Biography - International Insurance Society

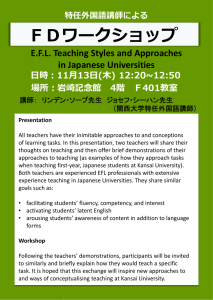

advertisement

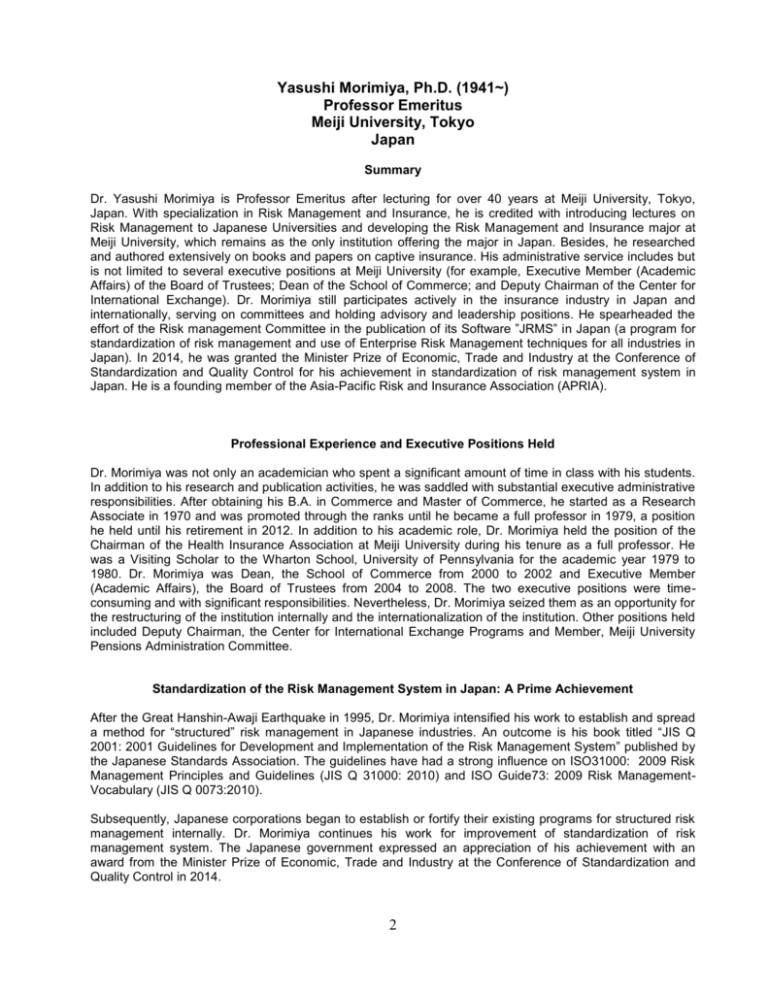

Yasushi Morimiya, Ph.D. (1941~) Professor Emeritus Meiji University, Tokyo Japan Summary Dr. Yasushi Morimiya is Professor Emeritus after lecturing for over 40 years at Meiji University, Tokyo, Japan. With specialization in Risk Management and Insurance, he is credited with introducing lectures on Risk Management to Japanese Universities and developing the Risk Management and Insurance major at Meiji University, which remains as the only institution offering the major in Japan. Besides, he researched and authored extensively on books and papers on captive insurance. His administrative service includes but is not limited to several executive positions at Meiji University (for example, Executive Member (Academic Affairs) of the Board of Trustees; Dean of the School of Commerce; and Deputy Chairman of the Center for International Exchange). Dr. Morimiya still participates actively in the insurance industry in Japan and internationally, serving on committees and holding advisory and leadership positions. He spearheaded the effort of the Risk management Committee in the publication of its Software ”JRMS” in Japan (a program for standardization of risk management and use of Enterprise Risk Management techniques for all industries in Japan). In 2014, he was granted the Minister Prize of Economic, Trade and Industry at the Conference of Standardization and Quality Control for his achievement in standardization of risk management system in Japan. He is a founding member of the Asia-Pacific Risk and Insurance Association (APRIA). Professional Experience and Executive Positions Held Dr. Morimiya was not only an academician who spent a significant amount of time in class with his students. In addition to his research and publication activities, he was saddled with substantial executive administrative responsibilities. After obtaining his B.A. in Commerce and Master of Commerce, he started as a Research Associate in 1970 and was promoted through the ranks until he became a full professor in 1979, a position he held until his retirement in 2012. In addition to his academic role, Dr. Morimiya held the position of the Chairman of the Health Insurance Association at Meiji University during his tenure as a full professor. He was a Visiting Scholar to the Wharton School, University of Pennsylvania for the academic year 1979 to 1980. Dr. Morimiya was Dean, the School of Commerce from 2000 to 2002 and Executive Member (Academic Affairs), the Board of Trustees from 2004 to 2008. The two executive positions were timeconsuming and with significant responsibilities. Nevertheless, Dr. Morimiya seized them as an opportunity for the restructuring of the institution internally and the internationalization of the institution. Other positions held included Deputy Chairman, the Center for International Exchange Programs and Member, Meiji University Pensions Administration Committee. Standardization of the Risk Management System in Japan: A Prime Achievement After the Great Hanshin-Awaji Earthquake in 1995, Dr. Morimiya intensified his work to establish and spread a method for “structured” risk management in Japanese industries. An outcome is his book titled “JIS Q 2001: 2001 Guidelines for Development and Implementation of the Risk Management System” published by the Japanese Standards Association. The guidelines have had a strong influence on ISO31000: 2009 Risk Management Principles and Guidelines (JIS Q 31000: 2010) and ISO Guide73: 2009 Risk ManagementVocabulary (JIS Q 0073:2010). Subsequently, Japanese corporations began to establish or fortify their existing programs for structured risk management internally. Dr. Morimiya continues his work for improvement of standardization of risk management system. The Japanese government expressed an appreciation of his achievement with an award from the Minister Prize of Economic, Trade and Industry at the Conference of Standardization and Quality Control in 2014. 2 Academic Leadership, Research, Service and Contributions Dr. Morimiya excelled in every area of performance: academic leadership and instruction, research, and service to the institution of higher learning, the business industry, and the society. 1. Academics (Instruction). Dr. Morimiya is renowned as the insurance expert in Japan. Many of his former students hold senior positions in the insurance and financial industry and in the public sector (including the Financial Services Agency for insurance regulation). His academic influence has fostered cooperation on insurance issues among educators, insurance industry leaders as well as regulators so as to further the cause and development of insurance. 2. Establishment of the Only Undergraduate Insurance Major Program in Japan. The Meiji University School of Commerce, founded in 1904, was the first private university of its kind established in Japan. One of the founders was a scholar of insurance who studied in Germany, and insurance has been one of the most important subjects at the university. Dr. Morimiya introduced “Risk Management” to the curriculum in the early 1990s, expanding it to “Risk Management and Insurance Program” for undergraduate students. 3. Introduction of Risk Management Practices to Japan. Dr. Morimiya translated more than 10 scholarly papers on Risk Management into Japanese during the 1970s. His work was helpful in introducing risk management theory to Japanese academy and industry. His study on risk management was compiled and published in Japan in 1985 in a book titled “Risk Management.” Among his many accomplishments are the following articles: a. Patterns of Risk Treatment and the Japanese Way of Handling Risks, Best’s Review (P/L), vol.76 No.3, 1975. b. The Japanese Approach to Risk Treatment, Risk Management, Risk and Insurance Management Society Inc., 1981. c. Demand for Natural Disaster Insurance, The Geneva Paper on Risk and Insurance, Vol. 9 No 32, 1984. He was the recipient of several research grants from a number of government institutions. He published over 10 books in addition to the scores of papers in renowned journals. 4. Introduction of Captive Study to Japan. Dr. Morimiya is an authority on Captive Insurance. He published over 20 papers (including his Ph.D. dissertation) investigating the issues of captives. More than 50 large Japanese companies operate their captives offshore. Dr. Morimiya’s study contributes to such development. His publication in this area includes but are not limited to: 5. a. A Study on Captives, Studies of Non-life Insurance, vol. 36. no.4, 1974 (Japanese). b. Domiciles for Captive insurance Companies, Memoirs of Institute of Social Science, Meiji University, vol.29, no.2, 1991 (Japanese). c. Recent Trend of Risk Finance-Cases of Protected Cell Captives, Memoirs of Institute of Social Science, Meiji University, vol.41, no.1, 2002 (Japanese). The Insurance Business Law does not permit the establishment of a captive insurance company in Japan. Nevertheless, Dr. Morimiya continued his discussion about the trends in risk finance in his 2002 article referenced in ‘c’ above. He recommended Cell Companies for employee benefits, concluding that the alternative risk transfer is an important factor to operate joint venture and multinational enterprise. 6. Founding Member of an International Academic Society. A founding member of the Asia-Pacific Risk and Insurance Association in 1997, Dr. Morimiya was the Society’s second president (1999 to 2001). Twice, he hosted its highly successful annual conference in Tokyo (2006 and 2011). APRIA expressed its appreciation for his service at the 2011 meeting, which took place in Tokyo and only 3 months after the horrific tsunami that struck Japan. Despite the enormous obstacles, Dr. Morimiya led his team to produce one of APRIA’s most outstanding conferences. 7. 8. Leadership in the Japanese Academic Societies. Dr. Morimiya is admired for his leadership in Risk Management and Insurance Academic Societies. Among his many academic professional roles were the following: 9. a. President, Japanese Society of Insurance Science, 1998-2002. b. President, Japanese Study for Systems Audits, 2007-2011. c. Board of Governors, the Society of Risk Analysis: Japan Section, 1998-2010. d. Board of Governors, the Japanese Association of Risk, Insurance, and Pension, 2002-2007. 10. Contribution to Globalization of Japanese Universities. Dr. Morimiya is one of the first Japanese scholars who presented papers at international conferences. Even after his retirement, he remains active in international academies. He seeks to promote globalization of Japanese Universities. As Deputy Chairman, the Center for International Exchange Programs of Meiji University, for example, he established exchange programs with many prestigious universities around the world, with a view to further promote the globalization of Japanese higher education. He played a leading role in the effort to globalize Meiji University. 11. Industrial Leadership As a speaker on a vast number of industry programs worldwide, Dr. Morimiya promoted international communication between Japanese insurance industry and the world. 1. Committee for Risk Finance Study, Ministry of Economy, Trade and Industry. He was appointed the Chair of the Committee for Risk Finance Study, Ministry of Economy, Trade and Industry, in 2005. The Committee was charged with the responsibility to produce a report on new perspectives on risky finance by Japanese companies. 2. Standardization of Risk Management System. After the Great Hanshin-Awaji Earthquake in 1995, Dr. Morimiya intensified his work to establish and spread a method for “structured” risk management in Japanese industries. An outcome is his book titled “JIS Q 2001: 2001 Guidelines for Development and Implementation of the Risk Management System” published by the Japanese Standards Association. The guidelines have had a strong influence on ISO31000: 2009 Risk Management Principles and Guidelines (JIS Q 31000: 2010) and ISO Guide73: 2009 Risk ManagementVocabulary (JIS Q 0073:2010). 3. Establishment of Meiji University Reunion of Workers in the Financial Industry. About 8,000 students graduate from Meiji University every year and about 20 percent of them works in the financial services industry. Dr. Morimiya established the alumni association of business major graduates and is now the President. Service to Society Dr. Morimiya has been very active in serving society throughout his entire career. Among his contributions are the following: 1. As a member of the Committee for Agricultural Disaster Compensation, Ministry of Agriculture, Forestry, he has received over 20 grants from a number of government institutions. 2. He served as a General Representative of several insurance companies, including: a. Meiji-Yasuda Life Insurance; b. Dai-ich Life Insurance; and 4 c. Dai-Hyaku Life Insurance. Currently, he serves on the Council of Insurance institutions, including a. Japan Institute of Life Insurance b. The General Insurance Institute of Japan; and c. The Life Underwriting Academy. Awards and Honors Dr. Morimiya has been honored with many awards, including: 1. The Minister Prize of Economic, Trade and Industry at the Conference of Standardization and Quality Control, Japan, 2014. 2. Kyobo Life Contribution Award at the 17th APRIA Annual Conference, 2013. 3. The Prize of Society of Risk Analysis, Japan, 2009. 4. The Distinguished Services Prize, Japan Information Processing Development Association (JIPDEC), 2007. 5. The Encouragement Prize of the Kagami Awards, the General Insurance Institute of Japan and Nippon Omni-Management Association, 1975. Curriculum Vitae Yasushi Morimiya was born in 1941 in Tokyo, Japan. He earned B.A. in Commerce in 1965 and Master of Commerce in 1967 from Meiji University. He was then invited to join the faculty as research associate in 1970. He was promoted to full professor in 1979. He spent the 1979/1980 academic year for research in risk management and insurance at the Wharton School, University of Pennsylvania. On his return to Japan, he began to facilitate globalization of not only Japanese insurance industries but also risk management and insurance academic societies and institutions. At Meiji University, he was appointed to several executive positions at Meiji University, including Executive Member (Academic Affairs), Board of Trustees, Deanship for the School of Commerce, and Deputy Chairmanship for the Center for International Exchange. Dr. Morimiya also participated actively in the insurance industry in Japan and internationally, serving on councils and committees while holding advisory and leadership positions. He is an author of several books in risk management and captive insurance. He retired from the University in 2014 but continues to remain an active participant and supporter for various government and industry committees as well as international academic societies. Nominator – Mariko Nakabayashi, Professor, Advisory Committee for President, Meiji University Seconds: 1. Toshiaki Egashira, Pepresentive Director, Executive Officer, MS&AD Insurance Group Holdings,Inc. (new for the 2016 nomination) 2. Masatoshi Sato, Former-Chairman and CEO, Sompo Japan Nipponkoa Insurance Inc.(current Senior Corporate Adviser) (new for the 2016 nomination) 3. Kenichi Fukumiya, Meiji University President (for the 2015 nomination as well) 4. Harold Skipper, Professor Emeritus, Georgia State University (for the 2015 nomination as well) 5