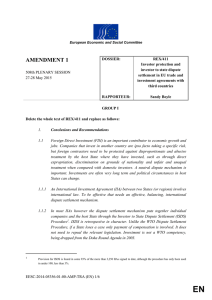

Investor protection and Investor to state dispute settlement in EU

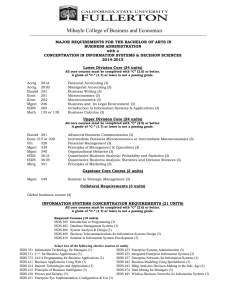

advertisement

European Economic and Social Committee REX/411 Investor protection and investor to state dispute settlement in EU trade and investment agreements with third countries Brussels, 21 May 2015 Information Memo (508th plenary session) Opinion of the European Economic and Social Committee on Investor protection and investor to state dispute settlement in EU trade and investment agreements with third countries OPINION: EESC-2014-05356-00-00-AS-TRA 1. Procedure Legal basis: Rule 29(2) of the Rules of Procedure Plenary Assembly decision: 10 July 2014 Section responsible: External Relations Section president: Mr Zufiaur Narvaiza (GR II – ES) Organisation of section work: Study Group on President: Investor protection and investor to state dispute settlement in EU Rapporteur: trade and investment agreements with third countries Members: Jonathan Peel (Gr. I–UK) Sandy Boyle (Gr. II–UK) Benedicte Federspiel (Gr. III–DK) Vitālijs Gavrilovs (Gr. I–LV) Christoph Lechner (Gr. II–AT) Paul Lidehäll (Gr. II–SE) Lutz Ribbe (Gr. III–DE) Igor Šarmír (Gr. I–SK) Dilyana Slavova (Gr. III–BG) OPINION ADOPTED by the section by 57 votes to 29 with 6 abstentions. REX/411 – EESC-2014-04956-00-00-NISP-TRA (EN) 1/3 Rue Belliard/Belliardstraat 99 — 1040 Bruxelles/Brussel — BELGIQUE/BELGIË Tel. +32 25469011 — Fax +32 25134893 — Internet: http://www.eesc.europa.eu EN 2. Background Since the entry into force of the Lisbon Treaty, the investment policy is an exclusive competence of the European Union. The EU is aiming to include therefore in the new trade and investment agreements provisions on investor protection and investor to state dispute settlement (ISDS) which will replace existing Bilateral Investment Agreements (BIT) signed by Member States and will grant the same level of protection to all EU investors. Despite the fact that most of the BITs singed by Member States include provisions on ISDS, the fact that the mandate unanimously given by EU Member States to the European Commission in June 2013 on TTIP includes the possibility for the European Commission to negotiate ISDS provisions in the Transatlantic trade and investment agreement (TTIP) provoked unprecedented public interest. In response to this interest the European Commission launched a public consultation on Investor protection and ISDS in the TTIP. Similar provisions are also currently negotiated with Japan and have been negotiated with Canada. Negotiations on an investment agreement with China are also under negotiation. Therefore, it is important to prepare an opinion of the Committee on this subject in order to define the Committee policy on investment protection and ISDS in trade and investment agreement. The objective is also to evaluate if this mechanism should be included in all investment agreements and ensure that if investment protection and ISDS provisions are included in new agreements, they represents an improvement in comparison to the provisions in existing BIT and clearly guarantees the right of governments to legislate in the public interest while also protecting the rights of investors. It is also important to clarify how the system will be more transparent and will prevent any unjustified abuses of the ISDS. 3. Gist of the opinion Foreign Direct Investment (FDI) is an important contributor to economic growth and foreign investors must have global protection against direct expropriation, be free from discrimination and enjoy equivalent rights as domestic investors. ISDS is an instrument of public international law that grants a foreign investor the right to initiate dispute settlement proceedings against a foreign government under the terms of an IIA. The Treaties are designed to create some basic obligations of the parties regarding foreign investment, by providing guarantees that governments will respect key principles such as an obligation not to discriminate on grounds of nationality and to ensure fair and equitable treatment a prohibition of direct or indirect expropriation without prompt, adequate and protective compensation protection on the possibility to transfer capital. Over time a number of abuses have arisen through the use of ISDS and these now need to be addressed. The systematic shortcomings arising from the working of ISDS include opacity, lack of clear rules of arbitration, the lack of right of appeal, discrimination against domestic investors who cannot use the system, the fear that purely speculative investments are protected, which, inter alia, do not have the effect of creating jobs, and the fear of exploitation by specialist legal firms. The objective now is to propose an alternative dispute settlement procedure in the interest of reconciling the REX/411 – EESC-2014-04956-00-00-NISP-TRA (EN) 2/3 legitimate demands of investors with the concerns of other civil society resulting from such negative perceptions with ISDS. The public consultation, organised by the European Commission highlighted a marked division between the views of the broad business community and those in the vast majority of responses from the rest of CS. In contrast to CETA, it has helped make TTIP negotiations more transparent and sets an important precedent which the Committee firmly believes must now be followed in all future trade negotiations. The response of the European Commission to this consultation was to identify four particular areas for further more detailed reflection: protection of the right to regulate, establishment and functioning of arbitral tribunals, relationship between domestic judicial systems and ISDS, review of the ISDS decisions through an appellate mechanism. While the EESC does not see this as an all-inclusive list, the opinion tries to provide detailed input on these specific issues. In general, the EESC considers that the need for FDI protection varies from country to country. In countries with a democratically functioning mature legal system free from corruption, investment disputes should be dealt with by mediation, domestic courts and State to state resolution. These components are present in EU, US and Canada and the current high levels of transatlantic investment flows show conclusively that the lack of ISDS provision does not impede investment. The EESC therefore concludes that an ISDS provision is not necessary in TTIP or CETA and is opposed to its inclusion. ISDS has in fact the potential to derail both TTIP and CETA. The EC needs to consider if continuing to pursue this politically sensitive and publicly unpopular objective is a sensible and correct way forward. There is a clear message emerging from developing countries that ISDS is an unacceptable mechanism which will be strongly resisted by an increasing number of important global players. If an alternative system is not found, it will become more difficult to incorporate investor protection into future agreements with countries where it is most needed. The EESC strongly urges the EC to consider the UNCTAD proposals for Reform of ISDS and concludes that the establishment of an International Investment Court provides the best solution to ensure a democratic, fair, transparent and equitable system. _____________ REX/411 – EESC-2014-04956-00-00-NISP-TRA (EN) 3/3