Grade 12 Economics Exam September 2014 Paper 2

advertisement

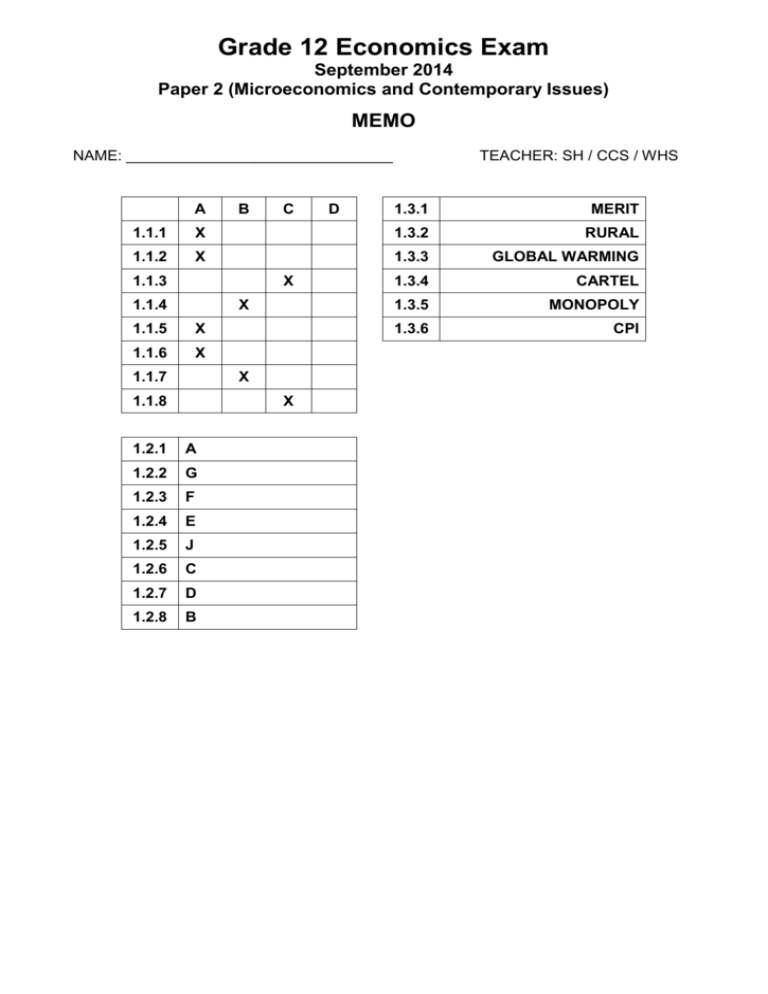

Grade 12 Economics Exam September 2014 Paper 2 (Microeconomics and Contemporary Issues) MEMO NAME: _______________________________ A B C D TEACHER: SH / CCS / WHS 1.3.1 MERIT 1.1.1 X 1.3.2 RURAL 1.1.2 X 1.3.3 GLOBAL WARMING 1.3.4 CARTEL 1.3.5 MONOPOLY 1.3.6 CPI 1.1.3 X 1.1.4 X 1.1.5 X 1.1.6 X 1.1.7 X 1.1.8 X 1.2.1 A 1.2.2 G 1.2.3 F 1.2.4 E 1.2.5 J 1.2.6 C 1.2.7 D 1.2.8 B SECTION B (ANSWER TWO QUESTIONS FROM THREE) 40 MARKS – 20 MINUTES QUESTION 2 (Microeconomics) 2.1 List TWO characteristics of perfectly competitive firms. (2 x 2 = 4) Many firms Homogeneous goods Price taker No barriers to entry etc 2.2.1 Identify the curves labelled A – D. A: MC B: AC C: AR (2) D: MR 2.2.2 What type of market structure is this firm operating in? (2) Imperfect 2.2.3 At what level of output and price will this firm be maximising profits? (2) Q1; P1 2.2.4 What is the total profit earned by this firm? (4) Area: P1;P4; t; s 2.3.1 What is the role of the Competition Commission? (2) Regulation of mergers/acquisitions, anticompetitive behavior etc. 2.3.2 According to the article, the major construction firms were fined for “anti-competitive behaviour and inclusive tendering”. Explain. (4) Firms colluded with one another rather than competing – especially w.r.t. tenders 2.3.3 Explain who would be claiming “civil damages” against the construction firms and why they would be doing so. (4) Firms/individuals who employed the construction firms. Paid higher prices than they needed to. 2.4 Identify the steps involved in a cost-benefit analysis. (8) Cost-benefit analysis, or CBA is a detailed outline of the potential risks and gains of a projected venture. 1. Define your CBA's unit of cost. 2. Itemize the tangible costs of the intended project. 3. Itemize any and all intangible costs. 4. Itemize the projected benefits 5. Add up and compare the project's costs and benefits. 2 6. Calculate a payback time for the venture. 7. Use your CBA to inform your decision about whether to pursue your project. 2.5 Explain the concept “shut-down point”. Draw a diagram to assist you in your explanation. (4 x 2 = 8) A firm will choose to implement a shutdown of production when the revenue received from the sale of the goods or services produced cannot even cover the variable costs of production. In that situation, the firm will experience a higher loss when it produces, compared to not producing at all. Technically, shutdown occurs if marginal revenue is below average variable cost at the profit-maximizing output. Producing anything would not generate returns significant enough to offset the associated variable costs; producing some output would add losses (additional costs in excess of revenues) to the costs inevitably being incurred (the fixed costs). By not producing, the firm loses only the fixed costs. [40] 3 QUESTION 3 (Contemporary Issues) 3.1 40 MARKS – 20 MINUTES Name any TWO World Heritage Sites in South Africa (2 x 2 = 4) iSimangaliso Wetland Park - (KwaZulu-Natal) Robben Island - (Western Cape) Cradle of Humankind - (Gauteng) uKhahlamba Drakensberg Park - (KwaZulu-Natal) Mapungubwe National Park - (Limpopo) Cape Floral Region - (Western Cape) Vredefort Dome - (Free State) Richtersveld Cultural and Botanical Landscape - (Northern Cape) 3.2.1 What is “Targeted Inflation”? (2) The range of inflation that SARB attempts to achieve – 3-6% 3.2.2 What is the SARB expecting to happen to “Targeted Inflation” over the next two years? Justify your answer. (4) Rise into 2015 out of target range, and then fall back into range in 2016. Heaviest line of forecast indicates this 3.2.3 Given your answer to 3.2.2, what sort of Monetary Policy actions can we expect to see for the same period? (4) In 2015: rising interest rates, sale of govt bonds (deflationary monetary policy) In 2016: easing of monetary policy – falling interest rates, purchase of govt bonds 3.3.1 Where do the majority of tourists to South Africa originate? (2) SADC region 3.3.2 What is the main motivation for these tourists to be visiting South Africa? (4) Shopping, business 3.3.3 What do you think could explain the 7.6% increase in tourist numbers to South Africa? (4) Rand weakness; effective marketing etc 3.4 Identify and very briefly discuss FOUR consequences of inflation. (4 x 2 = 8) Distributional effects: inflation affects the distribution of income and wealth among the various participants in the economy inflation benefits debtors at the expense of creditors. Inflation can also cause a reduction in the real value of savings - especially if real interest rates are negative. This means the rate of interest does not fully compensate for the increase in the general price level. In contrast, borrowers see the real value of their debt diminish. 4 redistributes income from the elderly to the young. Consumers and businesses on fixed incomes will lose out. Many pensioners are on fixed pensions so inflation reduces the real value of their income year on year. redistributes income from the private sector to the government (via bracket creep – the so-called Fiscal dividend). Economic effects: inflation may result in lower economic growth and higher unemployment than would otherwise occur because: 3.5 entrepreneurs / decision makers attempt to anticipate inflation rather than concentrating on output decisions. Inflation can also cause a disruption of business planning – uncertainty about the future makes planning difficult and this may have an adverse effect on the level of planned capital investment. Budgeting becomes a problem as firms become unsure about what will happen to their costs. If inflation is high and volatile, firms may demand a higher nominal rate of return on planned investment projects before they will go ahead with the capital spending. These hurdle rates may cause projects to be cancelled or postponed until economic conditions improve. A low rate of new capital investment clearly damages long-run economic growth and productivity inflation reduces South Africa’s competitiveness. If South Africa has higher inflation than the rest of the world it will lose price competitiveness in international markets. This assumes a given exchange rate. Ultimately, this will lead to a fall in the rate of economic growth and the level of employment. If the exchange rate depreciates, this may help to restore some of the lost competitiveness. it leads to higher nominal interest rates that should have a deflationary effect on GDP. it distorts the operation of the price mechanism and can result in an inefficient allocation of resources. When inflation is volatile, consumers and firms are unlikely to have sufficient information on relative price levels to make informed choices about which products to supply and purchase. it leads to an increase in search times to discover more about prices. Inflation increases the opportunity cost of holding money, so people make more visits to their banks and building societies (known as “shoe leather costs”). it results in extra costs to firms of changing price information (known as menu costs). This can be important for companies who rely on bulky catalogues to send price information to customers. it can lead to higher wage demands as workers try to maintain their real standard of living (the wage-price spiral). Higher wages over and above any gains in labour productivity causes an increase in unit labour costs. To maintain their profit margins they increase prices. The process could start all over again and inflation may get out of control. Higher inflation causes an upward spike in inflationary expectations that are then incorporated into wage bargaining. It can take some time for these expectations to be controlled. Identify and briefly discuss TWO policies that have been implemented by the South African government to ensure environmental sustainability. (2 x 4 = 8) National Water Act, 1998 National Environmental Management Act (NEMA),1998 Air Quality Act, 2004 Mineral and Petroleum Resources Development Act, 2002 Any other relevant policy or actions [40] 5 QUESTION 4 (Microeconomics & Contemporary Issues) 4.1 Identify TWO potential “barriers to entry”. 4.2 40 MARKS – 20 MINUTES (2 x 2 = 4) Patents Limit Pricing Cost advantages Advertising and marketing Research and Development expenditure Presence of sunk costs International trade restrictions etc Study the table below and answer the questions that follow: Output Price Total Cost 0 1 2 3 4 5 6 7 5 5 5 5 5 5 5 5 5 9 12 14 18 24 31 40 Marginal Cost 4.2.1 Identify the market structure in which this firm is operating. Explain your answer. (4) Perfect market; price is constant 4.2.2 What are the firm’s total fixed costs? (2) 5 4.2.3 What is the profit maximising level of output? Explain your answer. (4) Between 4 and 5; where MR = MC 4.3.1 What has caused the numbers of wild Chinese sturgeon to “crash” in the Yangtze river? (2) China's economic boom brings with it pollution, dams and boat traffic along the world's third-longest river. 4.3.2 Explain how the answer to 4.3.1 can be viewed as a market failure. (4) Pollution and traffic are classic examples of negative externalities – costs of production being passed onto 3rd parties. 4.3.3 Do you think environmental degradation is an inevitable consequence of development and urbanization? Explain. (4) Any well-argued answer acceptable 6 4.4 Using a table, compare monopolistic competition and oligopoly with reference to: number of firms; nature of the product; barriers to entry; and control over price. (4 x 2 = 8) Number of Firms Nature of Product Barriers to Entry Firm's control over price 4.5 Monopolistic competition So many, no firm thinks others will detect its actions Heterogeneous Oligopoly So few, firm must consider others' actions / reactions Homogenous / heterogeneous Free Significant Some influence Considerable influence Identify and briefly explain TWO reasons for the South African government to develop policies to grow the tourism industry in South Africa. (2 x 4 = 8) Reduces poverty Creates new businesses Contributes to GDP Conserves environment Economic redress + explanation [40] TOTAL SECTION B: 80 7 SECTION C (ANSWER ONE ESSAY QUESTION FROM TWO) Your answer will be assessed as follows: STRUCTURE OF THE ESSAY: Introduction Body: Main part: Discuss in detail/In-depth discussion/Examine/ Critically discuss/Analyse/Compare/Evaluate/Distinguish/ Explain/Assess/Debate Additional part: Give own opinion/Critically discuss/Evaluate/ Critically evaluate/Draw a graph and explain/Use the graph given and explain/Complete the given graph/Calculate/Deduce/ Compare/Explain/Distinguish/Interpret/Briefly debate Conclusion TOTAL QUESTION 5 (Microeconomics) MARK ALLOCATION: Max. 2 Max. 26 Max. 10 Max. 2 40 40 MARKS – 35 MINUTES “The extent to which supplies of goods are matched to demands for goods or services in a particular market. The notion of economic efficiency implies the possibility of an ideal market in which no value is lost due to waste, unneeded surpluses, unmet demand, or other misallocations of resources.” Compare the long run equilibrium position of a perfectly competitive industry with that of a monopoly, paying particular attention to the issues of productive and allocative efficiency. Your answers should include well labelled and relevant diagrams. (26) The diagram clearly shows that a perfectly competitive firm achieves both productive and allocative efficiency in the long run, provided there are no economies of scale. The firm is productively efficient because it produces the optimum output at the lowest point on the ATC curve, and it is allocatively efficient because P = MC. (Strictly, the firm is allocatively efficient only if all markets in the economy are perfectly competitive and in long-run equilibrium, which means that every firm in every market is producing where P = MC.) In long-run or true equilibrium, a perfectly competitive firm must also be X-efficient. The reason is simple. If the firm is X-inefficient, producing at a level of unit costs above its ATC curve, the firm could not make normal profits in the long-run. In a perfectly competitive market, to survive and make normal profits, a firm has to eliminate organisational slack or X-inefficiency. 8 In contrast to perfect competition — and once again assuming an absence of economies of scale — monopoly equilibrium is both productively and allocatively inefficient. At the profit-maximising level of output Q1, the monopolist’s average costs are above the minimum level and that P > MC. Thus, compared to perfect competition, a monopoly produces too low an output which it sells at too high a price. The absence of competitive pressures, which in perfect competition serve to eliminate supernormal profit, mean that a monopoly is also likely to be X-inefficient, incurring average costs at a point such as X which is above the average cost curve. A monopoly may be able to survive, perfectly happily and enjoying an ‘easy life’, incurring unnecessary production costs and making satisfactory rather than maximum profits. This is because barriers to entry protect monopolies. As a result, the absence or weakness of competitive forces means there is no mechanism in monopoly to eliminate organisational slack. Is it always the case that perfect completion provides the most efficient outcome in a market? (10) On the basis of the above analysis, it seems we can conclude that perfect competition is both productively and allocatively efficient whereas monopoly is neither. Monopoly is also likely to be X-inefficient. However, the conclusion that perfect competition is productively more efficient than monopoly depends on an assumption that there are no economies of scale. When substantial economies of scale are possible in an industry, monopoly may be more productively efficient than competition. [40] QUESTION 6 (Contemporary Issues) 40 MARKS – 35 MINUTES “A state in which the demands placed on the environment can be met without reducing its capacity to allow all people to live well, now and in the future.” Discuss the measures used to ensure environmental sustainability under the following headings: Market-related policies Public-sector intervention Public-sector control (26) 1. PUBLIC SECTOR INVOLVEMENT Aims to achieve social efficiency with regard to environmental sustainability: - 9 cost to tax payers reduce pollution - E.g. Kyoto Protocol, where developed countries pay developing countries for their right to - Pricing the environment – government levies fee on consumers and producers for waste - E.g. in SA local authorities lev - In other countries emission charges are levied on industries and vehicle owners for • Environmental - A tax could be imposed on the output or consumption of goods, wherever external • Enviro - Encourage production of environmentally - When government wants to reduce pollution, each business is given a license to pollute - Business can sell their licenses to other business who needs to expand production. It is - In SA done by Dept. of Mineral Resources to reduce permitted amount of pollution over 2. PUBLIC SECTOR CONTROL • When government intervention has no result – • Developed countries have environmental regulations e.g. air and water pollution, noise, • 3 approaches to devising CAC systems: - Social impact standards focu • Between government and businesses on voluntary basis to cut pollution – formal contract • Businesses prefer these agreements – can negotiate – build i • Innovative approaches in developing world to educate people to manage environment is: wildlife reserves transformed into areas managed for conservation, households more conscious of waste-recycling, co-operatives established to produce 10 organic foods, groups like Green Party + Friends of the Earth encourage environmental • Department of Agriculture – Conservation of Agricultural Resource Act – prevent soil • Aim: to foster scientific and te • Government published the White Paper on Integrated Pollution and Waste Management • Aims to reduce risks to human health and the environment by trying to eliminate the • Radioactive Waste Management Policy and Strategy – aims to establish a • September 2002 – • February 2004 – tyre industry agreed to certain targets with respect to the collection and • DEAT implemented the National Waste Management • Main components: waste information, health care waste recycling and capacity building • Examples: fuel and vehicle taxes, effluent charges, congestion charges, emission permits 3. MARKETS • Driven by self-interest – implies that environment is for individuals to use for own benefit – • Sustainability achieved in free market to extent of price of resources that rise as they become scarce and to extent of environment-friendly techn • Social interest (cost and benefit) in using environment – not only to direct producer/ non-excludable – – the larger the costs, the lower the socially efficient level of output – air polluted by business cannot be about t • Market mechanism has failed when market forces failed to produce desired result of • All costs and benefits are not captured in the market price – quantities produced and cons • Numerous bodies are involved in conservation activities to ensure sustainability – • Examples: Bird Life South Africa, Wildlife and Environment Society, Worldwide Wildlife • Examples: recycled waste paper, Collect-a11 Market related solutions refers to a set of measures designed to incorporate the price mechanism to better the effect Can be based on incentives which tax or charge polluters according to the amount or In your opinion, to what extent are international protocols and agreements successful? (10) Identification and explanation of agreements/protocols (Max 6) Motivation for success or failure (Max 4) [40] TOTAL SECTION C: 40 12 13