Chapter 010 Project Analysis

advertisement

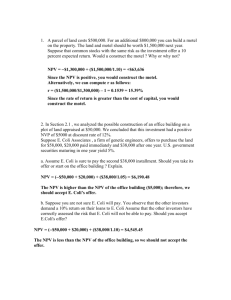

Chapter 09 Project Analysis True / False Questions 1. A capital budget shows a proposed list of investments. TRUE 2. The strategic planning portion of the capital budgeting process is essentially a "bottom-up" process. FALSE 3. Competitive advantage is an important element of many successful capital budgeting proposals. TRUE 4. While sensitivity analysis is forward-looking, scenario analysis attempts to reconstruct and analyze the past. FALSE 5. The level of sales at which project NPV is zero is referred to as the accounting break-even point. FALSE 6. The economic break-even level of sales will be higher than the accounting break-even level. TRUE 7. The degree of operating leverage shows the relationship between sales and pre-tax profits. TRUE 8. Operating leverage increases with fixed cost. TRUE 10-1 Chapter 09 Project Analysis 9. If a large proportion of costs is fixed, a shortfall in sales has a magnified effect on profits. From the above statement we know that the risk of a project is affected by the degree of operating leverage. TRUE 10. The greater the DOL, the greater the protection against operating losses during economic downturns. FALSE 11. Clothing industry is considered to have high degree of operating leverage. FALSE 12. The option to abandon a project becomes more valuable as the possible outcomes become more varied. TRUE 10-2 Chapter 09 Project Analysis 13. Conflicts of interest between shareholders and managers may result in the sacrifice of attractive capital budgeting proposals. TRUE 14. Sensitivity analysis takes into consideration the interrelationship of variables. FALSE 15. Scenario analysis allows managers to look at different and sometimes inconsistent combinations of variables. FALSE 16. "What-if" questions ask what will happen to a project in various circumstances. TRUE 17. What-if analysis is not crucial to capital budgeting. FALSE 18. What-if analysis can help identify the inputs that are most worth refining before you commit to a project. TRUE 19. The inputs that are most worth refining before you commit to a project are the ones that have the greatest potential to alter project NPV. TRUE 20. Scenario analysis allows managers to look at different but consistent combinations of interrelated variables. TRUE 21. A project that breaks even in accounting terms will surely have a negative NPV. TRUE 22. A project that simply breaks even on an accounting basis gives you your money back but does not cover the opportunity cost of the capital tied up in the project. TRUE 23. Managers that accept projects that only break even on an accounting basis are helping their shareholders. FALSE Multiple Choice Questions 10-3 Chapter 09 Project Analysis 24. What level of management is responsible for originating capital budgeting proposals? A. Senior management B. Divisional management C. Lower management D. All levels of management 25. The capital budget should be consistent with the firm's: A. growth in sales. B. strategic plans. C. current level of funds. D. dividend policy. 26. Which of the following would not be judged a traditional category of capital budgeting project? A. Machine replacement proposals B. Salary adjustment proposals C. New product proposals D. Plant expansion proposals 27. Which of the following industry has low operating leverage? A. Steel. B. Railroads. C. Electric utilities. D. Autos. 28. Which of the following capital budgeting proposals is most likely to display a conflict of interests? A. The proposal with highest NPV. B. The proposal with the longest payback period. C. The proposal with highest IRR and quickest payback. D. The proposal to solve pollution problems. 29. Which of the following is least likely to be responsible for a regional manager's conflict of interest in promoting a capital budgeting proposal? A. Desire for professional advancement B. Thorough knowledge of the region C. Overly optimistic economic forecasts D. The need for quick profitability 30. Soft capital rationing may be beneficial to a firm if it: A. reduces a firm's interest expense. B. weeds out proposals with weaker or biased NPVs. C. allows managers to select their favorite projects. D. increases funds to be used for other purposes. 10-4 Chapter 09 Project Analysis 10-5 Chapter 09 Project Analysis 31. The purpose of sensitivity analysis is to show: A. the optimal level of the capital budget. B. how price changes affect break-even volume. C. seasonal variation in product demand. D. how variables in a project affect profitability. 32. Sensitivity analysis evaluates projects by: A. forecasting changes in interest rates that would increase financing costs. B. recording profitability changes while changing one variable at a time. C. insuring that the project sponsor has proper incentives. D. testing for interrelated variables. 33. What happens to the NPV of a one-year project if fixed costs are increased from $400 to $600, the firm is profitable, has a 15% tax rate and employs a 12% cost of capital? A. NPV decreases by $200.00. B. NPV decreases by $173.91. C. NPV decreases by $130.00. D. NPV decreases by $113.04. change in cash flow = (200) + 70 = (130), which discounts to $113.04 34. What happens to the NPV of a one-year project if fixed costs are increased from $400 to $600, the firm is not profitable, has a 15% tax rate and employs a 12% cost of capital? A. NPV decreases by $200.00. B. NPV decreases by $178.57. C. NPV decreases by $130.00. D. NPV decreases by $113.04. change in cash flow = (200), which discounts to $178.57 35. Which of the following appears to be a more likely result from using sensitivity analysis? A. Agreement on the appropriate discount rate B. Determine whether to finance with debt or equity. C. Isolation of pivotal factor in project profitability D. Select the best capital budgeting project. 10-6 Chapter 09 Project Analysis 36. If a 20% reduction in forecast sales would not extinguish a project's profitability, then sensitivity analysis would suggest: A. deemphasizing that variable as a critical factor. B. requiring a more detailed sales forecast. C. the initial sales forecasts were inflated. D. a reallocation of fixed costs to this product. 37. If sensitivity analysis concludes that the largest impact on profits would come from changes in the sales level, then: A. fixed costs should be traded for variable costs. B. variable costs should be traded for fixed costs. C. the project should not be undertaken. D. additional marketing analysis may be beneficial before proceeding. 38. Which of the following statements is correct concerning sensitivity analysis? A. It ignores interrelationships between variables. B. Several variables are allowed to change concurrently. C. It considers all feasible variable combinations. D. Its results are free from ambiguity. 39. If sensitivity analysis indicates none of the individual variables will cause a negative NPV under pessimistic conditions, then the: A. project is assured to be successful. B. project's discount rate should be reduced. C. economic forecasts are possibly overly optimistic. D. interaction of the variables should be considered. 10-7