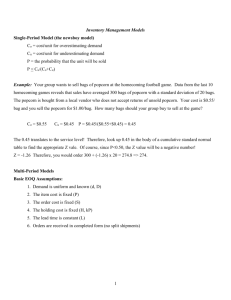

EOQ, Uncertainity HW

advertisement

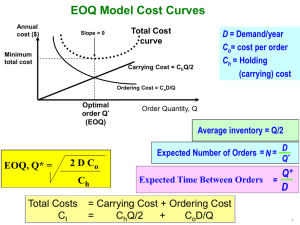

Solution Set Chapter 4 & 5 Problems: 4-32, 4-34, 4-36, 4-41; 5-28, 5-30, 5-32 4.32 a) Convert demand to annual basis: = (380)(12) = 4560 per year, c = 0.45, h = Ic = (.25)(.45) = .1125, K = 8.50. Q* = b) 2K h (2)(8.5)(4560) .1125 = 830 T = Q*/ = 830/4560 = .1820 years. (2.184 months) T r = (2/12)4560 = 760 760 c) Profit per sale = .99 - .45 = .54 Total annual profit = (.54)(4560) = $2462.40 Subtract annual holding and set-up cost: 2Kh (2)(8.50)(4560)(.1125) = 93.39 Hence the annual profit = $2369.01 4.34 K c a) = = = = 200 (both cases) (200)(52) = 10,400 75 locally 65 overseas Average annual cost at the optimal solution is G(Q) = c + 2KIc in both cases. Substituting the appropriate costs we obtain: locally G(Q) = (10,400)(75) + (2)(200)(10,400)(.2)(75) = $787,899.37 overseas G(Q) = (10,400)(65) + (2)(200)(10,400)(.2)(65) = $683,353.91 Difference = $104,545 annually. b) The average pipeline inventory is . Hence: locally: (200)(52)(1/12) = 866.67 units overseas: (200)(52)(6/12) = 5,200 units The value of the local inventory is (866.67)(75) = $65,000 Value of overseas is (5,200)(65) = $338,000 Difference = $273,000 Assuming 20% rate of interest, this difference would cost the firm (273,000)(.2) = $54,600 annually, which is less than the savings realized in holding and set-up cost realized by producing overseas. Hence on the basis of cost alone, overseas production is still preferred. c) The differences in cost of $50,000 yearly could easily be outweighed by the firm's competitive advantage at being able to be more responsive to market demands due to the shortened production lead time locally. 4.36 The President used the following EOQ: Q1 = = 707 (2)(100)(1800) (.3)(2.40) "True" EOQ was: Q2 = (2)(40)(1800) (,.2)(2.40) = 548 Cost error in percent = 1 Q Q* 1 707 548 = 2 Q * Q 2 548 707 1.033 Error is 3.3% only Optimal cost = = 263 (2)(40)(1800)(.2)(2.40) Additional cost = 263(.033) = $8.68 annually 4.41 a) c = .35 + .15 + .05 = .55 h = Ic = .11 EOQ b) 2K h Q 50,000 Q* 120,604 (2)(400)(2,000,000) (.11) = 120,604 = .41458 Error = 0.5[Q/Q* + Q*/Q] = 1.4133 41.33% additional cost Optimal cost = 2Kh = (2)(400)(2, 000, 000)(.11) 13,266.5 ~ $13,267 annually. Hence, the additional cost of using suboptimal policy: = (13,267)(.4133) = $5483 annually. 5.28 a) Newsboy model. Each three-month period corresponds to a period. Since there is considerable variation from one three-month period to the next, we must assume random demand. b) Since the demand rate is constant, an EOQ model would be appropriate. c) Because of the monthly variation, a random demand model is appropriate. The perishability does not appear to be an issue so that a (Q,R) model is probably appropriate. Whether to use a stock-out or service level model is unclear. d) EOQ with quantity discounts. e) Other type of model. This problem would require a model which includes both quantity discounts and random demand. Such a model was not considered in this chapter. 5.30 a) F(R) = .95 z = 1.645 R = z + µ = (102.1)(1.645) + 166.67 = 335 b) n(R)/Q = 1 - = .05 n(R) = (.05)(EOQ) = (.05)(1741) = 87.05 L(z) = n(R)/ = 87.05/102.1 = .8526 z = -.71 R = z + = (102.1)(-.71) + 166.67 = 94 c) n(R0) = L(z) = (102.1)(.8526) = 87.05 1 - F(R0) = .7612 2 Q1 = 8705 (1741) 2 87.05 .7612 L(z1) = .7612 = 1859 (.05)(1859) = .910 102.1 z1 = -.79 R1 = (102.1)(-.79) + 166.67 = 86 n(R1) = L(z) = (102.1)(.910) = 92.91 1 - F(R1) = .7853 Q2 92.91 92.912 (1741)2 .7853 .7853 = L(z2) = z2 = (.05)(1863) 102.1 = = 1863 .912 -.79 same as z1. Stop. (Q,R) = (1863,86) 5.32 a) Newsboy problem cu = 50 - 20 = 30 c0 = 20 - 8 + .3(20) = 18 Critical ratio = 30/(18 + 30) = .625 Demand is uniform from 20 to 70 .625 20 Q 20 70 20 b) = Q = .625 Q = 51 70 20 2 = 45 = 7 70 Q* = z + where F(z) = .625. From the table we obtain z = .32. Hence, Q* = (7)*(.32) + 45 47