On March 1, 2010, Pechstein Construction Company

advertisement

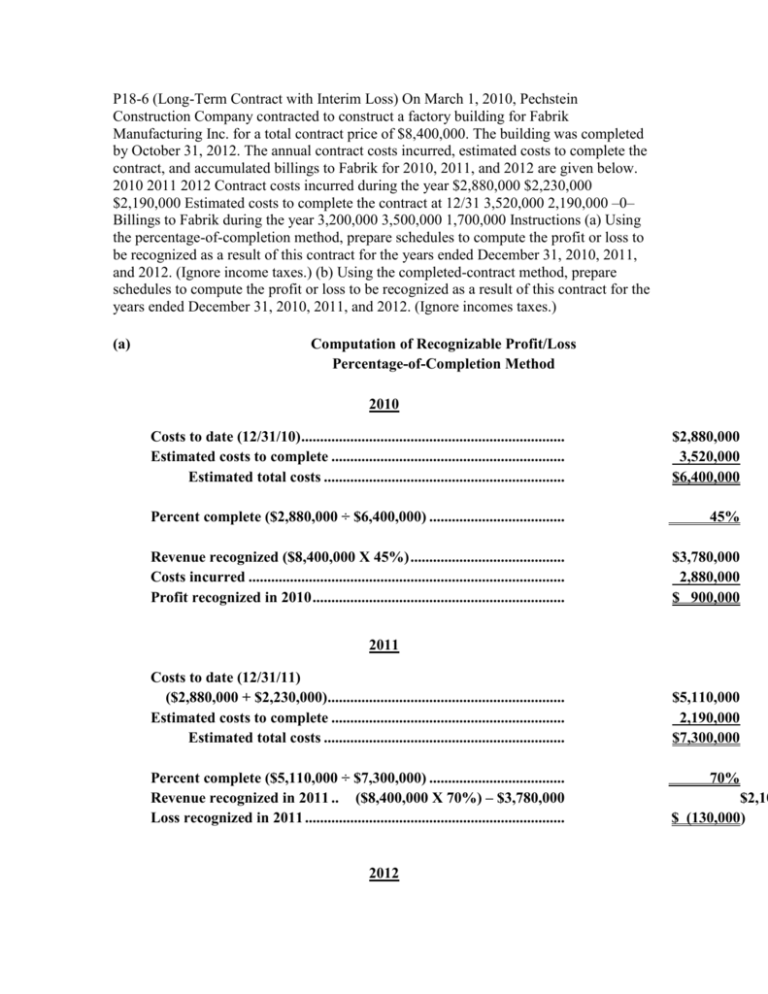

P18-6 (Long-Term Contract with Interim Loss) On March 1, 2010, Pechstein Construction Company contracted to construct a factory building for Fabrik Manufacturing Inc. for a total contract price of $8,400,000. The building was completed by October 31, 2012. The annual contract costs incurred, estimated costs to complete the contract, and accumulated billings to Fabrik for 2010, 2011, and 2012 are given below. 2010 2011 2012 Contract costs incurred during the year $2,880,000 $2,230,000 $2,190,000 Estimated costs to complete the contract at 12/31 3,520,000 2,190,000 –0– Billings to Fabrik during the year 3,200,000 3,500,000 1,700,000 Instructions (a) Using the percentage-of-completion method, prepare schedules to compute the profit or loss to be recognized as a result of this contract for the years ended December 31, 2010, 2011, and 2012. (Ignore income taxes.) (b) Using the completed-contract method, prepare schedules to compute the profit or loss to be recognized as a result of this contract for the years ended December 31, 2010, 2011, and 2012. (Ignore incomes taxes.) (a) Computation of Recognizable Profit/Loss Percentage-of-Completion Method 2010 Costs to date (12/31/10) ...................................................................... Estimated costs to complete .............................................................. Estimated total costs ................................................................ $2,880,000 3,520,000 $6,400,000 Percent complete ($2,880,000 ÷ $6,400,000) .................................... 45% Revenue recognized ($8,400,000 X 45%) ......................................... Costs incurred .................................................................................... Profit recognized in 2010 ................................................................... $3,780,000 2,880,000 $ 900,000 2011 Costs to date (12/31/11) ($2,880,000 + $2,230,000)............................................................... Estimated costs to complete .............................................................. Estimated total costs ................................................................ Percent complete ($5,110,000 ÷ $7,300,000) .................................... Revenue recognized in 2011 .. ($8,400,000 X 70%) – $3,780,000 Loss recognized in 2011 ..................................................................... 2012 $5,110,000 2,190,000 $7,300,000 70% $2,10 $ (130,000) Total revenue recognized .................................................................. Total costs incurred ........................................................................... Total profit on contract ..................................................................... Deduct profit previously recognized ($900,000 – $130,000) ..................................................................... Profit recognized in 2012 ................................................................... 770,000 $ 330,000* *Alternative Revenue recognized in 2012 ($8,400,000 X 30%) ........................................................................ Costs incurred in 2012 ....................................................................... Profit recognized in 2012 ................................................................... $2,520,000 2,190,000 $ 330,000 (b) $8,400,000 7,300,000 1,100,000 Computation of Recognizable Profit/Loss Completed-Contract Method 2010—NONE 2011—NONE 2012 Total revenue recognized .................................................................. Total costs incurred ........................................................................... Profit recognized in 2012 ................................................................... $8,400,000 7,300,000 $1,100,000 Question #2 Lazaro, Inc. sells goods on the installment basis and uses the installmentsales method. Due to a customer default, Lazaro repossessed merchandise that was originally sold for $800, resulting in a gross profit rate of 40%. At the time of repossession, the uncollected balance is $520, and the fair value of the repossessed merchandise is $275. Prepare Lazaro's entry to record the repossession. (List multiple debit/credit entries from largest to smallest amount, e.g. 10, 5, 2.) Debit Credit Repossessed Merchandise ? Deferred Gross Profit ? Loss on repossession ? Installment accounts receivable ? Repossessed Merchandise ............................................................................. Loss on Repossession ..................................................................................... Deferred Gross Profit ($520 X 40%) ............................................................ Installment Accounts Receivable ........................................................ 275 37* 208 520 *[$275 – ($520 – $208)] Question # 3 Jansen Corporation shipped $20,000 of merchandise on consignment to Gooch Company. Jansen paid freight costs of $2,000. Gooch Company paid $500 for local advertising which is reimbursable from Jansen. By year-end, 60% of the merchandise had been sold for $21,500. Gooch notified Jansen, retained a 10% commission, and remitted the cash due to Jansen. Prepare Jansen's entry when the cash is received. (List multiple debit/credit entries from largest to smallest amount, e.g. 10, 5, 2.) Debit Credit Cash ? commission expense ? advertising expense ? revenue from consignment sales ? Cost of goods sold ? Inventory on consignment ? Cash ...................................................................................................18,850* Advertising Expense ...................................................................................... Commission Expense ..................................................................................... Revenue from Consignment Sales ...................................................... 500 2,150 21,500 *[$21,500 – $500 – ($21,500 X 10%)] Cost of Goods Sold ......................................................................................... Inventory on Consignment .................................................................. [60% X ($20,000 + $2,000)] 13,200 13,200