EC 102 Summer School

EC 100

Macro Exercise 1

1

Discussion of LT Week 3

- First class for the Macroeconomics part

- Hand-out corrected

- Receive some model solutions with some general comments.

2

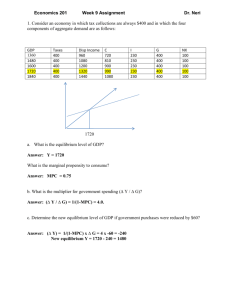

Problem 1

• Why is the aggregate equilibrium condition Y = E?

What happens if E <Y? If E>Y?

– Definition: Y =total supply, defined as the value of all goods and services produced in a year, or other fixed unit of time

– Definition: E = total demand, i.e., total spending that same period of time

– So condition Y = E is a simple equilibrium condition, that supply equals demand.

- If E < Y: less spending than value of output. Producers produce less? Spenders spend more?

- Where do the adjustments come from?

- Note that Y = P * Q, so equilibrium can be achieved by changes in P or in Q.

3

Problem 1

• Note aside:

• In an open economy: Y = E

D

+ E

F

• Output is absorbed by domestic spending or foreign spending.

In case Y < E

D

, we could have that the difference is absorbed by foreign spending in form of exports.

4

Problem 2

• Why is it important to know the equilibrium level of GDP?

• Knowing the equilibrium level of GDP helps guide policy.

– If the economy is capable of producing higher GDP in equilibrium, then macroeconomic policy might raise aggregate demand to achieve that higher GDP level.

– If, on the other hand, the economy’s equilibrium GDP level is lower than currently observed, the economy might be close to already experiencing unnecessarily high inflation: in that case, macroeconomic policy might lower aggregate demand. That’s why knowing evolution of P is of key importance!

– In either case, again, knowing the equilibrium level of GDP helps guide policy.

5

Problem 3

• Why is it useful to split up E into C, I, G, X, and M?

• Total demand (or, in equilibrium, total output) is usefully split into its different components C , I , G , X , M because the behaviour of each of these is driven by different economic considerations.

- Consider Consumption:

- C(Y D ) = c

0

+ mpc Y D

- An increase in taxes reduces disposable income, but is likely not going to have a direct effect on X or M or investment I

- So studying these elements separately is very important as it allows us to isolate the effects of certain policies.

- Consider G

- If the share of G in total output is large – is this good or bad?

6

Problem 4

• What does the analysis so far suggest might be done to prevent the high unemployment of the 1930s?

• We will discuss this a lot further, I just want to give a little preview here – we do not have the whole model set-up yet to be able to discuss this in a lot of detail.

7

Problem 4

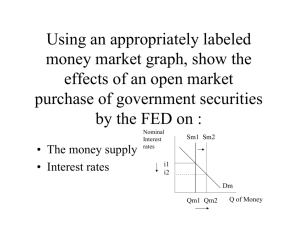

• The government could have expanded its share of expenditure, by increasing G.

• This is a policy instrument, that many governments did employ following Lehman brothers.

• Can you think of some problems?

– How do governments finance their spending?

– Imagine that governments need to access private savings to finance their expenditure <> this may increase the interest rate, which could affect private Investment

– Need a model to capture savings…

8

Problem 5

• Given the analysis so far, explain intuitively why an increase in government spending G increases GDP by more than the initial rise in

G.

9

Problem 5

• Given the analysis so far, explain intuitively why an increase in government spending G increases

GDP by more than the initial rise in G.

– Each additional dollar of consumption is somebody else‘s income , out of this additional one unit of income mpc*1 is additionally consumed by this agent, again, this is somebodys income who is consuming

1*mpc*mpc of it and so on and so forth.

– This infinite geometric series has a finite and closed form sum as long as mpc is between 0 and 1.

10

Problem 5

• Where is the multiplier coming from?

C

c

0

c

1

( Y

T )

Y

=

C

+

I

+

G

= c

0

+ c

1

( Y

-

T )

+

I

+

G

Þ

Y

=

1

1

c

1

( c

0

+

I

+

G

c

1

T )

11

Problem 5

• Where is the multiplier coming from?

C

c

0

c

1

( Y

T )

Y

=

C

+

I

+

G

= c

0

+ c

1

( Y

-

T )

+

I

+

G

Þ

Y

=

1

1

c

1

( c

0

+

I

+

G

c

1

T )

12

Problem 6

• Explain the government spending multiplier in your own words. What is the significance of this multiplier having value greater than one?

• The government spending multiplier is the increase in

GDP from an increase in government spending, expressed as a proportion of that government spending increase. That the multiplier exceeds 1 means the government has an effective instrument in its spending decisions for guiding changes to GDP.

13

Problem 7

What about changes in TAXES?

C

= a

+ b ( Y

-

T )

Y

=

PE

=

C

+

I

+

G

+

( X

-

M )

= a

+ b ( Y

-

T )

+

I

+

G

+

( X

-

M )

Þ

Y

=

1

1

b

( a

+

I

+

G

bT

+

X

-

M )

So tax multiplier is:

b

1

b

14

Problem 8

What about changes in IMPORTS?

C

= a

+ b ( Y

-

T )

Y

=

PE

=

C

+

I

+

G

+

( X

-

M )

= a

+ b ( Y

-

T )

+

I

+

G

+

( X

-

M )

Þ

Y

=

1

1

b

( a

+

I

+

G

bT

+

X

-

M )

So import multiplier is:

-

1

1

b

15

Problem 9

Suppose you increase TAXES by same amount as you increase G – what is the net effect?

The G multiplier is:

The T multiplier is:

1

1

b

b

1

b

What is the NET EFFECT:

1

1

b

b

1

b

=

1

16

Problem 9

So GDP still increases by 1 unit --- why?

The government consumes all, whereas if taxes are reduced the households save a fraction of this new income. Hence, the multiplier is lower as the initial agents who gets higher income does not consume all of it but only mpc*dT of it.

The Government is a more „effective” consumer.

17