Answers

advertisement

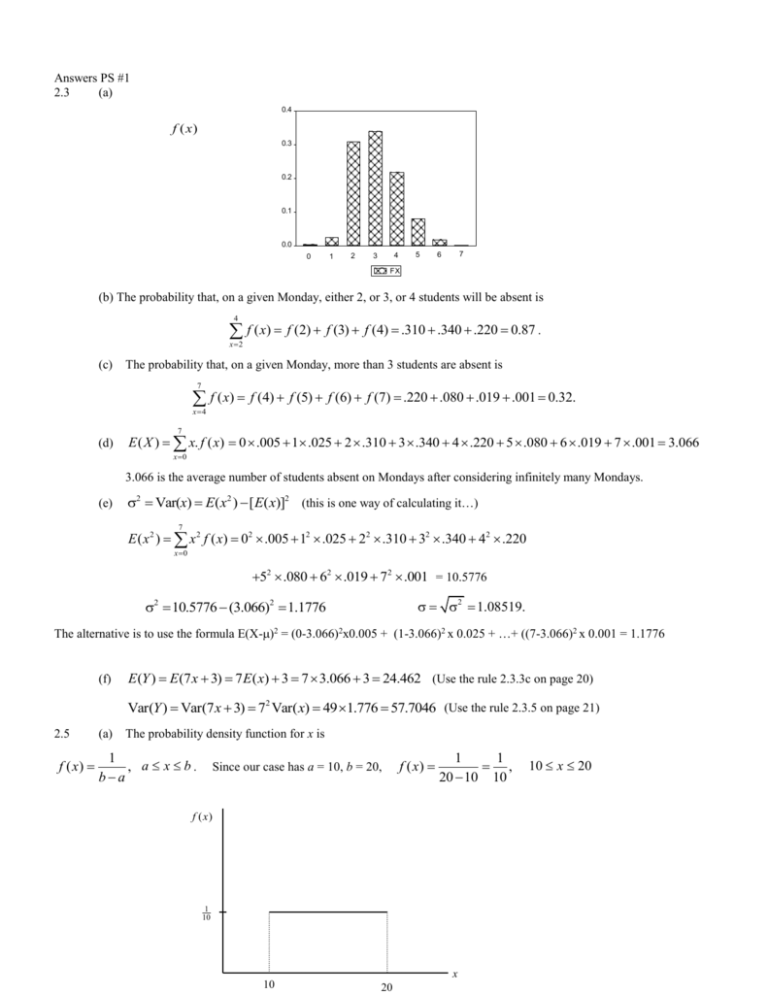

Answers PS #1 2.3 (a) 0.4 f ( x) 0.3 0.2 0.1 0.0 0 1 2 5 4 3 7 6 FX (b) The probability that, on a given Monday, either 2, or 3, or 4 students will be absent is 4 f ( x) f (2) f (3) f (4) .310 .340 .220 0.87 . x2 (c) The probability that, on a given Monday, more than 3 students are absent is 7 f ( x) f (4) f (5) f (6) f (7) .220 .080 .019 .001 0.32. x4 7 (d) E ( X ) x. f ( x) 0 .005 1 .025 2 .310 3 .340 4 .220 5 .080 6 .019 7 .001 3.066 x 0 3.066 is the average number of students absent on Mondays after considering infinitely many Mondays. (e) 2 Var(x) E( x2 ) [ E( x)]2 (this is one way of calculating it…) 7 E ( x 2 ) x 2 f ( x) 02 .005 12 .025 22 .310 32 .340 42 .220 x 0 52 .080 62 .019 72 .001 = 10.5776 2 1.08519. 2 10.5776 (3.066)2 1.1776 The alternative is to use the formula E(X-)2 = (0-3.066)2x0.005 + (1-3.066)2 x 0.025 + …+ ((7-3.066)2 x 0.001 = 1.1776 (f) E (Y ) E (7 x 3) 7 E ( x) 3 7 3.066 3 24.462 (Use the rule 2.3.3c on page 20) Var(Y ) Var(7 x 3) 72 Var( x) 49 1.776 57.7046 (Use the rule 2.3.5 on page 21) 2.5 f ( x) (a) The probability density function for x is 1 , a x b. ba Since our case has a = 10, b = 20, f ( x) 1 1 , 20 10 10 f ( x) 1 10 x 10 20 10 x 20 (b) The total area beneath the pdf for 10 x 20 is the area of a rectangle. Namely, Area = (20 10) (c) 2.6 1 1 10 P(17 X 19) (19 17) 1 0.2 10 (a) For 4-year schools P(men and 4-year) 4,076,416 0.27 15,064,859 P(women and 4-year) 4,755,790 0.32 15,064,859 (b) Let X=0 if a male is selected X=1 if a female is selected Y=1 if 4-year student is chosen Y=2 if 2-year student is chosen Y=3 if a less than 2-year student is chosen P( X 0) P( X 0, Y 1) P( X 0, Y 2) P( X 0, Y 3) 0.27 0.16 0.01 0.44 P(Y 2) P( X 0, Y 2) P( X 1, Y 2) 0.16 0.22 0.38 (c) For f ( x), we note from part (b) that f (0) 0.44. Similarly, for f (1) we obtain f (1) P( X 1) 0.32 0.22 0.02 0.56 Thus, the marginal probability function f ( x) is given by 0.44 for x 0 f ( x) 0.56 for x 1 For g ( y ) we have 0.27 0.32 0.59 for y 1 g ( y ) 0.16 0.22 0.38 for y 2 0.01 0.02 0.03 for y 3 (d) The conditional probability function for Y given that X = 1 can be obtained using the result P(Y y X x) Thus, P(Y y, X x) f ( x, y) P( X x) f ( x) 0.32 0.56 0.57 for y 1 f ( y x 1) 0.22 0.56 0.39 for y 2 0.02 0.56 0.04 for y 3 (e) If a randomly chosen student is male, the probability that he attends a 2-year college is P(Y 2 X 0) P(Y 2, X 0) .16 .36 P( X 0) .44 (f) If a randomly chosen student is a male, the probability that he attends either a 2-year college or a 4-year college is P(Y 1 or Y 2 X 0) P(Y 1 X 0) P(Y 2 X 0) P(Y 1, X 0) P(Y 2, X 0) P( X 0) P( X 0) .27 .16 .61 .36 .97 .44 .44 (g) For gender and type of college institution to be statistically independent, we need f ( x, y ) f ( x ) g ( y ) for all x and y. For x = 0 and y = 1, we have f (0,1) 0.27 f (0) g (1) 0.44 0.59 0.26 While these two values are close, they are not identical. Hence, gender and type of institution are not independent. 2.7 The mutual fund has an annual rate of return, X ~ N (0.1,0.042 ) . For each one of these problems, sketch a diagram of the normal curve and SHADE in the area that corresponds to the question. Then use the normal probability table to determine the actual area. (a) 0 0.1 P( X 0) P z p( z 2.5) 0.5 0.4938 0.0062 0.04 (b) 0.15 0.1 P( X 0.15) P z P( z 1.25) 0.5 0.3944 0.1056 0.04 (c) Now, X ~ N (0.12,0.052 ) 0 0.12 P( X 0) P z p( z 2.4) 0.5 0.4918 0.0082 0.05 0.15 0.12 P( X 0.15) P z P( z 0.6) 0.5 0.2257 0.2743 0.05 From the modification, the probability that a 1-year return will be negative is increased from 6.2% to 8.2%, and the probability that a 1-year return will exceed 15% is increased from 10.56% to 27.43%. Since the chance of negative return has increased only slightly, and the chance of a return above 15% has increased considerably, I would advise the fund managers to make the portfolio change. 2.9 2.12 not on list, but still good practice. Draw a normal distribution for each one of these and shade in the appropriate area: (a) P(Z 3) P(Z 0) P(0 Z 3) .5 .4987 0.9987 (b) P(Z 1) P(Z 0) P(0 Z 1) .5 .3413 0.8413 (c) P( z 1) P( z 0) P(1 z 0) 0.5 0.3413 0.1587 (d) P( z 3) P( z 0) P(3 z 0) 0.5 0.4987 0.0013 (e) P(1 Z 1) 2 P(0 Z 1) .3413 2 .6826 (f) P(3 z 1) P(3 z 0) P(0 z 1) 0.4987 0.3413 0.84 (g) Computer software files xr2-9.xls, contain the instructions for computing these probabilities. (a) 2 x 0 x 1 f x otherwise 0 f(x) 2 1 (b) x P(0 X 21 ) 21 ( 21 )(1) 41 (this is the area under the line above from X=0 to X=1/2. Shade this area in on the graph. To calculate the area, remember that the area of a triangle is (1/2)*base*height.) (c) P( 14 X 34 ) P( X 34 ) P( X 14 ) 12 ( 34 )( 32 ) 12 ( 14 )( 12 ) 169 161 12 (this is the area under the line above between X=1/4 and X=3/4. shade your graph…i can’t seem do shade in Word) 2.14 The joint probability density function for the random variables, gender (G) and political affiliation (P), is G P 0 1 2 0 .20 .30 .06 The marginal probability density functions are 1 .27 .10 .07 0.44 if g 0 f g 0.56 if g 1 0.47 if f p 0.40 if 0.13 if and p0 p 1 p2 (a) For the two random variables, G and P, to be independent, f g , p f g f p When g = 0 and p = 0, we have f (0,0) = 0.27. However, f ( g 0) = 0.44 and f ( p 0) = 0.47. Thus, f ( g 0). f ( p 0) = 0.44 0.47 = 0.2068 0.27 = f (0,0) . Hence the random variables P and G are not independent. Similarly, f (11 , ) = 0.3, f ( g 1) = 0.56 and f ( p 1) = 0.4. Again 0.3 0.56 0.4, providing further evidence that the two random variables G and P are not independent. (b) f g, p f p | G 1 f g 1 . Thus we can set up the following table. f g , p p f x p x 1 p 2.15 f p G 1 f g 1 0 0.20 0.56 0.3571 1 0.30 0.56 0.5357 2 0.06 0.56 0.1071 1 x for x = 0,1. (a) The mean of the discrete random variable, X, is E X x f x 0 f 0 1 f 1 p1 1 p 11 p x The variance of X is 2 var X E X E X x p f x x p p x 1 p 2 2 2 x p p 0 1 p 2 1 0 1 p p 1 1 p 2 1 x x 11 p 2 1 p 1 p p p1 p p 1 p p1 p 2 (b) E[ B] E[ X 1 X 2 ... X n ] E[ X 1 ] E[ X 2 ] ... E[ X n ] p p p np Given X 1 , X 2 ,..., X n are independent, we have var B var X 1 X 2 ... X n var X 1 var X 2 ... var X n p1 p p1 p... p1 p np1 p (c) np B 1 E[Y ] E E[ B] p n n n np1 p p1 p B 1 var Y var 2 var B n n n n2 2.16 2 4 6 X 1 Y 3 9 1/8 1/4 1/8 1/2 1/24 1/4 1/24 1/3 1/12 0 1/12 1/6 1/4 1/2 1/4 (a) The marginal probability density function of Y is h(y) where h(1) = 1/2 h(3) = 1/3 h(9) = 1/6 (b) The conditional probability density function for y is given by the equation f ( y | x) f ( x, y) . Applying f ( x) this rule, we can obtain f ( y |2) , which is given by f ( y |2) y 1 f (2,1) f (2) (1 / 8) (1 / 4) = 1/2 3 f (2,3) f (2) (1 / 24) (1 / 4) = 1/6 9 f (2,9) f (2) (1 / 12) (1 / 4) = 1/3 Therefore, the conditional probability density function, f ( y |2) , is given by f (1|2) = 1/2 f (3|2) = 1/6 f (9|2) = 1/3 (c) cov X , Y E[ X E ( X )][Y E (Y )] where E X 2 41 4 21 6 41 4 E Y 1 21 3 13 9 16 3 From first principles cov X , Y x 4 y 3 f x , y x y 1 2 41 3 81 2 43 3 24 1 64 93 1 6 43 3 24 12 0 Alternatively, using results in Section 2.5 it is possible to show that cov X , Y E[ X E X ][Y E Y ] E XY E X E Y This is an important result that will be used throughout the text. In terms of the current example we can show that E(XY) = 12 E(XY) = (2)(1)(1/8) + (2)(3)(1/24) + (2)(9)(1/12) + (4)(1)(1/4) + (4)(3)(1/4) + (4)(9)(0) + (6)(1)(1/8) + (6)(3)(1/24) + (6)(9)(1/12) = 288/24 = 12 and hence that cov X , Y 12 4 3 0 (d) This is an example where X and Y are not independent, despite the fact that their covariance is zero. If X and Y are independent, then f x, y g xh y . To prove that this result does not hold let us consider two outcomes. First, if x = 2 and y = 3, f 2,3 1 24 g2h3 1 1 1 4 3 12 Also, if x = 4 and y = 9 f 4,9 0 g4h9 2.23 1 2 1 6 1 12 (a) f 0,0 0.6 0.4 0.3 052 . 2 0 0.208 0 1 0 1 f 0,1 (0.6) 0 0.4 0.3 0.52 2 0 0120 . 1 1 0 f 1,0 0.6 0.4 0.3 0.52 2 0 0.312 1 0 0 1 f 11 , 0.6 0.4 0.3 0.52 2 1 0.360 1 0 1 0 X\Y 0 1 0 0.208 0.120 0.328 1 0.312 0.360 0.672 0.52 0.48 1.0 (b) (c) By summing the relevant values we obtain these marginal distributions x f x y f y 0 1 0.328 0.672 0 1 0.52 0.48 This function is given by f y | x 0 y f 0, y f 0, y f x 0 f x 0 f y | x 0 0 0.208 0.328 0.6341 1 0120 . 0.328 0.3659 (d) E[ X ] x f x 0.672 x (e) E[Y ] y f y 0.48 y (f) E[ X 2 ] x 2 f x 0.672 x var X E[ X 2 ] [ E X ]2 0.672 0.672 0.2204 2 E [Y 2 ] y 2 f y 0.48 y var Y 0.48 0.48 0.2496 2 E[ XY ] xy f x , y 0.36 this is the term (1)(1)(0.36) = 0.36 x y (This sum has four terms but three of the four involve zero values, leaving only one of the four terms being nonzeroOnly the terms where both x and y are equal to one needs to be considered in the above summation. Other terms are zero.) cov X , Y E [ XY ] E [ X ]E [Y ] 0.36 0.6720.48 0.03744 (g) cov X , Y var X var Y 0.03744 0.22040.2496 01596 . Use the rules on page 31: E[ X Y ] E[ X ] E[Y ] 0.672 0.48 1152 . var X + Y var X varY 2 cov X , Y 0.2204 0.2496 20.03744 0.5449 2.25 Let X represent the life length of the computer. The fraction of computers lasting for a given time is equal to the probability of one computer, selected at random, lasting for that given time. For each probability below, you should draw a picture of the normal distribution and shade in the area that corresponds to the question. Then, standardize the value and use the table to determine the probability (area). (a) 1 2.9 P X 1 P Z . 0.5 P0 Z 1357 . 0.5 0.413 0.087 P Z 1357 196 . (b) 4 2.9 P X 4 P Z P Z 0.786 0.5 P0 Z 0.786 0.5 0.284 0.216 14 . (c) 2 2.9 P X 2 P Z P Z 0.643 0.5 P0 Z 0.643 0.5 0.240 0.740 14 . (d) 4 2.9 2.5 2.9 P2.5 X 4 P Z P 0.286 Z 0.786 14 . 14 . P 0.286 Z 0 P0 Z 0.786 0112 . 0.284 0.396 (e) We want X0 such that P(X < X0) = 0.05. Now, P(0 < Z < 1.645) = 0.45 (from tables). Hence, P(Z < 1.645) = 0.05. Thus, an appropriate X0 is defined by 1645 . 2.26 NOTE: skip this one… X 0 2.9 . 14 . 0.6. or X 0 2.9 1645 14 .