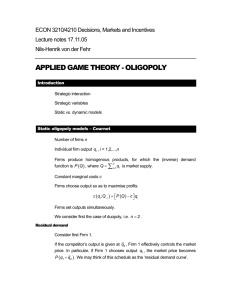

Dixit Entry Deterrence Model Analysis Basic Assumptions Firm 1 is

advertisement

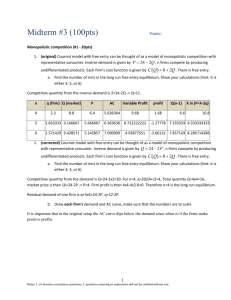

Dixit Entry Deterrence Model Analysis Basic Assumptions Firm 1 is the incumbent monopolist Firm 2 is a potential entrant The firms produce identical goods Demand: P = A - q1 – q2 Marginal cost of capacity for both firms = r Marginal cost of labor for both firms = w One unit of capacity and one unit of labor is required to produce one unit of output F1 wq1 rK1if q1 K1 F1 ( w r )q1if q1 K1. Firm 1’s cost given output q1, capacity K1, and fixed cost F1 is C1 (q1 , K1 ) Firm 2’s cost given output q2 and fixed cost F2 is C2 (q2 ) F2 (w r )q2 . Firm 2 can avoid its fixed costs by not producing. The game Dixit analyzes has 3 stages. Stage 1: Firm 1 chooses a level of capacity K1 which generates a cost rK1. Stage 2: Firm 2 decides to enter firm 1’s market or to stay out. Stage 3: If there is no entry in stage 2, Firm 1 chooses its output, q1. If there is entry in stage 2, firms 1 and 2 simultaneously and non-cooperatively choose their output levels, q1 and q2. In this analysis, we will graphically illustrate the subgame perfect Nash equilibrium for a range of values of F1 and F2. Figure 1 reflects the case in which the level of firm 1 output above which firm 2’s profit is negative is greater than firm 1’s monopoly output, M. Subgame perfection requires that we first analyze two types of subgames. In one type, entry has occurred. In the other type, entry has not occurred. Stage 3 with no entry. The equilibrium will involve the monopolist firm 1 producing the larger of M and Z. Stage 3 with entry: We need to derive the best-responses for each firm. These are illustrated in Figure 1. Firm 1: The red curve, R1(q2), is firm 1’s best-response. For q1 ≤ K1, firm 1 has sufficient capacity so its marginal cost of production is equal to w as the capacity cost is sunk. The upper portion of R1 corresponds to the situation in which firm 1’s profit-maximizing best-response in stage 3 requires no additional capacity. For q1 > K1, firm 1 must add extra capacity for each additional unit of output so its marginal cost now equals r + w. The lower portion of R1 corresponds to the situation in which firm 1 chooses to produce above K1. The middle, vertical segment of R1 corresponds to the situation in which firm 1 produces exactly K1. Given the values of q2 associated with this vertical segment, at any q1 < K1 firm 1’s marginal revenue is greater than w (this means firm 1 wants to produce at least q1) while at any q1 > K1 firm 1’s marginal revenue is less than r+w (this means firm 1 wants to produce no more than q1. Firm 2: The solid blue segment of R2(q1) is firm 2’s best response but, unlike in standard Cournot games, firm 2’s best-response output is positive only when q1 ≤ Z because when q1 > Z, the best firm 2 can do is earn negative profit. Thus, it will prefer to produce zero in order to avoid paying its fixed cost. Smaller values of F2 imply larger values of Z. Now we can put this information together to determine the stage 3 equilibrium. First note that any equilibrium quantities in which both firms produce must fall between points B and C. It also cannot involve firm 1 producing more than Z units. If K1 lies to the left of B, the equilibrium will be at B. If K1 ≥ Z, the equilibrium will involve only firm 1 producing at the maximum of M and Z. If K1 < Z and K1 lies to the right of B, then the equilibrium will be at point E and will imply q1 = K1. Note that because of the assumptions of linear demand and constant marginal costs, the Stackelberg equilibrium is at point S. That is, at point S, firm 1’s profits are maximized on R2. Stage 2 analysis. Given the stage 3 analysis, firm 2 will enter only if K1 ≤ Z and it will stay out if K1 > Z. For K1 = Z, firm 2 is indifferent between entering and staying out. For simplicity, we will assume that firm 2 stays out at K1 = Z. Stage 1 analysis. Given the above analysis of stages 2 and 3, firm 1 will find itself in one of three cases. Case 1. Z lies to the left of B. Entry will never occur regardless of firm 1’s capacity choice. Any choice of capacity between 0 and M will generate the same profit for firm 1 as it will end up producing its monopoly quantity, M. In this case, entry is naturally blockaded. Case 2. Z lies to the right of B and Z ≤ M. In this case, any value of K1 between Z and M will deter entry and still result in firm 1 producing its monopoly quantity, M. Case 3. Z > M. This case creates a trade-off for firm 1. One option is to invest in M units of capacity. Entry will occur. The stage 3 equilibrium will be at S so that firm 1 earns its Stackelberg profit. The other option is to invest in Z units of capacity. Entry will be deterred and firm 1 will produce Z units. Firm 1 could deter entry with more capacity but because Z > M, firm 1’s profit when it deters entry is decreasing in K1. Thus, K1=Z is the profit-maximizing entry-deterring capacity. The profit firm 1 will earn be choosing K1=Z is decreasing in Z. Thus, if Z is too large (that is, if F2 is too small), firm 1 will prefer to accommodate entry and choose K1=M. However, for Z closer to M, firm 1will prefer to deter entry with K1 = Z. Homework: Assume A = 150, r = 30, w = 60, and F1 = 200. Show that entry is naturally blockaded when F2 > 400 (Case 1), that firm 1 deters entry and ends up producing its monopoly quantity when 225 < F2 < 400 (Case 2), that firm 1 deters entry and produces more than its monopoly quantity when 19.3 < F2 < 225, and that firm 1 accommodates entry when F2 < 19.3. q2 R1(q2) B E S C R2(q1) q1 K1 M Z Figure 1