Victoria`s Industry Report 2013 - Department of Education and Early

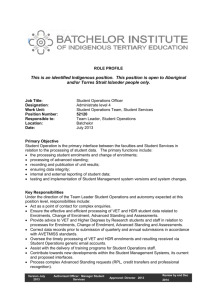

advertisement