P1 Neumann and Zaklan Poster

advertisement

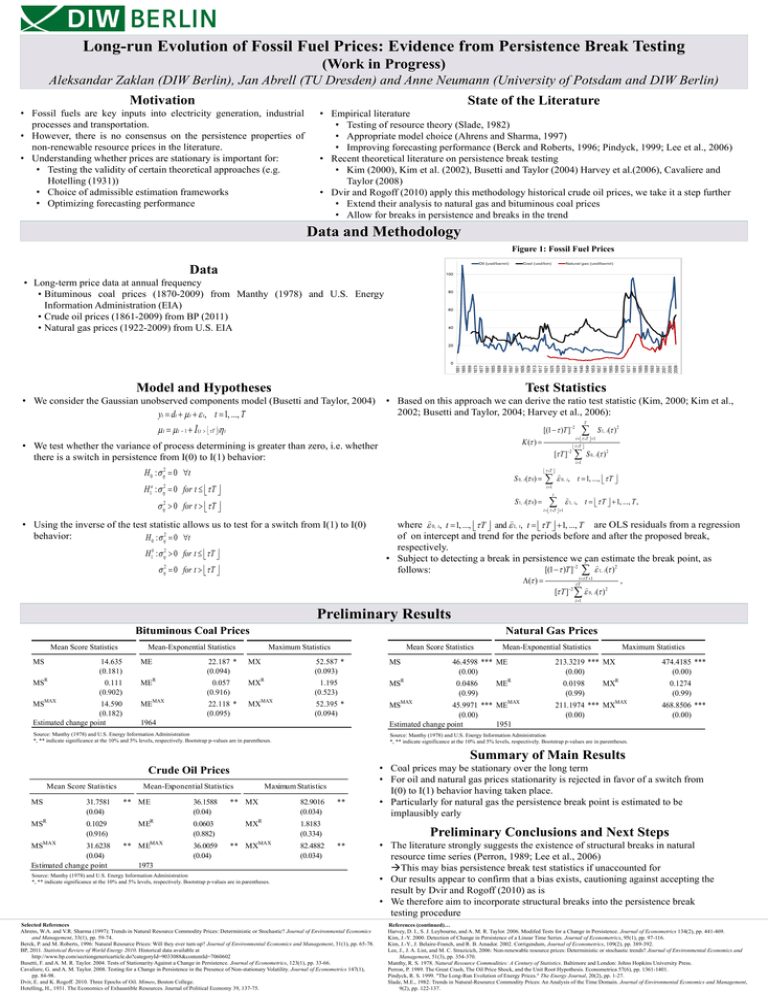

Long-run Evolution of Fossil Fuel Prices: Evidence from Persistence Break Testing (Work in Progress) Aleksandar Zaklan (DIW Berlin), Jan Abrell (TU Dresden) and Anne Neumann (University of Potsdam and DIW Berlin) Motivation State of the Literature • Fossil fuels are key inputs into electricity generation, industrial processes and transportation. • However, there is no consensus on the persistence properties of non-renewable resource prices in the literature. • Understanding whether prices are stationary is important for: • Testing the validity of certain theoretical approaches (e.g. Hotelling (1931)) • Choice of admissible estimation frameworks • Optimizing forecasting performance • Empirical literature • Testing of resource theory (Slade, 1982) • Appropriate model choice (Ahrens and Sharma, 1997) • Improving forecasting performance (Berck and Roberts, 1996; Pindyck, 1999; Lee et al., 2006) • Recent theoretical literature on persistence break testing • Kim (2000), Kim et al. (2002), Busetti and Taylor (2004) Harvey et al.(2006), Cavaliere and Taylor (2008) • Dvir and Rogoff (2010) apply this methodology historical crude oil prices, we take it a step further • Extend their analysis to natural gas and bituminous coal prices • Allow for breaks in persistence and breaks in the trend Data and Methodology Figure 1: Fossil Fuel Prices Data • Long-term price data at annual frequency • Bituminous coal prices (1870-2009) from Manthy (1978) and U.S. Energy Information Administration (EIA) • Crude oil prices (1861-2009) from BP (2011) • Natural gas prices (1922-2009) from U.S. EIA Model and Hypotheses Test Statistics • We consider the Gaussian unobserved components model (Busetti and Taylor, 2004) yt dt t t , t 1, ..., T t t 1 1 • Based on this approach we can derive the ratio test statistic (Kim, 2000; Kim et al., 2002; Busetti and Taylor, 2004; Harvey et al., 2006): [(1 )T ]2 ( t T ) t K ( ) • We test whether the variance of process determining is greater than zero, i.e. whether there is a switch in persistence from I(0) to I(1) behavior: [ T ]2 H 0 : 0 t S 0, t ( 0) H1a : 2 0 for t T 0T 0, i i 1 S 1, t ( 0) 0 for t T 2 t i 0T 1 • Using the inverse of the test statistic allows us to test for a switch from I(1) to I(0) behavior: H 0 : 2 0 t H : 0 for t T 2 0 for t T 2 S 1, i( ) 2 i 0T 1 0T S 0, i ( ) 2 i 1 2 b 1 T , t 1, ..., T 1, i, t T 1, ..., T , where 0, t, t 1, ..., T and 1, t, t T 1, ..., T are OLS residuals from a regression of on intercept and trend for the periods before and after the proposed break, respectively. • Subject to detecting a break in persistence we Tcan estimate the break point, as 2 2 [(1 ) T ] 1, i ( ) follows: ( ) i T 1 T [ T ]2 0, i ( )2 , i 1 Preliminary Results Bituminous Coal Prices Mean Score Statistics Mean-Exponential Statistics Natural Gas Prices Mean Score Statistics Maximum Statistics MS 14.635 (0.181) ME 22.187 * (0.094) MX 52.587 * (0.093) MS MSR 0.111 (0.902) MER 0.057 (0.916) MXR 1.195 (0.523) MSR MEMAX 22.118 * (0.095) MXMAX 52.395 * (0.094) MSMAX MSMAX 14.590 (0.182) Estimated change point 1964 Source: Manthy (1978) and U.S. Energy Information Administration *, ** indicate significance at the 10% and 5% levels, respectively. Bootstrap p-values are in parentheses. *, ** indicate significance at the 10% and 5% levels, respectively. Bootstrap p-values are in parentheses. Crude Oil Prices Mean Score Statistics Mean-Exponential Statistics Maximum Statistics MS 31.7581 ** ME 36.1588 ** MX 82.9016 ** (0.04) Mean Score(0.04) Statistics Mean-Exponential Statistics Maximum (0.034) Statistics MSR 0.1029 MER 0.0603 MXR 1.8183 MS 18.7789 * ME 29.8162 ** MX 68.4125 ** (0.916) (0.882) (0.334) (0.059) (0.027) (0.027) MAX MAX MAX MS 31.6238 ** ME 36.0059 ** MX 82.4882 ** R R MS 0.1294 ME 0.0676 MXR 1.3667 (0.04)(0.921) (0.04)(0.929) (0.034) (0.530) Estimated 1973MAX MAX change point MS 18.7187 * ME 29.7207 ** MXMAX 68.1542 ** Source: Manthy (1978) and U.S. Energy Information Administration (0.060) (0.027)are in parentheses. (0.027) *, ** indicate significance at the 10% and 5% levels, respectively. Bootstrap p-values Estimated change point 1964 Selected References Ahrens, W.A. and V.R. Sharma (1997): Trends in Natural Resource Commodity Prices: Deterministic or Stochastic? Journal of Environmental Economics and Management, 33(1), pp. 59-74. Berck, P. and M. Roberts, 1996: Natural Resource Prices: Will they ever turn up? Journal of Environmental Economics and Management, 31(1), pp. 65-78. BP, 2011. Statistical Review of World Energy 2010. Historical data available at http://www.bp.com/sectiongenericarticle.do?categoryId=9033088&contentId=7060602 Busetti, F. and A. M. R. Taylor. 2004. Tests of Stationarity Against a Change in Persistence. Journal of Econometrics, 123(1), pp. 33-66. Cavaliere, G. and A. M. Taylor. 2008. Testing for a Change in Persistence in the Presence of Non-stationary Volatility. Journal of Econometrics 147(1), pp. 84-98. Dvir, E. and K. Rogoff. 2010. Three Epochs of Oil. Mimeo, Boston College. Hotelling, H., 1931. The Economics of Exhaustible Resources. Journal of Political Economy 39, 137-75. Mean-Exponential Statistics 46.4598 *** ME (0.00) 0.0486 (0.99) MER 45.9971 *** MEMAX (0.00) Estimated change point 1951 Maximum Statistics 213.3219 *** MX (0.00) 0.0198 (0.99) 474.4185 *** (0.00) MXR 211.1974 *** MXMAX (0.00) 0.1274 (0.99) 468.8506 *** (0.00) Source: Manthy (1978) and U.S. Energy Information Administration *, ** indicate significance at the 10% and 5% levels, respectively. Bootstrap p-values are in parentheses. Summary of Main Results • Coal prices may be stationary over the long term • For oil and natural gas prices stationarity is rejected in favor of a switch from I(0) to I(1) behavior having taken place. • Particularly for natural gas the persistence break point is estimated to be implausibly early Preliminary Conclusions and Next Steps • The literature strongly suggests the existence of structural breaks in natural resource time series (Perron, 1989; Lee et al., 2006) This may bias persistence break test statistics if unaccounted for • Our results appear to confirm that a bias exists, cautioning against accepting the result by Dvir and Rogoff (2010) as is • We therefore aim to incorporate structural breaks into the persistence break testing procedure References (continued)… Harvey, D. I., S. J. Leybourne, and A. M. R. Taylor. 2006. Modifed Tests for a Change in Persistence. Journal of Econometrics 134(2), pp. 441-469. Kim, J.-Y. 2000. Detection of Change in Persistence of a Linear Time Series. Journal of Econometrics, 95(1), pp. 97-116. Kim, J.-Y., J. Belaire-Franch, and R. B. Amador. 2002. Corrigendum, Journal of Econometrics, 109(2), pp. 389-392. Lee, J., J. A. List, and M. C. Strazicich, 2006: Non-renewable resource prices: Deterministic or stochastic trends? Journal of Environmental Economics and Management, 51(3), pp. 354-370. Manthy, R. S. 1978. Natural Resource Commodities: A Century of Statistics. Baltimore and London: Johns Hopkins University Press. Perron, P. 1989. The Great Crash, The Oil Price Shock, and the Unit Root Hypothesis. Econometrica 57(6), pp. 1361-1401. Pindyck, R. S. 1999. "The Long-Run Evolution of Energy Prices." The Energy Journal, 20(2), pp. 1-27. Slade, M.E., 1982: Trends in Natural-Resource Commodity Prices: An Analysis of the Time Domain. Journal of Environmental Economics and Management, 9(2), pp. 122-137.