Master Rule 506(d) Covered Person Worksheet

Master Rule 506(d) Covered Person Worksheet

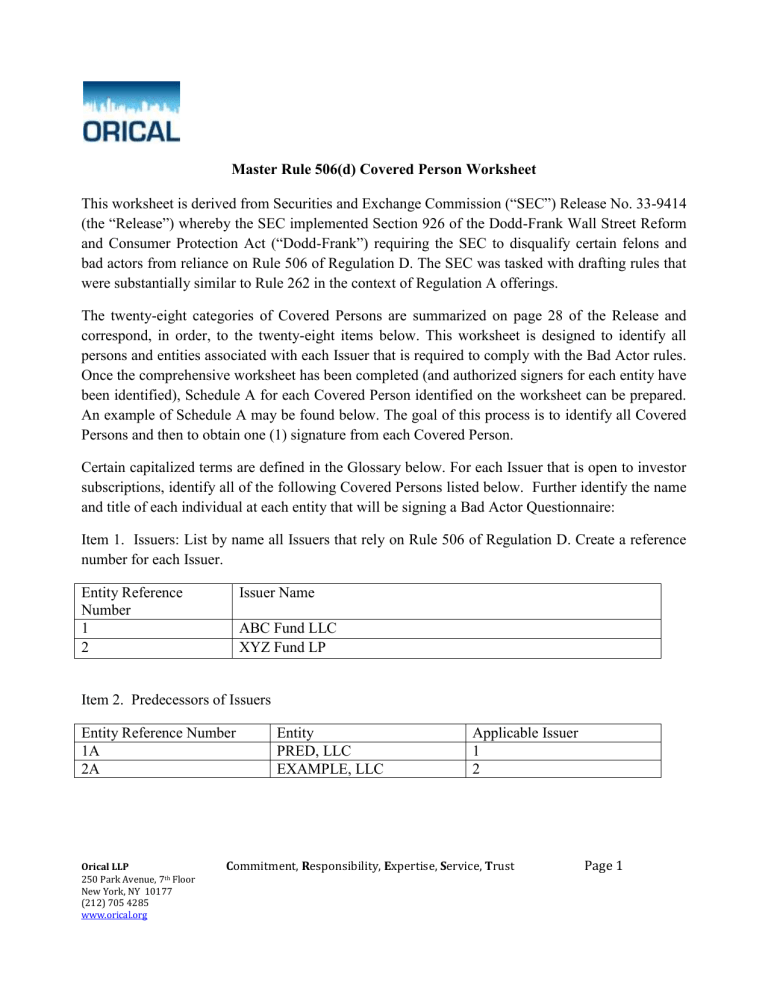

This worksheet is derived from Securities and Exchange Commission (“SEC”) Release No. 33-9414

(the “Release”) whereby the SEC implemented Section 926 of the Dodd-Frank Wall Street Reform and Consumer Protection Act (“Dodd-Frank”) requiring the SEC to disqualify certain felons and bad actors from reliance on Rule 506 of Regulation D. The SEC was tasked with drafting rules that were substantially similar to Rule 262 in the context of Regulation A offerings.

The twenty-eight categories of Covered Persons are summarized on page 28 of the Release and correspond, in order, to the twenty-eight items below. This worksheet is designed to identify all persons and entities associated with each Issuer that is required to comply with the Bad Actor rules.

Once the comprehensive worksheet has been completed (and authorized signers for each entity have been identified), Schedule A for each Covered Person identified on the worksheet can be prepared.

An example of Schedule A may be found below. The goal of this process is to identify all Covered

Persons and then to obtain one (1) signature from each Covered Person.

Certain capitalized terms are defined in the Glossary below. For each Issuer that is open to investor subscriptions, identify all of the following Covered Persons listed below. Further identify the name and title of each individual at each entity that will be signing a Bad Actor Questionnaire:

Item 1. Issuers: List by name all Issuers that rely on Rule 506 of Regulation D. Create a reference number for each Issuer.

Issuer Name Entity Reference

Number

1

2

ABC Fund LLC

XYZ Fund LP

Item 2. Predecessors of Issuers

Entity Reference Number

1A

2A

Entity

PRED, LLC

EXAMPLE, LLC

Applicable Issuer

1

2

Orical LLP Commitment, Responsibility, Expertise, Service, Trust

250 Park Avenue, 7 th Floor

New York, NY 10177

(212) 705 4285 www.orical.org

Page 1

Item 3. Affiliated Issuers: List any affiliated Issuer not listed above in Item 1.

Entity Reference Number

1B

2B

Affiliated Issuer Name

Item 4. Director(s) of the Issuer(s)

Individual’s Name

Applicable Issuer(s)

Applicable Issuer

Item 5. Executive Officer(s) of the Issuer(s)

Individual’s Name

Applicable Issuer(s)

Item 6. Other Officer(s) of the Issuer(s) participating in the offering

Individual’s Name

Applicable Issuer(s)

Item 7. General Partner(s) of the Issuer(s)

Entity Reference Number

1C

2C

General Partner Name

Item 8. Managing Member of the Issuer(s)

Managing Member Name Entity Reference Number

2

Applicable Issuer

Applicable Issuer

Item 9. Beneficial Owner of 20% or more of the Voting Power of the Issuer(s)

Beneficial Owner Applicable Issuer

Item 10. Investment Manager to the Issuer(s)

Entity Reference Number Investment Manager Name Applicable Issuer

Item 11. Director(s) of the Investment Manager

Individual’s Name

Applicable Investment Manager(s)

Item 12. Executive Officer(s) of the Investment Manager

Individual’s Name

Applicable Investment Manager(s)

Item 13. Other Officer(s) of the Investment Manager participating in the offering

Individual’s Name

Applicable Investment Manager(s)

Item 14. General Partner of the Investment Manager

Entity Reference Number General Partner Name Applicable Investment

Manager

3

Item 15. Managing Member of the Investment Manager

Entity Reference Number Managing Member Name Applicable Investment

Manager

Item 16. Director(s) of the General Partner of the Investment Manager

Individual’s Name

Applicable General Partner

Item 17. Executive Officer(s) of the General Partner of the Investment Manager

Individual’s Name

Applicable General Partner

Item 18. Other Officer(s) of the General Partner of the Investment Manager participating in the offering

Individual’s Name Applicable General Partner

Item 19. Director(s) of the Managing Member of the Investment Manager

Individual’s Name

Applicable Managing Member

Item 20. Executive Officer(s) of the Managing Member of the Investment Manager

Individual’s Name

Applicable Managing Member

4

Item 21. Other Officer(s) of the Managing Member of the Investment Manager participating in the offering

Individual’s Name Applicable Managing Member

Item 22. Promoters connected with the Issuer in any capacity

Entity Reference Number Promoter Entity Name Applicable Issuer

Individual Promoter’s Name Applicable Issuer

Item 23. Compensated Solicitors on behalf of Issuers

Entity Reference Number Compensated Solicitor Name Applicable Issuer

Item 24. Director(s) of a Compensated Solicitor

Individual’s Name

Applicable Compensated Solicitor

Item 25. Executive Officer(s) of a Compensated Solicitor

Individual’s Name

Applicable Compensated Solicitor

Item 26. Other Officer(s) of a Compensated Solicitor participating in the offering

Individual’s Name

Applicable Compensated Solicitor

5

Item 27. General Partner of a Compensated Solicitor

Entity Reference Number Entity

Item 28. Managing Member of a Compensated Solicitor

Entity Reference Number Entity

Applicable Compensated

Solicitor

Applicable Compensated

Solicitor

6

Glossary

Compensated Solicitor

: The term “compensated solicitor” includes any placement agent, finders or anyone else paid directly or indirectly in connection with the sale of securities. The Release suggests that for a registered broker-dealer acting as placement agent, the contract between the

Issuer and that broker-dealer should include ongoing representations and warranties and covenants with respect to compliance with these bad actor requirements. In addition, periodic checks should be made of publicly available databases such as BrokerCheck maintained by FINRA and the SEC’s

Investment Adviser Public Disclosure (“IAPD”) database. Release pages 28, 67, 68 and footnote

202.

Executive Officer

: The term “executive officer” is defined in Rule 501(f) of Regulation D (and in

Rule 405) to mean a company’s “president, any vice president . . . in charge of a principal business unit, division or function (such as sales, administration or finance), any other officer who performs a policy making function or any other person who performs similar policy making functions.”

Release footnote 34.

Investment Manager

: The SEC chose not to use the term “investment adviser.” The broader term

“investment manager” includes investment advisers but also includes managers of assets in addition to securities such as commodities, real estate and certain derivatives. Release footnote 65.

Issuer : The Issuer of securities includes any hedge fund or private equity fund that is open for periodic investor subscriptions where the fund issues its securities pursuant to a Rule 506 of

Regulation D exemption from the registration requirement of the Securities Act of 1933. Offerings conducted in reliance on Rule 506 account for 99% of the capital reported as being raised under

Regulation D from 2009-2012. Release p. 91.

Officer

: Under Rule 405, the term “officer” is defined as a “president, vice president, secretary, treasurer or principal financial officer, comptroller or principal accounting officer, and any person routinely performing a corresponding function with respect to any organization. Release footnote

31. The Release indicates that participation in an offering would have to be more than transitory or incidental involvement and could include activities such as participation or involvement in due diligence activities, involvement in the preparation of disclosure documents, and communication with the issuer, prospective investors or other offering participants. Release p. 17.

Promoter : The term “promoter” is intended to be very broad. Rule 405 defines “promoter” to mean any person (individual or legal entity) who: (i) acting alone or together with others, directly or indirectly takes initiative in founding or organizing the business or enterprise of an issuer; or (ii) in connection with the founding or organization of the business or enterprise of an issuer, directly or indirectly receives 10% or more of any class of issuer securities or 10% or more of the proceeds from the sale of any class of issuer securities. The result does not change if there are other legal entities (which themselves may be promoters) in the chain between that person and the issuer.

Release p. 27 and 28 as well as footnote 77.

7

Voting Power : By asking for identification of Beneficial Owners of 20% of the Issuer’s Voting

Power, the SEC intends to capture security holders (fund investors) that have or share the ability, either currently or on a contingent basis, to control or significantly influence the management and policies of the issuer through the exercise of a voting right. For example, the SEC would consider that securities that confer to security holders the right to elect or remove the directors or equivalent controlling persons of the issuer, or to approve significant transactions such as acquisitions, dispositions or financings, would be considered voting securities that have Voting Power for purposes of the rule. Conversely, securities that confer voting rights limited solely to approval of changes to the rights and preferences of a particular class of offered securities would not be voting securities and would have no Voting Power. The 20% of Voting Power test looks at the Issuer’s total outstanding voting equity securities (not class by class). Release p. 21.

8