Proceedings of Annual Tokyo Business Research Conference

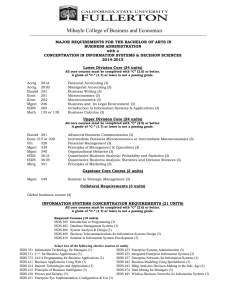

advertisement

Proceedings of Annual Tokyo Business Research Conference 9 - 10 November 2015, Shinjuku Washington Hotel, Tokyo, Japan, ISBN: 978-1-922069-88-7 Impact of The Investor State Dispute Settlement in The TTIP: Portuguese Analysis Cátia Marques Cebola* and Ricardo Campos Fernandes** This paper attempts to analyze the impact of the Investor State Dispute Settlement (ISDS) inserted in the Transatlantic Trade and Investment Partnership between US and EU (TTIP). The ISDS clauses grants a foreign investor the right to use dispute settlement proceedings against a Government when the protected rights of the trade treaty are breached, usually using arbitration courts. This possibility may jeopardize the State’s right to regulate public interests. In fact, most ISDS cases concern governments’ administrative measures, such as the invalidation of licenses or permits and land zoning. Therefore, the opponents of the ISDS clauses question their impact on the governments’ ability to implement legal reforms and policy programs related with public interests, such as environmental protection, labour rights or public health; since Governments have to obey the arbitration court decisions that will be based on the treaty clauses and not on the legal and constitutional rules of each country. We also highlight the lack of transparency on arbitration proceedings as another critical issue. Furthermore, the parties elect the arbitrators, a fact that might threat the independence and impartiality of the chosen referees. Nevertheless, data shows that European judicial systems face several problems, with the slowness being one of the main critical complications. Therefore, investment arbitration is essential in order to quickly and effectively solve conflicts that may emerge from the TTIP implementation. Under a qualitative methodology, we analyze the awards impact under the existing trade treaties indicating which guarantees should be addressed in the TTIP to ensure that their positive economic effects are not threaten by the ISDS clause. JEL Codes: K4, K330 Track: Economics Keywords: ISDS, TTIP, Investment, Arbitration *Dr. Cátia Marques Cebola, CIEJ - Research Centre on Legal Studies, ESTG, Polytechnic Institute of Leiria, Portugal. Email: catia.cebola@ipleiria.pt **Dr. Ricardo Campos Fernandes, Lawyer, Portugal, Email: r.direito@hotmail.com