Rate capping forum - Brief overview of alternatives to

advertisement

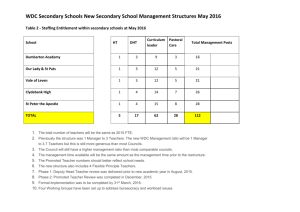

A Brief Overview of Alternatives to Amalgamation Dr Joseph Drew UNE Centre for Local Government. The 2007/08 amalgamation of Queensland councils has resulted in four deamalgamations thus far. In total 15 councils made bids for de-amalgamation and there is still an active de-amalgamation lobby group. This disastrous outcome is the result of ‘evidence free’ public policy. No empirical analysis was conducted prior to the amalgamations to support the claim of ‘Economies of Scale’. Fervent belief in never ending ‘Economies of Scale’ is the result of public policy advisers sleeping through the second half of the first lesson of Introductory Economics. Increased output can result in lower total average costs, however as output expands most production functions also exhibit evidence of increasing total average costs: what economist refer to as ‘Diseconomies of Scale’. Not content to allow the Queensland government to hold the prize for most incompetent public policy, the NSW government has also embarked on an illinformed forced amalgamation program. However, in the case of NSW the program is ‘evidence defiant’ rather than ‘evidence free’. That is, the NSW government is pushing through with its agenda despite 8 double blind peer review papers which demonstrate that the Fit for the Future reforms will result in decidedly ‘unfit’ municipalities. The real problem with forced amalgamation is that as long as politicians see it as the panacea to all local government financial sustainability problems little attention will be paid to more promising and less disruptive reforms. Alternatives to Amalgamation Financial Assistance Grant (FAG) reforms. The FAGs are not allocated in a consistent manner by the various states and territory. Moreover, the FAG allocations do not achieve the lofty objectives embodied in the legislation: full horizontal equalisation. Reform to the federal legislation is crucial to address this. Drew and Dollery (2015a) demonstrate the failure of the current system and discuss required reforms in a recent paper at Public Administration Quarterly. This is a particular problem for rural councils and councils with low revenue capacity. Political Structure. Recent research by Drew and Dollery (2015b) has demonstrated at the highest level of statistical significance an association between the number of wards and per capita expenditure. Consideration should be given to the necessity for ward structures; particularly wards set up subsequent to the Kennett amalgamations. Shared Services. Has great potential for increasing scale for specific municipal functions. It is an obvious reform for regional planning and advocacy. For other arrangements it is important to conduct empirical assessment of the quantum of possible savings arising from increased scale to ensure that these will be greater than the transaction costs. It is also important to ensure strong legislative support for shared service arrangements. Local Government Tax Reform. The biggest danger in rate capping is fiscal illusion. Rate capping in NSW has resulted in lower efficiency, higher per household debt and lower rates of asset maintenance. It has also resulted in significant intermunicipal inequity which in turn leads to inefficient migration of capital and labour. Personal Finance Theory offers a number of remedies which negate the need for Rate Capping. Agency Theory also offers a number of alternatives to Rate Capping. Price Benchmarking. Local Government participation in the provision of private goods distorts the market. Moreover, if the price of goods is lower than the value conferred by the good then an inefficient quantity of goods will be produced. Thus, should a local government find it necessary to produce private goods in order to address market failure then it is incredibly important that the council has an accurate knowledge of the cost of provision and prices the goods according to market price. Resident Education. When councils do not educate residents then the residents form opinions on the basis of assumptions and perceptions. This may damage the ‘brand’ of a council. It is important to reach out to the community with accurate information on the costs and rationale for service programs so that residents can make informed decisions and contribute constructively to debates. Collaboration with Academics. There are some exciting advances in empirical methods which have the potential to improve local government decision making. Academics are happy to collaborate with the local government sector. Collaboration with academics to improve municipal practice reduces the chances of deleterious and disruptive ‘top down’ reforms in the future. Efficiency Analysis. ‘Efficiency’ metrics used in NSW and Victoria do not measure efficiency. Technical efficiency is the conversion of inputs (staff and capital) into a set of outputs (best proxied by the number of assessments for each rating class and length of municipal roads). Using metrics such as those employed in Victoria implicitly assumes that councils don’t spend money on roads and that the cost to service residential, business and farm assessments is the same. This is simply wrong. Drew and Dollery (2015c, 2015d, 2015e) are leading the world in the application of intertemporal efficiency analysis to the municipal sector. Inter temporal data envelopment analysis can provide councils with a single efficiency score between 0 and 1 using the correct definition for efficiency. This measurement of efficiency allows councils to measure changes in efficiency over time as well as compare efficiency with peers. Debt Capacity Modelling. Financial ratios are unreliable, do not incorporate sufficient information and rely on arbitrary ‘evidence free’ benchmarks. In fact, Drew (2015) has shown that the use of six different financial ratios employed by the various states and ‘expert’ agencies results in six completely different lists of councils which supposedly have significant debt problems. An econometric approach provides a much more accurate representation of a council’s debt burden relative to its capacity. Moreover, debt capacity modelling allows councils to understand how much additional debt might be accommodated and allows councils to manage their debt before it becomes problematic. Depreciation Benchmarking. This econometric application provides an estimate of the ‘industry standard’ for the quantum of depreciation for a specific profile of assets, along with confidence intervals to allow for professional judgement. Extant depreciation as a rate of depreciable infrastructure property, plant and equipment (IPPE) ranges from 1% through to 4.9%. Clearly, this wide disparity presents all sorts of problems for the measurement of council performance, accuracy and reliability of financial statement data and the management of assets. Residential Revenue Effort. Rates are calculated according to the stock of wealth embodied in land and improvements. However, rates are paid out of flows of income. It is thus very important for councils to know their residential revenue effort and how it compares with respect to peers in Victoria. This will be critical information for Special Rate Variations going forward. Research by Drew and Dollery (2015f) indicates that the disparity in revenue effort will widen under a rate capping regime. Interpreting Performance Indicators. With the exception of the absence of reliable efficiency, debt and depreciation metrics the Victorian performance monitoring system is very comprehensive and a valuable source of information for supporting municipal decision making. However, the breadth of the performance indicators means that it will have limited usefulness in the absence of empirical analysis. Factor Analysis is one way of condensing the information into just a few numbers which can then be used to assess performance in specific fields, relative to peers. Agglomeration analysis can group councils according to a robust empirical methodology. I encourage councils to seek assistance in this task so they can extract maximum value from the performance monitoring data. I applaud the MAV for taking the trouble to link academics, consultants and councils together. This is critical to the on-going health of the sector, particularly given the looming challenges of rate capping. Academics are more than happy to apply their world class empirical advances to helping to solve the problems which councils might face. Should further information be required please feel free to contact the author at the UNE Centre for Local Government or on my mobile 0416 489 475. Thanks.