Study Guide for Exam 2 Answers

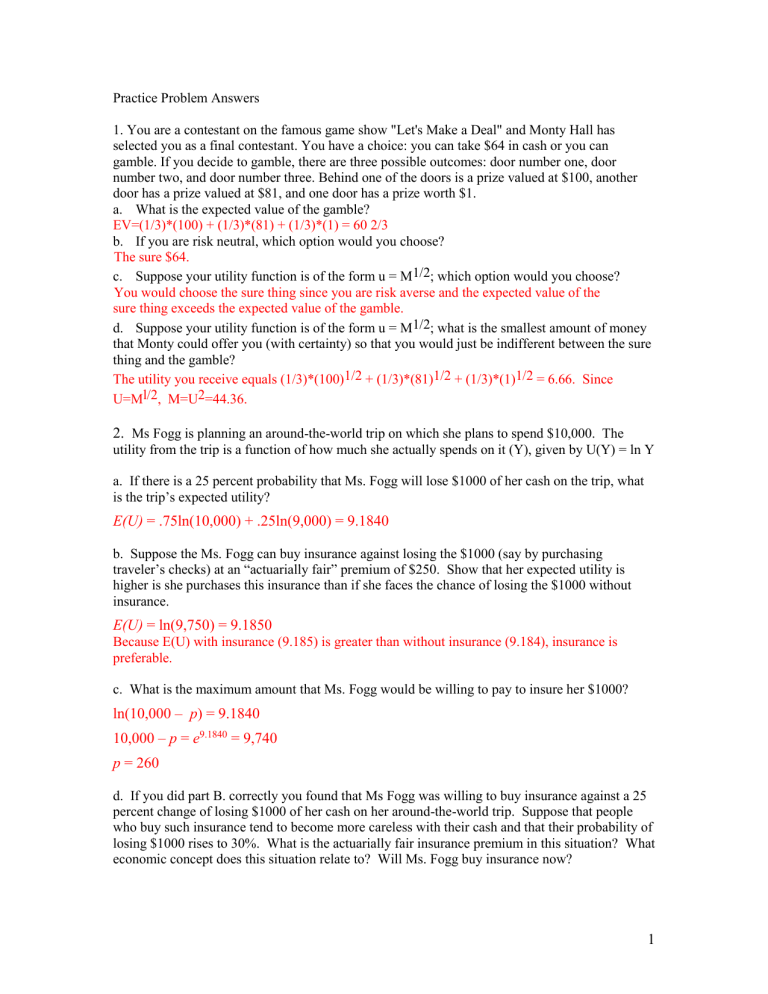

Practice Problem Answers

1. You are a contestant on the famous game show "Let's Make a Deal" and Monty Hall has selected you as a final contestant. You have a choice: you can take $64 in cash or you can gamble. If you decide to gamble, there are three possible outcomes: door number one, door number two, and door number three. Behind one of the doors is a prize valued at $100, another door has a prize valued at $81, and one door has a prize worth $1. a.

What is the expected value of the gamble?

EV=(1/3)*(100) + (1/3)*(81) + (1/3)*(1) = 60 2/3 b.

If you are risk neutral, which option would you choose?

The sure $64. c.

Suppose your utility function is of the form u = M1/2; which option would you choose?

You would choose the sure thing since you are risk averse and the expected value of the sure thing exceeds the expected value of the gamble.

d.

Suppose your utility function is of the form u = M1/2; what is the smallest amount of money that Monty could offer you (with certainty) so that you would just be indifferent between the sure thing and the gamble?

The utility you receive equals (1/3)*(100)1/2 + (1/3)*(81)1/2 + (1/3)*(1)1/2 = 6.66. Since

U=Ml/2, M=U2=44.36.

2.

Ms Fogg is planning an around-the-world trip on which she plans to spend $10,000. The utility from the trip is a function of how much she actually spends on it (Y), given by U(Y) = ln Y a. If there is a 25 percent probability that Ms. Fogg will lose $1000 of her cash on the trip, what is the trip’s expected utility?

E(U) = .75ln(10,000) + .25ln(9,000) = 9.1840 b. Suppose the Ms. Fogg can buy insurance against losing the $1000 (say by purchasing traveler’s checks) at an “actuarially fair” premium of $250. Show that her expected utility is higher is she purchases this insurance than if she faces the chance of losing the $1000 without insurance.

E(U) = ln(9,750) = 9.1850

Because E(U) with insurance (9.185) is greater than without insurance (9.184), insurance is preferable. c. What is the maximum amount that Ms. Fogg would be willing to pay to insure her $1000? ln(10,000 – p ) = 9.1840

10,000 – p = e

9.1840

= 9,740 p = 260 d. If you did part B. correctly you found that Ms Fogg was willing to buy insurance against a 25 percent change of losing $1000 of her cash on her around-the-world trip. Suppose that people who buy such insurance tend to become more careless with their cash and that their probability of losing $1000 rises to 30%. What is the actuarially fair insurance premium in this situation? What economic concept does this situation relate to? Will Ms. Fogg buy insurance now?

1

The actuarially fair p remium is now $300. If she buys insurance, spending is 9700, utility

= ln(9700) = 9.1799. This falls short of utility without insurance (9.1840), so here it is better to forego insurance. The fact that people become more careless with insurance indicates that there is a moral hazard in this case.

3. According to the Kahneman-Tversky (hedonic framing model), which of the following options would most people prefer to the other? a.) Option 1: A gain of $5,000 or Option 2: a gain of $6,000 and a loss of $1,000?

Option 1 (Combine small losses with large gains). b.) Option 1: A loss of $5,000 or Option 2: a loss of $4,000 and a loss of $1,000?

Option 1 (Combine losses). c.) Option 1: A 50% chance of winning $1,000 and a 50% chance of winning $0 or

Option 2: A sure gain of $500?

Option 2 (People are risk averse with respect to gains).

4. A firm’s short run production function is given by:

Q = ½ L 0.5 for 0 <= L <=2 and

Q = 3L – ¼ L 2 for 2 < L <= 7 a. Sketch the production function.

Q

9

L

2 6 7 b. Find the maximum attainable production. How much labor is used at that level?

Maximum production (Q=9) occurs at L=6. To find the maximum, you can either look at the graph, or to solve mathematically, take the first derivative and set it equal to zero (implying that the slope equals zero) and solve for L:

Q /

L = 3 - (1/2)L= 0, which yields L = 6, Q = 9.] c. Identify the ranges of L utilization over which the marginal product of labor is increasing or decreasing.

For 0<L<2, MPL is increasing. For 2<L<7, MPL is decreasing.

2

d. Identify the range over which the marginal product of labor is negative.

MPL < 0 for L>6.

5. A firm has production function Q=2 K 2 L 0.5

. The current amount of capital employed is 4 units and labor is 64 units. a.) What is the average productivity of labor? a.) AP

L

= Q/L = 256/64 = 4 b.) What is the marginal productivity of labor? b.) MP

L

=

Q /

L = 16*L -0.5

=16*0.125=2 c.) Is average productivity currently falling or rising? How do you know? c.) Average productivity is falling because marginal productivity is below it.

6. A firm has the following production function Q=2K 1/3 L 1/3 a. What is the marginal product of labor if K is fixed at 27?

For K=27, we have Q=6L1/3, so MP=

Q /

L =2L-2/3. b. Show whether the firm experiencing increasing, decreasing, or constant returns to scale.

This firm is experiencing decreasing returns to scale because 2(tK) 1/3 (tL) 1/3 is less than tQ.

c. Calculate the total cost as a function of Q.

TC = (Q 3 /216)*w + FC d. What is the marginal cost if w=$10 and L=50?

MC=w/MP

L

=$10/.1474=$67.86 e. What is the profit maximizing amount of K and L if r=$50, w=$100 and the firm cannot spend more than $2,000?

K*=20 and L*=10

7. When a firm is experiencing increasing returns to scale, what is happening to the long run total cost function and what is happening to the long run average cost function?

The long run total cost function is increasing at a decreasing rate, while the long run average cost function in decreasing.

8. When the average product of labor equals the marginal product of labor, how will marginal cost compare with average variable cost?

When MP=AP, marginal cost and average variable cost will be the same. To see this, note first that MC=

VC/

Q=w

L/

Q=w/MP. Similarly, AVC=wL/Q=w/AP. So when AP=MP, it follows that MC=AVC.

9. A firm has access to two production processes with the following marginal cost curves:

MC

1

=0.8Q and MC

2

=10+0.6Q.

If the firm needs to produce 40 units of output, how much should it produce with each process?

Q

2

= 15.7

3

Q

1

= 24.3

10. Professor Smith and Professor Jones are going to produce a new introductory textbook. As true economists, they have laid out the production function for the book as

Q= S 0. 5 J 0. 5

Where q equals the number of pages in the finished book, S equals the number of working hours spent by Smith, and J equals the number of hours spent working by Jones.

Smith values his labor as $3 per working hour. He has spent 900 hours preparing the first draft.

Jones, whose labor is valued at $12 per working hour, will revise Smith’s draft to complete the book. a. How many hours will Jones have to spend to produce a finished book of 150 pages? Of 300 pages? Of 450 pages?

900

0.5

0.5

J

30

25

150

J = 100 q = 300

J = 225 q = 450 b. What is the marginal cost of the 150 th page of the finished book? Of the 300 th page? Of the

450 th page?

Cost = 12 J = 12 q 2 /900

dC dq

24 q

2 q

900 75 q = 150 MC = 4 q = 300 MC = 8 q = 450 MC = 12

11. Given the following production function:

Q = 4L .8

K .8

a. Show the function has a diminishing rate of technical substitution.

MRTS =

Q

Q

/

/

L

K

3 .

2

L

0 .

2

3 .

2

L

0 .

8

K

K

0 .

8

0 .

2

K

L

So obviously as L increases, the MRTS decreases. Or if the derivative of the MRTS with respect to L is negative. b. Assume the wage rate (w) is 25 and the rental rate of capital (v) is 100. Solve for the cost minimizing levels of L and K to produce 1296 units of output. What is the total cost of producing in the long run?

4

MRTS

w v

25

100

1296

4 ( 4 K )

0 .

8

K

0 .

8

K

L

L

4 K

K

*

18 .

54

L

*

TC

TC

74 .

15

74 .

15 * ($ 25 )

18 .

54 * ($ 100 )

$ 3707

c. Assume in the short run that the level of capital is fixed at 10 units. What would be the short run total cost of producing 1296 units of output? Compare the long run cost of producing 1296 units of output to the short run cost of producing 1296 units of output

(which is greater and why?)

1296

4 L

0 .

8

( 10 )

0 .

8

L

*

TC

137 .

5

137 .

5 * ($ 25 )

10 *

TC

$ 4436 .

25

($ 100 )

In the short run (with a given amount of capital) the costs of producing a given amount will be higher than it is in the long-run, for the simple reason that the firm does not have the ability to adjust it’s input use to the cost minimizing allocation.

12.

Assume a single price firm is charging a price of $40, and is operating on a portion of the demand where the elasticity equals -2. What is the marginal revenue? What is the marginal cost?

MR = P(1 + 1/e) = $20; If they are maximizing profit, MC would also equal $20, or

(P-MC)/P = -1/e, (40 – MC)/40 = ½, MC=20.

13. A perfectly competitive firm has a total cost function given by: 0.1q

2 + 10q + 500 and the market price is constant at P=$20 for all quantities produced. a. How many units does this firm have to sell in order to turn a profit (at what q does profit become positive)?

Profit is never positive for this firm. b. What is the profit maximizing quantity of production for this firm?

MC C q

0.2

q

10

set MC = P = 20, yields q

*

= 50 c. What is their maximum attainable profit?

π =

Pq – C = 1000 – 1250 = -250

14. The cpst function for a firm in producing cork filled baseball bats is given by:

TC = 0.25Q

2 +40

5

The bats only sell in two areas: The Bronx, New York (where the Yankees win by cheating), has a demand given by Q=100-2P, and Queens (where the Mets don’t win nor cheat), has a demand given by

Q=100-4P. a.) What is the marginal revenue curve in each market?

The Bronx: MR=50 - Q

Philly: MR=25 - .5Q b.) If this firm can control quantities supplied to each market, how many should it sell in each location and what price should it charge to maximize profits?

Total cost = C = .25

q

2

= .25( q

B

+ q

P

)

2

MC

B

= .

5 (q

B

+ q

P

) MC

A

= .

5 (q

B

+ q

P

)

Set MR

B

= MC

B and MR

A

= MC

P

50 - q

B

= .

5 q

B

+ .

5 q

P

25 q

L = .

5 q

B

+ .

5 q

P

2

Solving these simultaneously gives q

B

= 30 P

B

= 35 q

P

= 10 P

P

= 22.5

Note: If you were to go through and set

MCp=.5

Q p = 25 - .5Q

p

and MC

B

= .5= 50 - Q

B and solve for the quantities that way, that would be adequate for the exam (ie. You won’t be asked to do more than that on the exam) d.) In which market is demand more elastic at the profit maximizing point?

It is more elastic in Philly.

d.) What do their total profits equal?

π = 1050 + 225

400 = 875

15. Suppose a firm has a supply function given by P=Q 1/2 . What is the amount of producer surplus between P=0 and P=30? What do their variable costs equal? What does their profit equal if their fixed cost equal $9,000?

PS = P 3 /3| 30 = $27,000/3 = $9,000.

PS = TR – VC; TR = $27,000, so VC = $18,000

PS = Profit + FC, so Profit = $0

Good Luck!!