Test 2

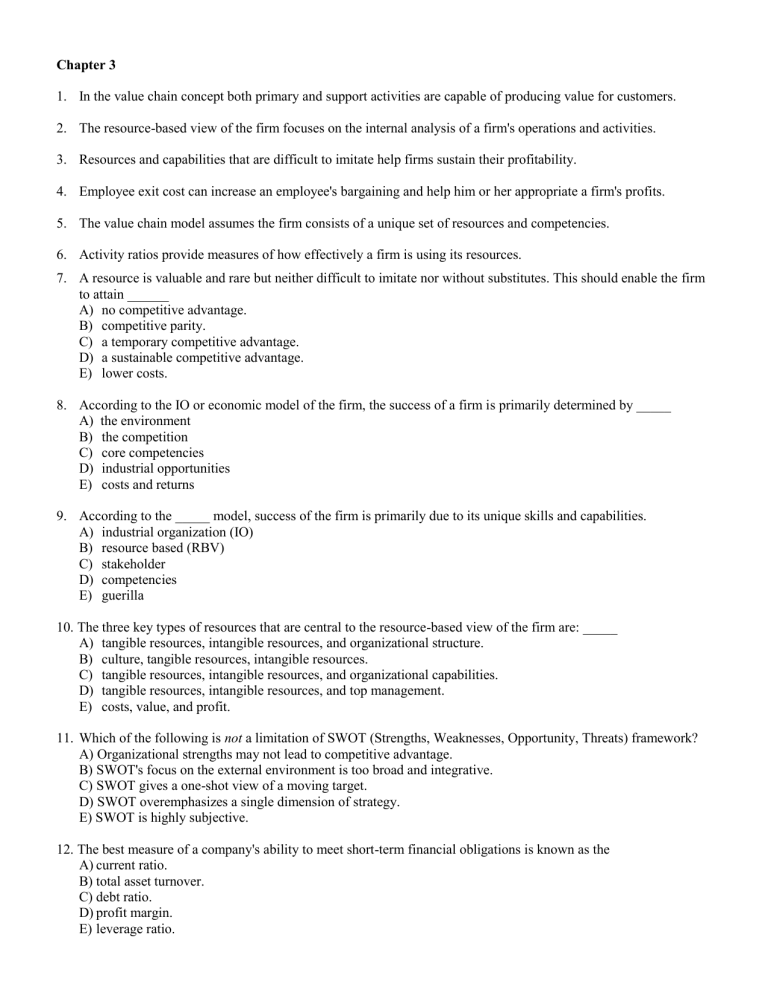

Chapter 3

1. In the value chain concept both primary and support activities are capable of producing value for customers.

2. The resource-based view of the firm focuses on the internal analysis of a firm's operations and activities.

3. Resources and capabilities that are difficult to imitate help firms sustain their profitability.

4.

Employee exit cost can increase an employee's bargaining and help him or her appropriate a firm's profits.

5. The value chain model assumes the firm consists of a unique set of resources and competencies.

6. Activity ratios provide measures of how effectively a firm is using its resources.

7. A resource is valuable and rare but neither difficult to imitate nor without substitutes. This should enable the firm to attain ______

A) no competitive advantage.

B) competitive parity.

C) a temporary competitive advantage.

D) a sustainable competitive advantage.

E) lower costs.

8. According to the IO or economic model of the firm, the success of a firm is primarily determined by _____

A) the environment

B) the competition

C) core competencies

D) industrial opportunities

E) costs and returns

9. According to the _____ model, success of the firm is primarily due to its unique skills and capabilities.

A) industrial organization (IO)

B) resource based (RBV)

C) stakeholder

D) competencies

E) guerilla

10. The three key types of resources that are central to the resource-based view of the firm are: _____

A) tangible resources, intangible resources, and organizational structure.

B) culture, tangible resources, intangible resources.

C) tangible resources, intangible resources, and organizational capabilities.

D) tangible resources, intangible resources, and top management.

E) costs, value, and profit.

11. Which of the following is not a limitation of SWOT (Strengths, Weaknesses, Opportunity, Threats) framework?

A) Organizational strengths may not lead to competitive advantage.

B) SWOT's focus on the external environment is too broad and integrative.

C) SWOT gives a one-shot view of a moving target.

D) SWOT overemphasizes a single dimension of strategy.

E) SWOT is highly subjective.

12. The best measure of a company's ability to meet short-term financial obligations is known as the

A) current ratio.

B) total asset turnover.

C) debt ratio.

D) profit margin.

E) leverage ratio.

13. Which of these categories of financial ratios is used to measure a company's ability to meet its short-term financial obligations?

A) leverage ratios.

B) profitability ratios.

C) activity ratios.

D) liquidity ratios.

E) utility ratios

14. Historical comparisons provide information to managers about changes in a firm's competitive position. Historical comparisons are often misleading

A ) if the overall strategy of the firm is the same.

B) in periods of recession or economic boom.

C) if the firm shows constant growth.

D) if the firm's stock is publicly traded.

Chapter 5

1. The focus strategy refers to focusing on the “non-price” attributes of a company's products.

2. Businesses that compete in markets that are in decline should simply be harvested or divested since they are no longer profitable.

3. If a firm has a successful differentiation strategy, it is not necessary to maintain parity on cost.

4. Concentrating solely on one form of competitive advantage generally leads to the highest level of profitability.

5. Which of the following is a risk (or pitfall) of cost leadership?

A) cost cutting may lead to the loss of desirable features

B) attempts to stay ahead of the competition may lead to gold plating

C) cost differences increase as the market matures

D) producers are more able to withstand increases in suppliers' cost

E) All of the above

6. In the _______ stage of the industry life cycle, there are many segments, competition is very intense, and the emphasis on process design is high.

A) introduction

B) growth

C) maturity

D) decline

E) adolescent

7. Of the following, which is are major disadvantages of a first mover strategy?

1. The high degree of uncertainty about new markets.

2. The high level of competition in new markets.

3. The high cost of developing new products.

A) 1 only

4. The inability to sustain a competitive advantage.

5. The low profits as new markets develop.

B) 1 and 2

C) 2 and 5

D) 1 and 3

E) 1, 2, 3, 4, and 5

8. Which of the following is NOT a source of competitive advantage?

A) Superior quality.

B) Superior efficiency.

C) Superior innovation.

D) Superior responsiveness

E) Superior management.

9. The primary aim of strategic management at the business level is

A) maximizing risk-return tradeoffs through diversification.

B) achieving a low cost position.

C) maximizing differentiation of products and/or services.

D) achieving competitive advantage(s)

E) maximizing returns to shareholders

10. A _______ can be defined as the total profits in an industry at all points along the industry's value chain.

A) profit maximizer

B) revenue enhancer

C) profit pool

D) profit outsourcing

E) competitive advantage