WEMA_Presentation

advertisement

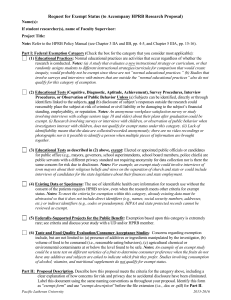

The Role of the Issuer David Todd: Director of Sales OmniArch Capital The information enclosed is for informational purposes only and is not a solicitation as to any investment product. This information is inherently limited in scope and does not contain all of the applicable terms, conditions, limitations and exclusions of the investment described herein. The information contained herein may contain public information and is for information purposes only. The views and opinions expressed herein are the opinions and views of the publisher and reporter, not created to promote sale of any investment product. This is not a solicitation for sale or purchase of securities, without the appropriate exemption documents being provided to prospective purchasers. This investment is only for investors by way of subscription agreement. Discussion Points 1. The Market 2. Role of the Issuer 3. Issuers and Vertical Markets 4. Bringing Product to Market 5. Product Examples The Exempt Market • • • • Sept 28, 2010 / NI 31-103 Exempt from the Prospectus Exemptions Provincially Regulated Includes • OM Exemptions • Hedge Funds • Bonds & PPNs Role of the Issuer • To create and develop the investment product or opportunity • To create the Offering Memorandum • Register with the Provincial Securities Commission • Present the product to EMDs (Exempt Market Dealers) for sale • Some Issuers are also their own EMDs but this is not the norm Vertical Market Applications • Issuers operate in different Vertical Markets • Prestige Capital / Building Hotels • Chestermere Lands / Land Development • Solar Income Fund / Green Energy • 982 Media / P&A of Film Industry Bringing Product to Market • Issuers bring product to market through the Offering Memorandum • The steps in getting to the OM are: 1. The Product “In / Development / Exit” is planned 2. The Analytics / Partnerships / Strategy are planned 3. The initial OM is written and corporate disclosures added 4. The OM is developed with / through law firms 5. The OM is registered with the commission 6. The OM is approved by the EMD 7. The OM must be presented to the investor Product Examples OM Dictates The Terms Of The Investment • • • • 5 Year Investment Term – Early Exit Available Predictable Cash Flow RRSP/TFSA/RIF/LIRA/Cash $5,000 CDN Minimum Investment OM Declares “How” The Investment Works 15 Year Time Frame M I L L I O N D O L L A R S 5% Interest (Coupon Rate) = $50,000 5 Year Hold Protective Spread $ 3 0 0 K 10% Interest to Investor = $30,000 Face Value (Current Worth) Liquidity Within The Exempt Market • 1 Year Committed Funds • 90 Days Written Notice • Declining Redemption Fee Media As An Asset Class Non Correlation Portfolio Diversification Senior Debt Inversely Related EM Can Provide Non-Correlation Print & Advertising of Motion Pictures • • • Investment in Senior Secured Loans Last In First Out (LIFO) Secured against the gross cash flow of the film Investments Can Be Inversely Related Box Office S&P 500 10 20 09 20 08 20 07 20 06 20 05 20 04 20 03 20 02 20 01 20 20 00 12 10 8 6 4 2 0 Investment Overview Summary of Fund • $5,000 CDN Minimum Investment (Registered Available) • 6% Preferred return (paid quarterly) and 50% profit participation • RRSP / TFSAS / RIF / LIRA / Cash • Potential 10 Year Dividend Stream • ROC starts approximately 5 yrs after investment date Product Examples • Examples have provided: • Diversification • Non-Correlation • Inverse Relationship • Predictable Returns Canadian Exempt Market “The Exempt Market is going main stream”…