paper

advertisement

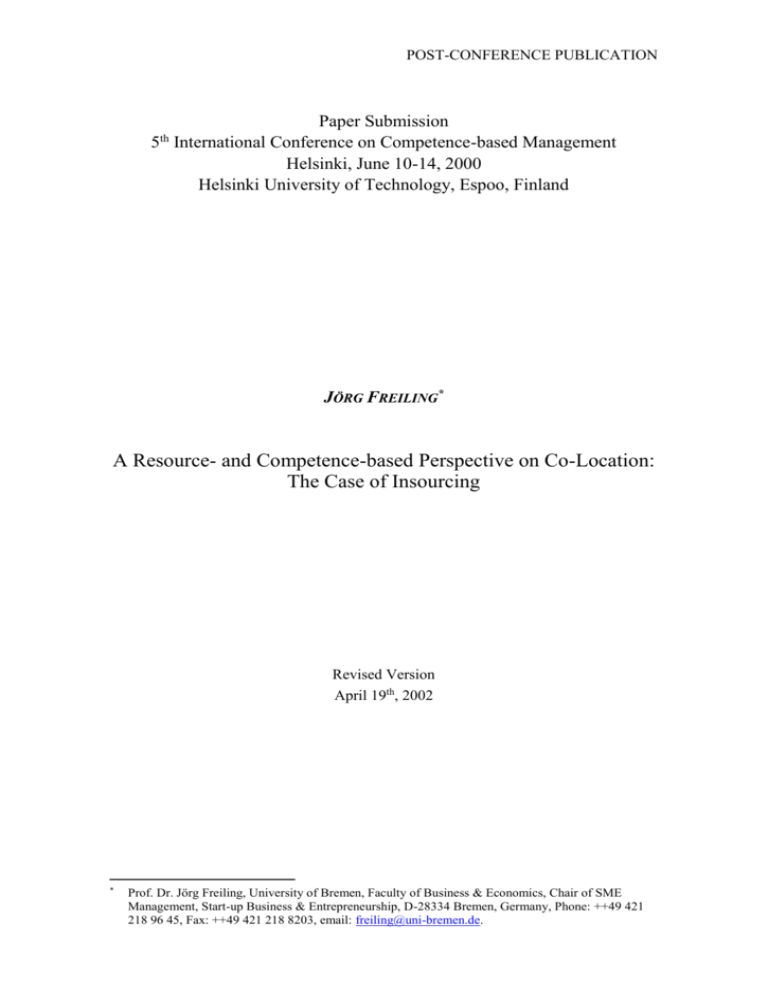

POST-CONFERENCE PUBLICATION Paper Submission 5th International Conference on Competence-based Management Helsinki, June 10-14, 2000 Helsinki University of Technology, Espoo, Finland JÖRG FREILING* A Resource- and Competence-based Perspective on Co-Location: The Case of Insourcing Revised Version April 19th, 2002 * Prof. Dr. Jörg Freiling, University of Bremen, Faculty of Business & Economics, Chair of SME Management, Start-up Business & Entrepreneurship, D-28334 Bremen, Germany, Phone: ++49 421 218 96 45, Fax: ++49 421 218 8203, email: freiling@uni-bremen.de. 1 A Resource- and Competence-based Perspective on Co-Location: The Case of Insourcing Abstract Despite several contributions in the last decade, the field of customer/supplier cooperation is still slightly under-researched. In practice, there are several new modes of inter-firm coordination which provide substantial improvements of both effectiveness and efficiency. One example among others is spatial supplier integration: suppliers erect plants at the customer’s site in order to improve collaboration. This case of close customer/supplier cooperation is termed as insourcing and belongs to the upcoming colocation arrangements in practice. One intention of the paper is to point out what insourcing is about. By the help of two case studies, one in the automotive component industry and one in the software industry, insourcing projects in practice are described and analyzed with regard to the experiences of the supplier. With the bilateral and the network coordination two different modes of insourcing could be identified. The findings of the case studies need to be analyzed in theoretical terms. Especially the resource- and competence-based perspective appears to be appropriate in order to explain the major difficulties and challenges of insourcing projects on the one hand. On the other hand, the competence-based view is useful in order to explain the key factors of the success of insourcing projects. The findings suggest that there are especially two different motives why firms make use of insourcing arrangements: First, the customer faces the problem of substantial resource gaps. Second, insourcing can be basic in order to found an effective learning partnership by resource pooling. The performance of insourcing arrangements largely depends on the absorptive capacities of the partners, the interconnectedness of assets, the asset mass efficiencies to be achieved, and the use of tacit knowledge. 2 The Problem Many firms are not satisfied with their degree of vertical integration and therefore try to make use of outsourcing in order to increase efficiency and/or effectiveness. Having outsourced several activities, the firms are often still dissatisfied because of the new outsourcing solution. At first glance, there seems to be a dilemma-like situation. By a more in-depth analysis we can conclude that there is a wide range of possible outsourcing arrangements (i.e., Arnold 2000, p. 25) and it is usually hard to find an approach matching firm-specific requirements. In many cases outsourcing is practiced in a too unspecific way with the result that the products delivered by the supplier do not respond to customer’s needs. Even practitioners call for more sophisticated approaches of outsourcing, using the full range of options bilateral coordination offers. With regard to the outsourcing debate we can summarize that one particular field of coordination appears to be slightly under-researched (apart from i.e. Willcocks/Lacity 1998; Grover/Teng/Cheon 1998): the range of coordination types very close to hierarchy but still resting on bilateral coordination. In business practice, several examples can be found where one special kind of such bilateral arrangements seems to be up-and-coming – co-location. Co-location means the durable unification of supplier’s and customer’s facilities in – at least – one of three following ways (see fig. 1): The supplier erects value adding facilities at the customer’s site. In case of close collaboration of component suppliers and OEM’s in developing new product concepts, such a co-location can be observed sometimes. The two parties decide to erect facilities at a completely new site. Again, we find those arrangements in the automotive component industry, especially when suppliers and OEM’s build up new R&D laboratories. The customer integrates himself at the site of the supplier. This case is the most relevant one in business practice and should, therefore, be examined more closely. 3 supplier's site neutral site customer customer's site supplier supplier supplier customer customer "insourcing" supplier expected to erect a factory within the factory at the customer's site ("in-plant") Fig. 1: Modes of Co-Location Overview Obviously, co-location – as a specific kind of outsourcing very close to hierarchy – makes sense in case of high degrees of vertical coordination which can be found in business-to-business markets and if there are considerable resource gaps to be closed by vertical partnerships. In a certain way co-location can be useful in oder to achieve substantial advantages of bilateral coordination by avoiding some of the most important drawbacks of traditional outsourcing arrangements. Co-location should be analyzed by taking a closer look at projects in practice. The paper proposes that especially the resource-/competence-based view is basic in order to understand the critical factors lying behind success and failure of such arrangements. In order to start an analysis of the idea and the effects of co-location, it seems to be necessary to focus upon one of three specific modes of co-location in order to avoid overloading this study. Therefore, as mentioned above, this paper deals with the phenomenon of local supplier integration at the customer’s site, called “insourcing”. The Outsourcing and Insourcing Debate Outsourcing has been one of the main topics of purchasing management during the 1980’s and 1990’s (e.g. Ford/Farmer 1986; Quinn 1992; Welch/Nayak 1992; Venkatesan 1992; Lacity/Hirschheim 1993; Stuckey/White 1993; Quinn/Hilmer 1994; Greco 1997). However, not all of the outsourcing arrangements which have been 4 established recently were completely satisfying (e.g. Bettis et al. 1992; Clark/Zmud/McCray 1998). Especially from the customer’s point of view there have been some important drawbacks with regard to managing the new customer/supplier interfaces. Beside some important benefits by making use of external sources, for example pointed out by Welch/Nayak (1992, p. 23) and Clark/Zmud/McCray (1998, pp. 64-69), the customer’s main problems usually are the following: purchasing products with a lack of customization, losing important know-how, eroding firm-specific capabilities, increased costs, and becoming dependent on the supplier. In the face of these facts, more and more customers are looking for new ways of interfirm cooperation avoiding the disadvantages of outsourcing arrangements as well as benefiting from the strengths of the suppliers. Such new modes should help to avoid too dangerous states of dependence on key suppliers. Moreover, the arrangements should cause synergies by a close supplier/customer collaboration. Such a cooperation can even be useful in order to develop key resources, capabilities, and competences of the partners. Following the ‘insourcing concept’ is one important way to respond to the challenges outlined above. With regard to insourcing there are some important aspects to be addressed in this paper: - Where do we find co-location in the way of insourcing and how do the arrangements look like? - What are the results of such insourcing projects in practice? - How can the results be explained in theoretical terms, especially in terms of the competence-based perspective? Basics of the Insourcing Concept Insourcing – as an acronym for “inside resource using” – is an ambiguous term which needs clarification. Insourcing can mean nothing else but turning a “buy” into a “make” situation. This process is a matter of traditional ways of vertical integration or reintegration, respectively, well-known from literature. Another interpretation of insourcing describes the process of a local supplier integration (“in-plants”, “factory within a factory”). In this case, a supplier is expected to move – at least with parts of his facilities – permanently to the customer's site in order to improve coordination between the partners due to the short distance. As only the second understanding of insourcing is consistent with co-location, this paper will only deal with: insourcing as durable local supplier integration on the customer’s site. Insourcing arrangements can be described more precisely by the following four elements: 5 The insourcing subject is the institution integrating one or more suppliers. Especially original equipment manufacturers (OEM’s) sometimes act as insourcing subjects. The insourcing object is the performance to be provided by the spatially integrated suppliers. Arnold (2000, p. 24) points out that the objects can also be defined in terms of the underlying processes to be performed. The insourcing partners are the suppliers erecting a resource network at the customer’s site. The insourcing design is the specific mode of cooperation which needs to be implemented by customer/supplier negotiation. With regard to the insourcing design a distinction between part-time supplier integration and supplier integration of the durable kind is necessary. In business-tobusiness settings, local supplier integration often takes place in case of project coordination, for instance in plant construction as well as in operation concepts based upon license/cross-license or leasing agreements. This kind of supplier integration usually does not belong to co-location as it is meant in this paper unless no permanent integration takes place. In contrast, we can find some “open-end arrangements” especially in the automotive and the software industry (Arnold/Scheuing 1997, Willcocks/Lacity 1998, Freiling/Sieger 1999, Arnold 2000). Moreover, there are some very specific situations where an insourcing takes place in case of “build-operate-own” arrangements between customer and supplier in the plant engineering and mechanical engineering industry (Backhaus 1999). The first two industries are subject to a closer analysis. As there are only a few quite complex examples of this close customer/supplier cooperation, the case study method appears to be adequate to gain empirical insights. Insourcing Arrangements: Empirical Observations The intention of the empirical work was to identify industries where insourcing arrangements are established in order to find better compromises between “in house” production and traditional ways of outsourcing. Moreover, the different ways of making local supplier integration work should be analyzed. Therefore, it is to be stressed that the intention of the study was not to deliver a representative impression about insourcing in different industries. This could be subject to ongoing research. As a starting point, a few well-fitting pilot cases should be selected in order to understand ways how insourcing can be implemented. Data was collected from several depth and telephone interviews, based upon explorative, non-standardized surveys in order to facilitate an extensive collection of information and opinions. One question was about focusing upon a single industry or to look for case studies from different ones. In the 6 last couple of years there were some new insourcing projects in the automotive industry which could be subject to the case study analysis. However, similar arrangements can be found in case of outsourcing IT and logistics. As a first step, it appeared to be useful to gather insights from different industries in order to get an impression about the different ways how this kind of co-location can be implemented. Industry-specific research could be an important step, even if a more representative state-of-the-art is necessary. Therefore, two prominent case studies were selected: the first one is the Micro Compact Car MCC GmbH, producing the ‘smart’ in Hambach, France; the second is about Oracle Switzerland in Bottmingen, Switzerland. Case Study 1: MCC’s ’smartville’ – the “industrial park” approach Beside the fact, that there are some more examples of insourcing arrangements in the automotive industry (Woodruff et al. 1996, Freiling/Sieger 1999), the cooperation between MCC, a Daimler-Chrysler subsidiary, and five component manufacturers seems to be the most delicate example of co-location. MCC established a so-called „industrial park“ (`smartville`) in Hambach, basing upon the co-location approach cited above. The component suppliers and MCC work together closely in order to improve the concept of the city car “smart” and to manage production. The industrial park represents an innovation in a threefold way: - The ‘smart’ itself is an innovation in the new segment of micro cars (product innovation). MCC is actually facing substantial buyer resistance and missed all the sales targets. - - MCC implemented a process innovation by making use of a sophisticated concept of modularization. The architecture of the car consists of a few highly integrated modules and systems. MCC’s co-location represents an organizational innovation, too, because MCC developed a completely new design of cooperation between the OEM on the one hand side and the part supplying component manufacturers as the so-called ‘system partners’ on the other. MCC worked out life-cycle contracts with every partner, following a single source approach, and gave the whole responsibility for specific modules to the particular first-tier supplier. MCC’s role in the project was about acting as a central coordinator (“hub firm”) in order to define production standards, to improve process flows, to foster product development, and to facilitate the coordination in order to establish an efficient insourcing network. Less than 25% of the value adding activities were performed by MCC itself. The insourcing partners were facing substantial problems by implementing the industrial park. The basic problems can be summarized as follows: 7 - It was difficult to match the high quality standards of MCC. - All the component manufacturers were depending on second-tier suppliers. Having erected the facilities at MCC’s site, they had to make close adaptations because of the fact that MCC expected the system partners to be highly flexible with regard to the delivery of components/modules. - Close adaptations were necessary between every single system partner and MCC and, furthermore, between the system partners themselves. The reason why all those adaptations were necessary was that MCC determined the assembly process and the location of every system partner exactly (see fig. 2) in order to guarantee an efficient process of value creation. Especially, such an approach enables MCC producing cars in round about four hours time. - The whole approach is only workable in case of all the partners working together in an atmosphere of mutual trust. MCC makes use of target pricing and therefore needs detailed information about the cost structures of all partners. However, not all the suppliers were ready for such an open atmosphere. Brakes Front axles Front module Assembly Drivetrain Cover-Parts Assembly Interior/ Exterior Meeting Point Drive module Assembly Cockpit Tridion-Frame Painting Doors Quality Control, Ignition of the completed vehicle's engine Delivery Production Preparation Center tasks to be performed by MCC tasks to be performed by MCC's system partners Fig. 2: MCC’s Insourcing Approach (Pfaffmann 1998, p. 22) With regard to recent developments, the insourcing partners got most of the initial problems fixed: 8 - MCC was in the intended position of a network coordinator after all. That means that MCC was in touch with recent important developments in the automotive component industry especially by permanently contacting the system partners. Of course, MCC is not in the position to accumulate component-specific know-how in a comparable way as in case of a “make” decision. Nevertheless, MCC is well informed about important trends in the supply sector. - Moreover, MCC is in an excellent position in order to establish a degree of product specificity matching internal requirements. The areas of the system partners can be “co-managed” by MCC: MCC is able to define frame-giving specifications without undermining the autonomy of the system partners who are free to choose their individual response. - By such an industrial park a state of close interdependence emerges. However, it is a state of dependence without significant power asymmetries. All the parties of the industrial park make substantial investments, the payoff depends on working together closely. Therefore it is one feature of this kind of insourcing that the different parties are striving for synergies by inter-firm collaboration. Consequently, the interviewed managers argued that the success largely depends on learning one partner from the other. Case Study 2: Oracle’s modular contract approach The question arises if insourcing arrangements could be interesting for firms in the software industry. Software firms are working in rather dynamic market settings. In many situations, the business is technology-driven and most of the customers are not aware of the various opportunities new software solutions are offering. Moreover, there are many customers in business markets demanding specific software applications as well as lots of services around the software. With regard to the fast-developing opportunities of using software and the permanently changing market situation, customers often perceive substantial risks in software buying decisions. It is possible to state that the search and experience qualities in software purchasing are decreasing while credence qualities (Nelson 1970; Darbi/Karni 1973) are increasing in such a way that the business turns into “credence transactions” from customer’s point of view. Hence, it is not astonishing at all that very many firms try to outsource their departments of information systems and to cooperate with reliable software firms. Some firms of the software industry were quite alert in the past and recognized their outstanding business opportunities. More and more customers need full service offerings and therefore they decided to provide more sophisticated software solutions, 9 even moving towards co-location. However, the insourcing projects differ substantially from those in the automotive industry (Freiling/Sieger 1999). Oracle Switzerland is one example among others. There are some key accounts of Oracle demanding specific software applications in order to turn traditional process management into a computer aided one or to manage computer aided processes in a better way. Among other suppliers, Oracle realized that in some cases only a close collaboration at the customer’s site could be an adequate response in order to find out what the customer-specific software solution is looking like and how it can be improved. Therefore, software engineers were sent out to the customer in order to acquire customer-specific know-how. Basically, in order to match customer requirements, it is very important to know exactly how the processes of the customer work and what kind of problems the staff of the customer realizes. Especially the workflows and routines of the customer need to be put into consideration when customer-specific IT solutions of the comprehensive kind are to be developed. Without a precise understanding of customer’s requirements, the software engineers are not able to make adequate decisions. Therefore, quite often implemented solutions need to be reconsidered because of non-conformance to certain internal process requirements of the customer. In other words, the personnel has to get to know customer’s processes almost as well as customer’s staff itself. The general task turns from software engineering to business process consulting in a certain way. It suggests itself that local supplier integration could be a useful means in order to arrange closeness to the customer and customer satisfaction. Furthermore, permanent or quasi-permanent presence of a team at the customer’s site is a basic supposition in order to strengthen customer ties by providing software-related services. Customers report that there are certain problems by using software almost all the time. In most of the cases the problems are extremely urgent because important procedures do not work anymore. When a quick response by the software provider is needed, supplier’s task force usually faces serious problems because the engineers are not fully aware of the customer’s specific hardware/software configuration. Usually, it takes precious time to analyze the specific situation. Such problems can be avoided by making use of insourcing arrangements. Members of the staff of the software supplier are assigned to the key account and quite often they spent predominant parts of their working time at the customer’s site. Their job is about providing the following software-related services: software consulting, process consulting, implementation, education of customer’s staff, troubleshooting, and maintenance. Oracle decided to establish a modular system of “support service offerings”. Different contract modules according to fig. 3 enable Oracle to match standard requirements of 10 non-key customers on the one hand and highly specific requirements of key accounts on the other hand more precisely. Insourcing solutions are part of Oracle’s support service offerings, promoted under the slogan “a dedicated Oracle support center at your site” and combined in way indicated in fig. 3. Oracle Switzerland extent of the service package Oracle Bronze Oracle Silver Oracle Gold Expert Online extent of service package, degree of proximity Expert Packages Expert Onsite Expert Satellite Oracle's insourcing philosophy: "... a dedicated full-service support center at your site" Fig. 3: Oracle’s Modular Contract Approach Core element of Oracle’s insourcing is a support account management where one or more service people are working at the customer’s site with the only task to manage key account’s software-related problems and needs. This support account management is subject of service contracts between Oracle and some very special key customers. As Oracle reports, the service people are predominantly utilized with their jobs because usually the staff of the customer realizes several different problems which will not be articulated in case of conventional troubleshoot visits by the software provider. In case of permanent presence, usually an atmosphere of trust in the Oracle staff emerges. This is useful to the customer-specific team of Oracle engineers because on this way they are able to gain a deeper understanding of customer’s problems and to several opportunities of product and service improvements, possibly deepening the relationship. However, this close and trustful cooperation does not only cause increasing customer loyalty but is very useful, indeed, when Oracle is trying to gather information about competitors. Customers are willing to give information about Oracle’s position in the 11 market compared with the relevant competitors. Another exciting opportunity of Oracle as insourcing partner is the chance to manage so-called “business migration” projects. Those business migrations represent the switch of a customer from one software supplier to another. In case of those switches, Oracle is able to analyze the former software solution and to install a completely new one. As a result, Oracle gets to know very much about the ways competitors implement customer-specific software applications. All those aspects clearly indicate that insourcing in this way can be an instrument to achieve competitive advantage. However, Oracle recognized that this ambitious way of insourcing is only appropriate in case of ‘real’ key accounts. General remarks Although small in number, the findings of the two case studies reveal that there is no general way of insourcing to be practiced. This impression is supported by other investigations in literature (i.e., Willcocks/Lacity 1998; Grover/Teng/Cheon 1998). It would be interesting to analyze more insourcing arrangements in practice in order to find out the most important features underlying the several co-locations in different industries. With regard to the two case studies cited above, we can distinguish between bilateral agreements between one supplier and one customer (Oracle) and network-like arrangements (MCC). Especially the extent and the kind of customer’s procurement problems are determinants of the customer’s decision to select a well-fitting approach. In case of substantial resource gaps, it is more likely that a network of suppliers will fill these gaps in an adequate way. Therefore, this dimension of an insourcing typology as indicated in fig. 4, can be theoretically founded by making use of the resource-based view1. Moreover, a distinction is possible with regard to the way of cooperation. On the one hand, the cooperation can be organized in a way of resource pooling without substantial knowledge transfer processes between the insourcing partners. On the other hand the accumulation of knowledge and competence building can be the central reason why customer(s) and supplier(s) cooperate. Again, this gives rise to the impression that especially the resource- and competence-based approach can be an appropriate theoretical background for a closer analysis. 1 Founded especially by Penrose 1959, Teece 1982 & 1984, Rumelt 1984, and Wernerfelt 1984, there were very many follow-up publications making significant contributions to theory development, such as Barney 1986 & 1991, Grant 1991 & 1995, Dierickx/Cool 1989, Amit/Schoemaker 1993, Peteraf 1993, Hamel 1994, Sanchez/Heene/Thomas 1996, Sanchez/Heene 1997. 12 gap-closing arrangements learning-oriented arrangements Oracle's approach insourcing dyad insourcing network MCC's industrial park Figure 4: A Resource-based Typology of Insourcing Arrangements The Resource- and Competence Perspective as a Theoretical Background When aspects of vertical coordination are to be addressed in theoretical terms, very often researchers favor the transaction-cost approach (TCA) developed by Coase (1937) and Williamson (1985). However, the TCA is an approach with some major deficiencies, as many researchers pointed out (i.e. Blois 1990; Sydow 1992). Especially the problem of inconsistencies in argumentation, the simple-mindedness, and the limited ability to analyze evolutionary aspects lead to the conclusion that theoretical alternatives should be put into consideration. The resource-and competence-based view represents a promising alternative in order to address some of the most important aspects of insourcing. The resource- and competence-based approach puts forward the question how sustaining competitive advantage can be achieved. The relevant basics can be summarized as follows (Barney 1986 & 1991, Dierickx/Cool 1989, Grant 1991, Amit/Schoemaker 1993, Peteraf 1993, Sanchez/Heene/Thomas 1996): - Uncertainty in economic decision-making and incomplete markets cause asymmetries concerning the dispersion of information and knowledge between economic actors as well as long-lasting differences between firms with regard to firm-specific resource endowments. 13 - - - Every firm follows an individual path of development. Especially, making economic decisions leads to irreversibilities and commitment to a specific organizational path (Ghemawat 1991; Ghemawat/Sol 1998). Therefore, firms appear heterogeneously in the marketplace caused by specific resources and competences. Many authors promote the notion that especially intangible resources are the drivers of heterogeneity (i.e. Hall 1992). Without trying to proof that, firm-specific capabilities and competences are usually dominant variables when sustaining competitive advantage of particular firms in the market process is to be explained (i.e. Hamel/Prahalad 1994). According to Sanchez/Heene/Thomas (1996, p. 7-8), capabilities can be understood as “repeatable patterns of action in the use of assets to create, produce and/or offer products to a market”, whereas competences reflect the “ability to sustain the coordinated deployment of assets in a way that helps a firm achieve its goals”. A path-dependent analysis of the development of firms does not only facilitate the explanation of the heterogeneity of organizations and phenomena of organizational commitment. Moreover, the accumulation of idiosyncratic knowledge and the use of this knowledge in the market process helps to create new market-relevant knowledge and to foster competence building. This is basic in order to perform activities in a way providing superior benefit to the market and to achieve competitive advantage. Competitive advantages resting upon unique resources and especially competences are hard to tackle by competitors, as there are usually forces protecting imitation and sometimes even substitution of critical resources and competences. In literature, those forces are termed as “isolating mechanisms” (Rumelt 1984). Those mechanisms – described in more detail in literature (i.e. Lippman/Rumelt 1982; Rumelt 1984; Dierickx/Cool 1989, Teece/Pisano/Shuen 1990, Barney 1991, Mahoney/Pandian 1992; Sanchez/Heene 1996; Eriksen/Mikkelsen 1996; Oliver 1997) – are especially tacit knowledge, interconnectedness/social complexity, asset mass efficiencies, time compression diseconomies, and causal ambiguity. The existence of asymmetrical resource endowments between firms is a basic reason why firms are engaged in inter-firm collaboration. Sanchez, Heene, and Thomas (1996, p. 7) use the term “firm-addressable resources” in order to stress that there are important assets outside the firm “which a firm does not own or tightly control, but which it can arrange to access and use from time to time”. Those firm-addressable resources and capabilities are maybe the basic reason why firms make use of co-location and especially of insourcing arrangements, indeed. Insourcing helps to achieve that the acquisition firm-addressable resources will be fostered in a more goal-directed way. Inter-firm cooperation in general does not guarantee that the external assets of the partner firm can be used in the way the firm wants to. In case of insourcing as local 14 supplier integration the situation turns. Some assets of the supplier will be dedicated to the customer for a longer period time, usually well-matching customer requirements. According to the Sanchez/Heene/Thomas (1996, p. 7) distinction between firm-specific resources (“those which a firm owns or tightly controls”) and firm-addressable resources, co-location leads to the following situation: The site specificity of the resources usually has no consequences with regard to ownership. However, arrangements such as insourcing cause a state of more or less tight control. Especially the MCC case study clearly demonstrated the considerable opportunities of MCC to make use of the resources of the five system partners. Although there is no state of perfect control of partner’s resources, a substantial amount of control is given. Therefore, co-location causes an interesting intermediate state between firm-addressable resources and firm-specific ones for a long time: the state of firm-addressable resources turning to de-facto firm-specific resources. This situation appears due to the state of “de-facto vertical integration”, described by Monteverde/Teece (1982) and Teece (1982) in another theoretical context, and helps to explain why it is possible for firms to make use of outsourcing payoffs while avoiding its pitfalls when insourcing takes place. With regard to co-location and especially insourcing in a resource- and competencebased context, according to the insourcing typology mentioned above there are two main reasons why such a close cooperation makes sense: - The insourcing project is gap-oriented: The gap, caused by missing or - underdeveloped resources of the customer, needs to be closed by the help of suppliers. On the one hand side, insourcing arrangements emerge with only one supplier working at the customer’s site in case of very specific gaps. On the other one, there is a network of suppliers collaborating according to customer’s requirements in ways such as the industrial park highlighted above. The pooling of resources is the key to partnership success. However, the partners are working more or less independently, as there is a close division of labor with only a limited number of tasks to be performed jointly. The insourcing is learning-oriented: It is not enough to pool supplier’s and customer’s resources at the customer’s site. Moreover, it is an explicit goal of the collaboration that the partners should learn one from another. The foundation of partnership-specific knowledge is maybe the most crucial part in order to further competence building. In both cases there is one particular question to be answered: How far do the resources of the insourcing partners fit together? This problem of asset complementarity in an inter-firm context needs to be considered carefully because closing resource gaps as well as realizing learning advantages can only be achieved if a resource fit is given. However, in business practice usually there are no perfect fits. Partner-specific 15 adaptations respond to this problem. These adaptation processes help to accumulate partner-specific knowledge. Nevertheless, not in every situation partner-specific adaptations lead to the expected results and sometimes they fail. Moreover, adaptations are costly. This stresses the need of a careful assessment of partner firms with regard to their resource endowment before insourcing takes place (see fig. 5). Concerning MCC’s industrial park such a careful selection took place. MCC had the chance to make use of the considerable purchasing experience of Mercedes-Benz. Furthermore, MCC negotiated with several eligible suppliers intensively in order to select their system partners. Oracle’s customers managed the situation similarly. Summing up the examples of insourcing as resource pooling, it appears that the way the suppliers specify their resources is one crucial factor of customer’s considerations to make use of spatial integration. If there are critical tasks of the customer to be performed where the own resource endowment is not strong enough and if there are well-fitting partner firms outside, insourcing as a resource gap-closing arrangement becomes a promising opportunity. Fig. 5: Resource- and Competence-based Determinants of Insourcing Success Whereas the resource-based view is an adequate reference point in order to analyze insourcing in terms of resource pooling, the learning partnerships need a more focused theoretical background. The competence perspective appears to be appropriate because 16 organizational learning can be used in order to foster competence building activities as major goal of these partnerships. Competence building can be defined according to Sanchez/Heene/Thomas (1996, p. 8) as “(...) any process by which a firm achieves qualitative changes in its existing stocks of assets and capabilities, including new abilities to coordinate and deploy new or existing assets and capabilities in ways that help the firm achieve its goals. Competence building creates, in effect, new options for future action for the firm in pursuing its goals”. Learning partnerships are founded especially in order to create synergies. The cooperation, again, is based upon pooling resources being different in kind but compatible. However, one decisive difference is that especially competence building by interorganizational learning becomes the main underlying target of learning partnerships. That means that the principle of a more or less strict way of partitioning work, well-known from gap-closing insourcing arrangements, will be substituted by a close collaboration represented by mutual exchange of knowledge between the participating firms. The knowledge management is centered around the two basic tasks: accumulation and integration of knowledge, both closely intertwined. The insourcing partners try to share their specific knowledge relevant to the insourcing arrangement. Sharing knowledge between organizations can be understood as a basic supposition in order to develop distinctive competences in competition (Leonard-Barton 1995, Pierick/Beije 1996). Leonard-Barton (1995) points out that competence buildingoriented activities of knowledge creation base upon (1) shared problem-solving, (2) implementing and integrating new technologies and methodologies, (3) constant formal and informal experimenting, and (4) pulling in expertise from outside. The Oracle case study clearly indicates that supplier’s technological skills and capabilities need to be combined with customer know-how to manage internal processes. Only if such knowledge integration takes place, it appears to be possible to make use of the various opportunities of IT systems. With regard to knowledge accumulation, the insourcing partners together are able to absorb a higher level of knowledge than all for their own. In this context, the notion of “absorptive capacity”, put forward by Cohen/Levinthal (1990), is useful in order to explain advantages of insourcing (see fig. 5). Absorptive capacity means the “(...) ability of a firm to recognize the value of new, external information, assimilate it, and apply it to commercial ends” (Cohen/Levinthal 1990, p. 128). Obviously, a local supplier integration is able to expand this capacity, as the case studies reveal. Whereas Oracle already tries to exploit the enhanced absorptive capacity, MCC’s industrial park could profit from this potential, especially if the corresponding firms make the decision to collaborate more closely with regard to special topics. 17 The question is still open how insourcing-related knowledge is to be managed in order to foster competence building. One important suggestion is made by Nonaka (1994), promoting four different kinds of knowledge conversion according to the epistemological and ontological dimension of knowledge: socialization, combination, externalization, and internalization. Indeed, there are certain requirements to be satisfied when competitive advantage based upon competences should be achieved. As Krogh/Roos (1992) point out, knowledge is only useful to the emergence of core competences if it is on the one hand not bound to a single person (subjective knowledge) and on the other hand not generalized in a way that almost can get access to (objective knowledge). Transforming knowledge in a way that a limited number of persons shares it, seems to be the most promising way to foster competence building because competitors are confronted with serious problems by trying to acquire it. The organizational knowledge is group-specific and not depending on a single person who could be hired away. This makes acquisition almost impossible. The case studies reveal that insourcing fosters the emergence of group-specific knowledge as usually only parts of supplier’s and customer’s staff work together closely. Beside this ontological aspect, knowledge management has to put epistemological matters into consideration. Especially, there is an on-going debate in literature (see Sanchez 1997, pp. 163-174) whether knowledge should be explicit or tacit in the face of the threat of imitation by competitors. The case studies reveal that the development of organizational and especially interorganizational routines (Nelson/Winter 1982) plays a key role when insourcing success is to be explained. The MCC case study indicates that without the abilities of the partners to interact and to make resource adaptations work, the value-adding activities were performed in a more or less poor way. Similarly, the Oracle case study reveals that the Oracle staff needs to be integrated into the specific processes of the customer in order to recognize what the IT-related problems are about. Moreover, the customer’s personnel has to get in touch with Oracle’s support team to be informed about the various opportunities IT systems are offering. Hence, the emergence of interorganizational routines appears to be basic in order to explain success and failure of insourcing arrangements: The more the partners are able to develop such routines and to embed specific knowledge, the more increases of efficiency respectively effectiveness can be observed. Furthermore, beside these facets of knowledge management, the insourcing partners have to make use of the other isolating mechanisms when competence building should be fostered and substantial contributions to the success of insourcing arrangements should be made. According to fig. 5 and the case studies the following isolating mechanisms are to be mentioned: 18 Interconnectedness/social complexity: Of course, it is usually impossible for competitors to get a complete impression about rival’s resource endowment and its development over time because of the complexity of resource ties in resource networks (Dierickx/Cool 1989; Reed/DeFillippi 1990; Eriksen/Mikkelsen 1996). With regard to interorganizational resource networks, there are even more substantial problems of complexity. Especially in case of an organizational network such as the MCC industrial park, it is very hard for “outsiders” to find out concrete ways of imitation and substitution. The complexity of resource networks underlying the (inter)organizational competences helps to safeguard the state of distinctive competences in competition, too. Asset mass efficiencies (i.e. Dierickx/Cool 1989; Markides/Williamson 1994): As mentioned above, every kind of insourcing as local supplier integration is based upon the pooling of resources. Such pooling usually makes sure that critical gaps in customer’s resource endowment can be closed. Having done so, the coordination will be much more effective. The asset mass is growing and especially in learning partnerships the complementarity of pooled resources sometimes safeguards critical mass effects (Dierickx/Cool 1989). Supplier and customer personnel work together hand in hand and cause such an impulse. Especially the Oracle case study revealed that after some adaptations between Oracle and its customers, the collaboration was gaining effectiveness due to the fact that important knowledge could be transferred between the partners – especially because of the insourcing partnership. Moreover, the emergence of interorganizational routines appeared to be basic in order to explain such efficiencies of asset mass. All in all the following conclusions can be drawn: - In order to explain success (and failure) of co-location arrangements, it appears to be useful to analyze the isolating mechanisms of the resource-based view. The more the firms are able to make them work, the more likely we can observe success such as achieving sustainable competitive advantage as an important measure of insourcing performance. However, measuring insourcing success in terms of - sustaining competitive advantage appears to be problematic as the measurability of this criterion is restricted. Therefore, we have to look out for other measures, such as indicators of product or total quality, the impact on market share or market penetration or similar aspects. This is to be put into consideration in on-going research in order to proof strengths and weaknesses of insourcing more closely. Moreover, it is not only necessary to analyze single isolating mechanisms but even the (dynamic) interplay among the mechanisms, as indicated in fig. 5. However, it is sometimes very hard to recognize how the mechanisms are intertwined. Very much more empirical work is necessary in order to operationalize the isolating 19 mechanisms and to measure the impact of specific isolating mechanisms on performance. - If the customer has a competence to manage supplier networks (see Gemünden/Ritter 1998) in a goal-oriented way, he is able to enhance the potential of insourcing arrangements - although there is no empirical evidence of network superiority. However, the discussion of co-location indicates (again) the necessity to gain further insights in developing competences of managing organizational networks. Co-Location and Recent Developments in Management Obviously, a growing number of firms considers to make use of co-location. However, the question arises whether insourcing is in a certain way contradictory to several recent developments in strategic management in general and interorganizational coordination in particular, as it promotes - centralization instead of decentralization, - hierarchy-like coordination instead of the usual forms of “co-ordination by cooperation” (Richardson 1972), and - fixed agreements instead of loose forms of virtuality. Despite the fact that empirical evidence is still low, the answer seems to be that insourcing – as shown in the study – is predominantly in tune with recent developments in management theory and practice. First, co-location as durable spatial integration of supplier(s) and customer(s) is usually not a “stand-alone concept” at all. It is accompanied by other forms of coordination as many of the observed suppliers perform only parts of their task on the customer’s site. Moreover, many of such preferred (firsttier) suppliers make use of special supplier networks of second- and third-tier suppliers by their own. By analyzing all the activities of the supplying network from the customer’s point of view, there is no doubt that co-location can only be a corrective of an over-emphasized decentralized coordination. It appears to be a useful instrument in order to establish an appropriate balance between centralization and decentralization. Moreover, it stresses the importance of making strategic decisions concerning this critical topic of centralized versus decentralized buying (Woodside/Samuel 1981; Ford 1990; Matthyssens/Faes 1996). Second, co-location demonstrates some limitations of virtual organizations. Obviously, there are some aspects of coordination which cannot be managed “virtually” because i.e. close personal interaction is necessary. However, much of the Miles and Snow vision came true. They stated: 20 “Thus, we expect the 21st century firm to be a temporary organization, brought together by an entrepreneur with the aid of brokers and maintained by a network of contractual ties.” (Miles/Snow 1984, p. 26-27) Nevertheless, the case studies from the automotive and software industry clearly indicate that even virtual coordination needs to be accompanied by durable, maybe even non-virtual arrangements. In this sense, co-location can represent something like a missing link. Understood in this sense, co-location again is not contradicting contemporary developments in management. References Amit, R./Schoemaker, P.J.H. (1993): Strategic Assets and Organizational Rent, Strategic Management Journal, vol. 14, pp. 33-46 Arnold, U. (2000): New Dimensions of Outsourcing: A Combination of Transaction Cost Economics and the Core Competencies Concept, European Journal of Purchasing & Supply Management, Vol. 6 (2000), pp. 23-29 Arnold, U./Scheuing, E.E. (1996): Creating a Factory within a Factory. In: Baker, R.J./Novak, P. (eds.): Purchasing Professionals, NAPM’s 82nd Annual International Purchasing Conference, Tempe/Az., pp. 79-84 Backhaus, K. (1999): Industriegütermarketing, 6th ed., Munich: Vahlen Barney, J.B. (1986): Strategic Factor Markets: Expectations, Luck, and Business Strategy, Management Science, vol. 42, pp. 1231-1241 Barney, J.B. (1991): Firm Resources and Sustained Competitive Advantage, Journal of Management, vol. 17, no. 1, pp. 99-120 Bettis, R.A./Bradley, S.P./Hamel, G. (1992): Outsourcing and Industrial Decline, Academy of Management Executive, vol. 6, no. 1, pp. 7-22 Blois, K.J. (1990): Transaction Costs and Networks. In: Strategic Management Journal, vol. 11, pp. 493-496 Clark, T./Zmud, R./McCray, G. (1998): The Outsourcing of Information Services: Transforming the Nature of Business in the Information Industry. In: Willcocks, L.P./Lacity, M.C. (eds.): Strategic Sourcing of Information Systems, New York: Wiley, pp. 45-78 Coase, R.N. (1937): The Nature of the Firm. In: Economica, vol. 4, pp. 386-405 Cohen, W.M./Levinthal, D.A. (1990): Absorptive Capacity: A New Perspective in Learning and Innovation, Administrative Science Quarterly, vol. 35, pp. 128-152 Darby, M.R./Karni, E. (1973): Free Competition and the Optimal Amount of Fraud, Journal of Law and Economics, vol. 16, pp. 67-88 Dierickx, I./Cool, K. (1989): Asset Stock Accumulation and Sustainability of Competitive Advantage, Management Science, vol. 35, pp. 1504-1511 Dyer, J.H. (1996): Specialized Supplier Networks as a Source of Competitive Advantage: Evidence from the Auto Industry, Strategic Management Journal, vol. 17, pp. 271-291 Eriksen, B./Mikkelsen, J. (1996): Competitive Advantage and the Concept of Core Competence, in: Foss, N.J./Knudsen, C. (eds.): Towards a Competence Theory of the Firm, London/New York, pp. 54–74 Ford, D. (ed.) (1990): Understanding Business Markets, London: Academic Press Ford, D./Farmer, D. (1986): Make or Buy – A Key Strategic Issue, Long Range Planning, vol. 19, no. 5, pp. 54-62 21 Freiling, J./Sieger, C. (1999): Insourcing as Spatial Supplier Integration – Empirical Observations and Theoretical Implications. In: McLoughlin, Damien; Horan, Conor (eds.): Interaction, Relationships and Networks in Business Markets, Competitive Papers, 15th IMP Conference, Dublin Gemünden, H.G./Ritter, T. (1998): Managing Technological Networks: The Concept of Network Competence, In: Interrelationships and Networks in International Markets, Gemünden, H.G./Ritter, T./Walter, A. (eds.), London: Elsevier 1998, pp. 294-304 Ghemawat, P. (1991): Commitment - The Dynamic of Strategy, New York et al.: Free Press Ghemawat, P./Sol, P. del (1998): Commitment versus Flexibility? In: California Management Review, vol. 40, pp. 26-42 Grant, R.M. (1991): The Resource-Based Theory of Competitive Advantage: Implications for Strategy Formulation, California Management Review, vol. 33, no 3, pp. 114-135 Grant, R.M. (1995): Contemporary Strategy Analysis, 2nd ed., Oxford: Blackwell Greco, J. (1997): Outsourcing: The New Partnership, Journal of Business Strategy, vol. 18, no. 4, pp. 48-54 Grover, V./Teng, J.T.C./Cheon, M.J. (1998): Towards a Theoretically-based Contingency Model. In: Willcocks, L.P./Lacity, M.C. (eds.): Strategic Sourcing of Information Systems, New York: Wiley, pp. 79-101 Hall, R.H. (1992): The Strategic Analysis of Intangible Resources, Strategic Management Journal, vol. 13, pp. 135-144 Hamel, G. (1994): The Concept of Core Competence, in: Competence-based Competition, Hamel, G./Heene, A. (eds.), New York: Wiley, pp. 11-33 Hamel, G./Prahalad, C.K. (1994): Competing for the Future, Boston/Mass.: HBS Press Klein, B./Crawford, R./Alchian, A. (1978): Vertical Integration, Appropriable Rents and the Competitive Contracting Process, Journal of Law and Economics, vol. 21, pp. 297-326 Krogh, G. von/Roos, J. (1992): Towards a Competence-Based Perspective of the Firm, Working Paper 1992/15, Norwegian School of Management, Sandvika 1992 Lacity, M./Hirschheim, R. (1993): Information Systems Outsourcing: Myths, Metaphors and Realities, Chichester: Wiley Leonard-Barton, D. (1995): Wellsprings of Knowledge. Building and Sustaining the Sources of Innovation, Boston/Mass.: HBS Press Lippman, S.A./Rumelt, R.P. (1982): Uncertain Imitability: An Analysis of Interfirm Differences in Efficiency under Competition. In: Bell Journal of Economics, vol. 13, pp. 418-438 Mahoney, J.T./Pandian, J.R. (1992): The Resource-based View within the Conversation of Strategic Management. In: Strategic Management Journal, vol. 13, pp. 363-380 Markides, C.C./Williamson, P.J. (1994): Related Diversification, Core Competences and Corporate Performance. In: Strategic Management Journal, vol. 15, Special Issue, pp. 149 - 165 Matthyssens, P./Faes, W. (1996): Coordinating Purchasing: Strategic and Organizational Issues, In: Interrelationships and Networks in International Markets, Gemünden, H.G./Ritter, T./Walter, A. (eds.), London: Elsevier, pp. 323341 Miles, R.E./Snow, C.C. (1984): Fit, Failure, and the Hall of Fame, California Management Review, vol. 26, pp. 10-28 Monteverde, K./Teece, D. J. (1982): Supplier Switching Costs and Vertical Integration in the Automobile Industry, The Bell Journal of Economics, vol. 13, no. 2, pp. 206-213 22 Nelson, P. (1970): Information and Consumer Behavior, Journal of Political Economy, vol. 78, pp. 311-329 Nelson, R./Winter, S. (1982): An Evolutionary Theory of Organizational Change, Cambridge/London Nonaka, I. (1994): A Dynamic Theory of Organizational Knowledge Creation, Organization Science, vol. 5, pp. 14-37 Oliver, C. (1997): Sustainable Competitive Advantage: Combining Institutional and Resource-Based Views. In: Strategic Management Journal, vol. 18, pp. 697-713 Penrose, E.T. (1959): The Theory of the Growth of the Firm, Oxford: Blackwell Peteraf, M.A. (1993): The Cornerstones of Competitive Advantage: A Resource-Based View, Strategic Management Journal, vol. 14, pp. 179-191 Pfaffmann, E. (1998): Mercedes-Benz and „Swatch“. Inventing the smart and the Networked Organization, INSEAD Case Study, Fontainebleau Pierick, E. ten/Beije, P.R. (1996): Strengthening and Developing Competences by Small and Medium-Sized Subcontractors: The Contribution of the Outsourcing Company, In: Interaction, Relationships, and Networks, Work-in-Progress Papers, 12th IMP Conference, Gemünden, H.G./Ritter, T./Walter, A. (eds.), Karlsruhe, pp. 1301-1332 Quinn, J.B. (1992): Intelligent Enterprise. A Knowledge and Service Based Paradigm for Industry, New York: Free Press Quinn, J.B./Hilmer, F. (1994): Strategic Outsourcing. In: Sloan Management Review, vol. 35, no. 4, pp. 43-55 Reed, R./DeFillippi, RJ. (1990): Causal Ambiguity, Barriers to Imitation, and Sustainable Competitive Advantage. In: Academy of Management Review, vol. 15, pp. 88-102 Richardson, G.B. (1972): The Organization of Industry, Economic Journal, vol. 82, pp. 883-896 Rumelt, R.P. (1984): Towards a Strategic Theory of the Firm, In: Competitive Strategic Management, Lamb, R.B. (ed.), Englewood Cliffs/N.J.: Prentice-Hall, pp. 556570 Sanchez, R. (1997): Managing Articulated Knowledge in Competence-based Competition, in: Sanchez, R./Heene, A. (eds.): Strategic Learning and Knowledge Management, Chichester: Wiley, pp. 163-187 Sanchez, R./Heene, A. (1996): A Systems View of the Firm in Competence-based Competition, in: Sanchez, R./Heene, A./Thomas, H. (eds.): Dynamics of Competence-based Competition: Theory and Practice in the New Strategic Management, Oxford: Pergamon, pp. 39-62 Sanchez, R./Heene, A. (1997): Competence-based Strategic Management, In: Competence-based Strategic Management, Heene, A./Sanchez, R. (eds.), Chichester: Wiley, pp. 3-42 Sanchez, R./Heene, A./Thomas, H. (1996): Towards the Theory and Practice of Competence-based Competition, In: Dynamics of Competence-based Competition, Sanchez, R./Heene, A./Thomas, H. (eds.), Oxford: Elsevier, pp. 1-35 Stuckey, J./White, D. (1993): When and When Not to Vertically Integrate. In: Sloan Management Review, vol. 34, pp. 71-83 Sydow, J. (1992): Strategische Netzwerke, Wiesbaden: Gabler Teece, D.J. (1982): Towards an Economic Theory of the Multiproduct Firm, Journal of Economic Behavior and Organization, vol. 3, no 1, pp. 39-63 Teece, D.J. (1984): Economic Analysis and Strategic Management, California Management Review, vol. 26, Spring, pp. 86-110 23 Teece, D.J./Pisano, G./Shuen, A. (1990): Firm Capabilities, Resources and the Concept of Strategy, Economic Analysis and Policy Working Paper, University of California, Berkeley/Cal. Venkatesan, R. (1992): To Make or Not to Make, Harvard Business Review, vol. 70, no.5, pp. 98-107 Welch, J.A./Nayak, P.R. (1992): Strategic Sourcing: A Progressive Approach to the Make-or-Buy-Decision, Academy of Management Executive, vol. 6, no. 1, pp. 23-31 Wernerfelt, B. (1984): A Resource Based View of the Firm, Strategic Management Journal, vol. 5, pp. 171-180 Willcocks, L.P./Lacity, M.C. (1998): Introduction – The Sourcing and Outsourcing of IS: Shock of the New? In: Willcocks, L.P./Lacity, M.C. (eds.): Strategic Sourcing of Information Systems, New York: Wiley, pp. 1-41 Williamson, O. E. (1985): The Economic Institutions of Capitalism, New York: Free Press Woodruff, D./Katz, I./Naughton, K. (1996): VW’s Factory of the Future, Business Week, October 7, pp. 52-56 Woodside, A.G./Samuel, D.M. (1981): Observation of Centralized Corporate Procurement, Industrial Marketing Management, vol. 10, no. 3, pp. 191-205