Derivation of the Black-Scholes Option Pricing Model

advertisement

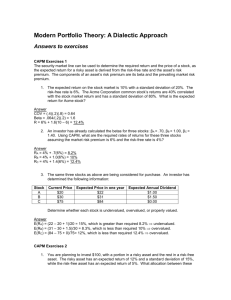

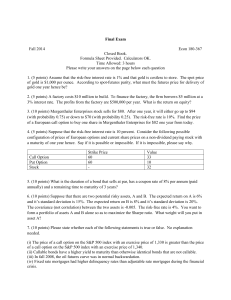

UVA-F-0945 DERIVATION OF THE BLACK-SCHOLES OPTION-PRICING MODEL Assume that we have one asset, W, whose price at time t, W(t), depends on the price of another asset at time t, S(t). In this case, we can write the price of W(t) as a function of the price of S at time t, or W(t) = F[S(t), t]. The simplest way of thinking of this is to think of the price of something depending on something else. For example, the prices of bonds depend on interest rates. In the discussion that follows, we focus on call options, where the price of the call option depends on the stock price. The basic definitions we will use are W(t) = price of options at t, and W(t) = F[S(t),t], where S(t) is stock price at time t. Assume dS(t) = asSdt + σsSdz. This stochastic differential equation assumes that the change in the stock price over time, dS(t), follows a log-normal distribution. Additional definitions we will use are N1(t) = number of shares of S, N2(t) = number of options, Q(t) = money in Rf, and P(t) = value of the portfolio. The value of a portfolio with holdings in the stock, option, and risk-free asset at time t is P(t)= N 1 (t)S(t) + N 2 (t)W(t) + Q(t), 1 where N1(t)S(t) is the value of the position in the stock, N2(t)W(t) is the value of the position in the options, and Q(t) is the dollar amount in the risk-free asset at time t. 2 UVA-F-0945 The change in the value of P(t) over time can be defined as dP = d( N 1 S) + d( N 2 W) + dQ, 2 which we can rewrite as dP = d( N 1 S) d( N 2 W) dQ N1 S + N 2W + Q. Q N1 S N 2W 3 Then d(N1S) and d(N2W) can be decomposed into two parts as follows: d( N 1 S) dN 1 dS = + S N1 S N1 4 d( N 2 W) dN 2 dW = + . W N 2W N2 5 and Assuming dN 1 dN 2 0 and 0 , N1 N2 then 6 d( N 1 S) dS d( N 2 W) dW = and = . S W dN 1 S N 2W The assumption that the percentage change in N1 and N2 is almost zero implies that any adjustments are very small per unit of time. Because the dollars invested in the risk-free asset earn the risk-free rate, Rf, dQ = QRfdt, with dt as the time measure. time: With these assumptions, we can write the change in the portfolio value over Because dQ = QR f dt, 7 dP = dS dW ( N 1 S) + ( N 2 W) + R f Qdt. S W Now let dW = a w dt + w dZ. W 8 3 UVA-F-0945 This stochastic differential equation describes how the price of the option, W(t), changes over time. Using this equation and the definition for the stochastic differential equation for the stock price, dS(t), we can do the following: Substituting for dS dW and , S W 9 dP = ( as dt + s dZ) N 1 S + ( aw dt + w dZ) N 2 W + R f Qdt. 10 Dividing by P yields dP N S N W Rf Q = ( as dt + s dZ) 1 + ( aw dt + w dZ) 2 + dt P P P P 11 The next step is to define weights for the portfolio. If P = N1S + N2W + Q, then (N1S)/P is the percentage of the value of P invested in the stock. The same would be true for the options and the risk-free asset. Define 1= N1 and substitute to yield or, collecting terms, P S W Q 3= , P P 2= N2 12 dP = ( a s dt + s dZ) 1 + ( a w dt + w dZ) 2 + R f 3 dt, P 13 dP = ( a s 1 + a w 2 + R f 3 )dt + ( s 1 + w 2 )dZ. P 14 At this point, we have a stochastic differential equation for the portfolio. If we would like to make the portfolio risk free, we must eliminate the stochastic part of the equation or the dZ part. We can do this as follows. Set 15 ( s 1 + w 2 )= 0 or 16 1= - w w , s dP and the result is that is nonstochastic. P 4 UVA-F-0945 For this portfolio, the expected return is dP E = ( a s 1 + a w 2 + R f 3 ) dt, 17 P but if the return is nonstochastic, it must be fixed per time unit, and the resulting portfolio should earn the risk-free rate of return, or 18 ( as 1 + aw 2 + R f 3 )dt = R f dt. At this point, we have three structural equations relating to the risk-free portfolio described previously: *1 + *2 + *3 = 1 19 *1 + w *2 = 0 and as 1 + aw 2 + R f (1 - 1 - 2 ) = R f . * * * * 20 Solving yields as - r s = aw - r w . 21 The result is an arbitrage condition that must hold at all times. We can now use this result to solve the differential equation for the option price. The key is to use the no-arbitrage result and Ito's Lemma to derive values for aw and σw. By Ito's Lemma, if y(t) = y(x,t), where dx = f(x,t)dt + σ(x,t)dZ, then 1 dy = ( yt + y x f(x,t) + y xx 2 (x,t)) dt + y x (x,t) dZ. 2 22 For W(t)=F(x,t), where dS = asSdt + σsSdZ, then 1 dW = F t + a s S F s + F xx 2s S 2 dt + F s S s dZ. 2 Thus, if W(t) = F(S,t) = awWdt + σwWdZ, then aw and σw can be written as 1 2 2 a w W = F t + a s S F s + F ss S 2 and w W = s S F s . 23 24 25 5 UVA-F-0945 From the no-arbitrage condition, we know that as - R f aw - R f = , 26 s w so we can use the definitions of aw and σw we found to substitute into the no-arbitrage condition. The result is 1 2 2 F t + a s S F s + S F ss - R f W as R f 2 27 = . s s S Fs Noting that W = F, we rearrange this equation to 1 2 a s S F s - R f S F s = F t + a s S F s + F ss S - R f F. 28 2 Canceling terms and bringing everything to the right-hand side of the equation yields the basic Black-Scholes stochastic differential equation: 1 0 = R f S F s + F t + F ss 2s S - R f F. 29 2 In order to derive the exact option-pricing formula, we need to add the boundary conditions that apply to a call option, which are W(T)=Max [0, ST - X] and W(t) 0 for all t, where T is the maturity date of the call option and X is the strike price. The solution to the stochastic differential equation turns out to be well known as the heat-transfer equation. The solution in this case is the Black-Scholes option-pricing model: Call price = S N( d 1 ) - X eR f (T-t) N( d 2 ), 30 where S= current stock price, X= strike price, (T-t)= time to maturity, Rf= risk-free rate of interest, N(.) is the cumulative standard normal, and S 2 ln + R f + (T - t) 2 X d1= T -t S 2 ln + R f - (T - t) 2 X = d1 - T - t . d2= T -t 31 32