Midterm Examination

advertisement

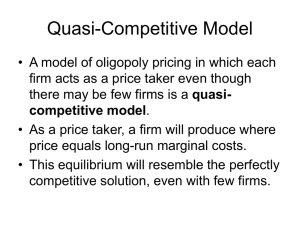

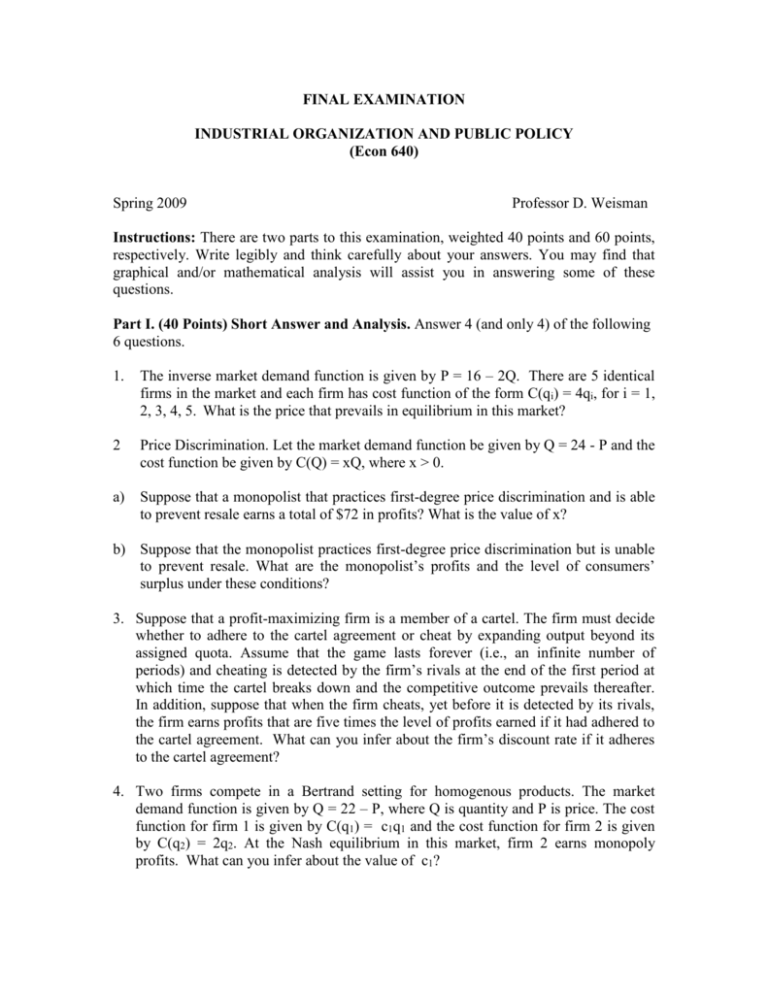

FINAL EXAMINATION INDUSTRIAL ORGANIZATION AND PUBLIC POLICY (Econ 640) Spring 2009 Professor D. Weisman Instructions: There are two parts to this examination, weighted 40 points and 60 points, respectively. Write legibly and think carefully about your answers. You may find that graphical and/or mathematical analysis will assist you in answering some of these questions. Part I. (40 Points) Short Answer and Analysis. Answer 4 (and only 4) of the following 6 questions. 1. The inverse market demand function is given by P = 16 – 2Q. There are 5 identical firms in the market and each firm has cost function of the form C(qi) = 4qi, for i = 1, 2, 3, 4, 5. What is the price that prevails in equilibrium in this market? 2 Price Discrimination. Let the market demand function be given by Q = 24 - P and the cost function be given by C(Q) = xQ, where x > 0. a) Suppose that a monopolist that practices first-degree price discrimination and is able to prevent resale earns a total of $72 in profits? What is the value of x? b) Suppose that the monopolist practices first-degree price discrimination but is unable to prevent resale. What are the monopolist’s profits and the level of consumers’ surplus under these conditions? 3. Suppose that a profit-maximizing firm is a member of a cartel. The firm must decide whether to adhere to the cartel agreement or cheat by expanding output beyond its assigned quota. Assume that the game lasts forever (i.e., an infinite number of periods) and cheating is detected by the firm’s rivals at the end of the first period at which time the cartel breaks down and the competitive outcome prevails thereafter. In addition, suppose that when the firm cheats, yet before it is detected by its rivals, the firm earns profits that are five times the level of profits earned if it had adhered to the cartel agreement. What can you infer about the firm’s discount rate if it adheres to the cartel agreement? 4. Two firms compete in a Bertrand setting for homogenous products. The market demand function is given by Q = 22 – P, where Q is quantity and P is price. The cost function for firm 1 is given by C(q1) = c1q1 and the cost function for firm 2 is given by C(q2) = 2q2. At the Nash equilibrium in this market, firm 2 earns monopoly profits. What can you infer about the value of c1? 5. Rank the following market structures in decreasing order of economic welfare: perfect competition, monopoly, first-degree price discrimination, Cournot Oligopoly, Bertrand Duopoly (homogenous products)? [You may assume that market demand and cost functions are invariant across market structures and that duopolists have identical costs.] 6. Agree or disagree with the following statement and provide the economic analysis in support of your claim. The secretary of transportation should prohibit the practice of third-degree price discrimination by the airlines because it results in lower economic welfare relative to uniform monopoly pricing. Part II. (60 Points). Problems and Essay. Answer 2 (and only 2) of the following 3 questions. 1.. There are three firms that belong to a cartel. Let the inverse market demand function be given by P = 20 – Q. The cost function for each firm is of the form C(Q) = 2Q. a) What is the profit-maximizing price and quantity for this cartel? b) Suppose that each of the 3 firms that belong to the cartel is assigned a uniform share of the profit-maximizing output level. Suppose that firm 1 believes that the other two firms will adhere to the cartel agreement. If firm 1 cheats on the cartel agreement, the other firms will discover the cheating and the end of the first period at which time the cartel breaks down and the competitive outcome prevails thereafter. Determine the discount rate for which the firm is indifferent between cheating and adhering to the cartel agreement in a 1 period, 2 period, 3 period and infinite period game. c) Suppose now that all of the firms cheat, but each firm believes that the other firms will adhere to the cartel agreement. What level of profits are realized by each of the cartel members and what is the resultant level of consumers’ surplus? d) Would consumers prefer that the firms in a cartel have a high or a low discount rate? Explain your answer carefully. 2. [Cournot Oligopoly] Let inverse market demand be given by P= 36 – 2Q, where P is price and Q = q1 + q2 . The cost function for firm 1 is given by C(q1) = 4q1 and the cost function for firm 2 is given by C(q2) = 8q2. a) Derive the reaction functions for firm 1 and firm 2. b) Determine the equilibrium level of output, price and consumers’ surplus. c) Suppose that firm 1 adopts a strategy of limit pricing. How much output would firm 1 put on the market? How much better/worse-off are consumers if firm 1 engages in limit pricing rather than Cournot-Nash Behavior? 2 3. The horizontal merger guidelines in the United States are based, in large measure, on the premise that “market share is synonymous with market power.” Use the models, articles and economic theories discussed in class to evaluate the reasonableness of this premise and its implications for economic welfare. [It may be helpful to construct a brief outline for your answer in advance to organize your thoughts in a logical manner.] 3