments to the public (TR) and tax payments to the government (TA) into account. Remember the definition of disposable income: YD = Y + TR - TA The economy’s disposable income (YD, the funds we can spend on consumer goods and services) is determined by our wages, interest, dividends, profits and rents earned (that is, Y) plus any money we might receive for the government in the form of transfer payments (TR, social security, disability, Pell grants, etc.) minus any taxes (TA) we pay on income, property, etc. Disposable income (YD) is also expressed as total income (Y) minus net taxes (T) to the government, where net taxes are calculated as tax payments to the government (TA) minus transfer payments (TR). I find it much easier to remember one equation (YD = Y + TR – TA) rather than two (YD = Y – T, and T = TA – TR), but go with whichever approach works for you. We have values for TR and TA. So we Department of Economics U.C. Berkeley Problem Set #3 Suggested Solutions Fall 2014 Economics 1 Page 4 can express YD as a function of Y and constants: YD = Y + TR – TA YD = Y + 1,000 – 1,500 YD = Y – 500 Now we can solve for equilibrium Y. Remember that C depends on YD, so that’s where you’ll substitute in the expression above. In equilibrium, Y = AD = C + I + G + EX - IM Y = 100 + 0.8YD + I + G + EX - IM Y = 100 + 0.8 (Y – 500) + 300 + 400 + 500 - 300 Y = 100 + 0.8Y – 400 + 300 + 400 + 500 - 300 Y = 600 + 0.8Y 0.2Y = 600 Y = 3000 So, the economy’s value of equilibrium income and output is $3,000 billion, or $3.5 trillion per quarter. Unless and until there is a change in aggregate demand, this economy will produce $3.0 trillion worth of final goods and services every 3 months. b. At the right, carefully graph planned Aggregate Expenditure as a function of income (Y). Label your axes (indicate what is being measured in billions of $ on each axis). Show the equilibrium level of output and income in your graph. c. Housing prices drop, reducing household wealth. Millions of families can no longer obtain credit through home equity lines of credit (HELOC). Without HELOCs, households cannot spend as much money on consumer goods & services. These wealth and credit effects cause consumption to drop by $200 billion. Graph the new planned Aggregate Expenditure as a function of income (Y). Show the new equilibrium level of annual output and income in your graph. The consumption function has two parts: the constant term or what is called “autonomous consumption” and the slope or what is called the “marginal propensity to consume.” In part (a), we were initially told that C = 100 + 0.8YD. So the initial value of autonomous consumption is $100 billion, and the initial value of the m.p.c. is 0.8. If something happens to change disposable income – a change in income, transfer payments, or taxes – then the change in consumption spending would be 0.8*ΔYD. If anything other than a change in disposable income triggers a change in consumption spending, it would show as a change in autonomous consumption, the constant term. With the drop in housing prices and difficulty obtaining credit, households reduce consumption. A drop in housing prices is a change in wealth, the value of the assets we own. A drop in credit availability is a change in our ability to incur liabilities. Neither a change in the value of our assets nor a change in our liabilities is a change in our disposable income. So these wealth & credit effects result Department of Economics U.C. Berkeley Problem Set #3 Suggested Solutions Fall 2014 Economics 1 Page 5 in a drop in autonomous consumption, a shift down of the consumption function. The new consumption function will be C = -100 + 0.8YD. With a decrease in autonomous consumption of $200 billion, we know that the AD line has shifted downward by $200 billion. The new AD line will be AD = 400 + 0.8Y. At every level of income, we now have $200 billion less aggregate demand. In the graph, this decrease is shown as a decrease in the vertical-intercept from $600 billion to $400 billion. d. Calculate the new equilibrium level of output and income and write the value in the box at the right. Attach your work or no points. Plug the new level of autonomous consumption into the equation. Since the change in autonomous consumption is -$200 billion per quarter, the new value of autonomous consumption equals -$100 billion per quarter. The new Consumption function is Cnew = (100-200) +0.8YD = -100 + 0.8YD. Y = Cnew + I + G + EX - IM Y = -100 + 0.8YD + I + G + EX - IM Y = -100 + 0.8(Y- 500) + 300 + 400 + 500 - 300 Y = -100 + 0.8Y – 400 + 300 + 400 + 500 - 300 Y = 400 + 0.8Y 0.2Y = 400 Y = 2,000 So, the equilibrium Y falls to $2,000 billion, or $2.0 trillion, per quarter when autonomous consumption spending falls by $200 billion per quarter. We also could have calculated the new level of income using the multiplier. In part (e) we will calculate that the multiplier equals 2.5 for this economy. So we have Total ∆income = Initial ∆spending × multiplier Total ∆income = (–$200 billion) × 5 = – $1,000 billion per quarter New income = old income + total ∆income = $3,000 billion – $1,000 billion = $2,000 billion per quarter Notice that when autonomous consumption spending falls by $200 billion per quarter, equilibrium Y decreases from $3.0 trillion to $2.0 trillion per quarter. Why is the decrease in equilibrium Y more than the initial decrease in consumption spending? Because of the multiplier effect! e. What is the value of the spending multiplier for this economy? Attach your work or no points. The spending multiplier is the ratio of the change in the equilibrium level of output to the initial change in spending. In an economy in which only consumption changes when income changes, the equation for the spending multiplier is: 1/(1 – MPC). (But be careful: this is the formula for the multiplier only in this special case where only consumption changes when income changes.) The safest way to find the value of the multiplier is to compute the ratio: total change in income initial change in spending This is the safest way to find the multiplier because this definition of the spending multiplier is always true. The definition doesn’t change when the equations describing C, I, G, EX, or IM change. Department of Economics U.C. Berkeley Problem Set #3 Suggested Solutions Fall 2014 Economics 1 Page 6 From part (d), we know that the total change in income is $1,000 billion = $3,000 -$2,000 billion. We also know that the initial change in spending is $200 billion. Both of these values are negative, but we can ignore the negative signs because income and spending always move in the same direction. So the value of the multiplier is multiplier total change in income $1,000 billion 5 initial change in spending $200 billion Notice that there are no units on the multiplier. It’s just a number. In this special case in which only consumption depends upon income, we can also find the value of the multiplier using the formula 1 / (1MPC). This is a second way to find the value of the multiplier. It’s not as safe as the first way because you have to be certain before you begin that only consumption changes when income changes. If any other component of AD depends upon income, then the formula 1 / (1MPC) will be wrong. But in this case, we can go ahead. Recall that the marginal propensity to consume can be found in the equation for consumption. It is the coefficient on disposable income, YD; the coefficient on YD describes the share of any change in disposable income that we tend to spend. Here, the marginal propensity to consume is 0.8. To find the multiplier, plug in the MPC to the multiplier equation: Multiplier = 1/(1-MPC) = 1/(1 - 0.8) = 1/0.2 =5 Therefore, we find that the multiplier is 5. This makes sense in the context of what we saw in part (d). A decrease of autonomous consumption spending of $200 billion led to a decrease of equilibrium output that is 5 times as large: - $1,000! f. If investment changed when GDP changed (for example, I = 100 + 0.1Y), would your answer to (e) be the same? Why or why not? No, my answer would not be the same. If investment changed when GDP changed, then the formula for the multiplier would be different. 1/(1-mpc) is the right formula only if consumption is the only component of C+I+G+EX – IM that changes when income changes. If something else – here, investment spending – also changes when income changes, then the formula for the multiplier must include a measure of that component’s responsiveness to a change in income. Remember your definition of slope: Slope = rise / run= I / Y. The slope of the equation is 0.1, which therefore describes how much investment changes (I ) when income changes (Y). Sometimes that value is called the “marginal propensity to invest.” Here, the marginal propensity to invest is 0.1: when income changes by 1, investment changes by 0.1. The formula for the multiplier would need to include not only the mpc, but also the marginal propensity to invest. The new formula for the multiplier would be 1 / (1 – mpc – mpi). The multiplier effect would be larger. In each round of the multiplier process, not only does C change, but I changes also. A $200 billion / quarter drop in autonomous consumption would lead to a larger drop in total income. 4. a. (2 points total). Your friend, who is not taking Economics and therefore doesn’t know economic language, doesn’t understand why an initial $400 billion annual decrease in construction spending makes income fall by more than $400 billion per year. Tell your friend why an initial change in planned aggregate expenditure results in a much larger change in equilibrium income. Your goal here is to explain this without using economic jargon, so that someone who isn’t in econ could understand. Essentially, you want to describe for them the process we watched unfold in class on Monday November 10. Department of Economics U.C. Berkeley Problem Set #3 Suggested Solutions Fall 2014 Economics 1 Page 7 When people spend less money buying goods and services, fewer goods and services are produced. When businesses produce and sell less output, they need fewer workers. People either lose their jobs completely or get their hours cut. Either way, workers have less income. Initially this is felt particularly by retail workers and retail business owners, but eventually by the producers of the output sold to consumers as well. These workers whose income is lower now spend less because they are earning less. Firms see reduced spending as a signal to produce less. The decrease in production will cause yet another set of layoffs / reduced hours and decreased income. Those workers who lost income will now reduce their spending, triggering another round of decreased production, layoffs and lost income. This is a continuous cycle. It is called the “multiplier effect.” The size of the effect will depend on what share of any change in income winds up back in the economy as spending. If someone’s income goes up by $1,000 a month, how much of that gets spent on newly produced goods and services? In an economy in which people spend a lot of any change in its income (instead of saving it), there will be big multiplier effects in response to an initial change in expenditure. Notice that the multiplier process works as the economy contracts and when the economy expands. If someone’s income is cut by $1,000 a month, how much will they reduce their spending? There are two ways to avoid having to cut spending by the full $1,000 a month: using previously accumulated assets (drawing down your savings), or acquiring new liabilities (running up your credit cards!). If people cut their spending a lot when their income falls, the multiplier effect will be quite large. If people are able to nearly sustain their spending despite a cut in income, the multiplier effect will be small. In this question, we looked at the impact of an initial drop in spending of $400 billion per quarter. Ultimately, income falls by more than $400 billion per quarter. The multiplier process makes the decline worse. b. In which case would the drop in GDP following the drop in housing construction be greater: • [case 1] Consumers have access to credit • [case 2] Consumers do not have access to credit Explain. How much consumption drops when income drops depends on whether workers are able to spend something other than their disposable income when they buy goods and services. If your paycheck drops by $1,000 per month and you don’t want to cut your spending by $1,000 per month, you’ve got only two choices: draw down your assets that you’ve accumulated by saving in the past (take money out of your savings account, sell off a savings bond, sell some stock, sell your car), or accumulate liabilities by accessing credit (charge things on your credit card to pay off later, take out a home equity loan, borrow from a sympathetic relative, go to a pawn shop). If you can’t access credit, you will have to cut your spending by a larger amount. Therefore, without access to credit, the mpc is larger, so the multiplier is larger, and the drop in GDP is larger. 5. Essay (2 points) There are two options for this essay. Choose either option A or option B. There is no need to do both. Option A You need to go to any business in the area and talk with the person in charge of hiring. It will probably be easiest if you choose a small business rather than something like Genentech. If you work off-campus for a business, you can just talk with your boss if you like. If you work on-campus (W-2 from UC), your place of work doesn’t satisfy the assignment; you work for a government agency, not a business. You also should not choose a non-profit organization. Ask the person in charge of hiring: What would make you want to hire another person and increase the number of people working here? Be sure they understand you are talking about increasing their work force, not just cutting everyone’s hours because another person is hired on. If he or she doesn’t have a ready answer, you may want to offer some options: Would you increase the size of your work force if you could pay the person a lower wage than you’re paying everyone else? What if the employer taxes were lower? What if there were more customers / higher sales? What if there were fewer government regulations? Then write a paper in which you answer these questions: $ What business did you visit? $ What do they sell? Who are their customers? $ What was the name and position of the person you talked with? $ What was the answer to the question: What would make you want to hire another person and increase the number of people working here? $ Suppose all employers gave the same answer to the question in the previous bullet. In that case, will an increase in aggregate demand Department of Economics U.C. Berkeley Problem Set #3 Suggested Solutions Fall 2014 Economics 1 Page 8 cause aggregate employment to increase? Option B Talk with someone who lost their job during the 2007-2009 recession. Ask them to describe to you the circumstances that led to their job loss. How many people were laid off when they were laid off? Why were people laid off? Did the company go out of business (exit the industry)? If not, have they re-hired people? If the firm has re-hired people, what led them to increase hiring again? Then write a paper in which you answer these questions: $ Who did you talk with? $ Where did they work before they were laid off and what did they do? $ When were they laid off? How many people were laid off at that time? $ Did the company continue to produce, or did it go out of business? $ (Key question) Why were there lay-offs? If the firm has re-hired employees, why did they start hiring again? $ Suppose all workers gave the same answers to the questions in the previous bullet. In that case, will an increase in aggregate demand cause aggregate employment to increase? Interviews may be in pairs but your essay must be your own work. To present anyone else’s work as your own is theft of intellectual property: plagiarism. That means you must use quote marks “ ” around any words you quote exactly from any source (and then provide the source for the quote). It also means that if you get ideas from anyone else, or if you paraphrase someone else, you must again give them credit for their ideas. To do otherwise is plagiarism, a violation of the Code of Student Conduct and one of the worst offenses in academe. If you have questions about whether or not you’ve properly cited your sources, please talk with your GSI, the Head GSI, or Prof. Olney. “Your own work” also means that essays crafted jointly on piazza or otherwise are not acceptable. That too is plagiarism. You can clarify and discuss the prompt with each other on piazza, but stop short of sharing specifics from your essay. Specifications: 400 words maximum, one page maximum. (“Works Cited” list can be on a second page and does not count against the 400 word maximum.) Double space. 10-11-12 pt font. 1" margins on all sides. Your name, date, and the word count in the top right corner. Attach your paper directly behind the problem set sheets.. Grading: 0 - 1 - 2 points, taking into account content, following specifications, and writing quality. Of course, there are lots of specific examples, so we can’t provide you with “this is what you should have written.” Guidelines: a. Did you follow the specifications? Maximum 400 words? Maximum one page? 1” margins? Double-spaced? 10 or 11 or 12 pt font? Your name, date, and word count in the top right corner? Your essay stapled at the back of your problem set? Attached your “works cited” list (either at the end of page 1 or on a separate page)? If so, you remained eligible for full credit. If not, you lost a point right off the top. b. Did you follow the prompts when you interviewed someone? Did you write up your interview notes following the prompts? If so, you remained eligible for full credit. c. Did you run a spell-check? Did you edit for proper use of grammar, clear writing, and so on? I can’t tell you how many people never get a response to a resume because it has one or more spelling & grammar errors. Start good practice now: always run a spell check. Always check any sentence that Word tells you is using bad grammar. Word is often right. d. What did you learn? Here’s my bet based on a thousand or so essays previously submitted. Most of you were told that hiring depends upon demand. People don’t always use that word “demand.” They say “if we had more customers,” or “if I had more orders,” or “if sales were to go up.” A tax cut for employers doesn’t cover the full cost of a new employee, so few will have mentioned taxes. Some will say “if I had more profit”; hopefully you pushed that person on whether it was more revenues or lower costs that would lead them to increase employment.