Econ 460/560: Industrial Organization

Econ 460/560: Industrial Organization

Homework/Review I

Spring 2009

To test your IO skills and prepare for examinations, please answer the following questions. Econ 560 students should answer all questions. Econ 460 students need not answer those labeled 560 HW . I encourage you to work together, but please understand and review your answers, as you may see one or more on your exams.

DEFINITIONS Please understand the following concepts: market structure market conduct market performance transactions costs sunk costs barrier to entry property rights demand and inverse demand marginal cost marginal revenue four-firm concentration ratio

Herfindahl-Hirschman index normal form game extensive form game

Nash equilibrium subgame perfect Nash equilibrium. mixed strategy

INTRODUCTION

1. Compare and contrast the different schools of thought in IO.

2. Assume the following regression results are accurately estimated: y = 21.39 + 0.224 x

(2.6) (2.3) where t-ratios are in parentheses. Given these results, calculate dy/dx. Would you be 95% confident that dy/dx ≠ 0. Explain.

3. Compare and contrast the benefits and costs of communism and capitalism in terms or our standard economic performance criteria (i.e., efficiency, equity, progress, and macro stability).

4. Explain the Coasian theory of why firms exist and the determinants of the optimal firm size. How is this issue relevant to the issue of optimal government size.

5. "Intelligent producers should integrate forward into their end markets and backwards into their material markets so that they can avoid payments to middle persons." Evaluate.

6. (560 HW) For a particular firm, assume that monitoring costs equal x 2 and transactions costs equal

240 - 20 x, where x equals firm size measured in millions of dollars of assets. Following Coase (1937), determine the optimal firm size. Explain.

7. In most intermediate micro textbooks, a firm is described as a single product producer. In reality, however, most firms are conglomerate. That is, they produce a number of unrelated products. Explain why a firm may want to produce more than one product.

BASIC CONDITIONS

8. Assume that a market inverse demand function takes the following form: p = 120 - 2 Q, where p is price and Q is the quantity of output demanded by consumers. Define the market demand function (i.e., in terms of Q instead of p). Mathematically derive the total revenue and marginal revenue functions for this market. Discuss the relationship between the marginal revenue and the price elasticity of demand. Now graph the total, average, and marginal revenue functions and discuss how they relate to the price elasticity of demand.

9. Assume that an inverse market demand function takes the following form: p = a + b Q + c Y, where p is price, Q is the quantity demanded, and Y is income. What sign should the following parameters take: a, b, and c? Explain.

10. (560 HW) Assume that firm i faces a limited number of competitors and the following demand function: q i

= 1 – p i

– b(p i

- p'), where q i

is quantity demand for firm i’s product, p i

is firm i’s price, p' is the average price of all firms in the industry, and b is a parameter. Discuss the properties of this demand function and the value that parameter b might take (think in terms of poles and the implications of each pole).

11. Assume that a firm faces the following cost function (input prices are assumed to be constant): c(q) = 25 + 60 q – 12 q 2 + q 3 , where c is total cost and q is the quantity of output.

A. Mathematically derive the average and marginal cost functions for this firm.

B. Graph the total, average, and marginal cost functions for q

[0, 20].

C. If this were a long-run cost function, discuss the degree of economies of scale for this functional form.

D. Is this a true long run cost function? Explain.

12. Assume that a firm faces the following cost function (input prices are assumed to be constant): c(q) = 20 q + F, where c is total cost, q is the quantity of output, and F is total fixed cost. Mathematically derive the shortrun average and marginal cost functions for this firm. Graph the total, average, and marginal cost functions for q

[0, 20].

13. (560 HW) Assume that a firm is an input price taker that faces a general long-run cost function: c(q, w), where c is long-run total cost, q is the quantity of output, and w is a vector of variable input prices.

Discuss the following derivatives:

A. ∂c/∂q.

B. ∂ 2 c/∂q 2 .

C. ∂c/∂w i

.

D. ∂ 2 c/(∂q∂w i

).

COMPETITION, MONOPOLY, IMPERFECT COMPETITION, AND NEIO

14. Compare and contrast the long-run equilibriums and the welfare effects of the following market structures: perfect competition, monopoly, monopolistic competition, and one model of oligopoly.

15. Assume that a monopolist faces the following demand and cost conditions:

Inverse Demand: p = 240 - 2 q,

Total Cost: c(q) = 20 q + F,

A. Derive the firm's profit maximizing output and price level.

B. Show how the value of fixed costs, F, affect firm profits.

C. (560 HW) Show that the second order conditions of profit maximization are met for this problem.

D. Assume this is transformed into a perfectly competitive market. What would be the new equilibrium price and market output levels (assuming a constant cost industry; i.e., input prices are constant).

16. Compare and contrast the profit maximizing and equilibrium conditions for a monopoly firm and a monopolistically competitive firm.

17. Derive and discuss a supply relation (not function) for an oligopoly firm. Discuss how you could use it to estimate the degree of exerted market power of that firm.

INDUSTRY STRUCTURE

18. Discuss the common measures of concentration and their main strengths and weaknesses.

19. Discuss the common measures of market power and the main strengths and weaknesses.

20. Explain how the following affect industry concentration.

A. Scale economies relative to the size of the market.

B. Barriers to entry and sunk costs.

GAME THEORY

According to Avinash Dixit and Barry Nalebuff, Thinking Strategically (W. W. Norton, 1991), there are several rules that may help you identify your best response in a game:

1. “If you have a dominant strategy, use it.”

2. “Eliminate any dominated strategies from consideration, and go on doing so successively.”

3. In a dynamic game, “look ahead and reason back.”

4. “Having exhausted the simple avenues of looking for dominant strategies or ruling out dominated ones, the next thing to do is look for an equilibrium of the game.”

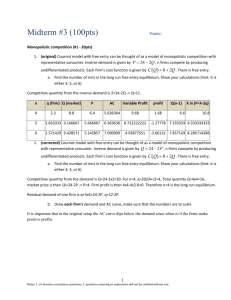

21. In the following normal form game for players 1 and 2, what strategy or strategies (A, B, C, D, E, or

F) survive iterated elimination of strictly dominated strategies? Which are Nash equilibria?

2

D E F

A 4, 2 1, 1 3, 1

1 B 1, 1 0, 4 2, 2

C 2, 2 2, 1 1, 4

22. In the following normal form game, what strategy or strategies survive iterated elimination of strictly dominated strategies? Which are Nash equilibria?

2

D E F

A 2, 0 1, 1 4, 2

1 B 3, 4 1, 2 2, 3

C 1, 3 0, 2 3, 0

23. Compare and contrast a dominant strategy from a Nash equilibrium strategy.

24. Microsoft Corp. (MS) is considering a marketing strategy for a potential new software game,

GameXX. Its strategic options are: (1) introduce GameXX and use a "Madison Avenue" (MA) campaign,

(2) introduce GameXX and use a "word-of-mouth" (WOM) campaign, or not introduce GameXX at all.

If Microsoft introduces GameXX, it is possible that Microsoft's competitor, Microworld (MW), will produce a legal clone of GameXX, which will take sales away from MS. If MS enters first and uses a

MA campaign, then profits (π) will be (π ms

= 380, π mw

= -250) if MW enters and (430, 0) if MW stay's out of the market. Note that the first profit number represents MS's profits. If MS enters first and uses a

WOM campaign, then profits will be (400, 100) if MW enters and (800, 0) if MW stay's out. Finally, if neither MS nor MW produce GameXX, then profits will be (0, 0). If this information is common knowledge:

A. Describe the extensive form of this sequential game.

B. Derive and identify the subgame perfect Nash Equilibrium.

25. Find the Nash equilibrium in advertising (A) for duopolists (1 and 2) who face the following profit (π) functions:

π

π

1

2

= 1000A

1

- A

1

2 - A

2

= 1000A

2

- A

1

A

2

- A

2

2

2

A.

Would joint profits (i.e., π

1

+ π

2

) be greater if they formed a cartel?

B.

Are A

1

and A

2

strategic substitutes are strategic complements? Exmplain.

26. (560 HW) Assume that two firms (A and B) are competing in a market and that entry is blocked.

The firms play a single period game by simultaneously choosing their profit maximizing output. The market inverse demand function is p = 240 - Q, where Q = q

A

+ q

B

. The marginal cost for firm A equals 5 and the marginal cost of firm B is 10.

A. Calculate the profit maximizing output for each firm and the market price for this game.

B. How would the equilibrium change if A first chooses output level, B observes A's output, and then B chooses its output level? Explain.

C. Again, assuming a simultaneous move game, describe this equilibrium if the marginal cost of

B rises above 240.

27. Consider an actual game that was played by General Electric (GE) and Westinghouse (West), where they simultaneously choose a pricing strategy (p

2

> p

1

[Scherer and Ross (1990, pp. 210-213)].

A. GE and West face the following payoff matrix for the sale of turbogenerators, and they each play a mutually best response strategy. Identify the resulting equilibrium.

GE

p

p

2

1

West

p

2

p

1

112, 112 58, 123

123, 58 91, 91

B. After playing this game, GE and West tried to form a cartel, but were caught and convicted of price fixing. This led to the following pricing scheme. In 1963, GE announced a "price protection" plan -- also known as a "most favored customer" plan -- under which it guaranteed that if it gave a discount on any new turbogenerator order, it would retroactively grant the same discount on all orders taken within the preceding six months.

In effect, GE unilaterally lowered the payoff associated with a low-price strategy, that is, it eliminated the attractiveness of defecting from the cooperative solution. In the context of part A above, if cutting the price from p

2

to p

1

required rebates totalling 150 to customers of the past six months, the payoff matrix is altered as follows:

West

p

2

p

1

GE

p

2

112, 112 58, 123

p

1

-28, 58 -51, 91

How do you expect West to respond to GE's most favored customer plan in the long run? Explain.

28. Suppose that Jason and Mark are bargaining over the division of a $100 surplus. They make alternating offers and do not discount the future at all; that is, they consider the receipt of a dollar at any time in the future equivalent to the receipt of a dollar today. The number of rounds is fixed in advance.

Determine the solution to this game if there are three bargaining rounds. That is, player 1 makes an offer, if player 2 accepts, the game is over. If play 2 rejects, player 2 makes a new offer. If player 1 accepts, the game is over. If player 1 rejects, player 1 makes a new and final offer.

29. (560 HW) Assume that firm i faces a limited number of competitors and the following demand function: q i

= 1 – p i

– b(p i

- p'), where q i

is quantity demand for firm i’s product, p i

is firm i’s price, p' is the average price of all firms in the industry, and b is a parameter. Derive firm i's best reply function in terms of p i

.

30. Describe, compare, and contrast the following duopoly models: a. Bertrand b. Cournot c. Stackelberg

31. Consider a game with two retailers (1 and 2), who must decide whether or not to run a sale. Thus, the feasible strategies are sale (discount) or not. Given the payoffs described below, calculate the pure and mixed strategy Nash equilibria. If you identify a mixed strategy NE, provide a graph of the best reply correspondences for each player. (Varian, “A Model of Sales,” AER, 1980).

1

p

p

2

1

p

0, 0

2

2

p

1

2, 1

1, 2 1, 1