Industrial Development Potential

advertisement

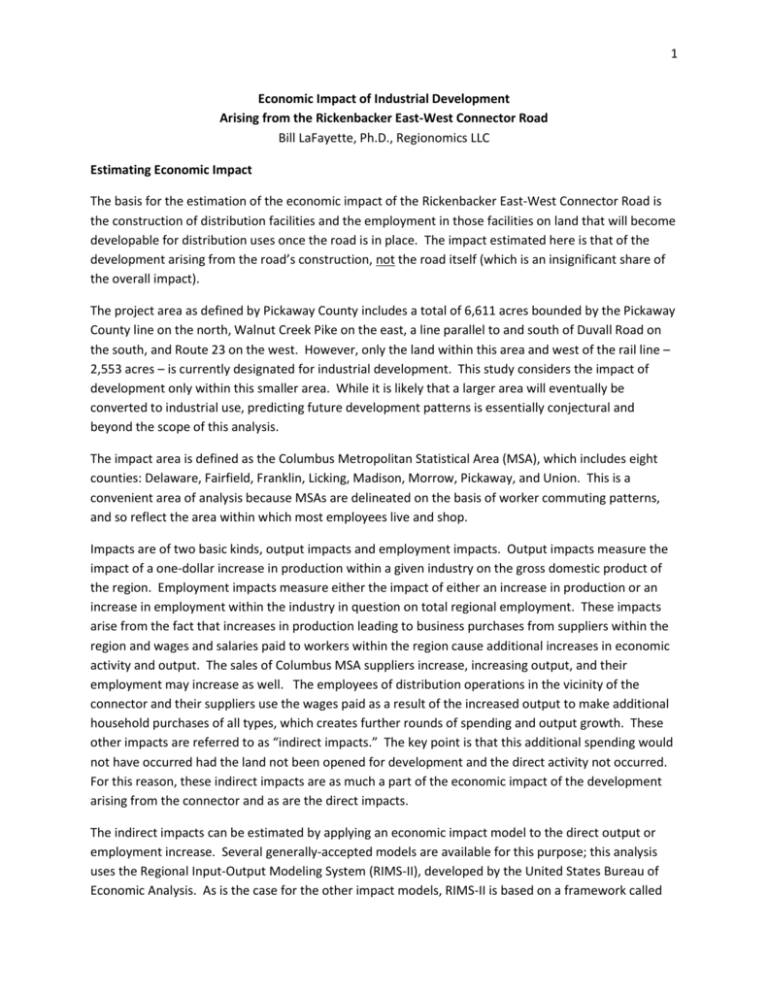

1 Economic Impact of Industrial Development Arising from the Rickenbacker East-West Connector Road Bill LaFayette, Ph.D., Regionomics LLC Estimating Economic Impact The basis for the estimation of the economic impact of the Rickenbacker East-West Connector Road is the construction of distribution facilities and the employment in those facilities on land that will become developable for distribution uses once the road is in place. The impact estimated here is that of the development arising from the road’s construction, not the road itself (which is an insignificant share of the overall impact). The project area as defined by Pickaway County includes a total of 6,611 acres bounded by the Pickaway County line on the north, Walnut Creek Pike on the east, a line parallel to and south of Duvall Road on the south, and Route 23 on the west. However, only the land within this area and west of the rail line – 2,553 acres – is currently designated for industrial development. This study considers the impact of development only within this smaller area. While it is likely that a larger area will eventually be converted to industrial use, predicting future development patterns is essentially conjectural and beyond the scope of this analysis. The impact area is defined as the Columbus Metropolitan Statistical Area (MSA), which includes eight counties: Delaware, Fairfield, Franklin, Licking, Madison, Morrow, Pickaway, and Union. This is a convenient area of analysis because MSAs are delineated on the basis of worker commuting patterns, and so reflect the area within which most employees live and shop. Impacts are of two basic kinds, output impacts and employment impacts. Output impacts measure the impact of a one-dollar increase in production within a given industry on the gross domestic product of the region. Employment impacts measure either the impact of either an increase in production or an increase in employment within the industry in question on total regional employment. These impacts arise from the fact that increases in production leading to business purchases from suppliers within the region and wages and salaries paid to workers within the region cause additional increases in economic activity and output. The sales of Columbus MSA suppliers increase, increasing output, and their employment may increase as well. The employees of distribution operations in the vicinity of the connector and their suppliers use the wages paid as a result of the increased output to make additional household purchases of all types, which creates further rounds of spending and output growth. These other impacts are referred to as “indirect impacts.” The key point is that this additional spending would not have occurred had the land not been opened for development and the direct activity not occurred. For this reason, these indirect impacts are as much a part of the economic impact of the development arising from the connector and as are the direct impacts. The indirect impacts can be estimated by applying an economic impact model to the direct output or employment increase. Several generally-accepted models are available for this purpose; this analysis uses the Regional Input-Output Modeling System (RIMS-II), developed by the United States Bureau of Economic Analysis. As is the case for the other impact models, RIMS-II is based on a framework called 2 an input-output table. For a given industry in a given geographical area, the input-output table shows the increase in purchases from other local firms by industry and the sales to other local firms by industry that result from a one dollar increase in the given industry’s output. Thus, the input-output table can be used to derive the impact on other local firms of an increase in production within a specific industry. These impacts are specific both to a given industry and to a given region. The array of suppliers that benefit from an increase in demand for distribution and logistics services is generally the same regardless of location. But if the structure of the regional economy is such that these companies are forced to make most of their purchases from vendors outside the region, then most of the impact will leak from the economy. Conversely, a broad regional economy with a wide array of suppliers will keep more of the impact of the output increase circulating within the economy, and the impact of an increase in activity in the area of the connector will be much greater. Thus, the values within the input-output table are unique both to the industry and to the MSA. RIMS-II summarizes the information in the regional input-output table by calculating a set of unique impact factors for each of 490 detailed industries within the Columbus MSA. Because of their origin in the input-output table, the factors implicitly reflect the structure of the regional economy and the presence or absence of suppliers within the Columbus MSA. In the case of construction impacts, the construction cost – and hence the impact on output – is available but the number of direct and indirect jobs sustained by the construction activity is not. On the other hand, the number of jobs supported by operations in a given number of square feet of development is available but the operating output is not. Because the RIMS-II multipliers are interrelated, the missing component (jobs for construction and output for operations) can be estimated along with associated indirect impacts by using the available component to back into the missing one. 1 Specifically, the given construction cost in producer-price terms is multiplied by the factor relating direct and total output to give the total impact on regional GDP; the indirect impact is the difference between total impact and indirect impact. Another factor represents the total number of jobs (direct and indirect) sustained by a $1 million increase in construction output. This is used to estimate the total impact on regional employment resulting from the construction activity. Direct jobs are obtained by dividing this total by the factor representing the number of total jobs sustained by each direct construction job; indirect jobs are the difference between total and direct. For the operating impacts, the given number of direct jobs enabled by the development is multiplied by the factor relating direct transportation and warehousing jobs and total jobs to obtain the total employment impact. Dividing total jobs by the factor relating transportation and warehousing output and total employment gives the direct output sustained by the employment (in millions). This result multiplied by the factor relating direct and total output gives the total and hence the indirect output impact. 1 The RIMS-II model requires that direct output activity be converted to producer-price terms, and all derived indirect and total output amounts are also in producer-price terms. The RIMS-II system includes the necessary conversion factors. 3 Estimating Construction and Operating Impacts of Development Enabled by the East-West Connector Impacts arising from development enabled in the 2,553-acre area by the East-West Connector are inherently speculative, so it is prudent to construct a range of impact estimates based on the amount of land opened for development and the rate at which development occurs. It is assumed that development will occur at an even pace over 10, 20, or 30 years.2 Output impacts are the present value of 40 years’ worth of the annual construction and operating impacts. Development and employment made possible on the available acreage are estimated from existing development patterns and employment in the Rickenbacker area. (It is implicitly assumed that the new development will resemble the existing development nearby in both type and scale.) On average, buildings in the Rickenbacker area occupy approximately 20,000 square feet of each acre (a floor area ratio of 46 percent); those 20,000 square feet accommodate approximately 10 workers. Thus, the 2,553-acre area can accommodate 51.06 million square feet of development and employ nearly 17,800. Construction costs are obtained by surveying executives at local construction companies and averaging the results, giving a construction cost per square foot of $39.25. Not all of this development can be counted as impact, however. Impact is created only by development that would not occur within the MSA if the road were not built. Newly-attracted projects create an impact, but so do existing projects that would have relocated to a different region had the developable land not been created. (Economists call this a “blockage impact.”) It is assumed that other projects locating in the study area would have located elsewhere in the MSA if the new acreage were not available for development. Because the construction and employment would have occurred within the region whether the connector were developed or not, this impact is a wash. It is assumed that 40 percent of the total new development represents attraction and one-half of the remaining development represents a blockage impact, so 70 percent of the total development creates a net impact on the regional economy. The final parameter needed is the discount rate to bring future output totals to present value terms. This rate must be estimated with care because the present value of long-term cash flows is highly sensitive to the discount rate. Because the flows cannot be forecast with precision, occur over a long period, and do not include inflation, the correct discount rate is a long-term real (i.e., inflation-adjusted) equity discount rate. Using the standard approach, this rate is constructed as a risk-free rate less a premium for expected inflation plus a risk premium. The risk-free rate is the average 30-year constantmaturity Treasury rate for May 2011 (4.3 percent) less an inflation premium of 2.0 percent. The equity risk premium is 3.5 percent, based on recent work of Donaldson, Kamstra, and Kramer.3 This results in a discount rate of 5.8 percent. 2 The impact includes only that of the initial construction, not demolition and construction of replacement facilities. 3 Donaldson, R. Glen, Mark J. Kamstra, and Lisa A. Kramer. "Estimating the Equity Premium." Journal of Financial & Quantitative Analysis 45.4 (2010): 813-846. Business Source Premier. EBSCO. Web. 1 July 2011. 4 Results of the Estimation The results of the analysis described in the previous sections are summarized below. Table 1 presents the total present value (in thousands) of the output impacts of the construction and operation of facilities under each of the three assumptions regarding the time required fully to develop the 2,553 acres. Table 2 gives the estimates of direct and indirect employment at five-year intervals to year 30. (Direct construction and warehouse employment are combined.) Table 1: Output Impacts (Dollar amounts in thousands) Development period 10 years 20 years Construction Direct Indirect Total Operating Direct Indirect Total Total Direct Indirect Total Year 5 10-year development Direct 8,255 Indirect 7,374 Total 15,629 20-year development Direct 4,127 Indirect 3,687 Total 7,814 30-year development Direct 2,752 Indirect 2,458 Total 5,210 $ 842,554 1,296,776 $ 2,139,330 $ 661,001 1,017,347 $ 1,678,348 30 years $ 531,609 818,199 $ 1,349,808 $ 16,216,344 18,300,144 $ 34,516,488 $ 12,147,951 13,708,963 $ 25,856,914 $ 9,248,426 10,436,849 $ 19,685,274 $ 17,058,898 19,596,919 $ 36,655,818 $ 12,808,952 14,726,310 $ 27,535,262 $ 9,780,035 11,255,048 $ 21,035,082 Table 2: Employment Impacts Year 10 Year 15 Year 20 Year 25 Year 30 17,190 14,803 31,993 17,871 14,858 32,729 17,871 14,858 32,729 17,871 14,858 32,729 17,871 14,858 32,729 8,595 7,401 15,997 13,063 11,116 24,179 17,531 14,830 32,361 17,871 14,858 32,729 17,871 14,858 32,729 5,730 4,934 10,664 8,709 7,411 16,119 11,687 9,887 21,574 14,666 12,363 27,029 17,644 14,840 32,484