Sol_Ch11

advertisement

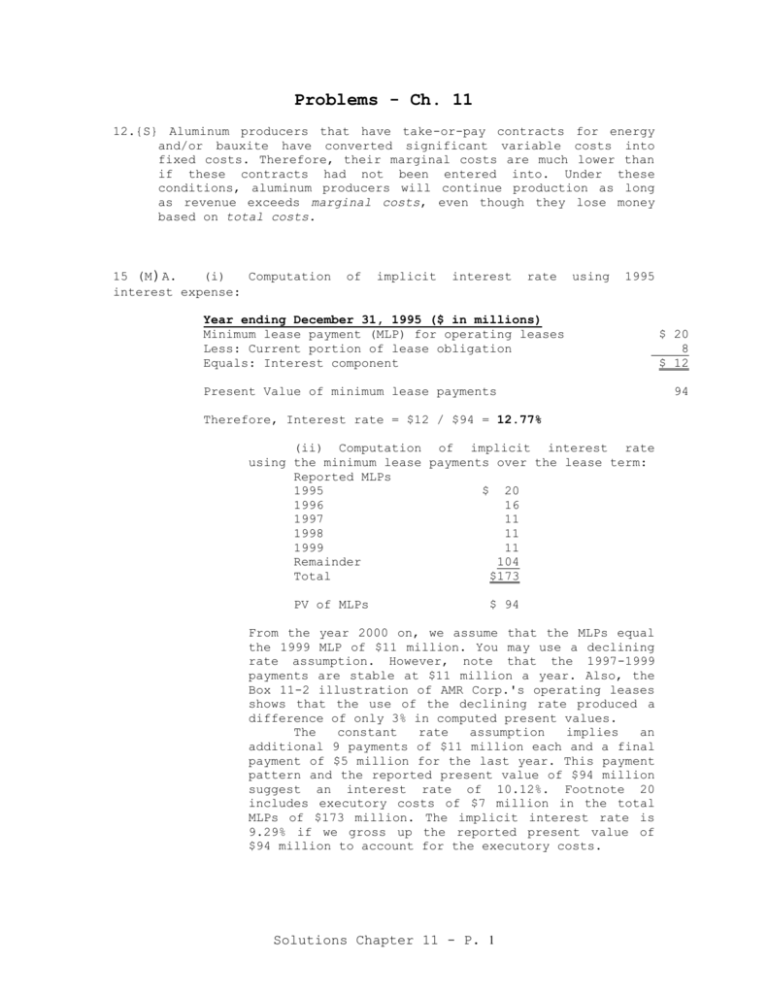

Problems - Ch. 11

12.{S} Aluminum producers that have take-or-pay contracts for energy

and/or bauxite have converted significant variable costs into

fixed costs. Therefore, their marginal costs are much lower than

if these contracts had not been entered into. Under these

conditions, aluminum producers will continue production as long

as revenue exceeds marginal costs, even though they lose money

based on total costs.

15 (M)A.

(i)

Computation

interest expense:

of

implicit

interest

rate

using

1995

Year ending December 31, 1995 ($ in millions)

Minimum lease payment (MLP) for operating leases

Less: Current portion of lease obligation

Equals: Interest component

Present Value of minimum lease payments

Therefore, Interest rate = $12 / $94 = 12.77%

(ii) Computation of implicit interest rate

using the minimum lease payments over the lease term:

Reported MLPs

1995

$ 20

1996

16

1997

11

1998

11

1999

11

Remainder

104

Total

$173

PV of MLPs

$ 94

From the year 2000 on, we assume that the MLPs equal

the 1999 MLP of $11 million. You may use a declining

rate assumption. However, note that the 1997-1999

payments are stable at $11 million a year. Also, the

Box 11-2 illustration of AMR Corp.'s operating leases

shows that the use of the declining rate produced a

difference of only 3% in computed present values.

The

constant

rate

assumption

implies

an

additional 9 payments of $11 million each and a final

payment of $5 million for the last year. This payment

pattern and the reported present value of $94 million

suggest an interest rate of 10.12%. Footnote 20

includes executory costs of $7 million in the total

MLPs of $173 million. The implicit interest rate is

9.29% if we gross up the reported present value of

$94 million to account for the executory costs.

Solutions Chapter 11 - P. 1

$ 20

8

$ 12

94

B.

Interest rate implicit in the capital leases based on:

(i)

1995 interest expense

12.77%

(ii) MLPs

over

the

life

of

10.12% (or 9.29%, see part (A))

the

lease

Using 1995 interest expense ignores the steep decline in

MLPs over the lease term. Footnote 20 shows a decline of

25% from $20 million to $16 million in 1996 and a decrease

of more than 31% in 1997 followed by equal payments in 1998

and 1999. When first year MLPs are significant, the timing

of lease payments can distort these computations. Use of a

declining rate assumption and consideration of executory

costs would produce a lower interest rate.

C.

Operating Leases

Reported MLPs

1995

1996

1997

1998

1999

Remainder

Total MLPs

$ 290 million

224

182

156

124

673

$ 1,649 million

The constant rate assumption gives us five more payments

equal to the 1999 payment of $124 million and a final

payment of $ 53 million. The present value of the operating

lease MLPs at 12.77% is $980 million.

D.

Exhibit 4.7 (page 164) contains the 1990-1994 duPont

long-term debt and solvency analysis. Summarized 1994 data

follow:

Capitalization Table

Reported

$ 7,668

Reported total debt

PV of operating lease

Adjusted total debt

980

$ 8,648

Reported total equity

Total capital

EBIT

Interest expense

Interest

leases

on

PV

of

Ratios

Debt to equity

Debt to capital

Times interest earned

Adjusted

12,822

20,490

4,941

703 Includes

capitalized interest

operating

21,470

5,066 (4,941+125)

828 (703+125)

125 (.1277 x 980)

0.60 (7,668/12,822)

0.37 (7,668/20490)

7.03 (4,941/703)

0.67 (8,648/12,822)

0.40 (8,648/21,470)

6.12 (5,066/828)

The addition of the PV of operating lease payments shows the higher

leverage and lower interest coverage relative to reported data.

Solutions Chapter 11 - P. 2