Chap008-hwk

Chapter 08 - Financial Statement Analysis

SOLUTIONS MANUAL

CHAPTER 08

FINANCIAL STATEMENT ANALYSIS

PROBLEMS

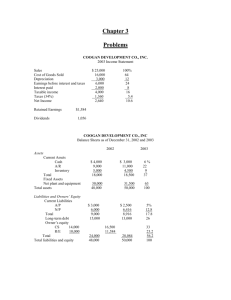

Income statement

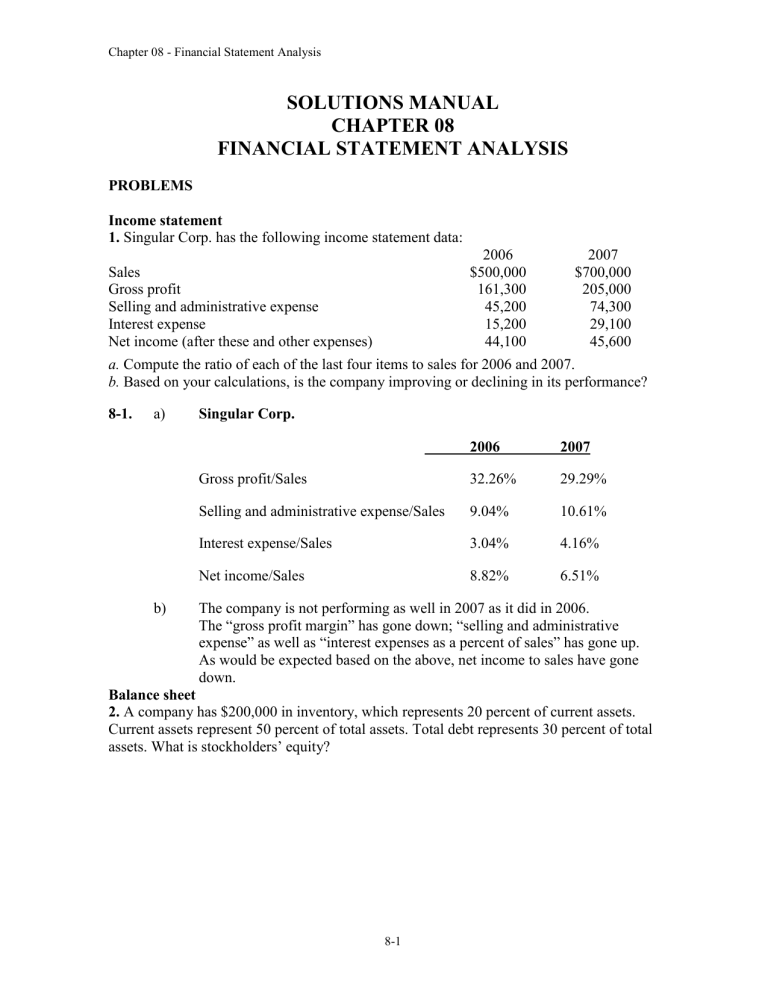

1. Singular Corp. has the following income statement data:

Sales

2006

$500,000

Gross profit

Selling and administrative expense

Interest expense

161,300

45,200

15,200

2007

$700,000

205,000

74,300

29,100

Net income (after these and other expenses) 44,100 a. Compute the ratio of each of the last four items to sales for 2006 and 2007.

45,600 b. Based on your calculations, is the company improving or declining in its performance?

8-1.

a) Singular Corp.

Gross profit/Sales

2006

32.26%

Selling and administrative expense/Sales 9.04%

2007

29.29%

10.61%

Interest expense/Sales

Net income/Sales

3.04%

8.82%

4.16%

6.51% b) The company is not performing as well in 2007 as it did in 2006.

The “gross profit margin” has gone down; “selling and administrative expense” as well as “interest expenses as a percent of sales” has gone up.

As would be expected based on the above, net income to sales have gone down.

Balance sheet

2. A company has $200,000 in inventory, which represents 20 percent of current assets.

Current assets represent 50 percent of total assets. Total debt represents 30 percent of total assets. What is stockholders’ equity?

8-1

Chapter 08 - Financial Statement Analysis

8-2. Inventory of $200,000 is 20% of current assets. This means current assets are

$1,000,000.

Current assets of $1,000,000 are 50 percent of total assets. This means total assets are

$2,000,000.

Total debt represents 30 percent of total assets. This means total debt is $600,000.

The balance of total assets must be financed with stockholders’ equity. This means stockholders’ equity is

$1,400,000.

Total assets − total debt = Stockholders’ equity

$2,000,000 − $600,000 = $1,400,000

Du Pont analysis

3. Given the following financial data: Net income/Sales = 4 percent; Sales/Total assets = 3.5 times; Debt/Total assets = 60 percent; compute: a. Return on assets. b. Return on equity.

8-3.

a) Return on assets

Net Income

Sales

Sales

Total assets

14%

4%

3.5

b) Return on equity

Return on Assets

35%

14%

Du Pont analysis

4. Explain why in problem 3 return on equity was so much higher than return on assets.

8-4. Return on equity was so much higher than return on assets because the firm had heavy debt in its capital structure. (60 percent of assets). This means that the firm has a relatively small equity base against which to generate income which leads to a higher return on equity.

Du Pont analysis

5. A firm has assets of $1,800,000 and turns over its assets 2.5 times per year. Return on assets is 20 percent. What is its profit margin (return on sales)?

8-2

Chapter 08 - Financial Statement Analysis

8-5.

Net Income

Sales

$360, 000

$4, 500, 000

Net Income / Sales

$360, 000 / $4, 500, 000

8%

Du Pont analysis

6. A firm has assets of $1,800,000 and turns over its assets 1.5 times per year. Return on assets is 25 percent. What is its profit margin (return on sales)?

8-6.

Net Income

$450, 000

Sales

$2, 700, 000

Net Income / Sales

(Profit Margin)

$450, 000 / $2, 700, 000

16.67%

8-3

Chapter 08 - Financial Statement Analysis

Du Pont analysis

7. A firm has a return on assets of 12 percent and a return on equity of 18 percent. What is the debt-to-total assets ratio?

8-7.

Return on equity

Return on Assets

18%

12%

18% (1 X)

12%

18% 18%X

12%

18%X

6%

X

33%

The debt/total assets ratio is 33%.

Proof

Return on equity

12%

12%

(1 33) .67

18%

8-4

Chapter 08 - Financial Statement Analysis

Du Pont analysis

8. In the year 2007, the average firm in the S&P 500 Index had a total market value of fives times stockholders’ equity (book value). Assume a firm had total assets of $10 million, total debt of $6 million, and net income of $600,000. a. What is the percent return on equity? b. What is the percent return on total market value? Does this appear to be an adequate return on the actual market value of the firm?

8-8.

a) Return on equity

Net Income $600, 000

Stockholders ' Equity $4, 000, 000

15%

Total assets

Total debt

Stockholders 'equity

$10, 000, 000

6, 000, 000

4, 000, 000 or

Return on Assets

Return on equity

$600, 000 / $10, 000, 000

6%

15%

.40

b) Return on Market Value

Net Income

Total Market Value

Total Market Value

$20, 000, 000

Return on market value

$600, 000

$20, 000, 000

3%

The return on total market value of three percent appears to the small, particularly when investors can get a higher rate on certificates of deposit (CDs).

The intend of this problem is to show it is not only return on stockholders’ equity that is important, but also what the firm can earn on its total value in the market. It is the latter term that represents the true value of the firm to stockholders.

8-5

Chapter 08 - Financial Statement Analysis

General ratio analysis

9. A firm has the following financial data:

Current assets $600,000

Fixed assets 400,000

Current liabilities 300,000

Inventory 200,000

If inventory increases by $100,000, what will be the impact on the current ratio, the quick ratio, and the net-working-capital-to-total-assets ratio? Show the ratios before and after the changes.

8-9.

Before After

Current ratio

$600, 000

$300, 000

2X

$700, 000

$300, 000

2.33X

Quick ratio

$400, 000

$300, 000

1.33X

$400, 000

$300, 000

1.33X

Net working capital to total assets

$300, 000

$1, 000, 000

30%

$400, 000

$1,100, 000

36.36%

8-6

Chapter 08 - Financial Statement Analysis

General ratio analysis

10. Given the following financial data, compute: a. Return on equity. b. Quick ratio. c. Long-term debt to equity. d. Fixed-charge coverage.

Assets:

Cash ...........................................................................................

Accounts receivable ..................................................................

Inventory ...................................................................................

Fixed assets ...............................................................................

Total assets ......................................................................................

Liabilities and stockholders’ equity:

Short-term debt..........................................................................

Long-term debt ..........................................................................

Stockholders’ equity..................................................................

Total liabilities and stockholders’ equity ........................................

Income before fixed charges and taxes ...........................................

Interest payments ............................................................................

Lease payment .................................................................................

Taxes (35 percent tax rate) ..............................................................

Net income (after-taxes) ..................................................................

$ 2,500

3,000

6,500

8,000

$20,000

$ 3,000

2,000

15,000

$20,000

$ 4,400

800

400

1,120

$ 2,080

8-10.

a)

Net income

$2, 080

Stockholders 'equity $15, 000

13.87% b)

Cash Accounts receivable

Short

term debt

$5, 500

3, 000

1.83X

c)

Long

term debt

$2, 000

Stockholders 'equity 15, 000

13.33% d)

Income before fixed charges & taxes

$4, 400

$4, 400

$1, 200

3.67X

8-7

Chapter 08 - Financial Statement Analysis

Coverage of sinking fund

11. Assume in part d of problem 10 that the firm had a sinking fund payment obligation of

$200. How much before-tax income is required to cover the sinking-fund obligation? Would lower tax rates increase or decrease the before-tax income required to cover the sinking fund?

8-11.

Before-tax income required =

After - tax payment

$200

$200

.65

$307.69

Lower tax rates would decrease the amount of before-tax income required to cover the sinking fund. As an example, reduce the tax rate to 20 percent and recomputed the answer.

$200 /(1 0.2)

$200 / 0.8

$250

Return on equity

12. In problem 10, if total debt were increased to 50 percent of assets and interest payments went up by $300, what would be the new value for return on equity?

8-12.

Income before fixed charges and taxes

Lease payments

Taxes (35% tax rate)

Net Income (after taxes)

$4, 400

1,100

400

1, 015

$1,885

Net income

$1,885

Stockholders 'equity $10, 000

18.85%

8-8

Chapter 08 - Financial Statement Analysis

Stock price ratios

13. Assume the following financial data:

Short-term assets .............................................................................. $300,000

Long-term assets .............................................................................. 500,000

Total assets ................................................................................. $800,000

Short-term debt................................................................................. $200,000

Long-term debt .................................................................................

Total liabilities ...........................................................................

168,000

368,000

Common stock ................................................................................. 200,000

Retained earnings .............................................................................

Total stockholders’ equity ..........................................................

232,000

432,000

Total liabilities and stockholders’ equity ......................................... $800,000

Total earnings (after-tax).................................................................. $ 72,000

Dividends per share ..........................................................................

Stock price ........................................................................................

Shares outstanding ...........................................................................

$ 1.44

$ 45

24,000 a. Compute the P/E ratio (stock price to earnings per share). b.

Compute the book value per share (note that book value equals stockholders’ equity). c. Compute the ratio of stock price to book value per share. d. Compute the dividend yield. e. Compute the payout ratio.

8-13.

a) P / E ratio

Pr ice

EPS

EPS

Earnings

$72, 000

Shares 24, 000

$3

P / E

$45

$3

15X b) Book value per share

Stockholders 'equity

Shares

$432, 000

24, 000

$18

8-9

Chapter 08 - Financial Statement Analysis c)Stock price to book value

$45

$18

2.5X

d) Dividend yield

Dividends per share

Common stock price

$1.44

$45

3.2% e) Payout ratio

Dividends per share

Earnings per share

$1.44

$3.00

48%

Tax considerations and financial analysis

14. Referring to problem 13: a. Compute after-tax return on equity. b. If the tax rate were 40 percent, what could you infer the value of before-tax income was? c. Now assume the same before-tax income computed in part b , but a tax rate of 25 percent; recompute after-tax return on equity (using the simplifying assumption that equity remains constant). d. Assume the taxes in part c were reduced largely as a result of one-time nonrecurring tax credits. Would you expect the stock value to go up substantially as a result of the higher return on equity?

8-14.

a)

Net income

$72, 000

Stockholders 'equity $432, 000

16.67% b) Before - tax income

After - tax income

$72, 000

$120, 000 c) Before - tax income

Taxes (25%)

After - tax income

120, 000

30, 000

$90, 000

Net income

$90, 000

Stockholders 'equity 432, 000

20.83%

8-10

Chapter 08 - Financial Statement Analysis d) No. Since the increased return on stockholders’ equity is a one time event, stockholders will not forecast a permanently higher income stream and increase valuation substantially.

Divisional analysis

15. The Multi-Corporation has three different operating divisions. Financial information for each is as follows:

Clothing

Sales ............................................. $3,000,000

Operating income ......................... 330,000

Net income (A/T) ......................... 135,000

Appliances

$15,000,000

1,250,000

870,000

Sporting Goods

$25,000,000

3,200,000

1,400,000

Assets ........................................... 1,200,000 10,000,000 a. Which division provides the highest operating margin? b. Which division provides the lowest after-tax profit margin? c. Which division has the lowest after-tax return on assets? d. Compute net income (after-tax) to sales for the entire corporation.

8,000,000 e. Compute net income (after-tax) to assets for the entire corporation. f. The vice president of finance suggests the assets in the Appliances division be sold off for

$10 millions and redeployed in Sporting Goods. The new $10 million in Sporting Goods will produce the same after-tax return on assets as the current $8 million in that division.

Recompute net income to total assets for the entire corporation assuming the above suggested change. g. Explain why Sporting Goods, which has a lower return on sales than Appliances, has such a positive effect on return on assets.

8-15.

Clothing Appliances Sporting Goods a) Operating income/sales 11.00% 8.33% 12.8% b) Net income/sales c) Net income/assets

4.50%

11.25%

5.80%

8.70%

5.6%

17.5%

Net income d)

Sales (for corporation)

(All values in 000’s)

8-11

Chapter 08 - Financial Statement Analysis

Total net income

Total sales

$2, 405

$43, 000

5.59% e)

Net income

Total assets (for corporation)

(All values in 000 's)

Total net income

Total assets

$135

$1, 200 10, 000

8, 000

$2, 405

$19, 200

12.53% f) $10,000,000 from Appliances is redeployed in Sporting Goods at an after-tax return on assets of 17.5 percent. This will mean incremental aftertax income of $1,750,000 for Sporting Goods to replace the $870,000 from Appliances. Total after-tax income will increase by $880,000 to $3,285,000. Net income to total assets for the corporation will now be:

Total net income

$3, 285, 000

Total assets $19, 200, 000

17.11% g) The big advantage that Sporting Goods has over Appliances is a rapid turnover of assets, which leads to a high return on assets despite a relatively low return on sales.

The asset turnover ratio for the Sporting Goods division is 3.125, but only 1.5 for

Appliances.

Approaches to security evaluation

16. Security Analyst A thinks the Collins Corporation is worth 14 times current earnings.

Security Analyst B has a different approach. He assumes that 45 percent of earnings (per share) will be paid out in dividends and the stock should provide a 4 percent current dividend yield. Assume total earnings are $12 million and that 5 million shares are outstanding. a.

Compute the value of the stock based on Security Analyst A’s approach. b.

Compute the value of the stock based on Security Analyst B’s approach. c. Security Analyst C uses the constant dividend valuation model approach presented in

Chapter 7 as Formula 7–5 on page 147 . She uses Security Analyst B’s assumption about dividends (per share) and assigns a growth rate, g , of 9 percent and a required rate of return

( K e

) of 12 percent. Is her value higher or lower than that of the other security analysts?

8-12

Chapter 08 - Financial Statement Analysis

8-16.

a) Security Analyst A

EPS

$12, 000, 000

5, 000, 000

$2.40

b)Security Analyst B

Pr ice

Dividend per share

.04

Dividend per share

Pr ice

$1.08

.04

$27 c) P o

D

1

(K e

g)

It is higher

Combining Du Pont analysis with P/E ratios

17. Sarah Bailey is analyzing two stocks in the semiconductor industry. It is her intention to assign a P/E of 16 to the average firm in the industry. However, she will assign a 20 percent premium to the P/E of a company that uses conservative financing in its capital structure. This is because of the highly cyclical nature of the industry.

Two firms in the industry have the following financial data:

Palo Alto Semiconductors Burr Ridge Semiconductors

Net income/Sales

Sales/Total assets

Debt/Total assets

Earnings

5.0%

2.1

60%

$40 million

4.2%

3.5

30%

$15 million

Shares $16 million $6.25 million a.

Compute return on stockholders’ equity for each firm. Use the Du Pont Method of analysis.

Which is higher? b. Compute earnings per share for each company. Which is higher? c. Applying the 20 percent premium to the P/E ratio of the firm with the more conservative financial structure and the industry P/E ratio of the other firm, which firm has the higher stock price valuation?

8-17.

a) Palo Alto Semiconductors Burr Ridge Semiconductors

Net income/Sales

Sales/total assets

Return on assets

5.0%

2.1

10.5%

4.2%

3.5

14.7%

8-13

Chapter 08 - Financial Statement Analysis

Debt/total assets 60.0% 30.0%

Return on stockholders 'equity

10.5%

(1-60)

26.52%

14.7%

(1-.30)

21.00% b)

Palo Alto Semiconductors is higher (26.52% vs. 21.00%).

Palo Alto Burr Ridge

40 million

$2.50

16 million

$15 million

6.25 million

$2.40

Palo Alto Semiconductors is higher ($2.50 vs. $2.40). c) Burr Ridge is more conservative with a debt ratio of 30% vs. 60% for Palo Alto.

Stock

EPS

Pr ice P / E Ratio

2.50

2.40

$40.00

$46.08

Burr Ridge Semiconductors is higher ($46.08 vs. $40.00).

8-14